Sports Bottle Market Size

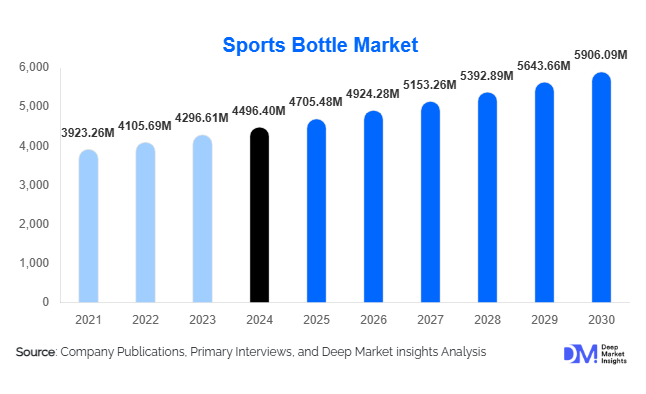

According to Deep Market Insights, the global sports bottle market size was valued at USD 4,496.40 million in 2024 and is projected to grow from USD 4,705.48 million in 2025 to reach USD 5,906.09 million by 2030, expanding at a CAGR of 4.65% during the forecast period (2025–2030). The sports bottle market growth is primarily driven by rising global fitness participation, increasing environmental preference for reusable hydration products, and rapid innovation in materials, insulation, and smart hydration technologies.

Key Market Insights

- Reusable, eco-friendly bottles are driving global demand as governments and consumers shift away from single-use plastics.

- Plastic remains the largest material segment, though stainless steel and insulated bottles are gaining momentum in premium categories.

- Asia-Pacific leads global demand, supported by urbanization, a rising middle class, and expanding sports and outdoor activity culture.

- North America and Europe dominate premium and insulated bottle consumption, driven by wellness and sustainability trends.

- Smart bottles with hydration tracking, UV sterilization, and temperature monitoring are emerging as a fast-growing niche segment.

- Corporate gifting and institutional orders (schools, gyms, events) are becoming major volume contributors in the mid-price tier.

What are the latest trends in the sports bottle market?

Eco-Sustainable Bottles and Recycled Materials Gaining Momentum

One of the strongest trends shaping the sports bottle industry is the rapid shift toward sustainability. Consumers worldwide are reducing reliance on disposable plastics and demanding long-lasting, BPA-free, recyclable, or biodegradable bottle options. Manufacturers are increasingly using recycled plastics, stainless steel, bamboo composites, and silicone-based designs to cater to eco-conscious buyers. This trend is bolstered by regulatory bans on single-use plastics across Europe, parts of Asia-Pacific, and North America. Additionally, brands are launching carbon-neutral production processes, eco-certified bottles, and packaging-free retail formats. Sustainability has evolved from a niche preference into a mainstream purchasing criterion, especially among Millennials and Gen Z, who place environmental impact at the forefront of their buying choices.

Smart Hydration Technology and Feature-Rich Designs

Technology integration is redefining the sports bottle segment. Smart bottles equipped with hydration tracking, LED reminders, app connectivity, temperature sensors, UV-C purification technology, and self-cleaning systems are growing in popularity, particularly in North America, Europe, and parts of East Asia. These “next-gen” bottles appeal to athletes, tech-savvy users, and wellness-focused consumers seeking personalized hydration insights. Lightweight collapsible bottles, dual-insulation systems, high-flow spouts, leak-proof engineering, and built-in filtration systems are also enhancing user convenience. Online retailers increasingly highlight these technologies, helping premium bottles command higher profit margins and creating rapid segmentation between basic and high-function bottles.

What are the key drivers in the sports bottle market?

Growing Global Fitness and Wellness Participation

The surge in fitness awareness and health-conscious lifestyles is the most prominent driver of the sports bottle market. More consumers are engaging in gym workouts, cycling, running, trekking, yoga, and outdoor recreation. Hydration solutions optimized for portability, durability, and performance are now essential accessories for active lifestyles. Expanding fitness clubs, corporate wellness programs, and organized sporting events worldwide further amplify demand.

Shift Toward Reusable Hydration Solutions

Environmental regulations restricting single-use plastics and rising sustainability concerns have accelerated global adoption of reusable sports bottles. Consumers are increasingly choosing stainless steel, Tritan plastic, and biodegradable materials over disposable options. This transition is particularly strong in Europe and North America, where sustainability is ingrained in consumer behavior, but is rapidly gaining traction in APAC urban centers as well.

Product Innovation and Premiumization

Manufacturers are investing heavily in design and material innovation, including insulated vacuum bottles, impact-resistant plastics, collapsible adventure bottles, and smart hydration technologies. These premium features attract higher-income consumers, create new revenue streams, and enhance brand differentiation. Innovations such as UV sterilization and hydration tracking apps position sports bottles as advanced lifestyle accessories rather than simple containers.

Restraints

Competition from Low-Cost or Single-Use Alternatives

In emerging markets, low-cost single-use or traditional plastic bottles continue to compete with reusable options. Price-sensitive consumers may prioritize affordability over sustainability, slowing penetration of premium bottles. Additionally, counterfeit or non-certified products in some markets limit revenue for established brands.

Raw Material Price Volatility

Fluctuations in the prices of stainless steel, high-grade plastics, silicone, and bamboo materials increase production costs and pressure profit margins. Manufacturers must balance cost optimization with quality assurance, especially in competitive markets with many low-cost producers.

What are the key opportunities in the sports bottle industry?

Eco-Friendly and Sustainable Bottle Expansion

Growing consumer demand for sustainable products presents a significant opportunity. Manufacturers can capitalize by developing bottles from recycled plastics, bamboo fiber, biodegradable materials, and stainless steel. Governments enforcing plastic bans further support reusable bottle adoption. “Green branding” and environmental certifications enable brands to charge premium prices and build long-term customer loyalty.

Growth of Smart Bottles and Hydration Tech Integration

The integration of sensors, mobile connectivity, UV-C sterilization, and hydration analytics opens a new premium growth segment. Smart bottles appeal to athletes, corporate wellness programs, and tech-forward consumers. As AI-powered wellness ecosystems expand, smart sports bottles will increasingly integrate with wearable devices, fitness apps, and health monitoring platforms, creating cross-industry partnerships.

Rising Institutional and Corporate Demand

Sports bottles are increasingly used in corporate gifting, school hydration programs, fitness clubs, tournaments, and branded promotional events. This B2B segment offers large-volume orders and repeat sales. Companies can expand their business by offering customization, bulk pricing, and branded bottle programs, particularly in Asia-Pacific and North America, where institutional purchasing is robust.

Product Type Insights

Non-insulated bottles dominate the global market, accounting for nearly 40–45% of the 2024 share. Their popularity stems from affordability, lightweight design, and suitability for everyday use across gyms, schools, offices, and casual activities. However, insulated bottles, particularly stainless-steel double-wall vacuum designs, are gaining fast traction among premium consumers seeking temperature control. Smart and feature-rich bottles represent a niche but rapidly emerging category with strong growth potential, especially in technologically advanced markets.

Application Insights

The largest application segment is fitness and daily hydration, driven by rising gym memberships, outdoor activities, commuting, and office use. Athletes and professional sports users form a premium segment demanding durable, insulated, and ergonomic bottles. Outdoor and adventure use, trekking, cycling, and camping are expanding rapidly due to interest in active tourism. Schools and youth sports leagues also represent a fast-growing segment as reusable hydration becomes standard in education environments. Corporate gifting, event merchandise, and promotional branding add a substantial B2B layer to demand.

Distribution Channel Insights

Offline retail remains the largest distribution channel, accounting for approximately 55–60% of the market in 2024. Sports stores, supermarkets, hypermarkets, and lifestyle outlets continue to dominate purchases due to consumer preference for physically evaluating material quality and size. However, online retail is the fastest-growing channel, driven by e-commerce marketplaces, direct-to-consumer (D2C) brands, and influencer-led product discovery. Customisation portals offering personalised printing and corporate bulk ordering are also expanding rapidly.

End-User Insights

Daily users, including office workers, students, and commuters, represent the largest end-user segment, contributing nearly 45–50% of market demand. Fitness enthusiasts and gym-goers follow closely, driving recurring purchases of durable, leak-proof, and insulated bottles. Outdoor users constitute a growing premium segment, especially in Europe and North America. Children’s bottles form another growing sub-segment, influenced by school hydration policies and parental preference for safe, BPA-free materials. Corporate and institutional demand continues to strengthen due to the surge in wellness initiatives and branded merchandise programs.

| By Material Type | By Product Type | By Capacity | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global market with a 30–35% share in 2024. Rising urbanization, active lifestyles, expanding outdoor recreation, and booming e-commerce contribute to strong growth in China, India, Japan, and Southeast Asia. Mid-range and plastic bottles remain popular due to cost accessibility, but premium insulated bottles are witnessing rapid expansion in metropolitan areas.

North America

North America accounts for 25–30% of global revenue, driven by strong fitness culture, high disposable income, and early adoption of premium smart & insulated bottles. The U.S. leads the market, supported by large-scale corporate wellness programs and widespread outdoor activity adoption. Sustainability preferences are pushing consumers away from disposable plastic options.

Europe

Europe contributes roughly 20–25% of global demand, with the U.K., Germany, France, and the Nordics leading adoption. Strict environmental regulations and a strong eco-conscious culture drive demand for stainless steel, bamboo, and recycled-material bottles. Outdoor and adventure culture enhances premium insulated bottle sales.

Latin America

Latin America holds approximately 5–8% of the global market. Brazil, Mexico, Argentina, and Chile exhibit rising demand driven by growing fitness culture and expanding middle-class populations. Affordably priced plastic bottles dominate, while insulated bottles are gaining traction among upper-income groups.

Middle East & Africa

MEA accounts for about 5–7% of global demand. Hot climates in the Gulf region encourage the use of insulated, metal bottles. South Africa and Kenya show growing adoption fueled by fitness, outdoor activities, and tourism. Price sensitivity in some markets limits premium bottle penetration, but growth potential remains strong.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Sports Bottle Market

- Thermos LLC

- Tupperware Brands Corporation

- SIGG Switzerland Bottles AG

- Vista Outdoor Inc.

- Decathlon S.A.

- Puma SE

- Milton Industries

- Nalgene (Thermo Fisher Scientific)

- Hydro Flask

- Contigo (Newell Brands)

- S’well

- CamelBak

- Klean Kanteen

- Brita GmbH

- Gigo Pack Industries

Recent Developments

- In April 2025, Thermos launched a new line of recycled stainless-steel insulated bottles under its sustainability initiative.

- In February 2025, Hydro Flask introduced a smart hydration tracking bottle integrated with app-based reminders and temperature sensors.

- In January 2025, SIGG announced the expansion of its eco-friendly bamboo composite bottles, targeting European and APAC premium markets.