Insulated Water Bottles Market Size

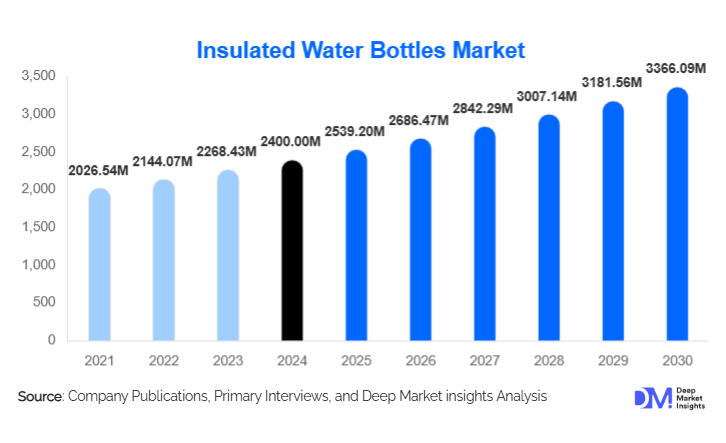

According to Deep Market Insights, the global insulated water bottles market was valued at USD 2,400 million in 2024 and is projected to grow to around USD 2,539.20 million in 2025 and reach USD 3,366.09 million by 2030, expanding at a CAGR of 5.8% over the forecast period (2025–2030). Demand is being driven by growing awareness of single-use plastic pollution, greater uptake of reusable hydration solutions, and strong consumer interest in lifestyle fitness and travel-ready drinkware.

Key Market Insights

- Sustainability is at the core of market expansion, as consumers increasingly favor insulated bottles over disposable plastics to reduce waste.

- Premium, vacuum-insulated stainless-steel bottles dominate, combining high performance with long life, making them especially popular in fitness, outdoor, and travel segments.

- Connected or “smart” bottles are emerging as a value differentiator, with features like temperature tracking, hydration reminders, and app integration gaining traction.

- Online sales lead the distribution mix, as direct-to-consumer and e-commerce brands proliferate, especially for premium and customizable bottles.

- Asia-Pacific is a fast-rising regional market, with strong demand in China, India, and Southeast Asia due to rising middle-class incomes and stronger environmental consciousness.

- Design, capacity, and thermal versatility matter: bottles that hold both hot and cold beverages and come in medium (500–1,000 ml) sizes are especially popular.

What are the latest trends in the insulated water bottles market?

Sustainable & Recycled Material Innovations

Manufacturers are increasingly turning to recycled stainless steel and eco-friendly composites to make insulated bottles more sustainable. These materials not only reduce the carbon footprint of production but also appeal to consumers who value environmental responsibility. Brands are incorporating recycled metal in their premium lines, promoting their lower-impact credentials, and marketing these bottles as part of a broader eco-lifestyle. This shift is supported by rising regulatory pressure on single-use plastics in many markets, driving more consumers to choose reusable and responsibly manufactured drinkware.

Smart Hydration Features

Smart bottles equipped with sensors, Bluetooth connectivity, and app-based hydration tracking are gaining strong momentum. These features help users monitor fluid intake, get reminders, and even measure internal liquid temperature. Fitness-focused consumers and tech-savvy users are especially attracted to these innovations. By integrating technology, brands are not only differentiating their products but also encouraging repeat engagement and loyalty through digital ecosystems.

Customization & Lifestyle Design

There is a growing demand for bottles that blend function with personal expression. Consumers are looking for insulated bottles in unique colors, finishes, sizes, and custom branding options. Whether for fitness, commuting, or gifting, custom laser engraving, limited edition palettes, and tailor-made capacities are helping brands stand out. This personalisation trend is particularly strong in D2C (direct-to-consumer) sales models and corporate gifting applications.

What are the key drivers in the insulated water bottles market?

Environmental & Health Consciousness

One of the primary drivers is the ever-increasing concern around plastic pollution, combined with a growing focus on health. As people become more environmentally aware, reusable drinkware is becoming a staple. Insulated water bottles offer the dual benefit of reducing single-use plastic while maintaining beverage temperature, making them an attractive option for daily hydration, fitness, and outdoor activities.

Active Lifestyle & Fitness Boom

The rise in fitness culture, gym memberships, outdoor recreation, and travel is driving robust demand for high-performance insulated bottles. Consumers want durable, temperature-retaining bottles that can survive long workouts, hikes, or long commutes. This trend has pushed manufacturers to innovate around capacity, insulation, and design to meet the evolving needs of active users.

Manufacturing & Material Advances

Advances in insulation technology (e.g., vacuum double-wall, reflective layers) and in materials (like food-grade stainless steel, high-grade plastics) are improving product performance. These innovations allow bottles to retain temperature longer, be lighter, and be more durable — making them more attractive to consumers and enabling premium pricing. In addition, manufacturing improvements (welding, sealing) are helping scale production efficiently.

What are the restraints for the global insulated water bottles market?

Price Sensitivity & High Cost of Premium Products

Premium insulated bottles are often significantly more expensive than basic reusable bottles or single-use plastic bottles. In markets with price-sensitive consumers, this high cost can limit adoption. Many potential buyers may opt for cheaper non-insulated or plastic bottles, reducing the addressable market for premium players.

Raw Material & Production Challenges

Volatility in raw material prices, especially stainless steel, can squeeze margins for manufacturers. In addition, the production of vacuum-insulated bottles is technically complex, requiring specialized equipment and precision welding. These factors raise production costs and can hinder the profitability of smaller or newer manufacturers, making it difficult to compete on both price and quality.

What are the key opportunities in the insulated water bottles industry?

Expansion into Emerging Markets

Emerging economies in Asia-Pacific (notably China and India), Latin America, and parts of Africa are underpenetrated but rapidly growing markets. Rising disposable incomes, increasing environmental legislation, and changing lifestyles (outdoor recreation, health consciousness) are creating fertile ground for growth. Brands can localize products (size, material, price) to tap into these markets, and invest in regional manufacturing to reduce costs and better serve local demand.

Corporate & Gifting Segments

There is a growing opportunity in corporate gifting and branded merchandise. Companies are increasingly using insulated bottles as part of wellness programs, employee gifts, or promotional products. By offering customization and bulk manufacturing, brands can capture this B2B demand. With a focus on sustainability, these bottles also align well with corporate ESG (Environmental, Social, Governance) goals, making them even more attractive.

Integration of IoT & Smart Technologies

Smart hydration is still an emerging frontier. By integrating sensors, connectivity, and mobile apps, manufacturers can offer differentiated products that justify premium pricing. Partnerships with fitness platforms, wearable-device companies, and health apps can further drive adoption. Over time, smart bottles may become a standard part of wellness ecosystems, offering data-driven insights to users and more value to brands.

Product Type Insights

In the insulated water bottles market, vacuum-insulated stainless-steel bottles dominate. Their superior thermal retention, durability, and “premium feel” make them the preferred choice among consumers focused on performance and longevity. For budget-conscious buyers, plastic-insulated bottles offer a lower-cost alternative, though with lower insulation performance. Glass-insulated bottles attract niche users who prioritize purity and chemical safety, particularly for home or office use.

Application Insights

The most prominent application is sports & fitness, where users demand rugged, high-performance bottles that keep drinks cold or hot for long durations. Travel and commuting are significant applications, as well as insulated bottles are popular among urban commuters and frequent travelers because of their ability to maintain beverage temperature and reduce reliance on disposable cups. The household segment continues to grow, with people replacing single-use bottles with reusable, stylish, and thermally efficient alternatives. Meanwhile, corporate gifting is emerging strongly, driven by sustainability goals and demand for branded, functional merchandise.

Distribution Channel Insights

Online retail (e-commerce and direct-to-consumer) is the dominant distribution channel, driven by the rise of D2C brands, customization options, and digital-first marketing. Offline retail remains significant, particularly in specialty stores (sporting goods, outdoor gear) and supermarkets. Brands are also leveraging corporate partnerships and B2B channels for gifting and bulk orders. Subscription models and membership-based sales (e.g., wellness clubs) are also emerging, giving repeat customers new ways to engage.

End-Use / Consumer Type Insights

The athletic and fitness community (gym-goers, runners, outdoor athletes) is a major user segment, drawn to bottles that support high performance and frequent use. Commuters and travelers also represent a strong customer base, valuing insulated bottles for maintaining drink temperature on the go. Eco-conscious consumers — often in households — are replacing disposable bottles with reusable insulated ones. Corporate buyers are increasingly using insulated bottles for employee wellness programs or branded gifts. Across age groups, millennials and Gen Z are especially responsive to sustainability and smart features, while older consumers value durability and design.

| By Product Type | By Material Type | By Capacity | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is a mature and high-value market for insulated water bottles. The U.S. leads the region, driven by strong fitness culture, disposable income, and environmental awareness. The region benefits from a well-developed e-retail infrastructure and a high consumer willingness to pay for premium, smart bottles.

Europe

Europe, particularly Western Europe (Germany, UK, France), is seeing solid demand for insulated bottles, supported by sustainability regulations, consumer preference for design, and high outdoor recreation activity. Eco-lifestyle trends and corporate gifting are also pushing demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region. Countries like China and India are witnessing surging demand driven by rapid urbanization, rising middle-class incomes, and growing environmental consciousness. Urban commuters and fitness enthusiasts in these markets are increasingly adopting insulated bottles, while local manufacturing is helping reduce costs and improve availability.

Latin America

In Latin America (Brazil, Mexico, etc.), growth is moderate but rising. Middle-class consumers are gradually shifting to reusable, branded bottles. Tourism and outdoor recreation, coupled with sustainability awareness, are fueling demand, though price sensitivity remains a challenge.

Middle East & Africa

The Middle East (Gulf countries) and parts of Africa are emerging markets. High temperatures, growing tourism, and corporate gifting demand contribute to the adoption of insulated bottles. Luxury and performance brands are beginning to make inroads through premium offerings, while affordability remains a constraint for broader penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Insulated Water Bottles Market

- Hydro Flask

- YETI

- Thermos

- Klean Kanteen

- CamelBak

- S’well

- Fnova

- Mira

- Rehydrate-Pro

- Cayman Fitness

- Healthy Human

- Geysa

- Ice Shaker

- Zojirushi

- Sigg

Recent Developments

- In 2025, several brands launched smart, Bluetooth-connected insulated bottles with hydration tracking and temperature sensors, targeting fitness and wellness consumers.

- Leading manufacturers are increasingly using recycled stainless steel in production to align with sustainability trends and appeal to eco-conscious buyers.

- Direct-to-consumer brands are scaling up subscription-based models, allowing users to purchase limited-edition or customizable bottles via membership, boosting brand loyalty and repeat purchases.