Specialty Malt Market Size

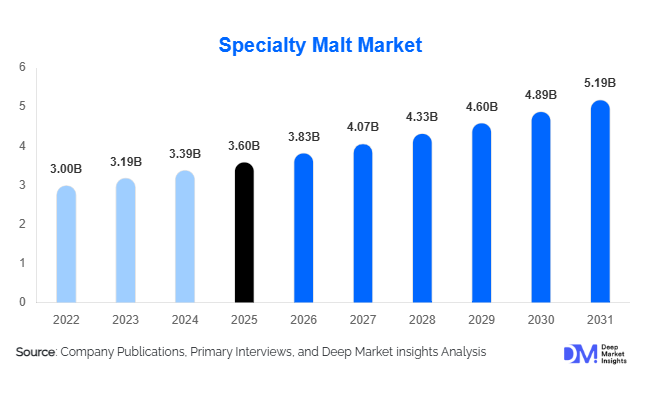

The global specialty malt market size was valued at USD 3.6 billion in 2025 and is projected to grow from USD 3.83 billion in 2026 to reach USD 5.19 billion by 2031, expanding at a CAGR of 6.3% during the forecast period (2026–2031). The specialty malt market growth is primarily driven by the rapid expansion of craft brewing, rising premiumization of alcoholic beverages, and increasing use of specialty malts as natural flavoring, coloring, and functional ingredients across food and beverage applications.

Key Market Insights

- Specialty malts are increasingly replacing artificial additives in food and beverage formulations due to clean-label and natural ingredient demand.

- Craft beer and premium spirits production remain the largest demand drivers, accounting for over 60% of global specialty malt consumption.

- Europe dominates global demand, supported by strong brewing heritage in Germany, Belgium, and the UK.

- Asia-Pacific is the fastest-growing regional market, driven by expanding brewing capacity and westernization of food consumption.

- Direct B2B supply agreements between maltsters and breweries account for the majority of specialty malt sales globally.

- Technological advancements in roasting and enzymatic modification are enabling higher customization and premium pricing.

What are the latest trends in the specialty malt market?

Premiumization and Custom Malt Profiles

Brewers and distillers are increasingly demanding customized malt profiles to differentiate their products in highly competitive beverage markets. Specialty malt producers are responding by offering tailored roasting levels, flavor intensities, and enzymatic characteristics designed for specific beer styles, whiskeys, and specialty spirits. This trend is particularly pronounced in the craft beer segment, where recipes frequently incorporate multiple specialty malts to achieve distinct sensory attributes. As a result, contract malting and collaborative product development between maltsters and breweries are becoming more common, strengthening long-term supply relationships and improving margin stability.

Expansion into Food and Functional Nutrition Applications

Beyond alcoholic beverages, specialty malts are gaining traction in bakery, breakfast cereals, snack coatings, and malt-based health drinks. Their ability to enhance flavor, color, and texture naturally positions them as alternatives to synthetic ingredients. Enzyme-modified and fiber-rich specialty malts are increasingly used in functional foods, particularly in Asia and the Middle East, where malted beverages are perceived as nutritious and energy-enhancing. This diversification is reducing reliance on beer-centric demand cycles and broadening the addressable market for specialty malt producers.

What are the key drivers in the specialty malt market?

Growth of Craft Brewing and Premium Spirits

The global rise of craft breweries and small-batch distilleries is a primary driver of specialty malt demand. Craft brewers prioritize flavor complexity, color variation, and mouthfeel—attributes that specialty malts uniquely provide. Premium whiskey and distilled spirits producers are also increasing usage of specialty malts to develop distinctive flavor profiles and aging characteristics. Emerging craft beer markets in Asia-Pacific and Latin America are further amplifying demand, as new breweries often rely heavily on imported specialty malts.

Rising Demand for Clean-Label and Natural Ingredients

Food and beverage manufacturers are increasingly eliminating artificial colors, flavors, and sweeteners from formulations. Specialty malts, derived through physical roasting and enzymatic processes, align well with clean-label trends. Regulatory scrutiny on synthetic additives in Europe and North America has accelerated adoption, while consumer perception of malt as a traditional and wholesome ingredient supports long-term growth.

What are the restraints for the global market?

Volatility in Raw Material Prices

Specialty malt production is highly dependent on high-quality barley and other cereals, making the market vulnerable to agricultural price fluctuations. Climate variability, supply chain disruptions, and rising input costs directly impact production economics and pricing stability. These factors can pressure margins and complicate long-term pricing contracts with breweries and food manufacturers.

Capital-Intensive Production Requirements

Producing specialty malts requires advanced roasting, kilning, and quality control infrastructure. High energy consumption and capital expenditure act as barriers for new entrants and limit rapid capacity expansion, particularly in emerging markets where access to advanced malting technology is constrained.

What are the key opportunities in the specialty malt industry?

Rapid Expansion in Asia-Pacific Brewing Markets

Asia-Pacific represents the strongest growth opportunity for specialty malt producers. Countries such as China, India, Vietnam, and Japan are witnessing rapid growth in craft beer production, supported by rising disposable incomes and evolving consumer tastes. Local malt supply remains limited, creating opportunities for exports, joint ventures, and regional production facilities tailored to local beer styles and food applications.

Functional and Nutritional Malt Innovations

The development of enzyme-modified, low-sugar, and high-fiber specialty malts offers strong growth potential in functional foods and beverages. Malt-based nutritional drinks, sports recovery products, and fortified bakery items are gaining traction, particularly in health-conscious consumer segments. These applications support premium pricing and reduce cyclicality associated with alcoholic beverage demand.

Product Type Insights

Caramel and crystal malts dominate the global specialty malt market, accounting for approximately 34% of total market value in 2025. Their leadership is primarily driven by their ability to enhance flavor complexity, sweetness, mouthfeel, and color across a wide range of beer styles, baked goods, and breakfast cereals. The versatility of caramel and crystal malts makes them a preferred choice for both large-scale breweries and craft producers seeking consistent sensory profiles.

Roasted and dark malts represent the second-largest product category, supported by strong demand from stouts, porters, dark lagers, and color-intensive food formulations. These malts are increasingly used to achieve deeper color tones, roasted flavors, and bitterness balance, particularly in premium and specialty beer segments.Smoked and functional specialty malts remain niche segments but are witnessing accelerated growth. Smoked malts benefit from increased experimentation in craft brewing and premium spirits production, while functional malts are gaining traction in nutraceuticals and fortified foods due to their perceived health benefits, including improved digestibility and nutrient content.

Application Insights

Alcoholic beverages remain the largest application segment, contributing nearly 62% of total specialty malt demand. Beer accounts for the majority of consumption, driven by the expansion of craft breweries, premium beer varieties, and seasonal or limited-edition offerings. Specialty malts play a critical role in differentiation, enabling brewers to create distinct flavor profiles and visual appeal.

Food processing accounts for approximately 24% of market demand, led by bakery products, breakfast cereals, confectionery, and malt-based beverages. The leading growth driver for this segment is the increasing consumer preference for natural ingredients, clean-label products, and enhanced flavor profiles in processed foods.Nutraceutical and pharmaceutical applications, although currently niche, are expanding at above-average growth rates. This growth is driven by rising awareness of functional nutrition, increasing use of malt extracts as natural sweeteners, and growing demand for fortified beverages and supplements.

Distribution Channel Insights

Direct B2B sales dominate the specialty malt market, accounting for approximately 55% of total distribution. Long-term supply agreements between malt producers and breweries ensure quality consistency, reliable supply, and cost stability, making this channel particularly important for large breweries and distilleries.

Specialty ingredient distributors play a vital role in serving small and mid-sized craft brewers, distilleries, and food manufacturers that require flexible volumes and technical support. Meanwhile, e-commerce platforms are emerging as a niche but growing channel, especially among microbreweries and experimental brewers sourcing limited batches of specialty malts.

End-Use Industry Insights

The beer industry remains the primary end-use sector for specialty malts, followed by distilled spirits and food manufacturing. The leading growth driver within this segment is the continued premiumization of beer, characterized by higher demand for specialty, flavored, and artisanal brews.

Premium spirits, particularly whiskey, represent the fastest-growing end-use industry, expanding at a CAGR of over 8%. Specialty malts are increasingly used to influence flavor depth and complexity in craft and aged spirits.Functional beverages and health drinks are emerging as new end-use applications, especially in Asia-Pacific and the Middle East. This trend is positively influencing long-term market growth as manufacturers seek natural malt-based ingredients for nutritional enhancement.

| By Product Type | By Grain Source | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the global specialty malt market with approximately 38% market share in 2025. Germany, Belgium, the United Kingdom, and France are the key contributors, supported by deep-rooted brewing traditions, advanced malting infrastructure, and strong export capabilities. Germany alone accounts for nearly 12% of global demand.The primary growth drivers in Europe include the continued strength of craft and specialty beer production, rising exports of premium malt products, and increasing use of specialty malts in artisanal food manufacturing. Regulatory support for traditional brewing practices further reinforces regional demand.

North America

North America holds approximately 29% of the global specialty malt market, led by the United States. The region benefits from a well-established craft beer ecosystem, a rapidly growing premium spirits industry, and strong innovation in flavor-driven brewing.Key regional growth drivers include increasing consumer preference for craft and small-batch alcoholic beverages, expansion of whiskey distilleries, and rising demand for specialty malts in clean-label food applications. Canada also plays an important role as both a producer and exporter of high-quality specialty malts.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of over 7.5%. China, India, Japan, and Australia are major markets, supported by rising beer consumption, urbanization, and a rapidly expanding craft brewing landscape.Growth drivers in the region include increasing disposable incomes, westernization of consumption patterns, and growing imports of premium specialty malts to meet quality requirements. The emergence of functional beverages and malt-based health drinks further accelerates regional demand.

Latin America

Latin America accounts for approximately 6% of global specialty malt demand, with Brazil and Mexico as the leading markets. The region is witnessing gradual adoption of craft brewing practices alongside steady growth in mainstream beer consumption.Key growth drivers include increasing investments in local breweries, rising demand for premium and flavored beers, and improving access to imported specialty malts.

Middle East & Africa

The Middle East and Africa represent around 5% of global demand. Growth is primarily driven by rising consumption of malt-based foods and non-alcoholic beverages in the Middle East, alongside brewing activity in South Africa and parts of North Africa.Regional growth drivers include population growth, increasing demand for functional and fortified beverages, and expanding hospitality and tourism sectors in select countries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Specialty Malt Market

- Malteurop Group

- Boortmalt

- Viking Malt

- Soufflet Malt

- Simpsons Malt

- Weyermann® Malting

- Muntons plc

- Crisp Malting Group

- GrainCorp Malt

- Castle Malting

- Bairds Malt

- IREKS GmbH

- Great Western Malting

- Maltexco

- Canada Malting Co.