Space Burial Service Market Size

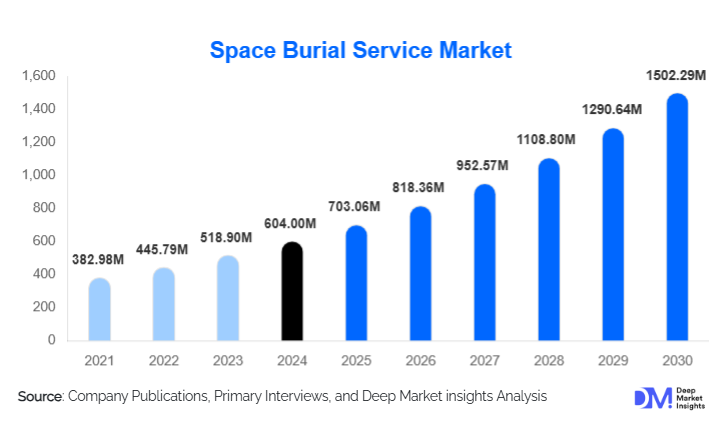

According to Deep Market Insights, the global space burial service market size was valued at USD 604.00 million in 2024 and is projected to grow from USD 703.06 million in 2025 to reach USD 1502.29 million by 2030, expanding at a CAGR of 16.40% during the forecast period (2025–2030). The market’s rapid growth is driven by the increasing accessibility of commercial spaceflight, rising consumer preference for personalized and symbolic memorial experiences, and the expansion of orbital and lunar memorial service offerings worldwide. Lower launch costs, partnerships between aerospace companies and memorial service providers, and rising cultural fascination with space exploration are further accelerating market penetration across both mature and emerging regions.

Key Market Insights

- Orbital burial services dominate global revenue due to rising demand for low Earth orbit memorial capsules and cost-efficient payload rideshare options.

- North America holds the largest market share, supported by strong commercial launch infrastructure and early adoption of space memorial solutions.

- Asia-Pacific is the fastest-growing regional market, driven by expanding space programs in China, India, and Japan and rising affluent consumer segments.

- Reusable launch vehicles account for nearly half of 2024 deployments, significantly reducing the per-mission cost of space burials.

- Digital memorial enhancements—including VR tributes, blockchain-verified records, and AR tracking—are transforming customer engagement.

- Pet space burial services and symbolic object launches represent emerging, fast-expanding niche segments appealing to personalization-focused consumers.

What are the latest trends in the space burial service market?

Integration of Digital & Immersive Memorial Technologies

Space burial operators are increasingly incorporating advanced digital technologies to enrich the memorialization experience. Virtual reality (VR) simulations allow families to preview orbital paths or lunar landing zones, while augmented reality (AR) apps enable real-time mission tracking and commemorative storytelling. Blockchain-based memorial certificates are becoming standard for verifying launch authenticity, ensuring long-term archival integrity. This technological evolution not only enhances emotional engagement but also appeals strongly to tech-savvy customers seeking futuristic and meaningful ways to honor loved ones. Digital memorial platforms are now central to differentiation strategies, allowing providers to offer multi-tiered, subscription-based remembrance packages.

Growth of Reusable & Eco-Friendly Launch Systems

The adoption of reusable launch vehicles is reshaping the industry’s cost structure, reducing payload pricing and enabling more frequent memorial missions. Companies are increasingly marketing “eco-conscious” space burial options featuring biodegradable capsules, carbon-neutral mission credits, and debris-free orbital flight paths. Environmental stewardship is becoming a market expectation, especially among younger demographics and sustainability-minded families. Hybrid propulsion systems and lighter composite capsule materials are being developed to reduce mission impact while offering reliable deployment, signaling a long-term shift toward greener memorial spaceflight services.

What are the key drivers in the space burial service market?

Rising Demand for Personalized & Symbolic Memorial Options

Families worldwide are increasingly seeking alternative, emotionally resonant memorial experiences that go beyond traditional funeral formats. Space burial services provide a powerful symbolic gesture—honoring a loved one’s legacy through exploration, transcendence, and cosmic remembrance. This personalization trend aligns with global increases in cremation rates and a shift toward non-religious or individualized memorial practices. The desire for unique and meaningful ceremonies continues to propel demand across all income segments, especially in North America, Europe, and parts of Asia.

Commercialization of Spaceflight & Launch Cost Declines

Major advancements in commercial aerospace, especially the rise of reusable rockets, have dramatically reduced the cost of launching small payloads. Rideshare missions allow space burial companies to integrate memorial capsules into regularly scheduled flights, lowering barriers to entry for customers. Increased launch cadence from emerging providers in the U.S., Europe, China, and India further supports reliable scheduling and service consistency. These developments have transformed space burial from a niche luxury service into a steadily expanding premium market.

What are the restraints for the global market?

High Service Costs & Limited Affordability

Despite recent cost improvements, space burial services remain substantially more expensive than traditional memorial options. Orbital packages, custom capsules, and lunar deployment missions typically place offerings beyond the reach of middle-income consumers. Fluctuating launch fees, regulatory obligations, and burial nsurance costs add financial pressures for both customers and service providers. This limits mass adoption and reinforces the market’s current concentration among affluent households, specialized memorial agencies, and institutional clients.

Regulatory Complexity & Launch Uncertainty

Space burial missions must comply with stringent aerospace regulations governing payload safety, orbital debris, launch authorization, and environmental impact. Scheduling delays, weather-related cancellations, and limited access to launch windows can disrupt memorial timelines. International customers face additional challenges involving cross-border remains transportation and varying legal frameworks. These constraints introduce operational risk and can impact consumer confidence without well-structured service guarantees.

What are the key opportunities in the space burial service industry?

Expansion into APAC & Emerging Space Economies

Countries such as China, India, South Korea, and Japan are rapidly expanding their commercial launch capabilities, creating new regional hubs for accessible and cost-efficient space burial missions. Rising disposable incomes, cultural openness to innovative memorials, and increasing public engagement with national space programs provide rich growth opportunities. Local partnerships with funeral homes, space agencies, and aerospace contractors can accelerate market penetration and reduce customer acquisition costs.

Digital Memorial Ecosystems & Subscription Models

There is a significant opportunity for space burial companies to expand beyond one-time launch events into recurring digital services. Families increasingly value ongoing remembrance experiences such as annual virtual observances, interactive cosmic timelines, and shared digital memory vaults. Subscription-based memorial memberships, AI-curated tribute histories, and connected family platforms can generate stable recurring revenue. This convergence of spaceflight and digital legacy technology represents a powerful avenue for long-term industry expansion.

Product Type Insights

Orbital burial services dominate the market, supported by cost-effective deployment and strong emotional appeal. These services typically involve placing a symbolic portion of ashes into low Earth orbit, with re-entry burn-up serving as a poetic “final journey.” Suborbital services offer more affordable entry options, while lunar and deep-space memorials cater to ultra-premium consumers seeking high-impact commemorative legacies. Digital memorial products, including VR experiences and interactive apps, complement physical launches and represent the fastest-growing product category.

Application Insights

The primary application of space burial services is individual and family memorialization, accounting for the majority of demand. Pet memorials are emerging rapidly as consumers seek unique ways to commemorate companion animals. Corporate commemorations, brand legacy missions, and institutional tributes represent growing applications, particularly for organizations involved in technology, aerospace, and research. Symbolic object launches—such as personal mementos, DNA samples, or artistic artifacts—are expanding the customer base beyond traditional funeral markets.

Distribution Channel Insights

Online direct-to-consumer platforms dominate sales, offering transparent package comparisons, mission calendars, and digital memorial features. Funeral homes increasingly partner with space burial providers to integrate services into premium memorial packages. Specialized aerospace-memorial agencies support custom missions, while subscription-based digital remembrance services are emerging as a new engagement channel. Social media and influencer-driven storytelling play a growing role in customer acquisition by showcasing emotional mission experiences.

End-User Insights

Individuals and families represent the largest end-user segment due to rising demand for unique, symbolic funeral alternatives. Funeral service providers adopt space burial offerings to differentiate premium packages and appeal to modern memorial preferences. Corporations and non-profits utilize space burial services for commemorations and legacy projects, often tied to brand identity or scientific heritage. Educational and research institutions employ symbolic space memorials as inspirational or ceremonial initiatives.

| By Service Type | By Type of Remains | By Launch Vehicle Type | By Pricing & Service Model | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with nearly 45–50% share, driven by the presence of advanced launch providers, high consumer awareness, and early adoption of space memorial services. The United States remains the epicenter of industry activity due to its robust aerospace sector and favorable regulatory environment. Strong interest among space enthusiasts, veterans, and technology-focused demographics supports continuous demand.

Europe

Europe accounts for approximately 20–25% of global demand, with the U.K., France, and Germany serving as key hubs for innovation and adoption. European customers exhibit high interest in digital memorial enhancements and sustainable launch technologies. Partnerships with European commercial space companies are expanding orbital and lunar memorial opportunities for regional consumers.

Asia-Pacific

APAC is the fastest-growing region, fueled by expanding national space programs, rising affluence, and growing fascination with space exploration. Demand is strongest in China, Japan, India, and South Korea, where consumers increasingly seek differentiated memorial options. Regional launch operators are improving accessibility and reducing costs, accelerating adoption across urban, high-income populations.

Latin America

Latin American demand remains modest but growing, with Brazil, Mexico, and Argentina showing increasing interest in symbolic memorial services. Outbound demand is primarily served by North American and European launch providers. Rising cultural openness to modern funeral practices is expected to drive steady growth through 2030.

Middle East & Africa

The Middle East shows rising demand, especially in the UAE, Saudi Arabia, and Qatar, where high-income consumers are drawn to premium memorial services. Africa’s participation is comparatively small but supported by South Africa’s emerging aerospace sector and growing awareness of space-based communications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Space Burial Service Market

- Celestis

- Elysium Space

- Space NTK

- Aura Flights

- Mesoloft

- Beyond Burials

- Ascension Flights

- Orbital Memorials

- LaunchMyAshes

- Aeternum Space

- Ashes to Space

- Droppers.Earth

- SpaceBurial.com

- Stargaze Memorials

- Lune Abyss

Recent Developments

- In March 2025, Celestis announced a new lunar memorial program integrating reusable lunar lander technologies to reduce mission costs.

- In January 2025, Elysium Space partnered with a major U.S. launch provider to expand orbital and deep-space memorial capacity.

- In October 2024, Aura Flights introduced biodegradable memorial capsules designed for eco-friendly suborbital deployments.