Burial Insurance Market Size

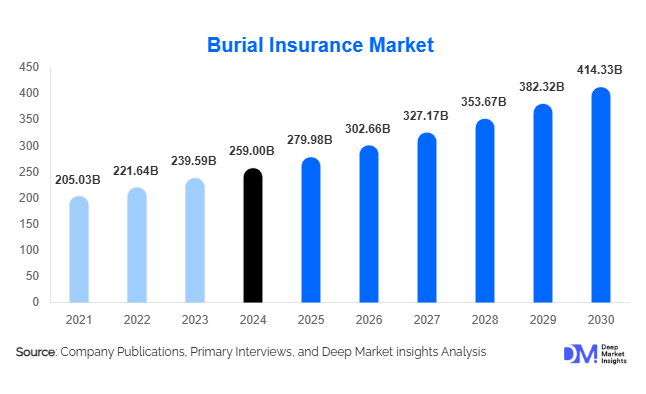

According to Deep Market Insights, the global burial insurance market size was valued at USD 259.0 billion in 2024 and is projected to grow from USD 279.98 billion in 2025 to reach USD 414.33 billion by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). Market expansion is primarily driven by the ageing global population, rising funeral costs, and increasing consumer preference for affordable, simplified insurance policies designed to cover end-of-life expenses. The proliferation of digital distribution channels, along with growing awareness of financial planning among seniors and their families, further underpins market growth.

Key Market Insights

- Modified or graded death-benefit policies dominate the market, accounting for approximately 46% of total revenues in 2024 due to their accessibility for older and high-risk individuals.

- The over-70 age group represents the largest insured demographic, contributing nearly 33% of total premiums, reflecting strong demand from senior citizens seeking financial security for final expenses.

- Monthly premium plans account for over 50% of global policy value, as retirees and fixed-income individuals prefer smaller, manageable instalments.

- Insurance agents and brokers remain the leading distribution channel, representing around 40% of sales; however, digital platforms are rapidly emerging as the fastest-growing channel.

- North America leads the global market with a 38–40% share, while Asia-Pacific is the fastest-growing region (CAGR 7–8%) due to low current penetration and rising middle-class adoption.

- The top five insurers collectively hold about 40% of the global market, with Mutual of Omaha, Globe Life, Colonial Penn, Gerber Life, and Fidelity Life as key leaders.

Latest Market Trends

Digitalisation and Insurtech Expansion

Digital transformation is reshaping the burial insurance landscape. Insurtech platforms are introducing instant online underwriting, AI-based risk scoring, and automated claims processing, making policy purchase faster and more transparent. Older consumers are becoming increasingly comfortable with online insurance purchases, while younger family members often assist senior relatives in selecting coverage online. Mobile applications enable customers to compare plans, estimate funeral costs, and manage premium payments in real time. This technological evolution reduces administrative overhead, improves customer experience, and enhances insurer profitability.

Rise of Bundled and Value-Added Funeral Planning Services

Insurers are increasingly offering value-added services such as funeral coordination, grief counselling, and prepaid memorial arrangements bundled with burial insurance. This integration transforms traditional final-expense policies into comprehensive end-of-life planning solutions. Eco-friendly burial options, like biodegradable urns and green cemeteries, are gaining traction among environmentally conscious consumers. Partnerships between insurers and funeral-home operators are also expanding, enabling seamless service delivery and cross-selling opportunities.

Burial Insurance Market Drivers

Ageing Global Population

The proportion of individuals aged 65 and above continues to rise worldwide, particularly in North America, Europe, Japan, and China. As the global elderly population grows, the need for financial protection against funeral expenses increases. Burial insurance offers a practical, low-premium option for older adults who may not qualify for traditional life insurance, driving sustained policy demand.

Rising Funeral and Burial Costs

Funeral and burial expenses have increased significantly over the past decade, with average costs in developed economies exceeding USD 8,000 per service. Families are turning to burial insurance to mitigate these unexpected financial burdens. As inflation affects funeral supplies, cemetery fees, and transportation services, more households seek affordable insurance coverage to ensure smooth financial settlement after death.

Simplified and Guaranteed-Acceptance Policies

Guaranteed-acceptance burial insurance, requiring no medical exams and minimal underwriting, is fueling growth by expanding eligibility to seniors and those with pre-existing health conditions. Simplified underwriting processes and predictable premiums make these products highly attractive to older demographics, especially in markets where traditional life-insurance premiums are prohibitively expensive.

Market Restraints

Low Awareness and Misconceptions

Despite its practicality, burial insurance faces low awareness levels in many emerging markets. Misconceptions persist that such policies are unnecessary or redundant with life insurance. Lack of targeted financial-literacy campaigns among low- and middle-income populations limits new policy uptake, particularly in Asia, Africa, and Latin America.

Regulatory and Waiting-Period Limitations

Many burial insurance products include waiting periods of 12–24 months before full benefits apply, discouraging some potential buyers. Additionally, regulatory inconsistencies across jurisdictions, such as disclosure requirements or pre-need trust-fund mandates, complicate international product standardization and can delay market entry for new insurers.

Burial Insurance Market Opportunities

Digital and Insurtech Integration

Expanding digital ecosystems present major opportunities for insurers. By adopting AI-based underwriting, tele-verification, and self-service portals, companies can reach underserved senior populations, lower operational costs, and improve claim transparency. New entrants can exploit online channels to deliver micro-policies at scale, particularly in emerging economies.

Emerging Market Expansion

Asia-Pacific and Latin America are witnessing surging demand as middle-income populations grow and cultural attitudes toward insurance evolve. Localized product designs, micro-premium models, and mobile-payment integration can help insurers penetrate previously untapped regions. India, China, and Brazil represent high-potential markets due to demographic growth and rising funeral-service costs.

Value-Added Bundling and Green Burial Solutions

Integrating funeral-planning, eco-burial, and grief-support services with insurance coverage can create differentiation in a commoditized market. Consumers increasingly value sustainability and convenience. Partnerships with eco-friendly service providers or funeral-tech startups can open new revenue streams while reinforcing brand positioning as socially responsible insurers.

Product Type Insights

Modified or graded death-benefit policies lead the market with approximately 46% share of global revenue in 2024. These policies appeal to individuals with pre-existing health conditions or advanced age by offering lower entry premiums and a graded payout structure. Level death-benefit policies attract healthier consumers seeking guaranteed fixed coverage, while guaranteed-acceptance products serve high-risk groups despite higher premiums. The flexibility and accessibility of graded plans make them the most widely adopted globally.

Premium Type Insights

Monthly premium policies dominate with more than 50% share, valued at around USD 139 billion in 2024. Consumers prefer predictable, manageable payments over lump-sum premiums, especially retirees on fixed incomes. Insurers also benefit from improved retention and steady revenue streams. Annual and single-premium options remain relevant for high-net-worth individuals seeking convenience and immediate coverage.

Distribution Channel Insights

Insurance agents and brokers continue to drive approximately 40% of global sales due to their personal relationships with senior clients. However, digital platforms represent the fastest-growing channel, capturing an increasing share each year. Insurers are investing in direct-to-consumer (D2C) websites, comparison portals, and social-media campaigns to reach tech-savvy seniors and caregivers efficiently.

Age Group Insights

The over-70 age group is the dominant consumer base, holding about 33% of market share in 2024, equal to roughly USD 89 billion. Rising life expectancy and heightened financial-planning awareness are expanding policy uptake among seniors. The over-60 segment also shows steady growth, while over-80 consumers increasingly rely on guaranteed-acceptance policies.

| By Product Type | By Premium Type | By Distribution Channel | By Age Group |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market, accounting for 38–40% of global revenue (USD 100 billion in 2024). High funeral costs, well-established insurance culture, and strong distribution networks drive demand. The U.S. leads with widespread adoption of final-expense policies, while Canada shows increasing penetration through digital channels. Growth remains moderate but stable due to market maturity.

Europe

Europe represents roughly 25% of the global market (USD 68 billion). Ageing demographics in the U.K., Germany, France, and Italy sustain steady demand. Green burial and eco-insurance products are gaining momentum, reflecting European consumers’ environmental values. Regulatory stability and strong financial-advisory networks further support the segment.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to grow at a 7–8% CAGR through 2030. Japan’s ageing population, coupled with rapid insurance adoption in China and India, underpins demand. Low penetration rates and increasing middle-class financial literacy create a substantial growth runway. Digital micro-insurance and mobile-first sales models are expanding coverage in emerging economies.

Latin America

Latin America holds 8–10% of the global market, led by Brazil, Mexico, and Argentina. Rising awareness of funeral-planning products, coupled with financial-inclusion initiatives, is increasing policy uptake. Economic volatility and low awareness still constrain growth, but partnerships between local banks and insurers are gradually improving accessibility.

Middle East & Africa

MEA represents 5% of the global market. GCC nations and South Africa show niche growth, driven by expatriate populations seeking repatriation coverage and local burial planning. Regulatory frameworks are evolving to accommodate prepaid funeral-insurance schemes. The region’s growth potential lies in expanding affordable micro-insurance solutions for low-income households.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Global Burial Insurance Market

- Mutual of Omaha

- Globe Life Inc.

- Colonial Penn Life Insurance Company

- Gerber Life Insurance Company

- Fidelity Life Association

- Foresters Financial

- Allianz SE

- Aviva PLC

- Zurich Insurance Group

- Generali Group

- New York Life Insurance Company

- State Farm Insurance

- Ethos Life Inc.

- Sun Life Financial Inc.

- Assurant Inc.

Recent Developments

- In May 2025, Mutual of Omaha launched a fully digital guaranteed-issue platform, enabling same-day policy issuance for seniors aged 60–85.

- In March 2025, Globe Life Inc. expanded its burial-insurance portfolio to include eco-funeral options and prepaid cremation coverage.

- In January 2025, Allianz SE announced strategic partnerships with European funeral-service networks to bundle insurance with digital memorial-planning tools.