Soybean Derivatives Market Size

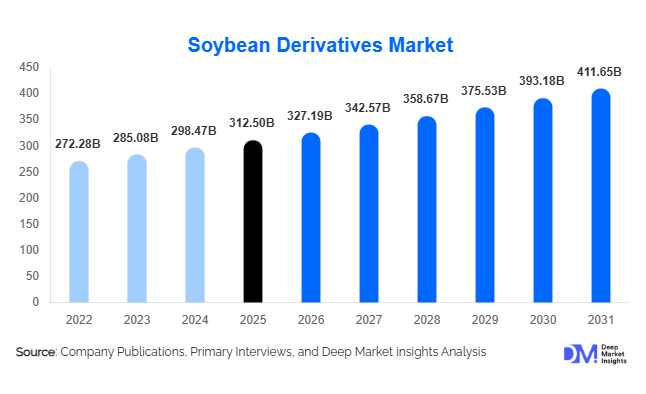

According to Deep Market Insights, the global soybean derivatives market size was valued at USD 312.5 billion in 2025 and is projected to grow from USD 327.19 billion in 2026 to reach USD 411.65 billion by 2031, expanding at a CAGR of 4.7% during the forecast period (2026–2031). Market growth is primarily driven by rising global demand for animal feed protein, increasing biodiesel blending mandates, and expanding applications of soy-based ingredients in plant-based food and industrial products. Soybean derivatives, including soybean meal, soybean oil, soy protein isolates, lecithin, and specialty soy chemicals, form a critical backbone of the global agricultural processing industry.

Key Market Insights

- Soybean meal dominates the product mix, accounting for approximately 46% of total market value in 2025, driven by strong livestock and aquaculture demand.

- Animal feed represents the largest application segment, contributing nearly 52% of global consumption.

- Asia-Pacific leads the market, holding around 38% of global demand, primarily due to large-scale soybean imports by China.

- Biofuel applications are the fastest-growing segment, supported by renewable diesel mandates in the U.S., Brazil, and Indonesia.

- The top five companies account for nearly 41% of the global market share, reflecting moderate consolidation in soybean crushing and derivative production.

- Sustainability and traceability standards are increasingly shaping procurement decisions, especially in Europe and North America.

What are the latest trends in the soybean derivatives market?

Expansion of Renewable Diesel and Biodiesel Production

Renewable diesel and biodiesel production capacities are expanding significantly, particularly in the United States and Brazil. Soybean oil is increasingly being diverted toward biofuel production due to favorable carbon intensity scores and blending mandates. This shift is tightening edible oil supply and altering global trade flows. Integrated crushing and biodiesel facilities are being developed to enhance margin stability and capture value across the supply chain. The trend is expected to continue as governments strengthen decarbonization commitments and offer fiscal incentives for renewable fuels.

Growth in Plant-Based Protein and Functional Ingredients

Demand for soy protein isolates, concentrates, and textured soy protein is rising due to the growth of plant-based meat and dairy alternatives. Food manufacturers are investing in flavor-neutral and high-functionality soy ingredients to improve texture and nutritional profiles. This trend is especially prominent in North America and Europe, where consumer preference is shifting toward sustainable and high-protein diets. Soy lecithin is also witnessing expanded usage in bakery, confectionery, and nutraceutical products.

What are the key drivers in the soybean derivatives market?

Rising Global Meat and Aquaculture Production

Growing consumption of poultry, pork, and farmed fish is significantly increasing demand for soybean meal as a high-protein feed ingredient. Asia-Pacific remains a key demand center due to expanding middle-class populations and dietary transitions toward protein-rich foods.

Government-Supported Biofuel Policies

Blending mandates and renewable fuel standards in the U.S., Brazil, and parts of Europe are strengthening structural demand for soybean oil. Tax credits and carbon trading mechanisms further enhance economic viability for biofuel producers.

What are the restraints for the global market?

Raw Material Price Volatility

Soybean prices are heavily influenced by climatic conditions in Brazil, the U.S., and Argentina. Droughts and export disruptions can significantly affect crushing margins and derivative pricing.

Trade Barriers and Geopolitical Risks

Tariffs and export restrictions between major producing and consuming nations, particularly involving China and the United States, create supply chain uncertainties and pricing instability.

What are the key opportunities in the soybean derivatives industry?

High-Value Specialty Soy Ingredients

Opportunities are expanding in pharmaceutical-grade lecithin, soy sterols, and bio-based chemicals. These specialty derivatives offer higher margins compared to bulk commodities and are supported by sustainability-driven procurement policies.

Integrated Crushing and Downstream Processing

Vertical integration across crushing, refining, and biodiesel production enables companies to optimize oilmeal spreads and improve operational efficiencies. Investment in advanced solvent extraction and enzymatic processing technologies further enhances yield and profitability.

Product Type Insights

Soybean meal leads the global soybean derivatives market with approximately 46% share of 2025 revenue, primarily driven by its indispensable role in the livestock and aquaculture feed industry. The segment’s dominance is supported by rising global meat consumption, particularly poultry and swine, which require high-protein feed formulations. Expanding aquaculture production in Asia-Pacific and Latin America has further strengthened demand, as soybean meal offers superior amino acid balance and digestibility compared to alternative feed proteins. Stable crushing margins supported by oil-meal spread economics also reinforce the segment’s leadership.

Soybean oil accounts for nearly 30% of the total market value, driven by its dual role as a key edible oil and biodiesel feedstock. Rising biodiesel blending mandates in the U.S., Brazil, and Indonesia are structurally increasing soybean oil utilization. Additionally, soybean oil remains widely consumed in food processing, quick-service restaurants, and packaged foods due to its favorable fatty acid profile and competitive pricing. Soy protein derivatives contribute approximately 12% of the market, expanding steadily with growth in plant-based meat alternatives, protein beverages, and fortified foods. Increasing consumer preference for high-protein and sustainable diets is driving this segment. Soy lecithin and specialty derivatives collectively represent the remaining 12%, benefiting from premium pricing in pharmaceuticals, cosmetics, industrial lubricants, and functional food applications.

Application Insights

Animal feed dominates applications, accounting for nearly 52% of total demand in 2025. The segment’s leadership is supported by expanding poultry production, rising pork consumption in Asia, and the intensification of aquaculture farming. Increasing feed efficiency requirements and rising demand for high-protein feed formulations continue to strengthen this segment globally.

Food & beverage applications represent approximately 28% of market value, driven by edible oil consumption, bakery, confectionery, and processed food demand. The rapid growth of plant-based protein products further supports soy protein usage in meat substitutes and dairy alternatives. Industrial applications, including biodiesel, bio-based plastics, inks, and lubricants, account for nearly 15% of global demand and are the fastest-growing application category. Government renewable fuel policies and corporate sustainability initiatives are key growth drivers. Personal care and pharmaceutical uses collectively contribute around 5%, supported by demand for soy-derived emulsifiers, sterols, and nutraceutical ingredients.

Processing Type Insights

Solvent extraction remains the dominant processing method, accounting for approximately 72% of global production. The segment leads due to its higher oil recovery efficiency, cost-effectiveness at an industrial scale, and suitability for large crushing plants. The scalability of solvent extraction supports global commodity trade and bulk derivative production. Mechanical and cold-press methods are gaining traction in specialty and non-GMO segments, particularly in Europe, where regulatory frameworks and consumer preference for clean-label products support alternative processing techniques. Enzymatic and fermentation-based methods are emerging in high-value soy protein production, offering improved functionality and flavor profiles.

End-Use Industry Insights

The livestock and aquaculture industry accounts for nearly 50% of total soybean derivative consumption, driven by rising meat consumption and the intensification of commercial farming. This segment’s growth is closely tied to urbanization, rising incomes, and dietary transitions toward animal protein. The biofuel industry is the fastest-growing end-use segment, expanding at over 6% CAGR, fueled by renewable diesel capacity expansion and carbon reduction targets. The food processing industry remains a stable and steadily growing end-user, supported by plant-based product innovation and global edible oil demand.

| By Product Type | By Application | By Processing Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds approximately 38% of the global market share in 2025, making it the largest regional market. China is the primary growth engine, as the world’s largest soybean importer, driven by large-scale animal feed production for the pork and poultry industries. Post-African swine fever herd rebuilding has accelerated feed demand. India and Southeast Asian nations such as Vietnam and Indonesia are experiencing strong growth due to expanding poultry production and increasing per capita protein consumption. Government support for feed self-sufficiency and aquaculture expansion further strengthens regional demand. Asia-Pacific is also the fastest-growing region, expanding at approximately 5.5% CAGR.

North America

North America accounts for around 26% of global market share, led by the United States, which is both a major producer and consumer of soybean derivatives. The region’s growth is primarily driven by renewable diesel capacity expansion and strong biodiesel mandates. Investments in integrated crushing facilities and advanced processing technologies are enhancing domestic supply chains. Additionally, stable livestock production and export-driven soybean meal shipments to Asia support consistent demand.

Europe

Europe contributes approximately 18% of global demand, with Germany, France, the Netherlands, and Spain being major consumers. Regional growth is driven by strict sustainability regulations, a strong preference for non-GMO soy imports, and the expansion of plant-based food industries. The European Union’s renewable energy directives also stimulate biodiesel demand, although feed demand growth remains moderate compared to Asia.

Latin America

Latin America holds roughly 14% of the global market share, led by Brazil and Argentina, which are major soybean producers and exporters. Brazil’s biodiesel blending mandates and crushing capacity expansion are key drivers of regional growth. Argentina remains a leading exporter of soybean meal, with export-driven demand supporting crushing volumes. Domestic livestock production is also steadily expanding.

Middle East & Africa

The Middle East & Africa region accounts for about 4% of global demand. Growth is primarily driven by rising poultry consumption and food security initiatives in Saudi Arabia, the UAE, and South Africa. Expanding feed milling capacity and increasing reliance on imported soybean meal are strengthening regional demand. Although the region’s growth rate is moderate compared to Asia-Pacific, improving agricultural investments and protein consumption trends provide steady long-term potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Soybean Derivatives Market

- Archer Daniels Midland

- Cargill

- Bunge

- Louis Dreyfus Company

- Wilmar International

- COFCO Corporation

- Marubeni Corporation

- CHS Inc.

- Viterra

- Olam Agri

- BRF S.A.

- CJ CheilJedang

- Shandong Bohi Industry

- Ruchi Soya Industries

- Fuji Oil Holdings