Sound Reinforcement Market Size

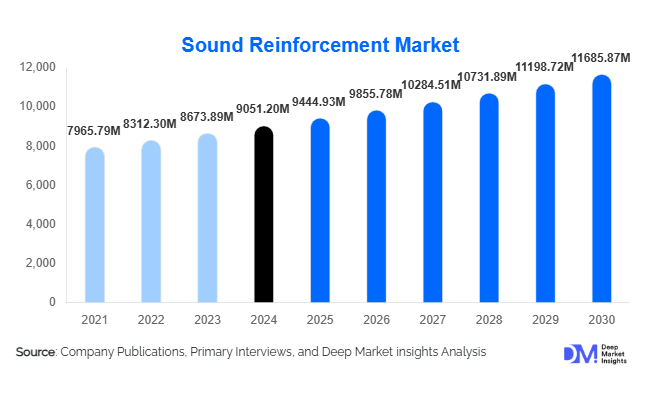

According to Deep Market Insights, the global sound reinforcement market size was valued at USD 9,051.20 million in 2024 and is projected to grow from USD 9,444.93 million in 2025 to reach USD 11,685.87 million by 2030, expanding at a CAGR of 4.35% during the forecast period (2025–2030). Market expansion is driven by rapid adoption of networked audio systems, a global resurgence in live entertainment events, large-scale infrastructure upgrades across stadiums and venues, and rising investments in digital signal processing (DSP), cloud-managed audio, and AV-over-IP technologies. The steady demand for high-performance loudspeakers, amplifiers, digital consoles, microphones, and touring-grade systems, combined with increasing uptake of enterprise and educational AV upgrades, continues to strengthen the outlook for the sound reinforcement industry.

Key Market Insights

- Networked audio and AV-over-IP are becoming the industry standard, with Dante, AES67, and AVB driving interoperability and high-value system upgrades.

- Loudspeakers remain the largest product segment, accounting for more than one-third of total market revenue due to demand from concerts, arenas, and touring productions.

- North America leads the global market, driven by mature live-event ecosystems and sizeable corporate AV spending.

- Asia-Pacific is the fastest-growing region, with India and China experiencing rapid infrastructure development and rising event activity.

- Cloud-managed audio, AI-based auto-mixing, and remote diagnostics are reshaping equipment lifecycle value and enabling subscription-based services.

- Rental and staging houses continue to influence purchasing trends, especially for touring-grade line arrays, amplifiers, and wireless systems.

What are the latest trends in the sound reinforcement market?

Growth of Networked Audio & Software-Driven Sound Systems

A defining trend in the sound reinforcement market is the broad transition from analog infrastructure to fully networked audio ecosystems. AV-over-IP platforms such as Dante and AES67 have enabled seamless routing, low-latency distribution, and centralized audio control across venues. Manufacturers are integrating advanced DSP, AI-powered auto-mixing, room calibration algorithms, and remote monitoring features directly into amplifiers, consoles, and processors. This has created new recurring revenue models such as subscription-based cloud monitoring, firmware-based feature unlocks, and analytics-driven service agreements. As stadiums, universities, theaters, and enterprise campuses modernize, networked audio has become a default requirement in RFP specifications, accelerating adoption across global markets.

Immersive & High-Fidelity Audio for Live Entertainment

Live entertainment is increasingly embracing immersive audio formats, object-based audio, beamforming arrays, and spatial amplification to enhance audience experience. Touring artists now demand lighter, higher-output line arrays, improved subwoofer steering, and energy-efficient Class-D amplifiers. Festivals and arena tours are incorporating multi-zone audio, distributed PA systems, and synchronized broadcast-grade feeds for hybrid or live-streamed events. This trend has pushed manufacturers to focus on rigging efficiency, weight reduction, and higher SPL-per-kg performance, ensuring faster setup times and reduced logistics costs, especially for international touring circuits.

What are the key drivers in the sound reinforcement market?

Global Surge in Live Events & Touring Activities

The resurgence of concerts, festivals, sports events, and touring productions is one of the strongest growth drivers. Promoters are reinvesting in premium PA systems to deliver consistent coverage and higher SPL output while reducing rigging labor and transportation costs. Rental companies are expanding fleets with modern line arrays, compact wireless mic systems, monitors, and digital consoles, creating recurring demand for high-value audio equipment. As touring cycles return to, and in some regions surpass, pre-pandemic levels, manufacturers are benefiting from rapid equipment refreshes and fleet expansions.

Venue Modernization & Infrastructure Expansion

Stadiums, airports, convention centers, universities, and houses of worship are undergoing extensive modernization. These facilities require integrated sound reinforcement systems with multi-zone audio, assistive listening, paging, conferencing, and broadcast capabilities. Government-funded smart city initiatives, cultural precincts, and mega-event preparations (e.g., World Cup, Expo events) are producing long-term procurement cycles. As digital transformation accelerates across institutions, demand for installed AV systems, especially networked loudspeakers, digital amplifiers, and multi-channel DSP processors, is increasing.

What are the restraints for the global market?

Price Pressure & Product Commoditization

In the mid-tier and entry-level segments, market competition from low-cost OEMs exerts significant price pressure on amplifiers, speakers, and wired microphones. This commoditization compresses margins for established brands, pushing them to differentiate through software features, reliability, and ecosystem integration. Manufacturers relying solely on hardware sales are most affected, as buyers increasingly demand network interoperability, cloud control, and long-term service support.

Skilled Labor Shortage & Integration Complexity

Advanced sound reinforcement systems require specialized design, networking expertise, and precise acoustic tuning. Many regions face shortages of certified AV technicians, slowing installations, raising labor costs, and complicating the adoption of advanced technologies such as AV-over-IP and immersive audio. Integration complexity is particularly challenging for stadiums, broadcast facilities, and multi-use arenas, which require extensive acoustic modeling, commissioning, and network configuration.

What are the key opportunities in the sound reinforcement industry?

Expansion of Cloud-Managed & AI-Enabled Audio Systems

The integration of cloud platforms into amplifiers, DSP units, and digital consoles offers major opportunities for recurring revenue through monitoring, analytics, and remote tuning services. AI-driven features, such as predictive maintenance, auto-mixing, dynamic feedback control, and automated room calibration, promise to reduce labor dependency and enhance user experience. Manufacturers that offer firmware upgrades, modular software licenses, and subscription-based services can capture long-term value beyond hardware sales.

Emerging Market Infrastructure & Venue Growth

Asia-Pacific, the Middle East, and parts of Latin America are experiencing rapid construction of stadiums, arenas, performing arts centers, and cultural venues. Governments are investing in tourism, sports infrastructure, and entertainment districts, creating significant system integration opportunities. As many of these markets leapfrog analog adoption and go directly to digital or networked solutions, global OEMs that localize manufacturing and partner with regional integrators can capture high-growth, multi-year project pipelines.

Product Type Insights

Loudspeakers, including line arrays, point-source boxes, and subwoofers, represent the largest product category, capturing over 35% of global revenue due to high demand in touring and fixed installations. Digital mixers and DSP-based consoles are gaining ground as venues prioritize remote control, flexible routing, and interoperability. Wireless microphone systems remain essential across corporate, education, and event settings, benefiting from rising demand for mobility and multi-channel digital RF technologies. Amplifiers with integrated DSP and network interfaces are rapidly replacing legacy analog units, enhancing efficiency and reducing rack space in large installations. Network interfaces and AV-over-IP bridges form a fast-growing sub-category as venues embrace centralized audio distribution.

Application Insights

Live entertainment, concerts, festivals, and touring remain the dominant application segment, contributing nearly 28% of market revenue. Sports stadiums and arenas increasingly invest in high-SPL, multi-zone PA systems to enhance fan experience and meet safety communication standards. Corporate and education sectors are upgrading auditoriums, meeting rooms, and campus facilities with integrated conferencing and reinforcement systems. Houses of worship represent a steady demand vertical due to frequent upgrades and acoustically challenging spaces. In hospitality and nightlife, immersive audio installations are gaining popularity as venues differentiate through high-fidelity soundscapes and digitally controlled multi-room audio.

Distribution Channel Insights

Rental and staging companies are among the most influential buyers, representing over 22% of market value due to large fleet purchases and frequent equipment refresh cycles. System integrators dominate project-based installations, especially in stadiums, universities, and corporate campuses. OEM direct sales remain common for large-scale projects requiring custom engineering. Specialist pro-audio dealers and VARs support regional sales through demos, training, and localized service, while e-commerce channels are expanding for mid-tier and entry-level equipment purchases.

Customer Type Insights

Large enterprises, stadiums, and multi-purpose venues account for more than 55% of global demand, driven by high-value installs and long-term service contracts. Mid-market buyers, including theaters, regional universities, and cultural centers, prioritize cost-effective digital systems with scalable architecture. Small venues such as clubs, restaurants, and houses of worship continue to upgrade to compact digital mixers, portable line arrays, and integrated amplifier-loudspeaker systems that offer higher performance at lower complexity.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market, holding approximately 34% of global revenue. The United States leads due to its dense network of arenas, festivals, rental companies, and corporate campuses. High adoption of networked audio, rapid turnover of touring equipment, and strong investments in stadium renovations fuel continued demand. Canada contributes steady growth through performing arts centers and university upgrades, supported by public cultural funding.

Europe

Europe accounts for nearly 20% of the global market, led by the U.K., Germany, France, and the Nordics. The region benefits from a strong festival ecosystem, a mature theater market, and stringent AV standards. Upgrades in opera houses, cultural venues, and broadcast facilities continue to support demand. A growing shift toward sustainability is further accelerating the adoption of energy-efficient amplifiers and lightweight loudspeaker systems.

Asia-Pacific

Asia-Pacific captures roughly 30% of global demand and is the fastest-growing region. China and India are the key drivers: China as both a manufacturer and a major consumer of pro audio, and India due to rapid growth in events, religious gatherings, and infrastructure projects. Japan and Australia add steady demand from broadcast, corporate, and performing arts markets. Increasing air connectivity and the growth of mega-events continue to strengthen the region’s outlook.

Latin America

Latin America shows moderate but rising demand, led by Brazil and Mexico. Growth is driven by expanding music festivals, sports events, and entertainment venues. Economic fluctuations affect large CapEx projects, but steady demand persists for touring-grade systems and mid-tier installation projects.

Middle East & Africa

MEA is experiencing strong growth driven by government spending on smart cities, mega stadiums, entertainment districts, and cultural centers. The UAE and Saudi Arabia are leading investors, while Africa hosts a mix of stadium projects, worship venue upgrades, and hospitality developments. South Africa remains the region’s most mature pro-audio market with established rental and touring ecosystems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Sound Reinforcement Market

- Harman International

- Bose Corporation

- Yamaha Corporation

- Shure Incorporated

- Sennheiser Group

- QSC, LLC

- Meyer Sound Laboratories

- d&b audiotechnik GmbH

- L-Acoustics

- Music Tribe (Behringer/Midas)

- Audio-Technica Corporation

- Bosch (Electro-Voice)

- RCF Group

- Martin Audio

- Genelec