Compact Wireless Microphone Market Size

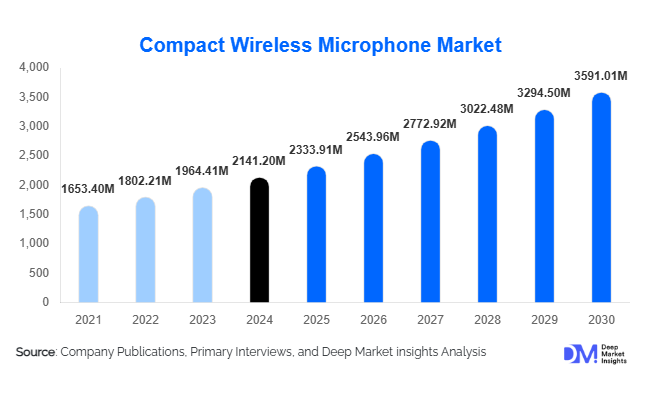

According to Deep Market Insights, the global compact wireless microphone market size was valued at USD 2,141.20 million in 2024 and is projected to grow from USD 2,333.91 million in 2025 to reach USD 3,591.01 million by 2030, expanding at a CAGR of 9.00% during the forecast period (2025–2030). Growth is driven by the rapid adoption of wireless audio solutions across content creation, hybrid work environments, live events, education, and broadcasting. The market is further supported by advances in digital RF technologies, rising demand for professional-grade audio recording, and the surge in global live entertainment and streaming content.

Key Market Insights

- Handheld compact wireless microphones dominate the product category, driven by extensive use in live events, concerts, houses of worship, and broadcasting.

- RF-based (UHF/VHF) wireless microphones hold the largest technology share, owing to their superior range, reliability, and professional-grade performance.

- North America leads global demand due to mature entertainment, corporate, and education sectors and high AV infrastructure spending.

- Asia-Pacific is the fastest-growing region, fueled by rapid growth in content creation, hybrid learning, and large-scale events in China, India, and Southeast Asia.

- Single-channel wireless microphone systems account for most installs due to simplicity, affordability, and suitability for individual creators and presenters.

- Technological advancements, digital audio, the 2.4 GHz band, AI-based noise reduction, and mobile-linked systems are reshaping user preferences across professional and consumer segments.

What are the latest trends in the compact wireless microphone market?

Surge in Digital Content Creation and Mobile-First Recording

The explosion of content creation, including livestreaming, vlogging, podcasting, short-form video content, and influencer-driven media, has transformed the compact wireless microphone landscape. Compact clip-on and handheld wireless systems are favored for mobility, professional audio quality, and compatibility with smartphones and mirrorless cameras. The trend is amplified by platforms such as YouTube, TikTok, Twitch, and Instagram, where creators demand wireless setups that support movement, outdoor shoots, fast pairing, and minimal setup time. Manufacturers are responding with compact transmitter packs, magnetic clip designs, and app-based audio controls, making high-quality recording more accessible for non-professionals.

Technological Integration Enhancing User Experience

Advancements such as digital RF transmission, 2.4 GHz wireless links, frequency-hopping spread spectrum (FHSS), and ultra-low-latency audio are redefining performance expectations. AI-driven noise cancellation and cloud-enhanced audio processing are becoming mainstream in mid-range and professional wireless systems. Some brands have introduced dual-channel compact wireless kits for creators working with multiple presenters. Integration with smartphone apps allows users to monitor audio levels, adjust EQ, upgrade firmware, and select channels seamlessly. These innovations appeal to tech-savvy users and enable professional-grade recording without requiring studio expertise.

What are the key drivers in the compact wireless microphone market?

Rising Demand from Live Events, Broadcasting & Entertainment

The revival and expansion of concerts, festivals, performing arts, religious gatherings, and sports events globally has created sustained demand for compact, portable wireless audio solutions. Professional-grade handheld wireless microphones remain the preferred choice for performers due to their reliability, mobility, and high fidelity. Broadcasters and studios are upgrading to digital RF systems that enhance clarity and reduce interference, which boosts market growth. As live event formats diversify, including hybrid and virtual experiences, compact wireless mics continue to gain relevance.

Digitalization of Workplaces and Education

Hybrid work and e-learning models have accelerated the adoption of AV systems in corporations, universities, training centers, and government institutions. Compact wireless microphones enable seamless communication across conference halls, classrooms, auditoriums, and virtual meeting platforms. Their ease of setup, flexibility across room sizes, and compatibility with conferencing systems (Zoom, Teams, WebEx) make them indispensable in modern digital workplaces. This structural change in global work culture remains a long-term growth catalyst.

What are the restraints for the global market?

Regulatory and RF Spectrum Constraints

Compact wireless microphones rely on regulated frequency bands, and spectrum allocation varies greatly across countries. Limitations on RF bands, interference risks in congested frequencies, and periodic reallocation of wireless spectrum can increase compliance burdens. Licensing requirements in some markets add further hurdles, especially for professional users. These regulatory complexities can slow product deployment and limit cross-border uniformity in product design.

Competition from Substitutes and Lower-Cost Alternatives

Low-cost substitutes such as wired microphones, USB plug-and-play mics, smartphone external mics, and beamforming microphone arrays can restrict market expansion among price-sensitive users. Budget-conscious creators may opt for mobile-based audio capture or entry-level lapel mics. As substitute technologies improve, compact wireless microphone manufacturers must differentiate through reliability, sound quality, and integrated digital features to maintain premium positioning.

What are the key opportunities in the compact wireless microphone industry?

Expansion in Content Creation & Mobile Production Ecosystems

The massive increase in online video-based communication, driven by individual creators, online coaches, educators, influencers, and small businesses, presents the largest opportunity. Manufacturers can tap into this demand with affordable dual-channel systems, smartphone-compatible receivers, and creator-focused kits that integrate audio, lighting, and mobile mounts. Growth in multilingual content across Asia-Pacific and Latin America further expands audience size.

Growing AV Infrastructure Upgrades Across Corporate, Education & Government Sectors

Organizations are upgrading their meeting rooms, hybrid classrooms, and auditoriums with new AV systems designed for flexible communication. This shift is opening procurement cycles for compact wireless microphone systems that offer mobility, professional clarity, and seamless integration with conferencing tools. Government initiatives supporting digital education and smart classrooms (India, UAE, China) are particularly favorable for industry expansion.

Product Type Insights

Handheld compact wireless microphones dominate the market with approximately 40% share in 2024, driven by demand from live events, broadcasting, houses of worship, and public speaking applications. Lavalier and clip-on microphones are rapidly growing due to widespread adoption among vloggers, podcasters, and corporate speakers. Headset-based wireless systems maintain strong demand in fitness instruction, theatre, and performance arts, where movement is continuous. Conference/tabletop wireless microphones are increasingly deployed across boardrooms, universities, and training halls as institutions modernize AV systems for hybrid communication environments.

Application Insights

Live events and performing arts represent the largest application segment, accounting for nearly 35% of market demand in 2024. Broadcasting and studio production remain a significant driver as channels upgrade to digital and IP-based workflows. The fastest-growing segment is content creation, fueled by independent creators, online educators, and small media studios. Corporate communications, meetings, seminars, webinars, and education (lecture capture, hybrid classes) also continue to expand rapidly, supported by global digital transformation initiatives.

Distribution Channel Insights

E-commerce platforms dominate sales for consumer and prosumer wireless microphones, offering global reach, product comparisons, and authentic user reviews. Specialist AV distributors and professional audio integrators control enterprise and institutional sales, where installation, training, and after-sales service are critical. Direct-to-consumer (D2C) sales are rising as brands enhance their digital presence, offering bundled kits, online support, and firmware updates. Retail audio stores remain relevant for professional buyers requiring hands-on testing before purchase.

End-Use Insights

Live events and concerts are the largest end-use segment, while digital content creation is the fastest-growing. Corporate and educational institutions increasingly drive adoption due to the transition toward hybrid communication environments. Religious organizations, hotels, government institutions, sports venues, and training centers also represent growing end-user categories. Export-driven demand from manufacturing hubs in Asia, particularly China and India, remains strong as Western markets continue to import mid- and high-end compact wireless systems.

| By Product Type | By Technology Type | By Channel Configuration | By End-Use Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for 32–35% of global revenue in 2024. The U.S. leads due to high adoption in professional recording, education, enterprise environments, and live events. Canada contributes steadily with strong demand in broadcasting, concerts, and corporate AV installations.

Europe

Europe represents 20–25% of the global share, led by the U.K., Germany, and France. The region’s strong theatre culture, established broadcasting industry, and focus on AV modernisation support growth. European creators and enterprises show high readiness to adopt digital wireless systems with sustainability and durability as key purchasing factors.

Asia-Pacific

Asia-Pacific is the fastest-growing region globally. China and India dominate due to booming content creation industries, expanding entertainment sectors, and massive investments in education and corporate infrastructure. Japan, South Korea, and Australia represent mature but high-value markets, driven by technology adoption and professional broadcasting ecosystems.

Latin America

Latin America is steadily growing, with Brazil, Mexico, and Argentina leading adoption. Growing digital media production, rising popularity of concerts, and corporate sector expansion contribute to the rising demand for cost-effective compact wireless solutions.

Middle East & Africa

The region shows emerging demand driven by large-scale events, religious gatherings, corporate expansions, and investments in smart education. The UAE and Saudi Arabia are key markets, while South Africa leads adoption across Africa. As AV infrastructure develops, compact wireless microphone usage is expected to accelerate.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Compact Wireless Microphone Market

- Shure Inc.

- Sennheiser Electronic SE & Co. KG

- Sony Corporation

- Audio-Technica Corporation

- Yamaha Corporation

- Samson Technologies

- HARMAN International

- BOYA

- RØDE

- Logitech

- Hollyland

- AKG

- Zoom Corporation

- Lewitt Audio

- Comica Audio

Recent Developments

- In March 2025, Shure announced next-generation digital wireless systems with enhanced AI noise reduction for creators and broadcasters.

- In January 2025, Sennheiser launched an ultra-compact 2.4 GHz digital wireless kit aimed at mobile vloggers and podcasters.

- In 2024, RØDE expanded its wearable wireless microphone lineup with magnetic clip-on systems designed for smartphone-based creators.