Social Casino Market Size

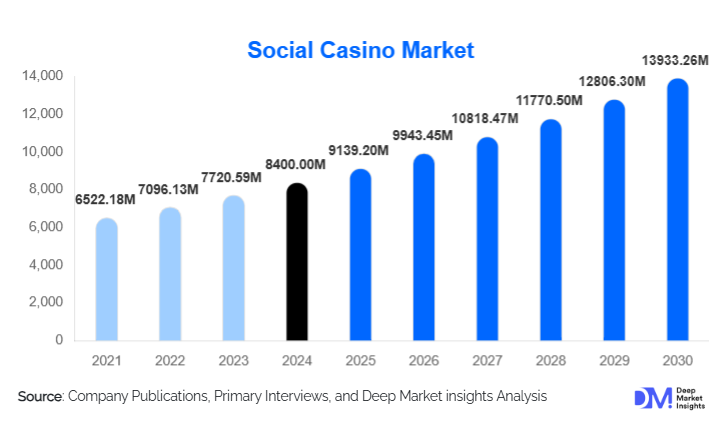

According to Deep Market Insights, the global social casino market size was valued at USD 8,400.00 million in 2024 and is projected to grow from USD 9,139.20 million in 2025 to reach USD 13,933.26 million by 2030, expanding at a CAGR of 8.8% during the forecast period (2025–2030). The social casino market growth is primarily driven by the rapid adoption of mobile gaming, increasing integration of social and multiplayer features, and the expansion of free-to-play monetization models that attract both casual and frequent gamers worldwide.

Key Market Insights

- Slots remain the dominant game category, accounting for more than half of global social casino revenues due to high engagement and repeat in-app purchases.

- Mobile platforms lead market adoption, contributing over 70% of total gameplay hours and revenue, reflecting the mobile-first gaming trend.

- North America holds the largest market share, while Asia-Pacific is the fastest-growing region, driven by mobile penetration and digital payment readiness.

- Advertising, microtransactions, and virtual currency sales continue to be the core revenue streams for leading operators.

- AR, VR, live events, and social multiplayer modes are transforming user experience and increasing session times.

- Regulatory clarity and responsible gaming frameworks are shaping new product designs that emphasize transparency and user protection.

What are the latest trends in the social casino market?

Increasing Integration of Social & Community-Based Features

Social casino operators are increasingly embedding multiplayer tournaments, live chat functions, social clubs, and competitive leagues into their platforms. These features replicate real-world casino camaraderie, enhancing user retention and boosting in-app purchase activity. Community-driven gaming experiences, such as team-based challenges and friend-invite reward programs, are becoming standard across top platforms. Developers are also leveraging behavioral analytics to recommend personalized tournaments, exclusive events, and loyalty rewards, further deepening engagement.

Technology-Driven Gameplay Enhancement

Advanced technologies, including augmented reality (AR), virtual reality (VR), and real-time analytics, are reshaping how users experience casino-style games. VR-based casino rooms simulate authentic casino floors, while AR overlays create interactive bonus rounds and visual effects. AI-powered personalization and dynamic difficulty adjustment improve satisfaction and spending likelihood. Additionally, blockchain technologies are emerging in reward systems, offering transparent, tamper-proof virtual asset management and collectible item trading within social casino ecosystems.

What are the key drivers in the social casino market?

Rapid Growth of Mobile Gaming Globally

The proliferation of affordable smartphones, 4G/5G connectivity, and gaming-optimized devices has significantly expanded the social casino user base. Mobile platforms contribute over 70% of total market revenue, with users engaging across short, frequent play sessions that fit daily routines. The convenience of app-based gaming, combined with push notifications, daily rewards, and on-the-go accessibility, continues to be a major catalyst for market expansion.

Increasing Popularity of Free-to-Play Models

The free-to-play (F2P) model has lowered entry barriers, enabling mass participation without upfront cost. Revenue is generated primarily through in-app purchases such as virtual coins, boosters, and premium features. Personalized offers and tier-based VIP systems encourage higher monetization per user. For advertisers, the large and diverse user base provides strong opportunities for targeted in-game promotions, making F2P the primary growth engine for the industry.

Enhanced Player Engagement Through Gamification

Gamification elements, including daily quests, leaderboards, spin streak rewards, and season-based events, significantly improve time spent in-game and overall user retention. Competitive and collaborative features elevate user participation and foster community attachment. These mechanisms closely mirror traditional casino reward systems, appealing to players seeking progression, achievement, and social recognition within a virtual environment.

What are the restraints for the global market?

Regulatory Ambiguity and Compliance Challenges

Social casino games occupy a grey zone between gambling and entertainment. Although they do not involve real-money payouts, some jurisdictions are pushing for stricter oversight due to concerns about addiction and perceived gambling-like mechanics. Regulatory uncertainty increases compliance costs and may restrict advertising or in-app purchase structures, creating market barriers for operators.

Rising User Acquisition Costs & Market Saturation

Intense competition among leading gaming studios has driven up digital advertising and user acquisition costs. Established players and new entrants alike face challenges in retaining users within a saturated market where switching costs are low. High marketing expenses reduce profitability for smaller developers, limiting innovation and market entry potential.

What are the key opportunities in the social casino industry?

Expansion into Emerging Markets

Regions such as Southeast Asia, India, Latin America, and the Middle East present significant growth potential due to improving mobile infrastructure and rising digital entertainment spending. Localized content, culturally relevant themes, and multilingual interfaces will allow developers to penetrate these fast-expanding markets more effectively.

Cross-Platform Integration and Connected Experiences

Seamless gameplay across smartphones, tablets, PCs, and smart TVs offers new engagement opportunities. Cross-platform wallets, synchronized progress, and cloud-based gaming ensure uninterrupted play, enhancing user retention. Partnerships with social platforms like TikTok, Instagram, and YouTube further enable integrated livestreaming, influencer marketing, and interactive social gaming campaigns.

Product Type Insights

Slots dominate the global social casino market, accounting for over 50% of total revenue thanks to their simplicity, familiar design, and frequent reward cycles. Card games, including poker and blackjack, cater to strategy-oriented users seeking competitive play. Table games such as roulette and craps maintain a loyal user base, while bingo and specialty games continue expanding due to their appeal among older demographics. The rising popularity of hybrid games that blend casino mechanics with role-playing or adventure elements is creating new revenue streams across user segments.

Application Insights

Entertainment-driven play remains the largest application category, with users engaging primarily for leisure and stress relief. Competitive tournaments and leaderboard-driven play are rapidly growing segments, supported by seasonal events and high-value virtual rewards. Social and community-based applications, including club tournaments and friend-versus-friend modes, are becoming key differentiators. Virtual currency collection, event participation, and tier-based progression systems further reinforce long-term engagement and spending patterns.

Distribution Channel Insights

Mobile app stores, including the Apple App Store and Google Play Store, dominate distribution with the highest download volumes and revenue generation. Browser-based platforms maintain niche usage among desktop players seeking multi-window gameplay. Direct-to-consumer (D2C) websites are expanding as developers adopt subscription models, offer exclusive events, and encourage in-house purchases that bypass third-party store fees. Social media-driven distribution, including instant-play formats on Facebook Gaming, continues to attract casual users.

Player Demographic Insights

Casual players form the largest demographic segment, attracted by accessible gameplay and free entry. Millennials and Gen X users drive strong spending patterns through microtransactions and loyalty programs. Competitive players, often focused on poker and tournament formats, exhibit the highest in-app purchase rates. Older demographics (50+ years) represent a growing user group within bingo, slots, and social table games, contributing significantly to daily active user metrics.

Age Group Insights

Players aged 31–50 constitute the highest share of global users, driven by stable income levels and interest in casual entertainment. The 18–30 age group shows strong adoption of competitive modes and socially integrated features. Players above 50 years old are rapidly increasing due to the appeal of simple, relaxing games such as bingo and classic slots. Each age segment displays unique spending patterns, prompting developers to design age-tailored reward systems and engagement loops.

| By Game Type | By Platform | By Monetization Model | By Revenue Source | By Player Demographics |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global social casino market, accounting for nearly 35–40% of total revenue. High smartphone penetration, strong digital payment infrastructure, and advanced gaming ecosystems drive sustained growth. The U.S. leads consumption, with players actively participating in slots, poker, and social tournaments. Premium in-app purchases and loyalty programs are particularly effective in this region.

Europe

Europe accounts for approximately 25% of the social casino market. Countries such as the U.K., Germany, and the Nordics demonstrate a strong affinity for mobile and social gaming. Europe’s stable regulatory environment supports steady market expansion, while cultural preferences for card and table games influence game development and localization strategies.

Asia-Pacific

Asia-Pacific is the fastest-growing social casino region, supported by massive mobile-first populations in China, India, Indonesia, Japan, and South Korea. Increasing disposable incomes and widespread adoption of digital wallets fuel growth. APAC users display high engagement levels and rising ARPU, particularly in competitive and community-driven game modes. Localization remains crucial for long-term expansion in this diverse region.

Latin America

Latin America is witnessing an accelerating demand for social casino games, largely driven by Brazil, Mexico, and Argentina. Expanding middle-class incomes and rising smartphone penetration are key factors. Socially integrated gameplay formats resonate strongly with LATAM users, making this region an emerging opportunity for global developers.

Middle East & Africa

MEA markets are gradually expanding due to improving digital infrastructure and growing interest in mobile entertainment. The UAE and Saudi Arabia lead regional adoption, while African nations such as South Africa and Nigeria show increasing potential. Cultural and regulatory variability across countries requires tailored market entry strategies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Social Casino Market

- Zynga Inc.

- Playtika Holding Corp.

- Caesars Entertainment (Interactive Division)

- Scientific Games Corporation

- DoubleDown Interactive

- PLAYSTUDIOS Inc.

- Huuuge Games

- Big Fish Games

- KamaGames

- Murka Games

- Product Madness

- Tangelo Games

- Akamon Entertainment

- Tripledot Studios

- Aristocrat Leisure Limited

Recent Developments

- In March 2025, Playtika introduced a new AI-driven personalization engine designed to enhance in-game purchase recommendations and event targeting.

- In January 2025, Zynga launched an AR-enabled slots experience, allowing players to interact with 3D slot environments through mobile devices.

- In April 2025, DoubleDown Interactive expanded its portfolio with the acquisition of a specialty bingo gaming studio to strengthen its position in the fast-growing bingo category.