Snorkeling Equipment Market Size

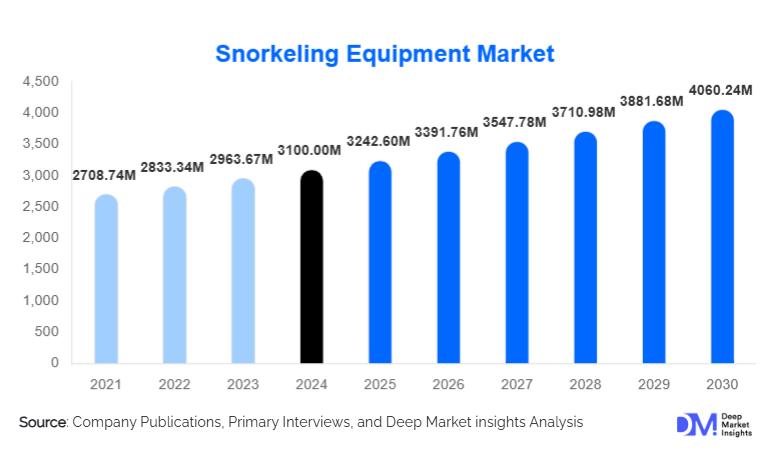

According to Deep Market Insights, the global snorkeling equipment market size was valued at USD 3,100.00 million in 2024 and is projected to grow from USD 3,242.60 million in 2025 to reach USD 4,060.24 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). The snorkeling equipment market growth is primarily driven by rising coastal tourism, expanding participation in marine recreational activities, a surge in eco-friendly adventure travel, and increasing adoption of snorkeling equipment among both leisure travelers and professional marine operators.

Key Market Insights

- Growing marine recreation and coastal tourism are expanding global demand for snorkeling masks, fins, snorkels, and complete kits.

- Resorts, cruise lines, and tour operators are rapidly increasing bulk procurement of rental-grade snorkeling equipment.

- Asia-Pacific dominates global demand growth, fueled by expanding middle-class tourism and booming beach destinations.

- Full-face masks, dry-top snorkels, and ergonomic fins are emerging as the fastest-growing product innovations.

- Online retail and specialty dive shops remain the leading distribution channels, offering accessibility and product expertise.

- Sustainability-focused materials and eco-certified gear are shifting consumer preference toward environmentally responsible brands.

What are the latest trends in the snorkeling equipment market?

Eco-Friendly & Sustainability-Driven Snorkeling Gear

Manufacturers are increasingly integrating sustainable materials into snorkeling equipment, such as biodegradable plastics, recycled polymers, and reef-safe components. Growing environmental awareness among travelers, especially in marine conservation zones, has accelerated demand for eco-friendly masks, fins, and snorkels. Tourism operators in Southeast Asia, the Caribbean, and Oceania are adopting sustainability-certified equipment to comply with eco-tourism standards and improve brand reputation among environmentally conscious travelers. Many brands are now allocating funds to coral-reef restoration and marine conservation projects, positioning snorkeling equipment as a contributor to sustainable tourism ecosystems.

Ergonomic & Comfort-Enhanced Product Innovation

Improved mask sealing technology, anti-fog lens coatings, flexible dry-top snorkels, and travel-friendly fin designs are redefining the snorkeling experience. Full-face panoramic masks continue to gain popularity due to their enhanced visibility, natural breathing, and comfort for beginners. Lightweight, foldable fins are becoming the go-to choice for frequent travelers. Smart accessories, such as integrated action-camera mounts and digital pressure-free strap systems, are increasingly appealing to younger demographics and adventure enthusiasts, driving premium product adoption.

What are the key drivers in the snorkeling equipment market?

Tourism & Coastal Recreation Expansion

Rebounding international tourism and rising participation in beach and island holidays have significantly boosted snorkeling equipment demand. Snorkeling remains one of the most accessible underwater activities compared to scuba diving, creating broad appeal across age groups and skill levels. Popular tourist destinations in Southeast Asia, the Caribbean, Hawaii, and the Mediterranean continue to attract millions of snorkelers yearly, generating strong equipment sales and bulk demand from resorts and rental operators.

Rising Disposable Income and Growth of Middle-Class Travelers

Emerging economies in Asia-Pacific and Latin America are witnessing the rapid ascent of middle-income households who are increasingly spending on leisure, adventure travel, and family-oriented beach vacations. This demographic shift elevates demand for both entry-level and mid-range snorkeling gear, with consumers prioritizing affordability and durability.

Shift Toward Adventure & Wellness-Oriented Travel

Global travelers are gravitating toward low-impact, wellness-enhancing, nature-connected activities. Snorkeling fits this trend perfectly by offering relaxing, scenic, and educational marine experiences. With marine conservation becoming a key travel motivation, snorkeling equipment demand is rising across eco-lodge operators, voluntourism programs, and marine parks.

What are the restraints for the global market?

Seasonality & Geographic Dependence

Snorkeling participation remains strongly seasonal, peaking during summer months and holiday seasons. Regions with short warm-weather windows or limited coastal areas contribute minimally to annual sales. This seasonality challenges manufacturers to maintain stable year-round revenue flows.

Safety, Liability & Regulatory Concerns

Snorkeling, although relatively safe, involves risks such as drowning, poor visibility, and a lack of user training. Resorts and tour operators face liability concerns and must adhere to equipment safety standards and regular maintenance. These factors may restrict bulk procurement or increase operational costs for smaller operators.

What are the key opportunities in the snorkeling equipment industry?

Rapid Growth of Resort & Rental-Based Demand

Resorts, cruise operators, and coastal tourism businesses are increasingly offering snorkeling as part of activity packages. This segment presents a large-scale B2B opportunity for manufacturers to supply durable, easy-to-maintain kits tailored for high usage. The repeated replacement cycle of rental gear ensures sustainable long-term demand.

High-Potential Emerging Destinations

Countries like Indonesia, Vietnam, Sri Lanka, Mexico, and several Caribbean islands are actively expanding marine tourism infrastructure. As these destinations promote snorkeling as a flagship activity, demand for equipment is expected to surge. Early market penetration offers a strategic advantage for established global brands and new entrants alike.

Premium & Technologically Enhanced Gear

There is rising interest in premium equipment with features such as hydrodynamic fin designs, hyper-clear lenses, dry-top snorkel valves, and ergonomic sealing technology. These innovations are attracting experienced snorkelers and frequent travelers willing to pay high margins. Smart wearable integration, including action-camera compatibility and anti-fog systems, presents additional avenues for differentiation.

Product Type Insights

Masks & snorkels dominate the market with a 30–35% share in 2024, driven by the essential need across all snorkelers regardless of skill level. Full-face masks are experiencing strong adoption, particularly among beginners seeking comfort and natural breathing. Fins represent another strong segment, supported by growing preference for adjustable travel fins. Snorkeling kits are increasingly popular among casual consumers seeking convenience and affordability. Accessories such as vests, defog sprays, and mesh gear bags are gaining traction due to increased rental and tourism activity.

Application Insights

Recreational snorkeling accounts for the largest share of global demand, supported by family tourism, island vacations, and adventure travel. Photography-driven snorkeling is rapidly growing as social media influence expands, encouraging travelers to capture underwater content using action cameras. Eco-volunteering programs and conservation-driven snorkeling activities, such as coral restoration participation, are rising among environmentally conscious tourists. Professional and training applications (school programs, water sports clubs) continue to gain ground in developed markets.

Distribution Channel Insights

Specialty dive and water-sports stores remain the preferred channel for quality gear, holding approximately 35–40% of market revenue due to personalized fitting and expert guidance. Online platforms are expanding rapidly, offering competitive pricing and wide product availability. Mass-market retail targets entry-level consumers with budget kits, while B2B sales to resorts and tour operators represent a fast-growing channel driven by the tourism boom.

Traveler Type Insights

Group travelers and families constitute a significant share, especially in resort destinations offering guided snorkeling trips. Solo adventurers and backpackers drive growth in budget gear, while couples and honeymooners prefer mid-range and premium equipment for curated travel experiences. Increasing participation of older adults in wellness travel is boosting demand for ergonomic, comfort-focused snorkeling gear.

Age Group Insights

The 31–50 age group remains the dominant consumer segment, combining disposable income with a strong interest in adventure travel. Younger travelers (18–30) fuel demand for affordable and travel-friendly snorkeling kits, heavily influenced by online reviews and social media. The 51–65 demographic prefers premium, comfort-oriented equipment, favoring ergonomic designs and high-clarity masks.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America contributes 20–25% of global demand in 2024, driven by a strong water-sports culture and outbound travel to snorkeling hotspots such as Hawaii, Florida, the Caribbean, and Mexico. High disposable income and a preference for premium gear support market growth.

Europe

Europe represents 15–20% of global demand, with strong participation in Mediterranean and island tourism. Sustainability-driven consumer preferences and adoption of eco-certified gear are shaping demand across Germany, the U.K., France, Italy, and Spain.

Asia-Pacific

APAC accounts for the largest share at 30–35% of the global market, fueled by booming tourism in Thailand, Indonesia, the Philippines, Malaysia, Australia, and India. Rising middle-class income and expansion of marine tourism infrastructure position APAC as the fastest-growing region through 2030.

Latin America

LATAM holds an 8–10% share, with growth concentrated in Mexico, Brazil, Costa Rica, and the Caribbean. Increasing promotion of marine adventure tourism supports expanding demand for snorkeling equipment.

Middle East & Africa

MEA contributes a 5–7% share, led by Red Sea destinations such as Egypt, Jordan, and Saudi Arabia. Africa’s coastal destinations, including Mauritius, Seychelles, and East Africa, are emerging hotspots with rising resort-based procurement.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Snorkeling Equipment Market

- Johnson Outdoors Inc.

- Cressi Sub S.p.A.

- Apollo Sports

- TUSA (Tabata Co.)

- Seavenger

- Mares

- Phantom Aquatics

- Kraken Aquatics

- Aqua Sphere

- Dive Rite

- Speedo

- TYR Sport

- Zoggs

- Scubapro

- Oceanic

Recent Developments

- In March 2025, Johnson Outdoors introduced a new line of eco-friendly snorkeling masks made from recycled marine plastics, aligning with global sustainability initiatives.

- In January 2025, Cressi expanded its manufacturing capacity in Europe to meet increasing tourism-driven demand for snorkeling fins and premium mask systems.

- In February 2025, Mares launched its ultra-light travel fin series targeting frequent travelers and cruise tourists.