Smart Adaptive Lighting Retrofit Market Size

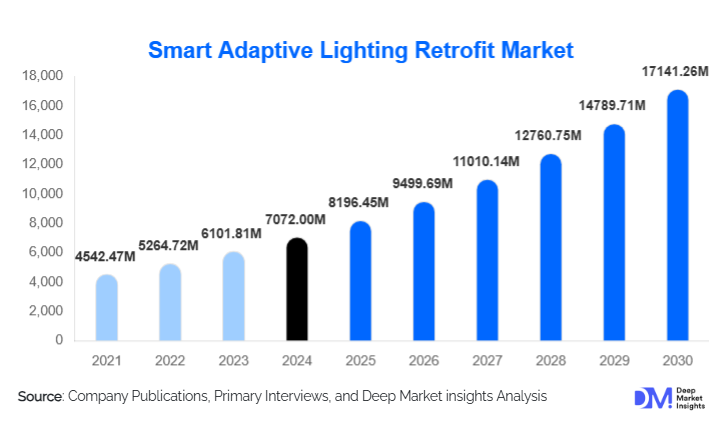

According to Deep Market Insights, the global smart adaptive lighting retrofit market size was valued at USD 7072.00 million in 2024 and is projected to grow from USD 8196.45 million in 2025 to reach USD 17141.26 million by 2030, expanding at a CAGR of 15.90% during the forecast period (2025–2030). Market growth is primarily driven by accelerating adoption of energy-efficient lighting upgrades, increasing regulatory pressure for carbon reduction, and the rapid shift toward IoT- and AI-enabled lighting systems that optimize energy usage in real time.

Key Market Insights

- Adaptive lighting retrofits are becoming central to global energy-efficiency strategies, driven by ESG compliance mandates and carbon-neutrality goals.

- Commercial and public infrastructure buildings lead demand, as organizations transition from legacy lighting to connected, sensor-driven, energy-saving systems.

- Wireless IoT retrofits are the fastest-growing technology segment, helping reduce installation complexity and modernization costs for older buildings.

- North America and Europe collectively account for over half of global revenue, supported by strong regulatory frameworks and smart city investments.

- Asia-Pacific is the fastest-growing region, led by industrial facility upgrades across China, India, Japan, and South Korea.

- AI-driven automation and predictive maintenance platforms are reshaping the competitive landscape, shifting market value toward software and services.

What are the latest trends in the Smart Adaptive Lighting Retrofit Market?

AI-Centric Adaptive Lighting Systems Gaining Momentum

AI-powered lighting platforms are quickly becoming essential for facilities seeking deeper automation and sustainability optimization. These systems analyze occupancy patterns, daylight availability, and environmental data to dynamically adjust lighting output, reaching energy savings of up to 70%. Predictive analytics also enable early fault detection, reducing maintenance costs for large campuses, industrial facilities, and citywide streetlight networks. Enterprises are integrating AI-driven lighting controls with HVAC and security platforms, creating a unified building intelligence layer. As AI algorithms continue to improve, adaptive lighting is evolving from simple sensor-based automation to a self-learning infrastructure that continuously optimizes building performance.

Rapid Expansion of Wireless and IoT-Enabled Retrofit Solutions

Wireless technologies such as Zigbee, Bluetooth Mesh, Wi-Fi, and Thread are transforming retrofit feasibility by eliminating the need for costly rewiring. Building owners increasingly prefer wireless-based adaptive lighting systems for their scalability, low deployment cost, and compatibility with modern building management systems. IoT-enabled modules allow remote monitoring, energy tracking, and cloud-based automation, making smart retrofits ideal for aging buildings. This trend is further supported by the rise of open standards such as DALI-2 and Matter, which ensure interoperability across lighting controllers, sensors, and platforms.

What are the key drivers in the Smart Adaptive Lighting Retrofit Market?

Stringent Energy Efficiency Regulations and ESG Compliance

Governments worldwide are implementing aggressive energy codes and emission reduction policies that directly impact lighting infrastructure. Regulations such as ASHRAE 90.1, EU Ecodesign standards, and national sustainability mandates are prompting facility owners to replace outdated lighting systems with adaptive, sensor-driven alternatives. Businesses are also adopting smart lighting retrofits to meet ESG reporting requirements, reduce operational energy intensity, and improve environmental performance across real estate portfolios.

Falling Sensor Costs and Advancements in Connectivity Technologies

Rapid innovation in semiconductor and wireless communication technologies has reduced the cost of occupancy sensors, daylight sensors, and motion detectors, making adaptive retrofits financially accessible. Wireless protocols significantly lower installation labor and enable scalable deployments in offices, schools, hospitals, and factories. These technologies ensure minimal disruption during installation, accelerating adoption among buildings that previously resisted modernization due to cost and complexity.

Growth of Smart Building Ecosystems and Autonomous Building Management

Organizations are increasingly investing in integrated building automation platforms that unify lighting, HVAC, access control, and energy management. Adaptive lighting retrofits offer a foundational layer for smart building ecosystems, delivering measurable ROI in energy savings and operational efficiency. The shift toward hybrid work models has increased demand for occupancy-aware lighting systems that align illumination levels with real-time usage, reducing waste and enhancing comfort for building occupants.

What are the restraints for the global market?

High Upfront Investment and Integration Costs

Despite long-term savings, the initial cost of retrofitting large buildings with smart adaptive lighting systems remains a barrier for small and mid-sized enterprises. Integration with legacy systems, upgrading control wiring, and ensuring compatibility with existing luminaires can raise deployment costs. These financial challenges are particularly significant in emerging markets where ROI expectations are shorter, and capital budgets are limited.

Interoperability Limitations and Fragmented Communication Protocols

The market faces challenges due to the lack of universal standards across lighting components, wireless protocols, and control platforms. Businesses often encounter compatibility issues when integrating devices from multiple vendors. Inconsistent cybersecurity protocols, differing regional standards, and limited cross-platform interoperability increase deployment complexity and discourage large-scale retrofits.

What are the key opportunities in the Smart Adaptive Lighting Retrofit Industry?

Smart City Infrastructure and Municipal Lighting Modernization

Urban governments are investing heavily in intelligent street lighting to reduce energy consumption, enhance public safety, and support connected city technologies. Adaptive lighting systems that offer dimming, remote monitoring, and environmental sensing capabilities deliver major operational savings. As global cities transition to digital infrastructure, companies offering scalable, cloud-managed retrofit solutions will capture significant municipal contracts.

AI-Powered Predictive Lighting and Software-as-a-Service Platforms

As hardware becomes increasingly commoditized, long-term market value is shifting toward AI-driven software platforms that deliver predictive maintenance, autonomous control, and data analytics. SaaS-based lighting management systems generate recurring revenue and enable superior performance optimization. This opportunity is especially attractive for technology firms entering the lighting ecosystem with advanced analytics, machine learning, and automation technologies.

Product Type Insights

Smart sensors and controllers dominate the market, accounting for nearly 32% of the global 2024 revenue. These components enable real-time adaptive control, daylight harvesting, and occupancy-based automation, making them essential for any modern retrofit. Smart luminaires and LED retrofit kits follow closely, driven by rapid replacements of inefficient fluorescent and HID lamps. Connectivity modules, particularly wireless ones, are experiencing a surge in demand as organizations transition to IoT-ready lighting ecosystems.

Software platforms are emerging as a high-margin segment, offering cloud-based lighting analytics, automated scheduling, and energy monitoring dashboards. Service-based offerings, including installation, commissioning, and maintenance, are also growing as enterprises seek end-to-end modernization solutions.

Application Insights

Energy management applications lead the market with a 41% share, driven by the urgent need to reduce electricity consumption across commercial and industrial buildings. Occupancy-based automation is another high-demand segment, especially within workplaces adopting hybrid attendance models. Environmental adaptation, such as daylight harvesting, continues to gain traction as organizations adopt more sophisticated sustainability strategies.

Security-integrated adaptive lighting is expanding in public spaces and industrial sites, while predictive maintenance is emerging as a fast-growing application powered by AI and IoT analytics. These applications collectively enhance safety, productivity, and operational efficiency across facilities.

Deployment Type Insights

Indoor retrofits dominate with a 64% market share due to the extensive need to modernize commercial offices, hospitals, schools, warehouses, and retail spaces. Controlled indoor environments support advanced automation features such as human-centric lighting (HCL), occupancy intelligence, and integrated building management. Outdoor adaptive lighting, particularly in streets, parking lots, and transportation hubs, is growing rapidly, supported by smart city initiatives and public infrastructure modernization programs.

End-User Insights

Commercial buildings represent the largest end-user segment with 36% of the 2024 global demand. Corporations are rapidly adopting adaptive lighting systems to reduce energy expenditures, enhance employee comfort, and meet ESG reporting standards. Industrial facilities are the fastest-growing subsegment, driven by automation, workplace safety requirements, and the rise of advanced manufacturing.

Healthcare, education, and public infrastructure sectors are expanding steadily, supported by government investment in sustainable building upgrades. Residential adoption remains modest but is rising as smart home ecosystems evolve, and wireless retrofits become more affordable.

| By Component | By Technology | By Application | By Deployment Type | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of global market revenue, led by the United States, which alone represents nearly 24%. The region benefits from strong regulatory enforcement, high adoption of smart building technologies, and extensive retrofit programs in both public and private infrastructure. Canada is also seeing rapid municipal adoption of smart street lighting, contributing meaningfully to regional growth.

Europe

Europe holds roughly 26% of the global market, supported by aggressive energy-efficiency directives under the EU Green Deal. Germany, the U.K., France, and the Netherlands are major adopters of connected lighting systems. Strong focus on sustainability and modernization of historic buildings further drives retrofit demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at an estimated CAGR of 17%. China leads in scale due to widespread industrial automation and government-backed modernization programs. India is experiencing rapid adoption through Smart Cities Mission initiatives, while Japan and South Korea are investing heavily in smart factories and logistics centers.

Latin America

Growth in Latin America is moderate but rising steadily, driven by Brazil, Mexico, and Chile. Commercial real estate modernization and industrial facility upgrades are contributing to increased demand for adaptive lighting solutions in the region.

Middle East & Africa

The Middle East is seeing strong momentum due to large-scale infrastructure projects in the UAE, Saudi Arabia, and Qatar. Africa’s market is primarily driven by public lighting modernization and donor-funded infrastructure programs. Collectively, MEA is emerging as an important opportunity zone for companies targeting municipal smart lighting contracts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Adaptive Lighting Retrofit Market

- Signify

- Acuity Brands

- Zumtobel Group

- ams OSRAM

- Hubbell Lighting

- Schneider Electric

- Legrand

- Lutron Electronics

- Honeywell

- Eaton Lighting

- Dialight

- Cree Lighting

- GE Current

- Enlighted (SmartSense)

- Ideal Industries

Recent Developments

- In March 2025, Signify expanded its IoT-enabled Interact platform with AI-driven predictive lighting analytics for commercial and public infrastructure clients.

- In January 2025, Acuity Brands launched a new wireless retrofit kit designed for rapid installation in older commercial buildings, cutting deployment time by 40%.

- In February 2025, Zumtobel Group introduced human-centric adaptive lighting systems optimized for healthcare and educational environments.

- In April 2025, Schneider Electric partnered with major smart city integrators to deploy adaptive street lighting solutions across Southeast Asia.