Smart Lighting Market Size

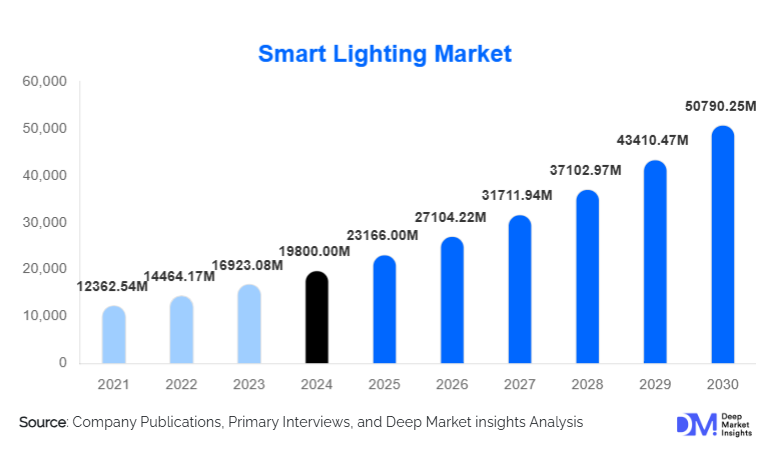

According to Deep Market Insights, the global smart lighting market size was valued at USD 19,800.00 million in 2024 and is projected to grow from USD 23,166.00 million in 2025 to reach USD 50,790.25 million by 2030, expanding at a CAGR of 17.0% during the forecast period (2025–2030). The market’s rapid growth is driven by surging adoption of LED-based intelligent lighting systems, rising demand for energy-efficient infrastructure, large-scale municipal smart-city deployments, and the integration of IoT, sensors, and cloud-connected controls within commercial and industrial spaces. Smart lighting is transitioning from a simple illumination technology to a critical component of intelligent buildings, data-driven energy management, and urban digital transformation initiatives worldwide.

Key Market Insights

- Smart lighting is increasingly becoming the backbone of smart buildings and smart-city ecosystems, driven by intelligent sensors, advanced lighting controls, and interoperable communication protocols.

- LED-based smart luminaires dominate the market, offering long lifespans, reduced maintenance costs, and seamless integration with IoT platforms.

- Asia-Pacific leads in volume adoption, propelled by rapid urbanization, large infrastructure investments, and national smart-city programs.

- North America remains a high-value market driven by commercial retrofits, enterprise energy-efficiency goals, and utility incentive programs.

- Wireless control technologies, Bluetooth Mesh, Zigbee, and Wi-Fi, are transforming retrofit economics and enabling scalable deployments across commercial and residential settings.

- SaaS-based lighting management platforms and lighting-as-a-service (LaaS) are creating recurring revenue streams and reshaping the competitive landscape.

What are the latest trends in the Smart Lighting Market?

IoT-Integrated and Sensor-Driven Lighting Systems

Modern smart lighting solutions now function as distributed sensor networks, capable of tracking occupancy, daylight intensity, air quality, and space utilization. These systems provide real-time data that supports energy optimization, predictive maintenance, and facility analytics. Building owners increasingly integrate smart lighting with HVAC, security, and workspace management systems to create holistic smart-building ecosystems. Advanced analytics and AI-driven automation are further enhancing energy savings, increasing efficiency, and enabling personalized lighting experiences in offices, hospitals, and educational institutions.

Rise of Wireless Protocols and Interoperability Standards

Wireless technologies such as Bluetooth Mesh, Zigbee, Wi-Fi 6, and emerging Matter/Thread standards are accelerating adoption by eliminating the need for extensive rewiring. These protocols simplify retrofitting and reduce installation costs, particularly valuable in commercial buildings, heritage structures, and large residential complexes. Interoperability frameworks like DALI-2 and Matter are gaining momentum, ensuring compatibility between fixtures, drivers, and control platforms. This shift is significantly reducing buyer concerns around vendor lock-in and future-proofing lighting investments.

What are the key drivers in the Smart Lighting Market?

Growing Demand for Energy Efficiency and Sustainability

Governments worldwide are enforcing stringent energy-efficiency regulations for buildings, encouraging the shift from traditional lighting to LED-based smart systems. Enterprises are pursuing net-zero goals and ESG benchmarks, making smart lighting a top-priority investment due to its immediate energy savings of 40%–70%. Utility incentives and green-building certifications such as LEED and BREEAM further accelerate deployment.

Expanding Smart City and Public Infrastructure Projects

Large-scale smart-city initiatives across Asia, Europe, the Middle East, and North America are driving mass deployment of connected streetlights equipped with sensors, remote controllers, and management platforms. Municipalities benefit from improved public safety, reduced energy consumption, and lower maintenance costs, strengthening long-term demand for intelligent outdoor lighting systems.

Advancements in IoT, AI, and Cloud-Based Lighting Platforms

Cloud-connected lighting management platforms provide remote control, real-time monitoring, and analytics-driven automation. AI-driven systems optimize lighting patterns, detect anomalies, and enable predictive maintenance, reducing downtime and operational costs. These technologies also create recurring revenue opportunities through subscription-based models.

What are the restraints for the global market?

High Initial Setup and Integration Costs

Although smart lighting offers long-term savings, upfront costs, including sensors, drivers, gateways, and commissioning, remain a barrier for small businesses and budget-constrained municipalities. Integration with legacy building systems may require additional hardware and specialized expertise, increasing deployment complexity and extending ROI timelines.

Interoperability and Cybersecurity Concerns

The market remains fragmented across numerous protocols and proprietary ecosystems. Incompatibility between devices and concerns over long-term maintenance discourage adoption in large-scale enterprise deployments. Additionally, connected lighting systems present cybersecurity vulnerabilities, requiring robust security frameworks to prevent unauthorized access and protect building data.

What are the key opportunities in the Smart Lighting Market?

Municipal Smart Infrastructure Modernization

Cities worldwide are upgrading millions of streetlights to connected LED systems. This shift opens opportunities for vendors offering adaptive lighting, environmental sensing, public Wi-Fi integration, and energy-as-a-service models. Long-term municipal contracts create stable revenue streams and drive large-scale deployments.

Software Monetization and Lighting-as-a-Service (LaaS)

As lighting becomes a managed service, vendors can generate recurring revenues through cloud-based lighting control platforms, analytics dashboards, and predictive maintenance solutions. Enterprises increasingly prefer OPEX-based models, reducing upfront burden while accessing predictable cost structures. LaaS is particularly attractive to retail chains, industrial facilities, and municipalities.

Smart Lighting for Specialized Applications

Emerging applications such as horticulture lighting (spectral tuning), healthcare circadian lighting, and industrial safety illumination create new growth frontiers. These segments demand advanced control systems and high-performance fixtures with premium margins. IoT-enabled monitoring enhances productivity in controlled-environment agriculture and improves patient outcomes in healthcare settings.

Product Type Insights

Smart luminaires dominate the product landscape, accounting for a major share of global revenue due to widespread commercial and municipal adoption. Integrated fixtures with embedded drivers and sensors reduce installation complexity and offer superior efficiency. Smart bulbs remain popular in residential applications, driven by affordability and compatibility with consumer ecosystems like Alexa, Google Home, and Matter-enabled hubs. Control devices, including sensors, dimmers, and gateways, are experiencing rapid adoption as buildings transition to data-centric automation. Software and lighting management platforms represent the fastest-growing segment by revenue, supported by AI-driven analytics, cloud dashboards, and subscription-based services.

Application Insights

Commercial buildings account for the largest application segment, driven by demand for energy management, occupancy sensing, and smart-building automation. Municipal and outdoor lighting is the second-largest segment, supported by widespread smart-city rollout programs. Industrial facilities are rapidly adopting smart high-bay lighting for safety compliance, energy savings, and integration with automation systems. Residential smart lighting continues to grow in volume, fueled by DIY products, voice assistants, and home automation hubs. Niche segments such as horticulture, healthcare, and education are emerging as high-margin opportunities for specialized smart lighting solutions.

Distribution Channel Insights

Direct sales and system integrators dominate enterprise and municipal projects, managing end-to-end procurement, installation, and commissioning. OEMs and electrical distributors play a major role in supplying fixtures and components for commercial upgrades. Online retail channels continue to expand, particularly for residential smart bulbs and small-scale retrofit kits. Subscription-based service models and cloud-enabled platforms are emerging as new channels, enabling recurring revenue for vendors and reducing initial costs for customers.

End-User Insights

Commercial and office spaces are the largest end-user category, driven by corporate sustainability mandates and attractive ROI profiles. Industrial users are increasingly deploying smart lighting for automation, safety, and productivity improvements. Municipalities remain a critical segment, with large-scale LED streetlight conversions driving global outdoor adoption. Residential consumers form a fast-growing base, influenced by voice-control ecosystems and affordable smart bulbs. Emerging end-users include greenhouses, hospitals, schools, and warehouses adopting advanced tuning, occupancy sensing, and analytics-driven controls.

| By Offering | By Technology / Light Source | By Communication Protocol | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents one of the highest-value smart lighting markets, driven by large-scale commercial retrofits, utility rebate programs, and the modernization of public infrastructure. The U.S. leads regional demand, with widespread adoption in offices, warehouses, and smart-city projects. Canada is expanding investments in sustainable building technologies, contributing to steady growth in energy-efficient lighting deployments.

Europe

Europe remains a global leader in energy-efficiency legislation and smart-building adoption. Countries including Germany, the U.K., the Netherlands, and the Nordics are at the forefront of DALI-2 and PoE lighting implementations. Municipal smart-city programs, strict environmental regulations, and demand for premium certified products sustain Europe’s strong smart lighting market performance.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by rapid urban development, government-led smart-city missions, and extensive manufacturing ecosystems. China leads in volume due to large-scale public infrastructure upgrades, while India records the highest growth rate as cities implement LED streetlighting, safety systems, and digital infrastructure projects. Japan, South Korea, and Australia contribute strong commercial and residential demand.

Latin America

Latin America’s smart lighting adoption is gradually increasing, driven by municipal LED replacement programs and commercial building upgrades. Brazil and Mexico lead regional demand with investments in public lighting, retail modernization, and industrial automation. Economic variability remains a challenge, but does not impede long-term regional potential.

Middle East & Africa

The Middle East is investing heavily in smart infrastructure as part of national diversification strategies, with the UAE and Saudi Arabia leading smart-city and commercial smart-building projects. Africa is undergoing widespread LED streetlight deployment, particularly in South Africa, Kenya, and Morocco, supported by government and development-bank-funded programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Lighting Market

- Signify (Philips Lighting)

- ams OSRAM

- Acuity Brands

- Eaton

- Hubbell

- Zumtobel Group

- Fagerhult

- Legrand

- Schneider Electric

- Cree

- Delta Electronics

- GE Current

- Panasonic

- Samsung LED (component leadership)

- Nichia

Recent Developments

- In March 2025, Signify expanded its Interact IoT lighting platform with AI-enabled energy optimization modules for commercial buildings.

- In February 2025, Acuity Brands launched a new portfolio of Matter-compatible luminaires designed to simplify home and office integration.

- In January 2025, Eaton unveiled a new series of smart outdoor lighting controllers supporting adaptive dimming and environmental sensing for smart-city deployments.