Sleep Tourism Market Size

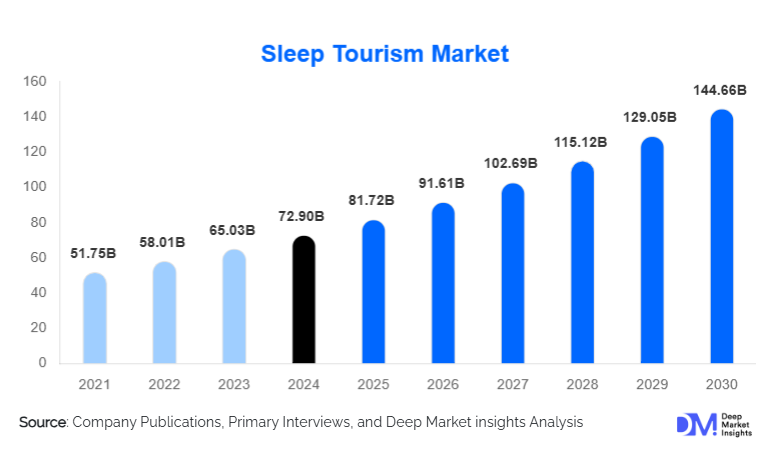

According to Deep Market Insights, the global sleep tourism market size was valued at USD 72.90 billion in 2024 and is projected to grow from USD 81.72 billion in 2025 to reach USD 144.66 billion by 2030, expanding at a CAGR of 12.1% during the forecast period (2025–2030). The sleep tourism market growth is primarily driven by rising awareness of sleep as a critical health factor, increasing demand for wellness-focused travel experiences, and the integration of advanced sleep technologies into hospitality offerings worldwide.

Key Market Insights

- Sleep tourism is increasingly becoming a primary travel motivator, with travelers seeking structured sleep therapy programs, holistic retreats, and tech-enabled sleep environments.

- Hotels and specialized wellness resorts dominate accommodation offerings, providing sleep-focused rooms, smart beds, circadian lighting, and guided relaxation programs.

- North America leads the market, with the U.S. and Canada accounting for the largest share due to high disposable income, corporate wellness adoption, and a strong wellness travel culture.

- Asia-Pacific is the fastest-growing region, led by China, India, Thailand, and Japan, driven by rising middle-class health consciousness and growing domestic tourism.

- Europe maintains significant demand through wellness culture, eco-conscious travel, and spa traditions, particularly in the U.K., Germany, and Scandinavia.

- Technological integration, including smart sleep suites, wearables, AI-based sleep analytics, and tele-wellness services, is reshaping traveler engagement and premium experience offerings.

What are the latest trends in the sleep tourism market?

Integration of Sleep Science and Technology

Sleep tourism operators are increasingly adopting sleep science and technology to enhance guest experiences. Smart beds, circadian lighting, neuro-acoustic therapy, and wearable sleep trackers are now integrated into hotel suites and wellness retreats. Data-driven personalization allows travelers to monitor improvements in sleep quality, creating measurable outcomes that enhance perceived value. Partnerships between hospitality brands and biomedical researchers are further positioning sleep tourism as a serious health-focused segment rather than a niche luxury add-on.

Expansion into Corporate and Medical Wellness

Sleep tourism is expanding into corporate wellness programs and medical tourism. Companies are offering restorative retreats to reduce burnout and improve productivity, while medical travelers seek diagnostic and therapeutic services to address sleep disorders. Tailored packages for corporate and clinical segments provide premium pricing opportunities and increase repeat visit potential. The convergence of healthcare and hospitality is opening new market segments with measurable benefits for both clients and service providers.

What are the key drivers in the sleep tourism market?

Growing Awareness of Sleep as a Health Priority

Increasing recognition of the health risks associated with poor sleep, such as chronic diseases, cognitive decline, and mental health challenges, has boosted demand for sleep-focused travel experiences. Travelers now actively seek vacations that integrate wellness programs designed to improve sleep quality and recovery, positioning sleep tourism as an essential component of preventive health.

Rise of Wellness Tourism

The expansion of global wellness tourism is directly benefiting sleep tourism. Travelers increasingly prioritize experiences that support mental, physical, and emotional well-being. Hospitality providers are responding with sleep-centric retreats, therapy programs, and restorative environments. Middle- and high-income segments are particularly drawn to premium offerings that promise measurable health benefits.

Technological Innovation

Advanced sleep technologies, including AI-driven sleep analytics, biofeedback systems, smart environmental controls, and wearable devices, are transforming the market. Personalization and measurable outcomes enhance consumer trust and willingness to pay for premium experiences, making technology a key growth enabler.

What are the restraints for the global market?

High Costs of Sleep Tourism Experiences

Sleep tourism packages, especially those including luxury accommodations, diagnostic services, and advanced technologies, remain expensive relative to standard travel. High pricing limits adoption among middle-income consumers and restricts broader market penetration.

Limited Awareness and Perceived Novelty

Despite growing interest, sleep tourism is still considered a niche offering in many regions. Many potential travelers perceive sleep wellness as a supplementary service rather than a primary travel motivator. Sustained education, marketing, and clinical validation are needed to increase adoption.

What are the key opportunities in the sleep tourism industry?

Hybrid Wellness Experiences

Combining sleep tourism with broader wellness programs, such as meditation, yoga, and holistic therapies, presents opportunities to attract new demographics. Hybrid models extend traveler stays and increase per-capita spend, appealing to both leisure and corporate wellness travelers.

Government and Regional Initiatives

Governments in Asia-Pacific, Europe, and North America are promoting wellness tourism through infrastructure support, tax incentives, and marketing campaigns. Emerging destinations with natural tranquility, forests, mountains, and coastal retreats are attracting travelers seeking restorative sleep, creating opportunities for regional development and branding.

Digital Platforms and Tele-Wellness Services

Follow-up programs through mobile apps, wearables, and teleconsultations extend the value of physical sleep tourism experiences. Providers can maintain engagement, upsell services, and create subscription-based revenue streams while collecting data to personalize future offerings.

Product Type Insights

Hotels and specialized sleep-focused suites dominate the global sleep tourism market, accounting for the largest share due to their ability to integrate sleep wellness offerings within established hospitality infrastructure. Leading hotel chains have rapidly upgraded premium rooms with smart beds, circadian rhythm–aligned lighting, noise-cancellation systems, air-quality controls, and curated sleep menus, making sleep optimization accessible to both leisure and business travelers. This segment is driven by scale, brand trust, and the ability to bundle sleep wellness with conventional travel services, resulting in higher occupancy rates and premium pricing.

Resorts and dedicated wellness retreats represent the fastest-growing product category, fueled by rising demand for immersive, multi-day restorative experiences. These properties offer structured sleep therapy programs combined with meditation, nature immersion, nutrition, and physical recovery, attracting high-value wellness and medical travelers. Boutique wellness lodges and eco-lodges cater to niche segments seeking privacy, sustainability, and unique natural settings such as forests, mountains, or coastal environments. Meanwhile, sleep clinics and medical retreat centers continue to expand their footprint by attracting diagnostic and therapeutic travelers seeking clinically supervised sleep interventions. Collectively, this diversified product mix allows the market to cater to varying price points, durations of stay, and traveler intent, strengthening overall market resilience.

Application Insights

Sleep therapy programs and wellness activities remain the leading application segment globally, driven by growing clinical validation of interventions such as cognitive behavioral therapy for insomnia (CBT-I), light therapy, sound therapy, and guided relaxation techniques. These programs are preferred by travelers seeking measurable improvements in sleep quality, stress reduction, and cognitive performance, making them central to both leisure and medical sleep tourism offerings.

Technologically enhanced sleep experiences are gaining strong momentum as hotels and retreats adopt wearable-integrated monitoring, AI-based sleep analytics, and biofeedback systems. This segment is driven by data-conscious consumers who value personalization and measurable outcomes. Educational workshops, sleep coaching, and diagnostic services are also expanding, particularly within medical tourism and corporate wellness segments. These applications enhance credibility, increase length of stay, and create opportunities for post-trip digital engagement, positioning application innovation as a key growth lever for the market.

Distribution Channel Insights

Direct bookings through hotel and retreat websites dominate the sleep tourism market, supported by consumers’ preference for personalized packages, transparent pricing, and bundled wellness services. Leading providers invest heavily in digital platforms, enabling customized sleep programs, flexible scheduling, and direct customer engagement, which improves margins and repeat visitation.

Online travel agencies (OTAs) and specialist wellness travel agencies continue to play a significant role, particularly for international travelers and first-time sleep tourists. Digital engagement through mobile apps, subscription-based wellness services, and tele-wellness platforms is expanding rapidly, allowing providers to extend the customer relationship beyond the physical stay. Influencer-driven marketing and social media content, especially sleep transformation stories and wellness journeys, are increasingly influencing booking decisions among younger demographics, strengthening omnichannel distribution strategies.

Traveler Type Insights

Leisure travelers account for the largest share of the sleep tourism market, driven by growing interest in restorative vacations that combine relaxation with health optimization. This segment benefits from rising disposable incomes and the normalization of wellness travel as part of mainstream tourism.

Medical tourism and corporate wellness travelers represent the fastest-growing segments, contributing disproportionately to revenue due to higher spend per trip and longer stays. Medical travelers seek diagnostic and therapeutic sleep solutions under professional supervision, while corporations increasingly sponsor sleep-focused retreats to address employee burnout and productivity loss. Family and group travelers are gradually adopting sleep-focused vacations that combine education, relaxation, and shared wellness activities, while solo travelers, particularly digital professionals, drive demand for highly personalized, technology-enabled sleep experiences.

Age Group Insights

Travelers aged 31–50 years form the largest age segment in the sleep tourism market, balancing strong purchasing power with heightened awareness of sleep-related health risks. This group is most likely to invest in premium, evidence-based sleep programs that promise long-term lifestyle improvements.

The 18–30 age group is a key growth driver, favoring tech-enabled, budget-friendly, and experiential sleep tourism offerings, often influenced by social media and wellness trends. Travelers aged 51–65 represent a significant premium segment, preferring guided programs, structured therapies, and wellness retreats that prioritize comfort and safety. The above-65 segment remains niche but high-value, focused on medical support, gentle therapies, and restorative environments, particularly in destinations with strong healthcare integration.

| By Product Type | By Application | By Distribution Channel | By Traveler Type | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global sleep tourism market, led by the United States and Canada. Regional growth is driven by high awareness of sleep disorders, strong integration of healthcare and wellness tourism, and widespread adoption of corporate wellness programs. Advanced hospitality infrastructure and early adoption of sleep technologies, such as smart suites and AI-driven sleep analytics, further reinforce market leadership. Demand is particularly strong for customized retreats, diagnostic sleep programs, and premium wellness experiences.

Europe

Europe accounts for a substantial share of the market, supported by a deep-rooted wellness culture, established spa traditions, and strong regulatory support for preventive healthcare. Countries such as Germany, the U.K., France, and Scandinavian nations lead demand due to high consumer preference for evidence-based sleep programs and sustainable tourism. Growth is further driven by eco-conscious travel behavior, public healthcare awareness campaigns, and rising interest in nature-based restorative retreats.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by rising middle-class incomes, rapid urbanization, and increasing awareness of stress- and sleep-related health issues. China and India contribute significant domestic demand, while Thailand, Japan, and Australia attract international sleep tourists through retreat-style wellness resorts and technology-integrated hospitality. Government promotion of wellness tourism, strong social media influence, and expanding air connectivity further accelerate regional growth.

Latin America

Latin America demonstrates moderate but steady growth, with Brazil, Argentina, and Mexico emerging as key demand centers. Regional growth is driven by increasing outbound wellness travel, growing interest in nature-linked restorative experiences, and rising affluence among urban populations. Sleep tourism in this region often intersects with adventure and eco-wellness travel, appealing to families and experiential travelers.

Middle East & Africa

Africa remains a natural hub for wellness and sleep tourism due to its tranquil landscapes, low-noise environments, and established retreat destinations. Growth is supported by eco-lodges and boutique wellness resorts that attract international travelers seeking deep restoration. The Middle East, particularly the UAE, Saudi Arabia, and Qatar, is emerging as a key source and destination market, driven by high-income populations, luxury hospitality investments, government-backed tourism diversification strategies, and growing interest in preventive health and wellness travel.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sleep Tourism Industry

- Hilton

- Marriott International

- InterContinental Hotels Group

- Hyatt

- Accor

- Mandarin Oriental Hotel Group

- Four Seasons Hotels & Resorts

- Canyon Ranch

- Six Senses Hotels, Resorts, and Spas

- Aman Resorts

- Banyan Tree Holdings

- COMO Hotels and Resorts

- Ananda in the Himalayas

- Vana Retreat

- Kamalaya Wellness Sanctuary