Seitan Powder Market Size

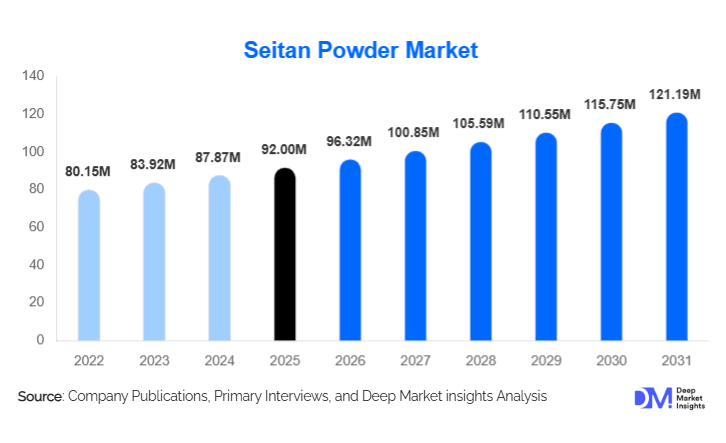

According to Deep Market Insights, the global seitan powder market size was valued at USD 92 million in 2025 and is projected to grow from USD 96.32 million in 2026 to reach USD 121.19 million by 2031, expanding at a CAGR of 4.7% during the forecast period (2026–2031). The market growth is primarily driven by the increasing adoption of plant-based diets, rising demand for high-protein meat alternatives, and expansion of product applications across foodservice, retail, and sports nutrition industries.

Key Market Insights

- Plant-based and flexitarian diets are driving seitan powder adoption, as consumers seek sustainable and high-protein alternatives to meat.

- Foodservice and processed food applications dominate demand, particularly in plant-based meat manufacturing and ready-to-eat meals.

- North America and Europe hold the largest market shares, owing to established vegan/vegetarian populations and mature retail networks.

- Asia-Pacific is the fastest-growing region, fueled by rising health awareness, increasing disposable incomes, and expanding vegan consumer bases in China and India.

- Technological innovations in texture, flavor enhancement, and functional protein fortification are enhancing consumer acceptance and product versatility.

- Online retail channels are becoming a primary mode of distribution, particularly for niche consumers seeking convenience and variety.

What are the latest trends in the seitan powder market?

Expansion Beyond Traditional Vegan Markets

Seitan powder is increasingly being adopted by flexitarian and health-conscious consumers who do not strictly follow vegan or vegetarian diets. Its high protein content and versatility make it ideal for plant-based snacks, protein bars, and ready-to-cook meals. Manufacturers are positioning seitan powder not only as a meat alternative but also as a functional ingredient to enhance nutritional profiles in processed foods. The trend is reinforced by the rising demand for high-protein diets among fitness enthusiasts and sports nutrition consumers.

Technological and Product Innovation

Advancements in processing technologies, including enzymatic treatment, flavor infusions, and texturization techniques, are improving the sensory profile and usability of seitan powder. These innovations allow manufacturers to create products that closely mimic meat textures, appealing to mainstream consumers. Innovations also extend to flavored and fortified powders, which cater to convenience-focused households and the ready-to-eat meal segment. As a result, product diversification and innovation are key strategies for market players to drive adoption.

What are the key drivers in the seitan powder market?

Rising Plant-Based and Flexitarian Diets

The increasing shift toward plant-based and flexitarian lifestyles globally is a primary driver for seitan powder demand. Health-conscious consumers are seeking high-protein, low-fat alternatives to traditional meat, and seitan powder satisfies both nutritional and functional requirements. The trend is particularly strong in North America and Europe, where awareness about sustainability, animal welfare, and environmental impact drives consumption of plant-derived proteins.

Expanding Foodservice and Processed Food Applications

Restaurants, quick-service chains, and processed food manufacturers are incorporating seitan powder into meat analogues, snacks, and ready-to-eat meals. This expansion increases market penetration by creating high-volume demand channels. The growth of plant-based meat substitutes, particularly in urban and health-focused markets, further fuels demand for textured seitan powders suitable for commercial production.

Functional Ingredient Adoption in Health & Nutrition Products

Seitan powder is increasingly being used in protein bars, bakery items, and functional beverages. Its high protein content and versatility make it attractive for sports nutrition, wellness foods, and meal-replacement products. The integration of seitan powder as a functional ingredient contributes to higher value propositions for food manufacturers.

What are the restraints for the global market?

Gluten Sensitivity and Dietary Restrictions

Seitan powder is primarily derived from wheat gluten, making it unsuitable for consumers with celiac disease or gluten intolerance. This limitation restricts the overall addressable market and may impact growth in regions with a high prevalence of gluten-free diets.

Flavor and Texture Acceptance Barriers

Despite technological advancements, seitan still faces challenges in replicating the taste and mouthfeel of traditional meat, which can limit adoption among mainstream consumers. Overcoming this requires continued R&D investment, marketing, and education to reposition seitan as a desirable alternative.

What are the key opportunities in the seitan powder market?

Flexitarian and Health-Oriented Market Expansion

The growing population of flexitarian and health-conscious consumers provides a major growth opportunity. Seitan powder can cater to a wider audience seeking high-protein and low-fat alternatives without fully eliminating meat. Marketing campaigns emphasizing health benefits, protein content, and sustainability are likely to expand consumer adoption across multiple regions.

Technological Innovation in Product Development

Advances in flavor, texture, and fortification technologies create opportunities for product differentiation. Enzymatic processing, seasoning enhancements, and texturization can improve the sensory appeal of seitan powder, facilitating its use in meat analogues, ready-to-cook meals, and functional foods. Manufacturers investing in innovation are likely to capture premium market segments and achieve higher margins.

Regulatory and Policy Support

Governments promoting plant-based diets for sustainability and health objectives create favorable policy environments. Incentives, trade agreements, and nutrition-focused programs support market expansion, especially in emerging markets. Leveraging policy support can help new entrants and established players increase visibility, access funding, and expand distribution networks.

Product Type Insights

Conventional seitan powders dominate the global market, accounting for approximately 75% of total demand, primarily due to their cost-effectiveness, large-scale availability, and widespread acceptance among food manufacturers. Conventional variants are extensively used in processed foods, plant-based meat analogues, and foodservice applications where price sensitivity and volume scalability are critical decision factors. The dominance of this segment is further reinforced by well-established wheat gluten supply chains and standardised processing technologies that allow consistent quality and competitive pricing.

Organic seitan powders, while representing a smaller share of the market, are witnessing faster growth rates compared to conventional products. Demand for organic variants is being driven by premium health-conscious consumers, clean-label trends, and regulatory support for organic food consumption in Europe and North America. Innovations in texture optimisation, flavour masking, and protein fortification are enhancing the functional performance of both conventional and organic seitan powders, enabling broader adoption across ready meals, plant-based meat substitutes, and functional nutrition products. Over the forecast period, organic seitan powder is expected to gain incremental share, particularly in developed markets where the willingness to pay for organic credentials is higher.

Application Insights

The food and beverage sector represents the largest application segment, accounting for approximately 55% of total seitan powder demand in 2024. This dominance is driven by extensive usage in ready-to-cook meals, plant-based meat manufacturing, frozen foods, and processed snacks. Seitan powder’s high protein content, excellent binding properties, and meat-like texture make it a preferred ingredient for plant-based burgers, sausages, nuggets, and deli-style products. The segment continues to benefit from the rapid expansion of the global plant-based meat industry and increasing shelf space for meat alternatives across retail channels.

Sports nutrition and health-focused applications are emerging as high-growth segments, supported by rising demand for protein-enriched diets, meal replacements, and functional foods. Seitan powder is increasingly being incorporated into protein bars, bakery products, and high-protein snacks due to its nutritional density. Meanwhile, foodservice adoption continues to expand as restaurants, quick-service chains, and institutional caterers introduce plant-based menu options to cater to vegan and flexitarian consumers. This diversification of applications is expected to enhance market resilience and reduce dependency on any single end-use segment.

Distribution Channel Insights

Online retail leads the seitan powder market with an estimated 40% share, driven by convenience, broader product assortments, transparent pricing, and direct engagement with health-conscious consumers. E-commerce platforms enable manufacturers to reach niche consumer segments such as vegans, fitness enthusiasts, and flexitarians, while also facilitating direct-to-consumer (DTC) sales strategies. Subscription models and bundled plant-based product offerings are further strengthening online channel penetration.

Supermarkets and hypermarkets remain critical distribution channels, particularly for conventional seitan powders and private-label offerings, benefiting from high footfall and impulse purchases. Speciality health food stores play an important role in promoting organic and premium variants, while B2B supply channels serve food manufacturers, foodservice operators, and institutional buyers purchasing in bulk. The coexistence of retail and B2B channels ensures both volume-driven and value-driven growth across regions.

Consumer Segment Insights

Vegan consumers remain the core customer base for seitan powder, driven by dietary restrictions, ethical considerations, and high protein requirements. However, flexitarian and vegetarian consumers are driving incremental demand, significantly expanding the addressable market. These consumers typically seek to reduce meat consumption without complete elimination, positioning seitan powder as a high-protein, affordable alternative to animal-based products.

From a demographic perspective, the 31–50 age group dominates consumption, supported by higher disposable incomes, strong health awareness, and a preference for functional and sustainable food products. This group is more inclined toward cooking at home and experimenting with plant-based recipes. Meanwhile, the 18–30 age group is driving demand for convenience-focused, innovative, and ready-to-eat applications, influenced by urban lifestyles, fitness trends, and digital food discovery platforms. Together, these segments underpin both volume growth and product innovation within the market.

| By Product Type | By Source | By Application | By Distribution Channel | By Consumer Segment |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for approximately 35% of global seitan powder demand, led by the United States and Canada. Regional growth is driven by a well-established vegan and flexitarian consumer base, high disposable incomes, and strong awareness of plant-based nutrition. The presence of advanced food processing infrastructure and leading plant-based meat manufacturers further supports large-scale adoption. Additionally, rising demand for functional foods, sports nutrition products, and clean-label ingredients continues to strengthen regional consumption. Regulatory clarity, strong retail penetration, and innovation-driven product launches make North America a mature yet steadily growing market.

Europe

Europe accounts for approximately 30% of the global market, with Germany, the U.K., and France leading regional demand. Growth is primarily driven by strong environmental awareness, government-backed sustainability initiatives, and widespread acceptance of plant-based diets. European consumers demonstrate a higher willingness to pay for organic, clean-label, and ethically sourced food products, supporting the faster growth of organic and premium seitan powders. Younger demographics and urban consumers are driving demand for convenient, processed plant-based foods, while stringent food labeling regulations further enhance product transparency and consumer trust.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by China, India, Japan, and Australia. Growth is supported by rising health consciousness, increasing disposable incomes, and expanding vegan and vegetarian populations, particularly in India. Rapid urbanization and the expansion of modern retail and foodservice infrastructure are accelerating the adoption of processed and ready-to-eat plant-based foods. In addition, growing exposure to Western dietary trends and increasing penetration of global plant-based brands are contributing to demand growth. The region also benefits from improved supply chain capabilities and increasing domestic production capacity.

Latin America

Latin America is witnessing moderate growth, with Brazil, Mexico, and Argentina emerging as key markets. Growth is largely concentrated in affluent urban populations with exposure to global food trends and rising awareness of plant-based nutrition. While overall penetration remains limited compared to developed regions, increasing investment in plant-based food startups and gradual expansion of modern retail formats are expected to support long-term growth. Price sensitivity remains a key challenge, favoring conventional seitan powder variants over premium offerings.

Middle East & Africa

The Middle East & Africa region represents a smaller but gradually expanding market. Africa benefits from natural wheat availability and localized production of seitan-based products, although domestic consumption remains limited. The Middle East, particularly the UAE, Saudi Arabia, and Qatar, is emerging as a growth hub driven by high-income consumers, growing health awareness, and strong demand for imported functional and plant-based foods. Expansion of premium retail formats, foodservice innovation, and government initiatives promoting healthy lifestyles are expected to drive incremental demand across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Seitan Powder Market

- Kikkoman Corporation

- Wheat Montana

- Bob’s Red Mill

- WestSoy

- Seapoint Farms

- Beyond Meat

- Taifun-Tofu

- Dr. Schär AG

- Venture Foods

- Organic Foods and Café

- Marigold Health Foods

- Shirakiku

- Rizopia

- PureHarvest

- Now Foods