Scent Beads Market Size

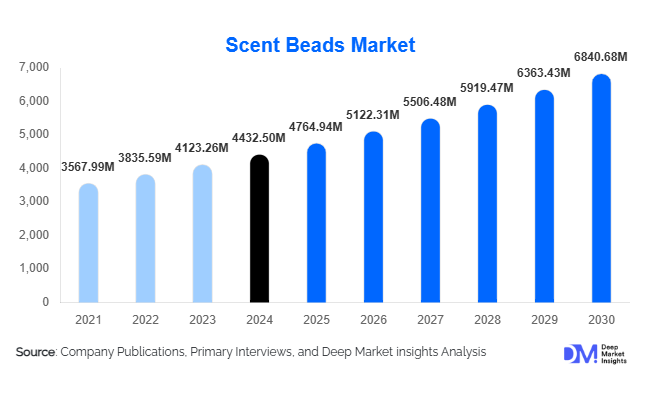

According to Deep Market Insights, the global scent beads market size was valued at USD 4,432.50 million in 2024 and is projected to grow from USD 4,764.94 million in 2025 to reach USD 6,840.68 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer interest in home and personal fragrance solutions, increasing adoption of eco-friendly products, and technological innovations in scent bead formulations that enhance fragrance longevity and sensory appeal.

Key Market Insights

- Household and personal care applications dominate the scent beads market, with room fresheners, laundry, and car air fresheners contributing the largest share of global demand.

- North America leads the market in 2024, driven by high disposable income, preference for premium fragrance products, and established retail infrastructure.

- Asia-Pacific is the fastest-growing region, led by China, India, and Japan, fueled by urbanization, e-commerce expansion, and rising middle-class spending on personal care products.

- Technological integration is reshaping product offerings, including micro-encapsulation for longer-lasting fragrances and smart diffusers that allow controlled scent release.

- Eco-friendly and biodegradable scent beads are increasingly in demand, responding to both consumer preference and regulatory requirements.

- Online retail channels are growing rapidly, enabling consumers to access a wider variety of fragrances and product types, enhancing global market penetration.

What are the latest trends in the scent beads market?

Eco-Friendly and Sustainable Products

Manufacturers are focusing on biodegradable, non-toxic, and plant-based scent beads to meet rising environmental awareness among consumers. Sustainability is now a key differentiator, with brands emphasizing recyclable packaging and eco-certified formulations. Products that combine aesthetics, fragrance longevity, and minimal environmental impact are increasingly preferred by households, commercial establishments, and premium consumers.

Technologically Enhanced Scent Beads

Advanced technologies such as micro-encapsulation, smart release beads, and IoT-enabled diffusers are enhancing consumer experiences. These innovations allow controlled fragrance intensity, longer-lasting scents, and integration with smart home devices. Technology-driven products appeal particularly to tech-savvy millennials and Gen Z consumers, supporting premium pricing strategies and encouraging repeat purchases.

What are the key drivers in the scent beads market?

Rising Demand for Home Fragrance Solutions

Urban lifestyles, increased household spending, and growing awareness of indoor air quality have contributed to strong demand for home fragrance products, with scent beads becoming a convenient and aesthetically appealing option. Consumers increasingly prefer customizable, multi-scent options that enhance ambient living spaces.

Rapid Expansion of E-Commerce Channels

Online platforms, including e-commerce marketplaces and direct-to-consumer websites, have significantly broadened consumer access to scent beads. This has accelerated product discovery, allowed for a wider selection of fragrances, and improved price transparency, driving market growth globally.

Innovation in Product Offerings

Introduction of multi-scent beads, biodegradable materials, and fragrance-stabilization technologies has expanded product portfolios. Such innovations allow manufacturers to target premium segments, differentiate from competitors, and increase brand loyalty.

What are the restraints for the global market?

High Cost of Premium Scent Beads

Advanced and premium formulations, particularly eco-friendly or technologically enhanced beads, are priced higher than traditional options. This can limit adoption in price-sensitive markets and pose challenges for market penetration in developing regions.

Regulatory Compliance Challenges

Variation in chemical safety, fragrance regulations, and labeling standards across regions poses hurdles for global manufacturers. Compliance requirements can delay market entry and increase production costs, restricting growth for smaller players or new entrants.

What are the key opportunities in the scent beads industry?

Expansion into Emerging Markets

Asia-Pacific, Latin America, and parts of the Middle East present high-growth potential due to rising urbanization, disposable income, and evolving consumer preferences. Localized fragrance offerings and targeted marketing campaigns can help companies tap into these emerging consumer bases effectively.

Integration of Smart & Innovative Technologies

IoT-enabled scent beads, smart diffusers, and micro-encapsulation technology create premium product offerings that provide longer-lasting fragrance and controlled release. Integrating technology enhances user experience, strengthens brand differentiation, and opens opportunities in both household and commercial applications.

Eco-Friendly and Biodegradable Products

Consumer preference for environmentally conscious products is driving the adoption of sustainable scent beads. Companies focusing on biodegradable materials and eco-friendly packaging can capitalize on regulatory support and growing consumer awareness, positioning themselves as leaders in a green product segment.

Product Type Insights

Solid beads dominate the market, accounting for 42% of the 2024 market share, due to their durability, ease of use, and versatility across household, personal, and commercial applications. Gel beads are growing rapidly because of their customizable shapes and vibrant visual appeal, while liquid-infused beads are gaining traction in premium applications for enhanced fragrance intensity.

Application Insights

Household care applications hold the largest share at 55% in 2024, led by room fresheners and car fragrances. Personal care applications, including laundry and bath beads, are expanding due to convenience and multi-sensory appeal. Commercial applications such as hospitality, spas, and retail spaces are emerging as high-value segments, offering long-term growth potential.

Distribution Channel Insights

Offline retail dominates with 60% market share, driven by supermarkets, hypermarkets, and specialty stores. However, online retail is growing fastest, offering consumers easy access to a wide variety of fragrances and convenient delivery options. D2C websites and subscription-based offerings are also increasing engagement in premium and niche segments.

End-Use Insights

Household consumers drive the majority of demand, followed by commercial applications such as hotels, spas, and automotive sectors. Emerging applications in wellness centers, luxury retail, and event spaces are creating new growth avenues. Export-driven demand is particularly strong in North America and Europe, where high-income consumers and businesses seek innovative fragrance solutions.

| By Product Type | By Application | By Distribution Channel | By Pricing Segment |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, led by the U.S., which accounts for significant adoption of premium and eco-friendly scent beads. High consumer awareness, disposable income, and widespread retail networks support sustained growth. Canada contributes moderately, with a CAGR of 6.5%.

Europe

Europe holds 28% of the 2024 market, with Germany, France, and the UK driving demand for sustainable and technologically advanced scent beads. Eco-friendly initiatives, regulatory support, and consumer inclination toward premium products contribute to strong market performance.

Asia-Pacific

Asia-Pacific is the fastest-growing region at 10% CAGR, with China, India, and Japan leading growth. Rising urbanization, increasing disposable income, and e-commerce expansion are key growth drivers. Mid-range and premium segments are witnessing strong adoption.

Latin America

Brazil and Mexico are leading markets, showing moderate growth. Rising urban middle-class adoption and demand for household and personal care products support incremental expansion.

Middle East & Africa

UAE and Saudi Arabia are key growth markets for premium scent beads. Africa remains a production and export hub, benefiting from government support and growing international demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Scent Beads Industry

- Procter & Gamble

- SC Johnson & Son

- Henkel AG & Co.

- Reckitt Benckiser

- Kao Corporation

- Godrej Consumer Products

- Air Wick

- Beiersdorf AG

- Unilever

- Colgate-Palmolive

- Church & Dwight Co., Inc.

- Mizkan Holdings

- Yankee Candle

- Glade

- S.C. Johnson Professional

Recent Developments

- In June 2025, SC Johnson launched biodegradable solid scent beads for household applications, targeting eco-conscious consumers in North America and Europe.

- In April 2025, Procter & Gamble introduced micro-encapsulated laundry scent beads in Asia-Pacific, extending fragrance longevity and premium adoption in emerging markets.

- In February 2025, Henkel AG expanded its scent bead production in India with advanced gel bead technology, addressing rising demand in the APAC region.