Scalp Serum Market Size

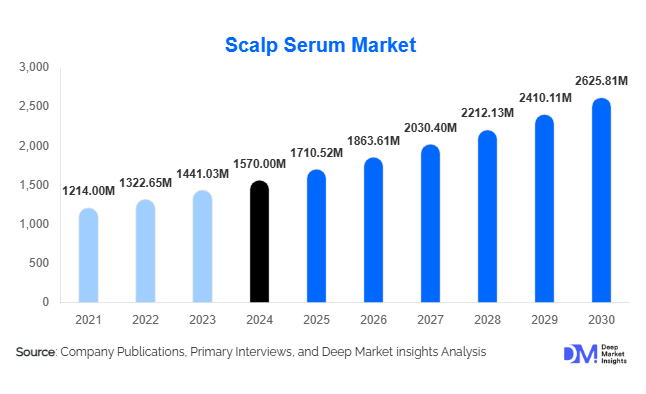

According to Deep Market Insights, the global scalp serum market size was valued at USD 1,570 million in 2024 and is projected to grow from USD 1,710.52 million in 2025 to reach USD 2,625.81 million by 2030, expanding at a CAGR of 8.95% during the forecast period (2025–2030). The scalp serum market growth is primarily driven by rising consumer awareness of scalp health, increasing prevalence of hair disorders, and a growing demand for targeted and advanced hair care solutions tailored for personalized treatment.

Key Market Insights

- Rising demand for natural and organic scalp serums is shaping product development, driven by consumers’ preference for chemical-free, safe, and sustainable formulations.

- Online retail channels are expanding rapidly, enabling direct-to-consumer sales and wider access to premium scalp serums.

- North America dominates the scalp serum market, with the U.S. leading demand due to high consumer spending on personal care and increasing adoption of specialized hair treatments.

- Asia-Pacific is the fastest-growing region, driven by growing middle-class income, rising urbanization, and increased awareness of scalp health in countries such as China and India.

- Technological adoption, including nanotechnology and microencapsulation for enhanced ingredient delivery, is improving serum efficacy and driving product differentiation.

What are the latest trends in the scalp serum market?

Shift Toward Natural and Sustainable Ingredients

Scalp serum formulations increasingly feature natural, plant-based, and organic ingredients. Consumers are showing a preference for products free of parabens, sulfates, and synthetic fragrances, while brands are highlighting eco-friendly sourcing and biodegradable packaging. This trend is particularly strong in Europe and North America, where consumers are willing to pay a premium for sustainability, resulting in the launch of high-margin, natural ingredient serums.

Technology-Driven Product Innovation

Advanced delivery systems, including nanotechnology and microencapsulation, are being used to improve the penetration of active ingredients such as biotin, peptides, and herbal extracts directly into the scalp. These innovations increase product efficacy and create differentiation among competing brands. Additionally, AI-driven formulation analysis and consumer personalization apps are enabling targeted solutions, catering to individual scalp concerns like hair loss, dryness, or dandruff.

What are the key drivers in the scalp serum market?

Rising Incidence of Scalp Disorders

Conditions such as dandruff, psoriasis, and seborrheic dermatitis are becoming more prevalent due to lifestyle, stress, and environmental factors. Consumers are increasingly seeking specialized treatments over general hair care products, driving demand for scalp serums designed to address these issues directly.

Increasing Consumer Awareness and Social Media Influence

Beauty influencers and social media campaigns have amplified awareness regarding scalp health, promoting regular use of serums for hair growth and scalp nourishment. Younger, tech-savvy consumers are adopting these products faster, contributing to rapid market expansion.

Preference for Personalized Hair Care Solutions

Modern consumers demand solutions tailored to their unique hair and scalp conditions. Brands offering customizable serums or targeted treatments for thinning, dryness, or sensitive scalps have gained a competitive edge, resulting in higher adoption rates globally.

What are the restraints for the global market?

High Product Pricing

Premium scalp serums often carry high price tags due to advanced ingredients and innovative formulations, limiting affordability for price-sensitive consumers, particularly in emerging markets. This pricing barrier constrains broader market penetration.

Limited Awareness in Developing Regions

In many developing countries, scalp health awareness is low, with consumers often prioritizing basic hair care. Lack of knowledge about the benefits of serums hampers adoption and slows growth in these regions.

What are the key opportunities in the scalp serum market?

Emerging Market Expansion

Asia-Pacific and Latin America present untapped opportunities due to rising disposable incomes and urbanization. Expanding distribution networks and targeted marketing campaigns can capture new consumer bases in countries like India, China, and Brazil.

Integration of Advanced Technologies

Companies can leverage innovations such as microencapsulation, nano-carriers, and AI-driven personalization to enhance serum efficacy and consumer satisfaction. Such differentiation can help brands gain a competitive advantage and enter premium market segments.

Sustainability and Eco-Conscious Product Offerings

Consumer demand for natural, cruelty-free, and eco-friendly products is rising globally. Brands that emphasize sustainable sourcing, recyclable packaging, and ethically produced ingredients can attract environmentally conscious consumers, increasing loyalty and market share.

Product Type Insights

Leave-in scalp serums dominate the market due to convenience and effective absorption of active ingredients. These serums allow direct application to the scalp without washing, appealing to both individual consumers and professional salon treatments. In 2024, leave-in serums accounted for approximately 42% of the global scalp serum market, reflecting their popularity and efficacy.

Application Insights

Hair growth and anti-hair loss applications are the largest drivers for scalp serum demand, supported by the increasing prevalence of alopecia and thinning hair. Anti-dandruff and soothing formulations are also gaining traction. Salons represent a growing professional end-use segment, while individual consumers continue to drive retail sales. Export-driven demand from emerging markets is increasingly supporting global sales.

Distribution Channel Insights

Online retail dominates, offering convenience and wide product availability. E-commerce platforms, direct-to-consumer websites, and subscription-based models are growing rapidly. Offline channels like specialty salons and retail stores remain important for premium and professional product lines. Influencer-driven marketing and social media campaigns are influencing purchase decisions, particularly in younger demographics.

End-Use Insights

Individual consumers represent the largest end-use segment, with professional salons and spas growing steadily. Rapid adoption is observed in urban areas of APAC and North America. The professional segment is expanding due to increasing demand for premium treatments, personalized scalp therapies, and salon-exclusive formulations. Export-driven demand from emerging regions is supporting market growth.

| By Product Type | By Application | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. and Canada account for 38% of the global market in 2024. High consumer awareness, disposable income, and preference for premium, specialized hair care products drive strong demand. Hair salons and professional channels significantly influence market adoption.

Europe

Germany, France, and the U.K. lead, collectively accounting for 28% of global market share in 2024. Sustainability trends, preference for organic ingredients, and growing influencer-led awareness campaigns are boosting sales.

Asia-Pacific

China and India are the fastest-growing markets, benefiting from rising middle-class incomes, urbanization, and heightened awareness of scalp health. Online retail penetration further fuels market growth in this region.

Latin America

Brazil and Mexico are emerging markets, with increasing adoption of premium hair care products and growing awareness of scalp treatments among urban populations.

Middle East & Africa

The market is expanding due to young population demographics, rising disposable income, and increasing urbanization. UAE, Saudi Arabia, and South Africa are leading contributors in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Scalp Serum Market

- L’Oréal

- Unilever

- Procter & Gamble

- Shiseido

- Beiersdorf

- Johnson & Johnson

- Revlon

- Estée Lauder

- Amway

- Kao Corporation

- Perricone MD

- Matrix

- Alpecin

- Forest Essentials

- Biotique

Recent Developments

- In March 2025, L’Oréal launched a new line of personalized scalp serums using AI-driven diagnostic tools for customized hair treatment recommendations.

- In February 2025, Unilever expanded its natural and organic scalp serum portfolio across Asia-Pacific, targeting rising urban middle-class consumers.

- In January 2025, Shiseido introduced nanotechnology-based scalp serums in Europe and North America, enhancing active ingredient delivery and absorption.