Salt Brines Market Size

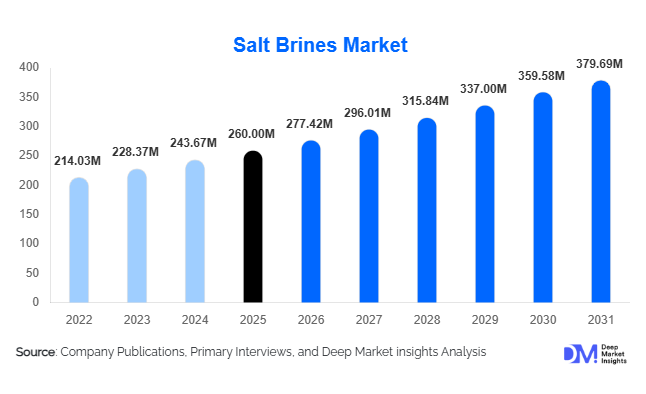

According to Deep Market Insights, the global salt brines market size was valued at USD 260.00 million in 2025 and is projected to grow from USD 277.42 million in 2026 to reach USD 379.69 million by 2031, expanding at a CAGR of 6.7% during the forecast period (2026–2031). The salt brines market growth is primarily driven by increasing municipal and industrial demand for de-icing and anti-icing applications, rising adoption in water treatment and industrial refrigeration, and growing utilization in food processing and dust control across key global regions.

Key Market Insights

- De-icing applications dominate global demand, particularly in North America and Europe, where winter road safety budgets and extreme weather events drive high-volume municipal brine procurement.

- Industrial usage is expanding, including water treatment, chemical processing, and refrigeration, with APAC showing rapid growth due to urbanization and industrialization.

- Sodium chloride brines remain the leading product type, valued for cost efficiency and broad applicability across transportation, water utilities, and food processing sectors.

- Asia Pacific is emerging as the fastest-growing region, supported by increasing infrastructure investment, industrial expansion, and municipal water treatment projects in China, India, and Japan.

- Technological adoption, including automated brine generation systems, smart dosing, and IoT-enabled process monitoring, is enhancing operational efficiency and reducing environmental impact.

- Export-driven demand for food processing and specialty brines is expanding in Europe, North America, and APAC, creating new growth avenues for manufacturers.

What are the latest trends in the salt brines market?

Blended and Specialty Brines for Efficiency

Manufacturers are increasingly offering calcium and magnesium chloride blends alongside traditional sodium chloride solutions. These specialty brines provide lower freezing points, faster ice-melting capabilities, and reduced corrosion risks, appealing to municipalities and industrial users aiming to enhance efficiency. Adoption of blended brines has risen significantly in colder climates, as they deliver improved performance at lower dosages and operational costs.

Smart Brine Generation and Dosing Systems

Technological integration is transforming the brine market. Automated brine generation units, IoT-enabled dosing systems, and real-time quality monitoring allow municipalities and industrial facilities to optimize usage, reduce waste, and maintain consistent product quality. Smart systems also facilitate predictive maintenance, ensuring a continuous supply during peak winter months or high industrial demand periods, aligning with sustainability goals and cost-saving measures.

What are the key drivers in the salt brines market?

Rising Winter Infrastructure Expenditure

Government and municipal investment in winter road safety is a primary growth driver. Salt brines offer cost-effective, environmentally preferable alternatives to solid salt for early ice prevention. Seasonal procurement peaks and long-term infrastructure projects ensure steady demand, particularly in the U.S., Canada, Germany, and Nordic countries.

Growing Industrial Demand

Salt brines are integral in water treatment, chemical processing, industrial refrigeration, and cooling systems. Expansion of food processing, cold storage, and chemical manufacturing industries in APAC and Latin America is driving industrial consumption. Technological upgrades in industrial brine systems are further improving operational efficiency, reducing waste, and sustaining demand growth.

Environmental Compliance and Water Treatment Needs

Stringent water quality regulations globally are increasing brine demand for ion exchange, softening, and salinity control. Regions facing water scarcity, particularly the Middle East and Asia Pacific, are heavily investing in municipal and industrial water treatment infrastructure, supporting steady market growth for brine applications.

What are the restraints for the global market?

Environmental Concerns and Runoff

Excessive chloride runoff from brine usage can impact soils and freshwater ecosystems. Regulatory restrictions and sustainability mandates are pushing some municipal and industrial users to adopt alternatives or lower-chloride solutions, which could constrain traditional brine demand.

Raw Material Price Volatility

Salt mining, energy costs, and transportation expenses directly affect brine production. Volatility in these inputs can impact profit margins and pricing competitiveness, especially for smaller manufacturers operating with thin margins.

What are the key opportunities in the salt brines market?

Enhanced Winter Road Safety Solutions

Extreme weather patterns and prolonged winters create opportunities for high-performance brine solutions. Governments and municipalities are increasingly investing in automated spraying systems and optimized brine formulations, enabling manufacturers to supply larger volumes with superior operational efficiency.

Industrial and Water Treatment Expansion

Growing urbanization, industrialization, and water scarcity in APAC and Latin America are driving demand for brines in water softening, salinity control, and wastewater treatment. Public-private partnerships for municipal water infrastructure upgrades create potential entry points for new and existing brine suppliers.

Food Processing and Specialty Brines

Rising demand for processed, preserved, and exported food products supports specialty brine consumption. Innovations in high-purity brines for curing, pickling, and fermentation allow manufacturers to expand product portfolios and increase revenue in both domestic and international markets.

Product Type Insights

Sodium chloride brines dominate the global salt brines market due to their cost efficiency, widespread availability, and broad functional applicability across de-icing, industrial processing, water treatment, and food preservation. Their relatively low production cost and established supply chains make sodium chloride brines the preferred choice for large-volume municipal and industrial applications, particularly in transportation infrastructure and public utilities. This segment benefits from strong government procurement contracts and long-standing usage standards, enabling it to retain a leading share of overall market revenue.

Calcium chloride and magnesium chloride brines are gaining traction in performance-critical and specialty applications, where lower freezing points, faster ice-melting capability, and reduced corrosion risks are required. These blends are increasingly adopted in colder climates and high-traffic road networks, as well as in industrial refrigeration systems that demand superior thermal performance. Their higher effectiveness per unit volume supports premium pricing and growing adoption despite higher production costs.

Application Insights

De-icing and anti-icing applications represent the largest share of the salt brines market, accounting for approximately 35% of global demand. This dominance is driven by consistent municipal spending on winter road safety, increasing adoption of preventative anti-icing strategies, and the cost-effectiveness of brine solutions compared to solid salts. The ability of brines to prevent ice bonding, reduce salt consumption, and improve roadway safety makes them indispensable for transportation authorities in cold-climate regions.

Water treatment applications account for nearly 25% of market demand, supported by rising investments in municipal water softening, ion-exchange systems, and industrial wastewater treatment. Growing regulatory pressure to meet water quality standards, combined with expanding urban populations, continues to drive brine usage in this segment. Industrial refrigeration and cooling applications contribute roughly 15% of total demand, particularly within food processing, cold storage, and chemical manufacturing facilities.

Distribution Channel Insights

Direct B2B sales dominate the salt brines market, accounting for approximately 60% of total revenue. This channel is preferred for large-scale municipal, transportation, and industrial customers that require consistent supply volumes, customized formulations, and long-term procurement contracts. Direct sales models allow producers to optimize logistics, ensure quality control, and provide technical support, particularly for automated brine systems.

Distributors and industrial suppliers play a critical role in serving regional markets, smaller municipalities, and commercial customers with lower volume requirements. These channels enhance market penetration in fragmented regions and support just-in-time delivery models. The increasing adoption of digital procurement platforms, online ordering systems, and IoT-enabled inventory monitoring is improving supply chain transparency, reducing lead times, and strengthening customer relationships across both direct and indirect sales channels.

End-Use Insights

Transportation and municipal infrastructure represent the largest end-use segment, accounting for approximately 40% of global market demand. This segment’s dominance is driven by public safety priorities, government-funded winter maintenance programs, and the increasing shift toward proactive anti-icing practices. Seasonal demand spikes and recurring procurement cycles provide predictable revenue streams for brine producers.

Industrial and chemical end-use sectors are among the fastest-growing segments, particularly in Asia-Pacific and Latin America, where manufacturing capacity expansion and infrastructure modernization are accelerating. Brines are widely used for cooling, processing, and water conditioning in chemical plants, refineries, and industrial utilities.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global salt brines market with approximately 30% market share in 2025. Growth is driven by substantial public spending on winter road safety across the U.S. and Canada, where prolonged winter seasons necessitate large-scale de-icing and anti-icing operations. Strong adoption of automated brine spraying systems, combined with well-established municipal procurement frameworks, supports sustained demand. Additionally, robust industrial activity in chemical manufacturing, food processing, and water treatment further reinforces regional market leadership.

Europe

Europe accounts for roughly 22% of global market share, with Germany, France, and the UK serving as major demand centers. Regional growth is driven by cold climate zones, high road density, and stringent environmental regulations encouraging efficient and sustainable de-icing practices. Increasing emphasis on reducing chloride runoff has accelerated the adoption of specialty brines and blended formulations. Industrial demand from chemical processing, food manufacturing, and municipal utilities continues to support steady market expansion.

Asia-Pacific

Asia-Pacific holds approximately 28% market share and represents the fastest-growing regional market. Rapid industrialization, urban infrastructure expansion, and rising municipal water treatment investments in China, India, Japan, and South Korea are primary growth drivers. Government initiatives focused on infrastructure modernization, domestic manufacturing, and water sustainability are increasing brine consumption across industrial and municipal applications. Expanding food processing and cold storage industries further contribute to regional demand growth.

Middle East & Africa

The Middle East & Africa region accounts for nearly 10% of global demand, with growth primarily driven by water treatment and industrial applications rather than de-icing. Arid climatic conditions and water scarcity have led to increased investment in municipal water softening, desalination support processes, and industrial utilities. GCC countries and South Africa are key contributors, supported by government-led infrastructure and utility development programs.

Latin America

Latin America represents approximately 10% of the global salt brines market, with Brazil and Mexico leading regional demand. Growth is driven by expanding food processing industries, increasing municipal water infrastructure investments, and rising industrial activity. While de-icing demand remains limited due to climate conditions, applications in food preservation, industrial cooling, and dust suppression are supporting steady market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Salt Brines Market

- Cargill

- Morton Salt

- Compass Minerals

- K+S AG

- Dow Chemical

- Albemarle

- HALLAN GmbH

- Great Lakes Solutions

- United Salt Corporation

- Austrian Salt Works

- Chemcon Speciality Chemicals

- TETRA Technologies

- Geo Drilling Fluids

- Sinomine Resource Group

- Cleveland Salt Company