Saffron Market Size

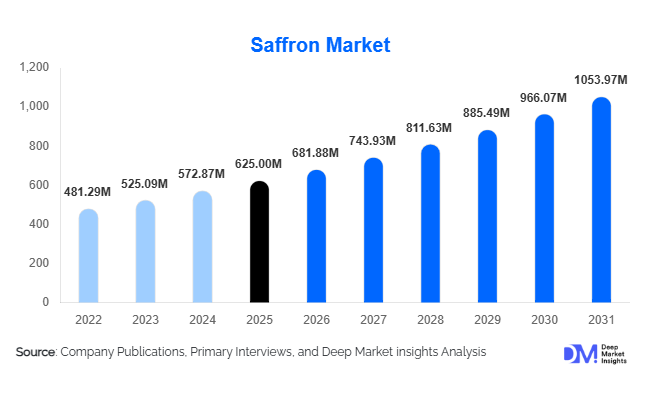

According to Deep Market Insights, the global saffron market size was valued at USD 625 million in 2025 and is projected to grow from USD 681.88 million in 2026 to reach approximately USD 1,053.97 million by 2031, expanding at a CAGR of around 9.1% during the forecast period (2026–2031). The saffron market is experiencing growth primarily driven by rising demand for natural and functional ingredients, increasing adoption in nutraceuticals and pharmaceuticals, and strong premiumization trends in the food, beverage, and personal care industries.

Key Market Insights

- Saffron threads remain the most dominant product form, accounting for over 60% of global market value due to premium culinary demand and export-led trade.

- Food & beverage applications continue to lead consumption, supported by gourmet foods, luxury dining, and traditional cuisines across Europe and the Middle East.

- Europe represents the largest consumption market by value, driven by Spain, France, Italy, and Germany as key importing and re-export hubs.

- North America is the fastest-growing demand region, led by the U.S. nutraceutical and dietary supplement industries.

- Pharmaceuticals and nutraceuticals are emerging as high-growth segments, supported by clinical validation of saffron’s antidepressant and antioxidant properties.

- Technology-led traceability and quality certification are reshaping buyer confidence and pricing dynamics in the premium saffron trade.

What are the latest trends in the saffron market?

Rising Use of Saffron in Nutraceuticals and Mental Wellness Products

The saffron market is witnessing a strong shift toward nutraceutical and pharmaceutical applications, particularly in mood enhancement, stress management, and women’s health supplements. Standardized saffron extracts are increasingly incorporated into capsules, tablets, and functional blends due to growing scientific evidence supporting their antidepressant and anti-inflammatory effects. This trend is accelerating demand for pharmaceutical-grade saffron with consistent crocin and safranal content, enabling producers to command significantly higher margins compared to traditional culinary grades.

Digital Traceability and Anti-Adulteration Technologies

Adulteration has historically challenged the saffron trade, prompting the rapid adoption of digital traceability solutions. Blockchain-based origin verification, ISO 3632 grading, and AI-enabled quality testing are becoming standard practices among leading exporters. Buyers, particularly in Europe and North America, increasingly demand lab-certified, single-origin saffron with transparent supply chains. These technologies are strengthening trust, supporting premium pricing, and facilitating long-term B2B procurement contracts with multinational food and pharma companies.

What are the key drivers in the saffron market?

Growing Demand for Natural and Clean-Label Ingredients

Consumers worldwide are shifting away from synthetic additives toward natural, plant-based ingredients. Saffron’s dual role as a natural coloring agent, flavor enhancer, and functional ingredient positions it favorably across food, beverages, supplements, and cosmetics. This clean-label preference is a major driver supporting consistent demand growth, particularly in developed markets.

Expansion of Premium and Gourmet Food Consumption

Premiumization in global food culture has significantly boosted saffron demand. High-end restaurants, luxury packaged foods, artisanal confectionery, and specialty beverages increasingly use saffron to differentiate products. Europe and the Middle East remain key markets where saffron is culturally embedded in premium cuisines, sustaining high per-capita consumption despite elevated prices.

What are the restraints for the global market?

Supply Constraints and Labor-Intensive Cultivation

Saffron production is highly labor-intensive, requiring manual harvesting of stigmas. Limited cultivation regions, climate sensitivity, and rising labor costs restrict scalability and lead to supply volatility. These factors contribute to price fluctuations and constrain rapid capacity expansion.

Adulteration and Quality Variability

Widespread adulteration using dyed fibers, synthetic substitutes, or blended grades continues to undermine consumer trust in some markets. While certification standards exist, inconsistent enforcement across producing regions remains a key restraint to market transparency and large-scale institutional adoption.

What are the key opportunities in the saffron industry?

Pharmaceutical-Grade Saffron and Extract Manufacturing

High-growth opportunities exist in value-added processing, such as standardized extracts and concentrates for pharmaceutical and nutraceutical use. Producers investing in extraction facilities and clinical-grade quality control can significantly enhance margins and reduce dependence on volatile raw saffron pricing.

Geographic Diversification of Cultivation and Exports

Buyers are actively diversifying sourcing away from single-country dependence. Emerging producers such as Afghanistan, India (Kashmir), Morocco, and Greece are gaining traction through government support, export incentives, and organic certification, creating opportunities for new entrants and investors.

Product Type Insights

Saffron threads dominate the market, accounting for approximately 62% of total market value in 2025 due to their premium perception and widespread culinary use. Powdered saffron represents a smaller but stable share, driven by convenience in food processing and retail use. Saffron extracts and concentrates, while currently accounting for less than 20% of market value, are the fastest-growing product type, supported by pharmaceutical, nutraceutical, and cosmetic applications.

Application Insights

Food and beverage applications lead the market with around 44% share, driven by traditional cuisines, gourmet foods, and luxury dining. Pharmaceuticals and nutraceuticals account for approximately 26% of global demand and represent the fastest-growing application segment. Cosmetics and personal care applications, including skincare and fragrances, are emerging as a high-margin niche, while traditional medicine continues to support steady baseline consumption in Asia and the Middle East.

Distribution Channel Insights

Direct B2B trade dominates global saffron distribution, accounting for nearly 55% of sales, as bulk buyers such as food processors and pharma companies procure directly from producers and exporters. Offline retail remains important in producing regions and specialty spice markets, while online and D2C channels are rapidly expanding, now representing close to 18% of global sales, supported by premium branding and traceability-focused marketing.

| By Product Type | By Grade / Quality | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe is expected to account for approximately 34% of the global saffron market value by 2025. Spain, France, Italy, and Germany are key demand centers, with Spain also serving as a major processing and re-export hub. Strong culinary traditions, premium food consumption, and strict quality standards support stable demand.

North America

North America represents about 27% of the global market, led by the United States. Demand is driven by nutraceuticals, dietary supplements, and gourmet food products. The U.S. is also the fastest-growing country market, expanding at over 10% CAGR.

Asia-Pacific

Asia-Pacific dominates global supply, with Iran accounting for over 85% of production. India and Afghanistan are emerging exporters, while China and Japan are growing demand markets, particularly for functional foods and supplements.

Middle East & Africa

The Middle East shows high per-capita consumption, particularly in Iran, the UAE, and Saudi Arabia, where saffron is deeply embedded in cuisine and traditional medicine. Africa, led by Morocco, is expanding production for export markets.

Latin America

Latin America remains a niche market, with demand concentrated in gourmet food segments in Brazil, Mexico, and Argentina, supported by rising premium food consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Saffron Market

- Gohar Saffron

- Novin Saffron

- Rowhani Saffron

- Esfedan Trading

- Tarvand Saffron

- Iran Saffron Company

- Mancha Red Gold

- Ramón Sabater

- Verdú Cantó Saffron

- Baby Brand Saffron