Royal Jelly Market Size

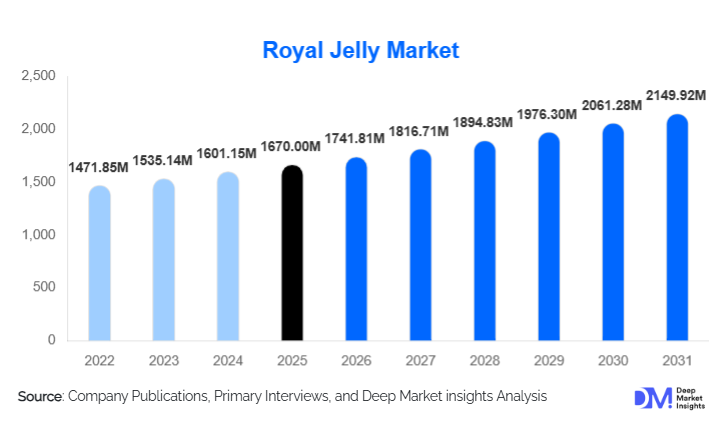

According to Deep Market Insights, the global royal jelly market size was valued at USD 1,670 million in 2025 and is projected to grow from USD 1,741.81 million in 2026 to reach USD 2,149.92 million by 2031, expanding at a CAGR of 4.3% during the forecast period (2026–2031). The royal jelly market growth is primarily driven by rising demand for natural nutraceuticals, increasing adoption of clean-label cosmetic ingredients, and growing consumer preference for preventive healthcare and immunity-boosting products derived from natural sources.

Key Market Insights

- Nutraceutical and dietary supplement applications dominate global demand, supported by rising health awareness and aging populations.

- Freeze-dried royal jelly leads product adoption due to superior shelf life, stability, and suitability for international trade.

- Asia-Pacific accounts for the largest share of global production and consumption, led by China and Japan.

- Europe represents a premium-driven market, with strong demand for organic, pharmaceutical-grade, and cosmetic applications.

- Online and direct-to-consumer channels are the fastest-growing, supported by cross-border e-commerce and digital health platforms.

- Standardization of 10-HDA content and traceability is emerging as a key differentiator among leading manufacturers.

What are the latest trends in the royal jelly market?

Rising Demand for Preventive Healthcare and Nutraceuticals

Royal jelly is increasingly positioned as a core ingredient in preventive healthcare formulations due to its immune-modulating, anti-inflammatory, and metabolic health benefits. Consumers across Asia-Pacific, North America, and Europe are integrating royal jelly supplements into daily wellness routines, particularly for immunity support, hormonal balance, and cognitive health. This trend is reinforced by post-pandemic health consciousness and growing acceptance of natural bioactive compounds. Manufacturers are responding by launching clinically validated formulations, improving dosage accuracy, and emphasizing pharmaceutical-grade processing standards.

Expansion of Royal Jelly in Premium Cosmetics

The cosmetics and personal care industry is witnessing growing adoption of royal jelly as a high-performance natural ingredient in anti-aging, skin regeneration, and premium skincare products. Luxury beauty brands are leveraging royal jelly’s antioxidant and collagen-stimulating properties to meet rising demand for clean and functional beauty solutions. This trend is particularly strong in Japan, South Korea, France, and Italy, where consumers are willing to pay premium prices for scientifically backed natural cosmetics. Sustainable sourcing and organic certification are increasingly influencing brand positioning.

What are the key drivers in the royal jelly market?

Growth in Natural and Functional Nutrition

The global shift toward natural, clean-label, and functional nutrition products is a major driver for the royal jelly market. Royal jelly’s rich nutritional profile, including proteins, amino acids, vitamins, and unique fatty acids such as 10-HDA, makes it highly attractive for dietary supplements and medical nutrition. The rising incidence of lifestyle-related disorders and aging populations further supports sustained demand growth.

Advancements in Processing and Preservation Technologies

Technological advancements in freeze-drying, cold-chain logistics, and encapsulation have significantly improved the shelf life and export viability of royal jelly. These innovations enable manufacturers to preserve bioactivity while expanding access to global pharmaceutical and nutraceutical markets. Improved processing efficiency has also reduced wastage and enhanced product consistency, strengthening buyer confidence.

What are the restraints for the global market?

Volatility in Raw Material Supply

Royal jelly production is highly dependent on environmental conditions, bee health, and seasonal factors. Climate change, pesticide exposure, and colony collapse disorder continue to pose risks to stable supply, particularly in traditional producing regions. These challenges can lead to price volatility and supply disruptions, impacting long-term contracts and profitability.

Regulatory and Quality Compliance Challenges

Regulatory classification of royal jelly varies across regions, with differing standards for supplements, pharmaceuticals, and food products. Compliance with stringent quality, labeling, and safety regulations increases operational costs and can delay market entry, particularly in Europe and North America.

What are the key opportunities in the royal jelly industry?

Pharmaceutical-Grade and Clinical Applications

There is a strong opportunity to expand royal jelly usage in pharmaceutical and therapeutic applications through clinical validation and standardized formulations. Companies investing in research, bioavailability enhancement, and dosage precision can unlock higher-margin segments such as immune therapies, recovery supplements, and medical nutrition.

Emerging Market Expansion and Government Support

Government-supported apiculture programs in Asia-Pacific, Latin America, and parts of Africa are expanding raw material availability while lowering production costs. Countries such as China, India, Vietnam, and Brazil are actively promoting beekeeping as part of rural development and biodiversity initiatives, creating favorable conditions for market expansion and export-oriented growth.

Product Form Insights

Freeze-dried royal jelly continues to dominate the global market, accounting for approximately 38% of total revenue in 2024. Its prominence is primarily driven by extended shelf life, stability during transportation, and suitability for both dietary supplements and pharmaceutical-grade formulations. Fresh royal jelly retains strong demand in domestic Asian markets, particularly in China and Japan, where traditional consumption patterns and local medicinal use remain prevalent. Capsules, tablets, and powdered forms are steadily gaining traction across North America, Europe, and emerging markets, as consumer preference shifts toward convenient, precise dosing formats that integrate easily into daily wellness routines. The growing trend toward personalized nutrition and the inclusion of royal jelly in multi-ingredient supplements further support the adoption of these versatile forms. Overall, product innovation and advancements in preservation technologies are reinforcing freeze-dried formats as the market leader, while ready-to-use formats are expanding the global footprint by catering to convenience-oriented consumers.

Application Insights

Dietary supplements and nutraceuticals represent the largest application segment, contributing nearly 42% of global market revenue in 2024. The segment’s growth is propelled by increasing awareness of preventive healthcare, aging populations, and a rising preference for natural alternatives to synthetic supplements. Pharmaceutical applications are steadily expanding, particularly in immune-support, metabolic health, and recovery formulations, with regulatory approval for functional claims boosting adoption in these high-value markets. Cosmetics and personal care applications are witnessing rapid growth at over 10% CAGR, driven by demand for premium skincare products featuring natural anti-aging and regenerative ingredients. Functional foods and beverages remain niche but are emerging applications, particularly in Japan, South Korea, and North America, as consumers increasingly seek value-added health products. Overall, the market growth is strongly tied to the multifunctional properties of royal jelly, which allow seamless integration across multiple health, wellness, and cosmetic categories.

Distribution Channel Insights

Online retail and direct-to-consumer (D2C) platforms account for approximately 27% of global sales and represent the fastest-growing distribution segment. Growth in this channel is supported by cross-border e-commerce, subscription models, and increasing consumer trust in verified quality and organic certifications. Pharmacies and health stores continue to serve as essential channels for premium and clinically validated products, offering accessibility to healthcare-oriented consumers. Direct sales from apiaries remain significant in Asia-Pacific, especially in China, Japan, and Southeast Asia, where traditional purchasing patterns and direct sourcing from local beekeepers maintain strong relevance. The combination of online convenience and offline credibility is enabling companies to reach a broader consumer base, facilitating market penetration across both mature and emerging regions.

End-Use Industry Insights

The healthcare and pharmaceutical sector leads demand with around 35% market share, primarily due to the adoption of royal jelly in immune-support supplements, medical nutrition, and recovery formulations. The food and beverage industry also represents a significant segment, as functional foods and fortified beverages increasingly incorporate royal jelly to meet growing health-conscious consumer trends. Cosmetics and personal care applications are rapidly expanding, supported by demand for natural, anti-aging, and skin-repairing ingredients. Emerging end-use segments, including animal nutrition, veterinary supplements, and biotechnology research, are creating additional avenues for growth. This diversification across industries enhances the long-term market potential and positions royal jelly as a multifunctional bioactive ingredient with widespread industrial applications.

| By Product Form | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global royal jelly market with approximately 48% share in 2024. China alone accounts for nearly 32% of global consumption and remains the largest producer, driven by advanced apiculture infrastructure, government support programs, and strong domestic health and wellness demand. Japan and South Korea are key high-value markets, primarily focused on premium dietary supplements and cosmetics, with consumers willing to pay a premium for certified, high-potency royal jelly. India and Southeast Asia are emerging as high-growth markets due to increasing awareness of preventive healthcare, urbanization, and rising disposable incomes. The region’s growth is further supported by improved cold-chain logistics, export initiatives, and regulatory frameworks promoting quality standardization.

Europe

Europe holds approximately 26% of the global market, with France, Germany, Italy, and Spain as leading consumers. Market growth is primarily driven by rising demand for organic, clean-label nutraceuticals and high-end cosmetic products. Consumers in Europe increasingly favor natural, traceable ingredients, which has accelerated the adoption of certified royal jelly products in premium segments. Regulatory frameworks that ensure quality, safety, and functional claims reinforce market confidence and support growth. Additionally, growing awareness of anti-aging and wellness trends among aging populations is driving consistent demand, particularly in the dietary supplement and personal care segments.

North America

North America represents approximately 18% of global demand, with the United States accounting for over 70% of regional consumption. Market growth is supported by a strong preventive healthcare culture, increasing adoption of dietary supplements, and expanding e-commerce channels that improve accessibility. Rising disposable income, coupled with consumer preference for functional ingredients and immunity-boosting formulations, is encouraging adoption across both pharmaceuticals and nutraceuticals. The region also demonstrates increasing demand for anti-aging cosmetics, positioning royal jelly as a multifunctional ingredient across wellness and beauty sectors.

Latin America

Latin America accounts for a smaller but growing share of the market, led by Brazil and Mexico. Growth in the region is driven by government-backed beekeeping initiatives, which increase production efficiency and local availability. Rising consumer awareness of nutraceuticals and natural health products is expanding market demand, particularly in urban populations. Additionally, export opportunities to North America and Europe are creating incentives for improved production standards and premium product development, contributing to long-term market expansion.

Middle East & Africa

The Middle East & Africa region contributes about 4% of global revenue, with the UAE and South Africa serving as primary demand hubs. Growth is fueled by rising health awareness, increasing adoption of premium supplements, and a focus on natural, high-quality ingredients in cosmetics and nutraceuticals. High-income populations in the UAE, Saudi Arabia, and Qatar are driving demand for premium imported products, while African markets, particularly South Africa, are benefiting from local apiculture programs and initiatives supporting sustainable beekeeping practices. Expanding awareness of functional foods and natural wellness products is expected to accelerate growth in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Royal Jelly Market

- YS Royal Jelly

- API Co., Ltd.

- Jiangshan Bee Enterprise

- Beijing Tongrentang

- Comvita

- NOW Health Group

- Swisse Wellness

- Melbros

- Blackmores

- Natura Siberica

- Eu Yan Sang

- Hunan Bee Biological

- Manuka Health

- Alpine Health

- Life Extension