Resort Planning Market Size

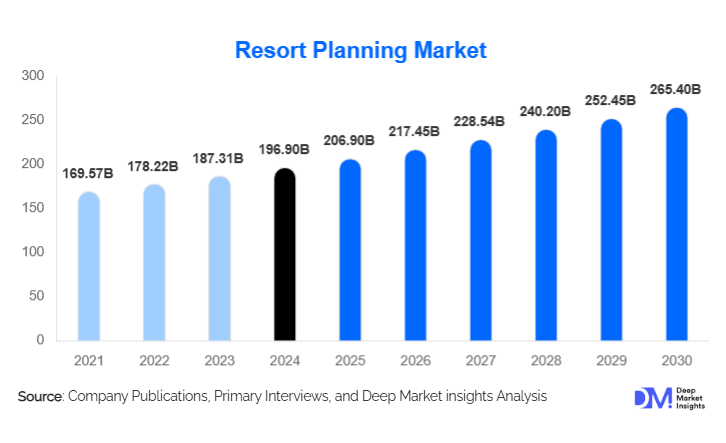

According to Deep Market Insights, the global resort planning market was valued at USD 196.9 billion in 2024 and is projected to grow from USD 206.9 billion in 2025 to reach USD 265.4 billion by 2030, expanding at a CAGR of 5.1% during the forecast period (2025–2030). The growth of the resort planning market is primarily driven by rising global tourism, increasing demand for luxury and wellness resorts, and the adoption of sustainable and technology-enabled planning solutions for resorts worldwide.

Key Market Insights

- Luxury, boutique, and wellness resorts are increasingly shaping resort planning demand, requiring specialized design, operational efficiency, and sustainability integration to attract high-value travelers.

- Full-service and consultancy-based planning services dominate the market, offering end-to-end solutions from concept development to operational readiness, reducing investor risk and enhancing ROI.

- North America leads globally, with the U.S. and Canada driving demand due to high tourism infrastructure, luxury resort development, and affluent traveler preferences.

- Asia-Pacific is the fastest-growing region, fueled by emerging economies such as China, India, Thailand, and Japan investing heavily in coastal, adventure, and wellness resorts.

- Technological adoption, including AI-based operations, IoT for smart resort management, and BIM-assisted design, is increasingly transforming resort planning approaches.

- Sustainability and eco-resort planning are becoming critical differentiators, with developers integrating renewable energy, water management, and low-impact construction practices.

What are the latest trends in the resort planning market?

Technology-Driven Resort Planning

Modern resort development is increasingly leveraging technology for design, operations, and guest experience optimization. Tools like Building Information Modeling (BIM), AI-driven predictive analytics, and IoT-enabled energy management help planners optimize costs, enhance operational efficiency, and improve guest satisfaction. Smart resorts with integrated digital services, automated maintenance, and advanced booking systems are gaining popularity. Technology adoption is especially strong in luxury and wellness resorts, which rely on data-driven insights to deliver personalized guest experiences and sustainable operations.

Sustainability and Eco-Resorts

The trend toward eco-conscious resort planning is accelerating globally. Developers and planners are incorporating renewable energy, water recycling systems, and low-impact construction methods to meet environmental standards and appeal to environmentally aware travelers. Governments are encouraging sustainable resort development through incentives, grants, and streamlined approvals. Eco-resorts not only reduce operational costs in the long term but also enhance brand reputation and marketability, making sustainability a key trend in the resort planning market.

What are the key drivers in the resort planning market?

Rising Global Tourism

The global increase in leisure, wellness, and adventure tourism is driving demand for new resorts, particularly in emerging markets. Tourists are seeking experiential stays, including luxury, wellness, and adventure-focused resorts, prompting developers to invest in comprehensive planning solutions to ensure high-quality, profitable resort operations. International tourist arrivals in regions like APAC and Europe are rising steadily, contributing to increased demand for professional resort planning services.

Demand for Luxury and Wellness Resorts

The growing affluent traveler base is fueling demand for high-end, wellness, and boutique resorts. Investors and operators are focusing on unique guest experiences, including spa and wellness offerings, sustainable architecture, and personalized services. Full-service resort planning is critical in this segment to ensure design, operational efficiency, and ROI optimization, driving market growth in luxury and wellness categories.

Integration of Advanced Planning Technologies

Technology adoption is reshaping resort planning, enabling efficient project management, predictive operational planning, and energy optimization. Smart resort solutions, including IoT devices, AI-powered guest management, and data-driven decision support, help planners deliver better ROI and guest satisfaction, contributing to overall market growth.

What are the restraints for the global resort planning market?

High Capital Investment

Developing resorts requires substantial upfront investments in land acquisition, design, and construction, making it challenging for small-scale developers to enter the market. High capital intensity can restrict market growth and limit access to full-service planning solutions for smaller players.

Regulatory and Environmental Challenges

Strict zoning regulations, labor laws, and environmental compliance requirements can delay projects and increase costs. Navigating complex legal frameworks and environmental approvals is a key challenge for planners and investors, particularly in eco-sensitive and high-demand tourist regions.

What are the key opportunities in the resort planning industry?

Expansion in Emerging Tourism Destinations

Emerging markets such as Africa, Southeast Asia, and Latin America present untapped opportunities for resort development. Planners and investors can establish early market presence by offering full-service and specialized planning for luxury, wellness, and adventure resorts, catering to growing tourist inflows.

Eco-Resort and Sustainable Planning

Increasing environmental awareness and regulatory support for sustainability create opportunities for specialized eco-resort planning. Services focusing on renewable energy, water management, waste reduction, and low-impact architecture are increasingly in demand, allowing planners to differentiate their offerings and enhance investor appeal.

Technology Integration and Smart Resorts

The adoption of smart technology in resorts presents opportunities for planners to provide AI, IoT, and data-driven operational solutions. Smart resorts improve efficiency, enhance guest experiences, and attract tech-savvy travelers, allowing planning companies to capture high-value projects and new market segments.

Product Type Insights

Full-service planning dominates the resort planning market, accounting for approximately 40% of the global market in 2024 (USD 3,460 million). The dominance of this segment is primarily driven by investor and developer preference for turnkey, end-to-end planning solutions that minimize execution risks, reduce cost overruns, and accelerate time-to-market. As resort projects involve high capital investment, complex regulatory approvals, and multi-stakeholder coordination, full-service planning provides a single-point accountability model covering concept development, master planning, construction oversight, sustainability integration, and operational readiness. This segment is particularly strong in luxury, mixed-use, and destination-scale resort projects, where integrated planning directly influences long-term profitability and brand positioning.

Consultancy and feasibility services represent the second-largest segment, contributing nearly 28% of the 2024 market share. Growth in this segment is driven by the increasing importance of financial viability studies, demand forecasting, and ROI optimization before capital deployment. Investors are increasingly engaging specialized consultants during the pre-construction phase to assess market demand, pricing strategy, and risk exposure, especially in emerging tourism markets. Additionally, sustainable resort design, green certification consulting, and operational planning services are gaining traction as standalone offerings, particularly within luxury and eco-resort developments, where regulatory compliance and environmental performance directly impact brand value and operating costs.

Application Insights

Resort planning demand is primarily driven by luxury, wellness, adventure, and eco-tourism resorts, each requiring specialized planning expertise. Luxury resorts remain the largest application segment, as high-net-worth travelers continue to prioritize exclusivity, experiential design, and premium services. These projects demand complex architectural planning, advanced operational modeling, and long-term asset optimization, supporting strong demand for professional planning services.

Wellness resorts are among the fastest-growing applications, supported by the global rise in health-conscious travel, aging populations in developed markets, and increasing integration of spa, medical, and holistic wellness offerings. Eco-resorts are also expanding rapidly as sustainability becomes a core travel preference, requiring expertise in low-impact construction, renewable energy integration, and water and waste management systems. Adventure resorts, including ski, mountain, coastal, and desert resorts, are emerging as high-growth applications due to experiential tourism trends and government-backed destination development initiatives. Additionally, medical tourism and spa-focused resorts are creating incremental demand for specialized resort planning that integrates healthcare compliance, accessibility, and long-stay guest infrastructure.

Distribution Channel Insights

The resort planning market is predominantly B2B-driven, with services delivered directly to resort developers, private investors, hotel groups, and government tourism authorities. Direct engagement allows planning firms to tailor solutions based on project scale, geography, and regulatory environment. Strategic partnerships with construction firms, architectural studios, sustainability consultants, and technology providers are increasingly common, enabling integrated project delivery and cost efficiency.

In parallel, technology-enabled consultancy platforms are emerging, allowing clients to access feasibility studies, benchmarking tools, and modular planning services digitally. These platforms are particularly relevant for mid-scale and boutique resort developers seeking faster decision-making and comparative analysis across regions. While traditional relationship-driven models remain dominant for large-scale projects, digital engagement is improving transparency, shortening sales cycles, and expanding access to international planning expertise.

Traveler Type Insights

Resort planning demand is strongly influenced by the evolving preferences of luxury travelers, wellness tourists, and adventure seekers, as these segments generate the highest per-guest revenue and longer average stays. Luxury travelers drive demand for bespoke resort designs, privacy-focused layouts, and high-end amenities, encouraging developers to invest heavily in professional planning services.

Family and group travelers play a critical role in shaping demand for mid-range, destination, and experiential resorts, particularly in beach and theme-based locations. These travelers require safety-focused design, recreational infrastructure, and scalable accommodation planning. Investors are increasingly prioritizing guest segmentation strategies during the planning phase to optimize occupancy rates and diversify revenue streams. Additionally, growing demand from eco-tourists and medical tourists is expanding the scope of resort planning beyond traditional leisure models, requiring integration of sustainability, accessibility, and healthcare-aligned infrastructure.

Age Group Insights

Travelers aged 31–50 years represent the most influential demographic driving resort planning demand, combining high disposable income with a strong interest in experiential, wellness, and luxury travel. Resorts targeting this age group emphasize premium amenities, work-leisure integration, and family-friendly offerings, shaping design and operational planning priorities.

The 18–30 age group is driving growth in adventure, eco, and mid-range resorts, favoring immersive experiences, social connectivity, and sustainability. This has increased demand for flexible resort layouts and cost-efficient planning solutions. Meanwhile, travelers aged 51–65 years significantly influence luxury and wellness resort development, prioritizing comfort, accessibility, and health-oriented services. This demographic segmentation directly impacts investment decisions, resort typologies, and long-term planning strategies.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the global resort planning market in 2024, led by the United States and Canada. Regional growth is driven by high disposable incomes, mature tourism infrastructure, strong domestic travel demand, and sustained investment in luxury and wellness resorts. The region also benefits from advanced technological adoption, enabling smart resort planning and operational efficiency. Government support for tourism redevelopment and growing interest in eco-certified and wellness-focused resorts further support steady market expansion.

Europe

Europe represents around 25% of the global market, with France, Italy, and Spain driving demand through coastal, heritage, and luxury resort developments. Growth is supported by strong intra-regional tourism, regulatory incentives for sustainable development, and rising demand for wellness and boutique resorts. Germany and the UK are key markets for spa and eco-resorts, while Southern Europe benefits from year-round tourism and infrastructure upgrades. Europe’s emphasis on sustainability and heritage preservation continues to shape resort planning demand.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, supported by rising middle-class wealth, rapid urbanization, and aggressive government investment in tourism infrastructure. China, India, Thailand, Indonesia, and Japan are major contributors, with demand for luxury, wellness, adventure, and eco-resorts. Government-backed destination development programs, increasing international tourist arrivals, and expanding air connectivity are key growth drivers. The region is expected to grow at a CAGR of approximately 7% through 2030.

Middle East & Africa

The Middle East and Africa region is driven by large-scale tourism diversification strategies and destination megaprojects. The UAE and Saudi Arabia are investing heavily in luxury, coastal, and desert resorts as part of economic diversification agendas. Africa, led by Kenya, Tanzania, South Africa, and Morocco, remains a global hub for eco-tourism and adventure resorts. Growth is supported by strong government incentives, international tourist inflows, and increasing private investment in high-end and sustainable resort developments.

Latin America

Latin America is an emerging growth region, led by Brazil, Mexico, Chile, and Costa Rica. Growth is driven by rising international tourism, expanding coastal and eco-resort developments, and increasing foreign direct investment. Adventure and experiential tourism are key demand drivers, supported by improving infrastructure and government initiatives aimed at boosting tourism competitiveness. Resort planning demand in the region is expected to accelerate steadily over the next decade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Resort Planning Market

- AECOM

- HVS Global

- Jones Lang LaSalle (JLL)

- WATG

- Wilson Associates

- HBA

- Perkins&Will

- Gensler

- CallisonRTKL

- SmithGroup

- Stantec

- IBI Group

- Rockwell Group

- Design Worldwide Partnership

- Studio Piet Boon