Religious Tourism Market Size

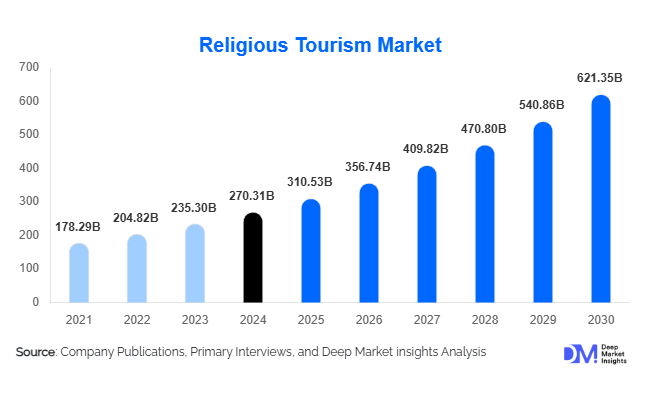

According to Deep Market Insights, the global religious tourism market size was valued at USD 270.31 billion in 2024 and is projected to grow from USD 310.53 billion in 2025 to reach USD 621.35 billion by 2030, expanding at a CAGR of 14.88% during the forecast period (2025–2030). Market growth is being driven by rising global interest in spiritual, heritage, and faith-based experiences; improved accessibility and infrastructure around pilgrimage sites; and the digital transformation of travel services that make faith journeys more convenient and personalized.

Key Market Insights

- Pilgrimage tourism remains the dominant offering type, accounting for roughly 60% of global religious tourism revenues in 2024.

- Christianity-led travel experiences constitute the largest faith segment, representing about 30% of the global market, while Islamic and Hindu pilgrimages are expanding fastest.

- Asia–Pacific dominates the global market with nearly 45–50% share, led by India, Southeast Asia, and China as major pilgrimage and heritage destinations.

- Technology-driven faith travel, including mobile apps, VR temple tours, and digital booking systems, is reshaping how pilgrims plan and undertake sacred journeys.

- Government investment in religious infrastructure, such as India’s pilgrimage circuit programs and Saudi Arabia’s Vision 2030 initiatives, is accelerating destination capacity and revenue potential.

- Wellness, cultural, and multi-faith travel integration is creating new hybrid segments appealing to younger and spiritually curious travelers.

What are the latest trends in the religious tourism market?

Digital Pilgrimages and Smart Travel Experiences

The adoption of technology is revolutionizing how travelers experience religious tourism. Virtual reality (VR) and 360° temple and church tours now allow pilgrims to explore sacred sites before booking. Mobile applications offering itinerary planning, prayer schedules, language translation, and guided navigation have become integral for large-scale pilgrimages like Hajj, Kumbh Mela, and Camino de Santiago. Real-time crowd management, AI-based booking systems, and wearable devices for pilgrim safety are gaining traction. This trend particularly appeals to younger, tech-savvy travelers who value accessibility, personalization, and safety when engaging in spiritual travel.

Faith + Wellness Tourism Expanding Rapidly

The blending of spirituality and wellness has become one of the most prominent trends. Buddhist meditation retreats, yoga and Ayurveda-based spiritual circuits in India, and Christian or Islamic wellness pilgrimages that combine reflection with holistic health are expanding globally. This hybrid category attracts urban professionals and millennials seeking mental restoration through faith-linked experiences. Operators integrating mindfulness, organic cuisine, and sustainable lodging near sacred destinations are tapping into high-value segments that extend the average stay and increase per-visitor expenditure.

What are the key drivers in the religious tourism market?

Rising Global Spiritual Awareness and Cultural Curiosity

Growing demand for meaningful, culturally immersive travel has fueled participation in faith-based tourism. Pilgrims and general travelers alike are seeking authentic spiritual experiences that connect them to heritage, community, and tradition. This sociocultural shift toward experiential travel has made religious tourism a mainstream segment of the global tourism economy.

Infrastructure and Government Investment

Governments are heavily investing in improving transport, lodging, and safety infrastructure around religious destinations. India’s development of pilgrimage corridors, Saudi Arabia’s expansion of Mecca and Medina facilities, and multi-country heritage route collaborations across Europe are enhancing site accessibility. These initiatives are stimulating both domestic and international travel flows, unlocking new opportunities for tour operators, hotels, and service providers.

Digital Transformation of Faith Travel Services

Digitalization, through online booking platforms, destination apps, and integrated payment systems, has simplified pilgrimage planning and increased transparency. This evolution has not only reduced dependence on intermediaries but also allowed small and emerging destinations to reach global audiences. Technology has become a key enabler for scaling capacity and personalizing traveler engagement.

What are the restraints for the global market?

Seasonality and Overcrowding Challenges

Major pilgrimages often occur seasonally and attract massive crowds within short time windows, creating logistical bottlenecks and straining local resources. Overcrowding reduces visitor satisfaction and raises safety concerns. Capacity constraints at heritage sites, combined with environmental degradation risks, remain persistent challenges for market stability.

Geopolitical and Visa Barriers

Religious tourism frequently involves cross-border travel to sensitive or politically complex regions. Restrictions on travel, security concerns, and visa complexities can disrupt international pilgrim movement. Destinations must address these policies and safety issues to sustain long-term growth and traveler confidence.

What are the key opportunities in the religious tourism industry?

Infrastructure Modernization and Smart Destination Development

Public–private partnerships in developing pilgrimage circuits, smart crowd management systems, and high-speed transport corridors are unlocking massive opportunities. Governments and investors collaborating on multi-faith heritage routes can generate high economic multipliers while improving visitor experience and safety. This modernization will help lesser-known religious destinations capture global visibility.

Digital Faith Platforms and Virtual Tourism

Technology startups are entering the religious tourism sector with innovations such as virtual pilgrimages, blockchain-based booking verification, and live-streamed ceremonies. As physical travel fluctuates due to global conditions, virtual religious experiences represent an alternative revenue channel for faith institutions and tour operators alike. The integration of AR/VR, AI chatbots, and multilingual assistance tools will enhance accessibility for global audiences.

Emerging Markets and Youth Spiritual Travel

Rising middle-class populations in India, Indonesia, Brazil, and parts of Africa are creating new demand hubs for faith travel. Simultaneously, the under-35 demographic is redefining religious tourism as a form of cultural and spiritual exploration. Operators catering to youth groups, interfaith travelers, and educational institutions can leverage this generational shift to establish long-term loyalty and digital community engagement.

Product Type Insights

Pilgrimage tourism dominates the global religious tourism market, representing nearly 60% of total revenues in 2024. It encompasses large-scale journeys such as the Hajj in Saudi Arabia, the Kumbh Mela in India, and the Camino de Santiago in Spain. Heritage and sacred site tourism, focused on exploring religious monuments and architecture, accounts for a significant secondary share. Faith-based wellness retreats are the fastest-growing product type, supported by increased interest in holistic health, meditation, and sustainable travel experiences.

Traveler Type Insights

Group tours organized by religious institutions constitute the largest traveler type, representing over 40% of the market, given their affordability and structured logistics. Individual travelers and family pilgrimages are rapidly growing, driven by higher disposable incomes and flexible booking options. Institution-led and youth-focused faith travel is emerging as a niche, offering educational and interfaith exposure programs. Online booking channels now dominate, with over 60% of travelers using OTAs or direct digital platforms to arrange travel journeys.

| By Tour Type | By Mode of Travel | By Traveler Type | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia–Pacific

Asia–Pacific leads the global market with approximately 45–50% share in 2024. India, China, Japan, and Southeast Asia are major contributors. The region’s rapid urbanization, strong domestic pilgrimage culture, and proactive government initiatives, such as India’s PRASAD and Swadesh Darshan schemes, are driving growth. India alone hosts hundreds of millions of domestic pilgrims annually, making it the fastest-growing country for faith-based tourism globally.

Europe

Europe holds around 25% of the global religious tourism market, anchored by Christian pilgrimage routes including Lourdes (France), the Vatican (Italy), and Santiago de Compostela (Spain). The region also benefits from cross-border heritage tours integrating cultural and spiritual experiences. With mature infrastructure and cultural diversity, Europe attracts high-value international pilgrims, though growth is moderate compared with emerging regions.

North America

North America accounts for about 15% of global market revenues, driven by outbound travel to Europe and the Middle East, as well as domestic pilgrimages and heritage visits. The U.S. and Canada are key source markets, with rising interest in faith-inspired retreats, Christian heritage tours, and interfaith programs. Technological adoption and wellness integration are supporting steady growth.

Middle East & Africa

The region contributes roughly 10–12% of the market but posts one of the fastest growth rates. Saudi Arabia remains a cornerstone due to Hajj and Umrah pilgrimages, supported by Vision 2030 infrastructure expansion. Israel and Egypt attract Jewish and Christian heritage travelers. Africa’s emerging destinations, such as Ethiopia and South Africa, are developing new pilgrimage circuits and faith-based heritage routes.

Latin America

Latin America represents 5–8% of the global market, led by Mexico’s Basilica of Guadalupe and Brazil’s Catholic festivals. Growing outbound faith tourism to Europe and the Holy Land is supported by increasing airline connectivity and disposable income among urban populations. Regional tour operators are promoting cross-cultural pilgrim exchanges within the Americas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Religious Tourism Market

- Expedia Inc.

- Booking Holdings Inc.

- Globus Tours

- Trafalgar Tours

- G Adventures

- Insight Vacations

- Kesari Tours

- Catholic Travel Centre

- TourRadar

- Cox & Kings Ltd.

- China CYTS Tours Holding Co.

- American Express Global Business Travel

- Travel Leaders Group

- HRG (Hogg Robinson Group)

- AAA Travel

Recent Developments

- In August 2025, the Government of India announced expanded funding under its “Pilgrimage Rejuvenation and Spiritual Augmentation Drive (PRASAD)” to modernize over 50 pilgrim destinations nationwide.

- In July 2025, Saudi Arabia unveiled new high-speed rail routes and digital visa solutions to streamline Hajj & Umrah travel as part of Vision 2030’s religious tourism strategy.

- In March 2025, Expedia Group launched a specialized faith-travel booking section integrating multi-faith pilgrimage packages with VR previews of sacred destinations.