Quinoa Seeds Market Size

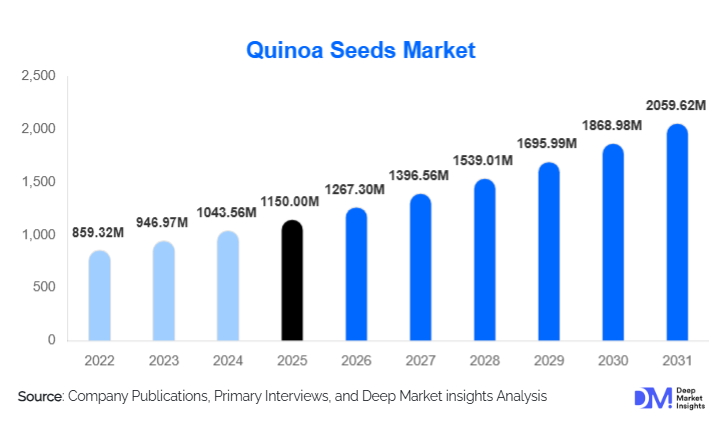

According to Deep Market Insights, the global quinoa seeds market size was valued at USD 1,150 million in 2025 and is projected to grow from USD 1,267.30 million in 2026 to reach USD 2,059.62 million by 2031, expanding at a CAGR of 10.2% during the forecast period (2026–2031). The quinoa seeds market growth is primarily driven by rising global demand for plant-based proteins, increasing adoption of gluten-free diets, and the expanding use of quinoa as a functional ingredient across food, nutraceutical, and specialty nutrition industries.

Key Market Insights

- White quinoa seeds dominate global consumption due to their mild flavor, versatility, and widespread use in household and industrial food applications.

- Conventional quinoa seeds account for the majority of the supply, supported by higher yields and cost efficiencies compared to organic cultivation.

- North America leads global demand, driven by strong health food consumption trends and growing domestic quinoa cultivation.

- Europe remains a mature but steadily expanding market, supported by clean-label food demand and organic product penetration.

- Asia-Pacific is the fastest-growing region, led by China, India, and Australia, as quinoa adoption expands beyond niche health segments.

- Value-added and pre-washed quinoa seeds are gaining traction as consumers increasingly prioritize convenience and ready-to-cook food products.

What are the latest trends in the quinoa seeds market?

Expansion of Value-Added and Functional Quinoa Products

One of the most prominent trends in the quinoa seeds market is the growing shift toward value-added and functional offerings. Food manufacturers are increasingly using quinoa in ready-to-eat meals, breakfast cereals, protein bars, bakery products, and fortified foods. Pre-washed, sprouted, and fortified quinoa seeds are witnessing higher demand as they reduce preparation time while enhancing nutritional value. This trend is particularly strong in North America and Europe, where consumers are willing to pay premium prices for convenience-oriented and health-enhancing food products. As a result, processors investing in cleaning, sprouting, and enrichment technologies are achieving higher margins compared to bulk seed suppliers.

Rising Adoption of Organic and Sustainably Sourced Quinoa

Demand for organic and sustainably produced quinoa seeds is increasing steadily, supported by consumer preference for clean-label, pesticide-free food products. Although organic quinoa currently represents a smaller share compared to conventional varieties, it is growing at a faster pace. Retailers and food brands are increasingly highlighting traceability, fair trade practices, and sustainable sourcing in their marketing strategies. This trend is strengthening partnerships between growers and food companies, particularly in Europe, where sustainability certifications strongly influence purchasing decisions.

What are the key drivers in the quinoa seeds market?

Growing Demand for Plant-Based and Gluten-Free Diets

The rapid global shift toward plant-based nutrition is a key driver of the quinoa seeds market. Quinoa’s status as a complete plant protein containing all essential amino acids makes it highly attractive to vegan and vegetarian consumers. Additionally, the growing prevalence of gluten intolerance and celiac disease has accelerated the adoption of quinoa as a substitute for wheat, barley, and other gluten-containing grains. This has led to increased incorporation of quinoa into gluten-free food formulations, boosting both retail and industrial demand.

Increasing Industrial Use in Food and Nutraceutical Applications

Quinoa is increasingly being used as an ingredient rather than solely as a standalone grain. Food processors and nutraceutical manufacturers are integrating quinoa into protein supplements, functional snacks, infant nutrition, and sports nutrition products. This shift toward industrial-scale consumption is supporting stable, high-volume demand and encouraging long-term supply contracts between growers and processors.

What are the restraints for the global market?

Price Volatility and Supply Chain Concentration

Quinoa prices remain vulnerable to climatic variability and yield fluctuations, particularly in traditional producing regions. Although cultivation is expanding globally, supply concentration in a limited number of countries continues to create pricing uncertainty. This volatility can impact profit margins for both producers and downstream buyers, especially in price-sensitive markets.

Limited Mass-Market Penetration in Developing Economies

In many developing regions, quinoa is still perceived as a premium or imported product, restricting its adoption among price-sensitive consumers. Limited consumer awareness and higher retail prices compared to staple grains such as rice and wheat act as barriers to broader market penetration.

What are the key opportunities in the quinoa seeds industry?

Geographic Expansion of Quinoa Cultivation

The expansion of quinoa cultivation beyond South America presents a significant opportunity for market participants. Countries such as the United States, Canada, India, China, and parts of Europe are investing in climate-resilient quinoa varieties. Localized production reduces import dependence, lowers logistics costs, and supports competitive pricing, creating opportunities for new entrants and regional agribusiness players.

Growth in Institutional and Public Nutrition Programs

Government-backed nutrition initiatives, including school meal programs and public health schemes, are increasingly incorporating nutrient-dense grains. Quinoa’s high protein and micronutrient profile positions it as a suitable candidate for institutional procurement, offering stable, long-term demand opportunities for large-scale suppliers.

Product Type Insights

White quinoa seeds account for approximately 52% of the global market in 2025, making them the dominant product type due to their neutral taste and wide culinary applicability. Red and black quinoa seeds together represent a growing premium segment, favored in salads, gourmet dishes, and specialty food products. Tri-color and blended quinoa seeds are gaining popularity in retail channels, particularly in health food stores, as consumers seek visual appeal and nutritional diversity.

Application Insights

Food and beverage processing is the largest application segment, contributing nearly 44% of total market demand in 2025. Household and retail consumption remains strong, particularly in developed markets. Nutraceuticals represent the fastest-growing application segment, driven by demand for plant-based protein supplements and functional nutrition products. Emerging applications in animal feed and cosmetics, though currently niche, are expected to contribute incremental growth over the forecast period.

Distribution Channel Insights

Modern retail formats such as supermarkets and hypermarkets account for the largest share of quinoa seed sales, supported by strong shelf visibility and consumer trust. Online and e-commerce channels are growing rapidly, driven by convenience, subscription models, and direct-to-consumer branding. Specialty and health food stores continue to play a critical role in premium and organic quinoa distribution, particularly in urban markets.

| By Seed Color / Variety | By Cultivation Type | By Seed Form / Processing State | By Distribution Channel | By Application / End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 32% of the global quinoa seeds market in 2025, led by the United States. Strong consumer awareness, high disposable incomes, and growing domestic cultivation support sustained demand. Canada also contributes steadily through health food and organic product consumption.

Europe

Europe accounts for nearly 28% of global market share, with Germany, the U.K., France, and Italy being key consuming countries. Demand is driven by clean-label food trends, organic product penetration, and strong regulatory support for sustainable agriculture.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to register a CAGR exceeding 12% during the forecast period. China and India are leading demand growth as quinoa adoption expands among urban consumers and food processors. Australia represents a mature but innovative market with growing domestic production.

Latin America

Latin America remains a critical production hub, with Peru and Bolivia dominating exports. Regional consumption is gradually increasing, supported by value-added processing and export-oriented agribusiness investments.

Middle East & Africa

Demand in the Middle East & Africa is driven by premium food imports, health-conscious expatriate populations, and rising interest in functional grains, particularly in the UAE and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Quinoa Seeds Market

- Alter Eco

- Andean Naturals

- Quinoa Foods Company

- Inca Organics

- The British Quinoa Company

- Ancient Harvest

- Irupana Andean Organic Food

- Royal Quinoa

- Nature’s Path Foods

- Organic Bolivia

- Grain Millers

- Archer Daniels Midland (ADM)

- Benexia

- Norquin

- Quinoabol