Processed Potatoes Market Size

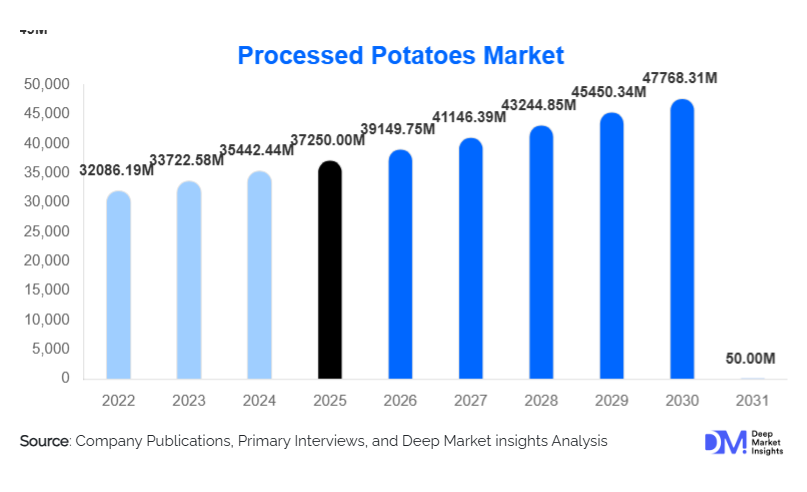

According to Deep Market Insights, the global processed potatoes market size was valued at USD 37,250.00 million in 2025 and is projected to grow from USD 39,149.75 million in 2026 to reach USD 50,204.49 million by 2031, expanding at a CAGR of 5.1% during the forecast period (2026–2031). The processed potatoes market growth is primarily driven by the rapid expansion of quick-service restaurants (QSRs), increasing consumption of convenience foods, and continuous advancements in freezing, dehydration, and extrusion technologies that improve product quality, shelf life, and supply chain efficiency.

Key Market Insights

- Frozen processed potatoes dominate the market, accounting for nearly half of global revenue due to their extensive use in QSRs and foodservice operations.

- Foodservice remains the largest end-use segment, driven by standardized procurement by global restaurant chains and recovery of dine-in and delivery channels.

- North America leads global consumption, supported by high per-capita potato intake, large-scale farming, and advanced processing infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by the westernization of diets, rising disposable incomes, and expanding cold-chain logistics.

- Technological adoption, such as IQF freezing and automation, is improving yields, reducing waste, and enhancing sustainability metrics.

- Private-label and retail frozen potato products are gaining traction as household freezer penetration increases globally.

What are the latest trends in the processed potatoes market?

Premiumization and Value-Added Product Innovation

Manufacturers are increasingly focusing on premium and value-added processed potato products, including specialty cuts, seasoned fries, low-oil formulations, and organic or non-GMO variants. These innovations cater to evolving consumer preferences for taste differentiation, clean-label ingredients, and perceived health benefits. Premium frozen potato products are gaining shelf space in modern retail formats, particularly in North America and Europe, where consumers are willing to pay higher prices for restaurant-style quality at home.

Automation and Sustainable Processing Technologies

The adoption of automation, AI-based sorting, and energy-efficient freezing and drying systems is reshaping the processed potatoes industry. Leading producers are investing in water recycling, renewable energy integration, and waste valorization to meet sustainability targets set by global foodservice buyers. These technologies not only reduce environmental impact but also lower long-term operating costs, strengthening competitiveness in a margin-sensitive market.

What are the key drivers in the processed potatoes market?

Expansion of Quick-Service Restaurants

The global proliferation of QSR chains is the most significant driver of processed potatoes demand. French fries and other frozen potato products are menu staples for international brands, creating consistent, high-volume demand. Emerging markets across Asia-Pacific, the Middle East, and Latin America are witnessing aggressive outlet expansion, directly boosting frozen potato imports and local processing investments.

Rising Demand for Convenience Foods

Urbanization, changing lifestyles, and increasing workforce participation are driving demand for ready-to-cook and ready-to-eat foods. Processed potatoes offer convenience, versatility, and long shelf life, making them a preferred choice for both households and institutional buyers. Growth in modern retail and e-commerce grocery platforms is further accelerating retail consumption.

What are the restraints for the global market?

Raw Material Price Volatility

Potato prices are highly sensitive to weather conditions, water availability, and disease outbreaks. Seasonal fluctuations in raw material costs can significantly impact processing margins, particularly for manufacturers operating under fixed-price supply contracts with foodservice clients.

Health and Regulatory Pressures

Growing consumer awareness regarding fat, sodium, and acrylamide content in processed potato products has led to stricter food safety and labeling regulations, especially in Europe and North America. Compliance requirements increase R&D and reformulation costs, posing challenges for smaller producers.

What are the key opportunities in the processed potatoes industry?

Emerging Market Processing Capacity Expansion

Asia-Pacific, the Middle East, and Africa present significant opportunities for capacity expansion. Governments in countries such as India, China, and Egypt are supporting agri-processing through food parks, export incentives, and cold-chain investments. Establishing local processing facilities reduces import dependence and improves supply chain resilience.

Clean-Label and Health-Oriented Products

There is a growing demand for low-fat, air-fried, organic, and clean-label processed potato products. Manufacturers that invest in healthier formulations and transparent labeling can access premium consumer segments and secure long-term contracts with health-conscious foodservice operators.

Product Type Insights

Frozen processed potatoes lead the global market, accounting for approximately 46% of total revenue in 2025, primarily driven by strong and consistent demand for French fries, potato wedges, and hash browns from quick-service restaurants (QSRs) and foodservice operators. The dominance of this segment is supported by its long shelf life, ease of storage and transportation, standardized quality, and compatibility with large-scale foodservice operations. Technological advancements such as individually quick frozen (IQF) processing have further enhanced product texture, yield, and portion control, reinforcing the leadership of frozen potato products across both developed and emerging markets.

Dehydrated processed potatoes, including flakes, granules, and powders, represent a significant share of the market due to their extensive use in food manufacturing and institutional catering. These products are widely used in soups, sauces, bakery fillings, snack coatings, and ready-meal formulations, particularly in Europe, Japan, and North America. The segment benefits from higher profit margins compared to frozen products, owing to lower transportation costs, extended shelf life, and reduced cold-chain dependency. Demand for dehydrated potatoes is also supported by defense, healthcare, and disaster-relief food programs where shelf-stable ingredients are essential.

End-Use Insights

The foodservice sector dominates global processed potato consumption, accounting for nearly 58% of total market demand in 2025. Growth in this segment is primarily driven by the rapid expansion of QSRs, fast-casual dining, cloud kitchens, and large-scale catering services. Processed potato products, particularly frozen fries, are menu staples for international restaurant chains due to their cost efficiency, consistent quality, and minimal preparation time. Post-pandemic recovery in dine-in traffic and sustained growth in food delivery platforms have further reinforced foodservice demand.

Retail and household consumption represent the fastest-growing end-use segment, supported by increasing freezer penetration, rising popularity of home cooking, and strong growth of private-label frozen foods. Consumers are increasingly purchasing restaurant-style frozen potato products for at-home consumption, particularly in North America and Europe. The expansion of modern retail formats and e-commerce grocery platforms has significantly improved product accessibility and visibility, accelerating retail segment growth.

Distribution Channel Insights

Direct B2B supply channels account for over 60% of processed potato distribution, reflecting the dominance of large-volume, long-term contracts with QSR chains, food manufacturers, and institutional buyers. This channel benefits from predictable demand, scale efficiencies, and streamlined logistics, making it the preferred route for major processors supplying frozen and dehydrated potato products.

Modern retail channels, including supermarkets and hypermarkets, are expanding steadily as frozen and snack-grade potato products gain prominence in consumer shopping baskets. Retail growth is supported by increased private-label offerings, promotional pricing strategies, and improved cold storage infrastructure. E-commerce and direct-to-consumer (DTC) platforms are emerging as high-growth distribution channels, particularly for premium, branded, and specialty processed potato products. Online grocery adoption, subscription-based food services, and digital-first brands are reshaping purchasing behavior, especially among urban and younger consumers.

| By Product Type | By End Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global processed potatoes market share in 2025, led by the United States. Regional dominance is driven by high per-capita potato consumption, well-established QSR networks, and large-scale domestic potato farming. The presence of major global processing companies, advanced freezing and dehydration infrastructure, and strong cold-chain logistics further support market leadership. Additionally, rising demand for premium frozen and clean-label potato products in retail channels continues to strengthen regional growth.

Europe

Europe accounts for around 29% of global demand, with Germany, the U.K., France, and the Netherlands as key consumer markets. The region benefits from a strong food processing ecosystem, high consumption of frozen and snack-grade potato products, and strict quality standards that favor technologically advanced processors. The Netherlands and Belgium play a critical role as export hubs, supplying frozen potato products across Europe, the Middle East, and parts of Asia. Growth is also driven by demand for dehydrated potato ingredients in food manufacturing and institutional catering.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, registering a CAGR of over 7%. Growth is driven by rapid urbanization, westernization of diets, rising disposable incomes, and aggressive expansion of QSR chains in China, India, and Southeast Asia. Investments in cold-chain infrastructure, food parks, and local processing facilities are reducing import dependence and improving supply reliability. Increasing consumption of potato snacks among younger demographics further accelerates regional demand.

Latin America

Latin America represents nearly 6% of the global market, led by Brazil and Argentina. Regional growth is supported by increasing fast-food consumption, rising middle-class populations, and growing investments in local potato processing capacity. Expanding modern retail and improving cold storage infrastructure are also enabling greater penetration of frozen and snack-grade potato products.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of global demand, driven largely by high import dependence in Gulf Cooperation Council (GCC) countries such as Saudi Arabia and the UAE. Strong growth in foodservice, tourism, and hospitality sectors supports consistent demand for frozen potato products. In Africa, South Africa and Egypt are emerging as important processing and export hubs, supported by favorable agro-climatic conditions and government-backed agri-processing initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|