Pro Speakers Market Size

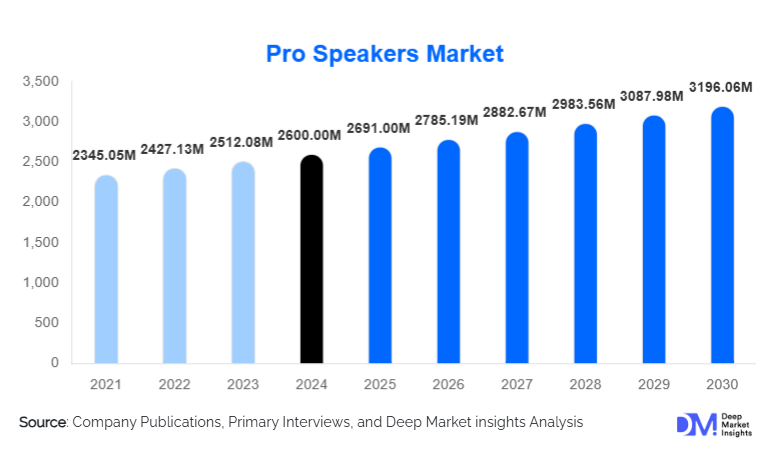

According to Deep Market Insights, the global pro speakers market size was valued at USD 2,600.00 million in 2024 and is projected to grow from USD 2,691.00 million in 2025 to reach USD 3,196.06 million by 2030, expanding at a CAGR of 3.5% during the forecast period (2025–2030). The pro speakers market growth is primarily driven by the resurgence of live events, upgrades in corporate AV systems for hybrid work, and rising adoption of networked and powered speaker technologies across commercial, entertainment, and institutional environments.

Key Market Insights

- Line-array speakers dominate global revenue share, supported by widespread adoption in concerts, festivals, and large venues.

- Powered (active) speakers account for nearly 68% of global market demand, driven by easy installation, portability, and integrated amplification.

- Corporate installations represent one of the fastest-growing end-use segments due to hybrid work models and increased AV spending.

- North America holds the largest market share (34% in 2024), supported by mature entertainment and corporate sectors.

- Asia-Pacific is the fastest-growing region, driven by rising investments in entertainment infrastructure, hospitality, and education.

- Wireless and networked audio technologies (Dante, AV-over-IP) are reshaping speaker deployment, management, and system scalability.

What are the latest trends in the pro speakers market?

Smart, Networked & Wireless Speaker Ecosystems

Pro speaker manufacturers are increasingly integrating advanced connectivity technologies such as Dante, AV-over-IP, Wi-Fi, and Bluetooth into their systems. These smart speakers allow remote monitoring, system tuning, diagnostics, and multi-room control, significantly reducing installation and maintenance time. As event venues, corporate institutions, and houses of worship shift toward scalable digital infrastructure, demand for intelligent, networked speaker setups has surged. IoT-enabled devices are also growing in popularity, enabling audio engineers to manage large venue soundscapes through unified cloud dashboards with real-time alerts and automated optimization algorithms.

Miniaturized, High-Power, Portable Systems

Technological miniaturization has enabled compact speakers to deliver higher wattage and improved sound pressure levels. Portable PA systems and lightweight line-array modules are increasingly preferred in corporate events, educational institutions, and small to mid-sized venues. Consumers seek flexible systems that balance portability with professional-grade output, driving strong adoption among mobile DJs, rental services, and touring entertainers. Many manufacturers have introduced battery-powered PA units, DSP-enhanced drivers, and modular systems that offer premium acoustics without the bulk of traditional equipment.

What are the key drivers in the pro speakers market?

Resurgence of Live Events and Entertainment

Global recovery of concerts, festivals, theatre productions, and outdoor events has injected strong momentum into the pro speakers market. Large venues continue to invest heavily in high-performance line-array systems, subwoofers, and high-wattage PA speakers to meet audience expectations for immersive sound experiences. Touring artists and event organizers are upgrading to modern, lightweight, and digitally integrated systems, fueling significant demand.

Corporate AV Upgrades and Hybrid Work Adoption

The rapid shift toward hybrid work has triggered extensive upgrades in corporate audio-visual infrastructure. Boardrooms, conference halls, auditoria, and training centers increasingly require networked speakers with crystal-clear speech reinforcement and seamless integration with UC (unified communications) tools such as Zoom, Teams, and Webex. Organizations are making recurring investments to modernize AV systems for high-quality presentations, seminars, and live-streamed events.

Advancements in Audio Networking & DSP Technologies

Audio-over-IP, digital signal processing (DSP), and remote configuration tools have revolutionized the deployment of professional speakers. AV integrators can now deliver precise acoustic tuning, lower-latency sound transmission, and centralized control of large multi-room installations. These advancements significantly enhance sound quality, reduce setup complexity, and lower long-term operational costs, driving widespread adoption across studios, venues, and corporate spaces.

What are the restraints for the global market?

High Cost of Professional-Grade Equipment

Professional speaker systems often require substantial investment, especially for large venues that rely on complex line-array configurations and high-output subwoofers. The cost of installation, cabling, amplifiers, and acoustic engineering services further elevates total project expenses, limiting demand among small businesses and emerging economies. Price sensitivity in developing regions remains a major barrier to market penetration.

Competition from Consumer Audio and Alternative Solutions

High-quality consumer-grade speakers, soundbars, and portable smart speakers increasingly encroach on entry-level professional use cases. Smaller venues sometimes opt for low-cost DIY audio setups instead of investing in professional-grade equipment. Additionally, distributed low-wattage systems and compact wireless speakers often serve as substitutes for traditional PA or installed speakers, reducing market potential for premium systems.

What are the key opportunities in the pro speakers industry?

Integration of Smart, IoT & AI-Powered Audio Solutions

The shift toward intelligent audio ecosystems creates major opportunities for manufacturers. Cloud-connected speakers with AI-enabled tuning, predictive maintenance, and real-time acoustic adjustments are expected to gain traction across large venues, stadiums, hospitality chains, and corporate facilities. As AV ecosystems merge with IT infrastructure, speaker brands offering seamless interoperability will gain a competitive edge.

High-Growth Potential in Emerging Markets

Asia-Pacific, the Middle East & Africa, and Latin America are rapidly expanding their event, hospitality, and education sectors. New hotels, stadiums, auditoria, and cultural venues require professional-grade speaker installations, creating large, untapped opportunities for brands offering scalable, high-value solutions. Government investments in public infrastructure and smart-city initiatives further support long-term growth.

Corporate, Education & House of Worship Expansion

These segments represent strong recurring demand sources. With hybrid events, live-streaming, and digital worship services on the rise, institutions increasingly invest in networked audio systems, active speakers, and studio-grade equipment. Solutions tailored for speech clarity, acoustic coverage, and remote management will see strong adoption in the years ahead.

Product Type Insights

Line-array speakers dominate the product landscape, representing approximately 42% of global revenue in 2024. Their unrivaled scalability, coverage, and clarity make them the preferred choice for concerts, festivals, stadiums, and touring events. Studio monitors remain essential for production houses, broadcasters, and recording studios, while portable PA systems are expanding in demand among mobile performers and rental companies. Subwoofers continue to gain traction as immersive audio experiences grow in popularity across entertainment venues.

Application Insights

Live events and performance venues remain the largest application segment, driven by the global recovery of the entertainment industries. Corporate installations, however, represent one of the fastest-growing segments due to hybrid conferencing needs and increased reliance on professional-grade speech reinforcement. Broadcast studios, educational institutions, and houses of worship are increasingly adopting digital, networked speakers to support content creation, streaming, and large-group communication. Rental and mobile AV services continue to provide steady demand for portable and modular speaker systems.

Distribution Channel Insights

Professional AV integrators dominate the distribution ecosystem, providing end-to-end solutions for venues, corporate facilities, universities, and houses of worship. Online platforms and OEM-direct channels are expanding due to greater price transparency and the availability of detailed technical specifications. Retail distributors continue to serve small studios, independent musicians, and mobile DJs. Subscription-based equipment leasing and pay-per-event rental models are also gaining ground, especially in the events and hospitality sectors.

End-User / Client Type Insights

Large venues and touring companies constitute the highest-value customers, with sizable investments in high-output, durable speaker systems. Corporate clients, government institutions, and universities prioritize clarity, reliability, and ease of integration with AV platforms. Content creators, podcasters, and production houses rely heavily on premium studio monitors. Rental companies remain consistent bulk purchasers due to demand for portable and rugged speaker systems, while hospitality and religious institutions increasingly invest in scalable, aesthetically integrated audio solutions.

| By Product Type | By Application | By Connectivity / Technology | By Power Output | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global market (34% in 2024), driven by strong entertainment and corporate sectors. The U.S. leads with heavy investment in stadiums, theaters, universities, and houses of worship. Large-scale touring events and music festivals continue to boost demand for high-performance speaker systems. Canada contributes a stable demand, particularly in corporate AV upgrades and educational installations.

Europe

Europe represents a mature market with significant demand from Germany, the U.K., France, Italy, and the Netherlands. Strong cultural affinity for live music, widespread adoption of acoustic standards, and renovation of public spaces support stable market growth. Corporate and institutional AV spending, especially in hybrid communication environments, continues to rise across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, expanding entertainment infrastructure, and growth in hospitality and education. China and India lead volume growth, with booming events industries and rapid development of hotels, malls, and auditoria. Japan, South Korea, and Australia represent mature markets with high adoption of professional audio for concerts, broadcasting, and corporate installations.

Latin America

Latin America is experiencing steady growth, particularly in Brazil, Mexico, Chile, and Argentina. Demand is fueled by active music cultures, increasing investments in event venues, and rising corporate spending. Local rental companies and touring businesses contribute significantly to sales of portable and mid-power pro speakers.

Middle East & Africa

MEA is an emerging market with strong government-led infrastructure development. The UAE, Saudi Arabia, and Qatar are investing heavily in event venues, stadiums, mosques, and cultural centers. Sub-Saharan Africa is gradually adopting professional audio systems as educational institutions, churches, and entertainment venues modernize their AV infrastructures.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pro Speakers Market

- Bose Corporation

- JBL Professional (Harman)

- Yamaha Corporation

- QSC

- L-Acoustics

- Electro-Voice

- Mackie

- Adam Audio

- KRK Systems

- Behringer

- Sennheiser

- Shure

- Roland Corporation

- PreSonus Audio Electronics

- AKG Acoustics

Recent Developments

- In March 2025, JBL Professional introduced a new line of compact networked line-array speakers optimized for mid-sized venues and touring applications.

- In January 2025, Bose launched an AI-powered acoustic tuning system integrated with its latest powered speaker range for corporate and educational deployments.

- In September 2024, Yamaha released its updated series of Dante-enabled powered speakers, enabling seamless AV-over-IP integration for large installations.