Wireless Speakers Market Size

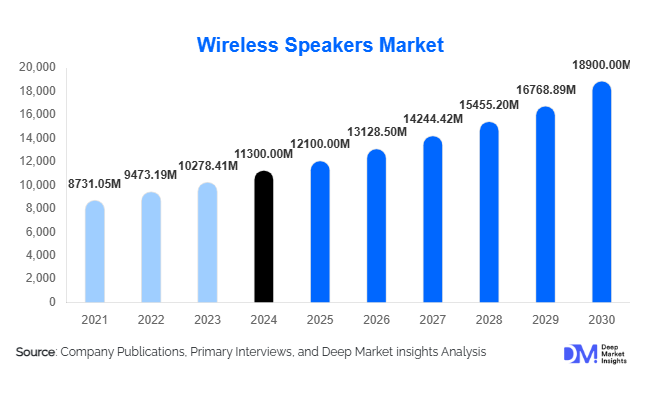

According to Deep Market Insights, the global wireless speakers market size was valued at USD 11,300 million in 2024 and is projected to grow from USD 12,100 million in 2025 to reach USD 18,900 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The wireless speakers market growth is primarily driven by increasing adoption of smart home devices, rising demand for portable and high-quality audio solutions, and technological advancements in wireless connectivity and AI-integrated smart speakers.

Key Market Insights

- Portable/Bluetooth speakers dominate the market, owing to their affordability, convenience, and growing popularity among millennials and Gen Z consumers.

- Smart speakers with AI integration are transforming residential audio experiences, serving as control hubs for home automation and multi-room audio setups.

- North America holds the largest market share, led by the U.S. and Canada, due to high disposable incomes, technological adoption, and strong smart home penetration.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class populations in China, India, and Southeast Asia, coupled with rapid urbanization and digital adoption.

- Online retail channels are expanding rapidly, offering consumers convenient access to diverse product offerings, competitive pricing, and global brands.

- Technological innovations, including advanced Bluetooth standards, Wi-Fi multi-room systems, AI integration, and battery-efficient designs, are reshaping consumer expectations and driving premium adoption.

Latest Market Trends

Smart Home Integration and AI Adoption

Wireless speakers are increasingly integrated into smart home ecosystems, acting as central hubs for controlling lighting, entertainment, and connected devices. AI-enabled voice assistants like Alexa, Google Assistant, and Siri are enhancing usability and convenience. Consumers are demanding multi-room audio, personalized music recommendations, and seamless streaming, prompting manufacturers to invest heavily in software updates, AI algorithms, and user-friendly interfaces. The rise of IoT-based smart home adoption is positioning wireless speakers not only as audio devices but as interactive home control solutions.

Portable and Outdoor Audio Solutions

Portable Bluetooth speakers and outdoor party speakers are gaining traction among younger consumers and outdoor enthusiasts. Water-resistant and rugged designs, combined with improved battery life and high-fidelity sound, appeal to users engaged in travel, fitness, and outdoor events. Social media influence and lifestyle marketing have further accelerated adoption, with compact yet powerful speakers becoming a lifestyle accessory. Consumers are increasingly prioritizing portability without compromising on sound quality or connectivity range.

Wireless Speakers Market Drivers

Rising Smart Home and IoT Adoption

The growing smart home ecosystem drives demand for Wi-Fi and AI-enabled wireless speakers. Consumers increasingly prefer devices that integrate with home automation, offering convenience, multi-room audio capabilities, and voice-controlled functionality. The shift toward connected devices is positively impacting both premium and mid-range speaker segments, encouraging manufacturers to develop compatible ecosystems and software upgrades to enhance interoperability.

Increased Consumer Preference for Portable Audio

The mobile lifestyle of millennials and Gen Z has fueled the growth of portable Bluetooth and outdoor speakers. Lightweight, compact, and durable devices that support extended battery life are particularly popular. Outdoor and travel-focused consumers value devices that combine high-quality sound with convenience, boosting demand across residential, commercial, and recreational applications.

Rising Disposable Income and Urbanization

Higher disposable incomes in developed and emerging markets are encouraging spending on premium home entertainment systems. Urban consumers prefer compact, stylish, and high-performance wireless speakers that integrate seamlessly with smart TVs, mobile devices, and streaming platforms. This trend is further fueled by increased e-commerce penetration and the availability of innovative audio solutions at varying price points.

Market Restraints

Intense Competition and Price Sensitivity

The market faces significant pricing pressures due to the presence of multiple low-cost competitors. Premium brands often struggle to maintain margins while competing with budget-friendly alternatives. Price sensitivity, especially in developing regions, limits the adoption of high-end smart speaker models.

Compatibility and Connectivity Challenges

Lack of standardization across Bluetooth, Wi-Fi, and proprietary wireless systems may hinder consumer adoption. Users often experience difficulties integrating devices from different brands or ecosystems, which can negatively impact market expansion. Ensuring seamless cross-device connectivity remains a critical challenge for manufacturers.

Wireless Speakers Market Opportunities

Technological Innovations and Product Differentiation

Advancements in battery technology, acoustic engineering, and compact designs are enabling manufacturers to develop next-generation portable and professional speakers. Companies investing in features such as enhanced bass response, voice assistant integration, and multi-room connectivity can capture premium segments and strengthen brand loyalty. The opportunity to differentiate products through innovation provides a competitive edge in a saturated market.

Emerging Regional Demand

Rapid economic growth and rising urbanization in the Asia-Pacific and Latin America are creating untapped opportunities. Countries such as China, India, and Brazil are witnessing increasing demand for wireless audio devices in residential, commercial, and professional applications. Expanding distribution networks, localized marketing, and affordable product offerings can help manufacturers capture these high-growth markets.

Integration with Smart Home and IoT Ecosystems

The rising adoption of smart home solutions presents a strategic opportunity for wireless speaker manufacturers. Devices compatible with AI assistants, smart TVs, and home automation systems can become central to connected living. Multi-room setups and IoT-based applications provide avenues for upselling, subscription services, and premium features, offering sustainable revenue streams in the long term.

Product Type Insights

Portable/Bluetooth speakers dominate the market, accounting for nearly 45% of the 2024 market share. Smart speakers follow closely, benefiting from AI integration and smart home compatibility. Soundbars and professional PA systems cater to niche segments like home theaters and entertainment venues. Outdoor and rugged speakers are increasingly popular among travel, fitness, and recreational users, driving steady adoption growth across portable and outdoor segments.

Application Insights

Residential/home entertainment remains the largest application, representing 50% of the 2024 market. Consumers increasingly prefer wireless speakers for streaming music, multi-room audio, and voice-controlled smart home integration. Commercial applications, including retail and office spaces, are growing steadily, while professional/entertainment venues such as concerts and conference halls drive demand for high-performance PA systems and soundbars. Fitness and outdoor activities are emerging as new use cases, contributing to market expansion.

Distribution Channel Insights

Online retail dominates with a 40% market share, driven by e-commerce platforms, direct brand websites, and online promotions. Offline retail stores, including electronics chains and specialty audio stores, account for 35% of market share. B2B direct sales make up 25%, focusing on commercial and professional applications. Digital marketing, influencer promotions, and social media campaigns are increasingly shaping consumer purchase behavior, particularly in younger demographics.

| By Product Type | By Connectivity | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the wireless speakers market, contributing 40% of 2024 revenues. The U.S. and Canada drive demand due to high disposable income, strong tech adoption, and extensive smart home infrastructure. Consumers favor premium and mid-range speakers with Bluetooth and Wi-Fi connectivity. Multi-room audio systems and AI-integrated devices are particularly popular in residential and office environments.

Europe

Europe accounts for 25% of the 2024 market, with Germany, the U.K., and France leading adoption. High consumer preference for premium audio, home automation, and smart devices drives growth. Sustainability-focused designs and energy-efficient products are increasingly valued. Europe also demonstrates steady professional/entertainment segment demand in venues requiring high-fidelity audio systems.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, and South Korea. Rising middle-class populations, urbanization, and digital adoption accelerate demand. Affordable smart speakers and portable Bluetooth devices are widely adopted, while premium smart speakers with AI integration are gaining traction in urban households. Emerging e-commerce and mobile-based sales channels further fuel growth.

Latin America

Brazil leads the LATAM market, followed by Argentina and Mexico. Rising smartphone penetration, e-commerce adoption, and growing awareness of home entertainment systems drive demand. Outbound and imported premium brands from North America and Europe are increasingly preferred by affluent consumers.

Middle East & Africa

UAE, Saudi Arabia, and South Africa lead the MEA wireless speakers market. High disposable incomes and luxury-focused preferences drive premium smart speaker adoption. Increasing commercial and hospitality investments support demand for high-end audio solutions, while intra-regional trade is fostering awareness and adoption of international brands.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wireless Speakers Market

- Bose Corporation

- Sonos Inc.

- Sony Corporation

- JBL (Harman International)

- Apple Inc.

- Samsung Electronics

- LG Electronics

- Amazon

- Ultimate Ears (Logitech)

- Bang & Olufsen

- Harman Kardon

- Anker Innovations

- Skullcandy

- Denon

- Pioneer Corporation

Recent Developments

- In March 2025, Sonos launched a new multi-room smart speaker series with enhanced Wi-Fi connectivity and AI voice assistant support.

- In May 2025, Bose introduced a rugged portable Bluetooth speaker line targeting outdoor and adventure enthusiasts, featuring improved battery life and a waterproof design.

- In April 2025, Apple expanded its HomePod lineup with advanced sound processing and seamless integration with Apple ecosystem devices, strengthening its premium smart speaker segment.