Prenatal Vitamins Market Size

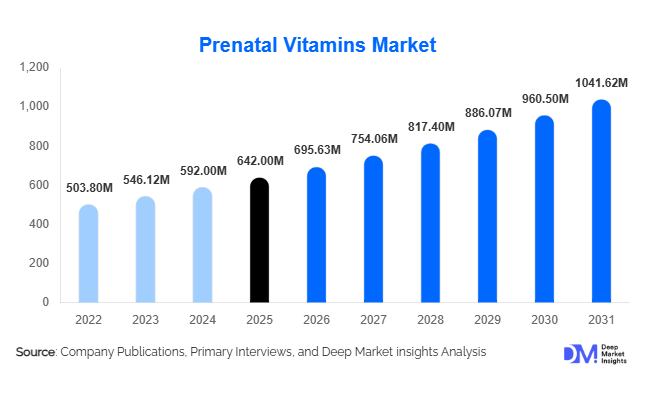

According to Deep Market Insights,the global prenatal vitamins market size was valued at USD 642 million in 2025 and is projected to grow from USD 695.93 million in 2026 to reach USD 1,041.62 million by 2031, expanding at a CAGR of 8.4% during the forecast period (2026–2031). The market growth is primarily driven by rising maternal health awareness, increasing planned pregnancies, and growing physician recommendations for pre-conception micronutrient supplementation. Expanding e-commerce penetration, innovation in DHA-enriched and gummy formulations, and rising participation of working women in emerging economies are further supporting sustained demand. As consumer focus shifts toward preventive healthcare and clinically validated nutritional support, prenatal supplementation is becoming an essential component of maternal wellness globally.

Key Market Insights

- DHA-fortified prenatal formulations are gaining strong traction, driven by rising awareness of fetal brain development benefits.

- Online retail is the fastest-growing distribution channel, supported by subscription models and direct-to-consumer strategies.

- North America dominates global demand due to high supplement penetration and strong physician endorsement.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income and expanding maternal healthcare awareness.

- Mid-premium pricing tier leads the market, balancing affordability and brand trust.

- Clean-label, non-GMO, and allergen-free formulations are reshaping consumer preference trends.

What are the latest trends in the prenatal vitamins market?

Shift Toward DHA and Choline-Enriched Formulations

Consumers are increasingly prioritizing advanced micronutrient blends that include DHA, choline, iodine, and methylated folate. The integration of plant-based DHA sources and iron-balanced formulas is expanding product appeal among women experiencing digestive sensitivities. As medical research continues to highlight the importance of early fetal neural and cognitive development, combination prenatal + DHA supplements are becoming the standard rather than optional add-ons.

Digital Subscription and Direct-to-Consumer Growth

E-commerce now accounts for more than 28% of total prenatal vitamin sales globally. Subscription-based replenishment services are increasing repeat purchase rates and improving lifetime customer value. Digital marketing, influencer campaigns, and telehealth consultations are accelerating online adoption, particularly among urban millennial and Gen Z mothers.

What are the key drivers in the prenatal vitamins market?

Rising Awareness of Pre-Conception Nutrition

Global medical guidelines recommending folic acid intake prior to conception have significantly expanded the target consumer base. Increasing fertility consultations and delayed maternal age are further driving proactive supplementation practices.

Growth in Planned Pregnancies and Urban Healthcare Access

Urbanization and higher female workforce participation are leading to planned pregnancies supported by structured nutritional intake. Expanding private healthcare infrastructure in Asia-Pacific and Latin America is improving supplement accessibility.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Premium prenatal formulations face affordability challenges in price-sensitive economies, limiting penetration beyond metropolitan regions.

Regulatory and Labeling Complexity

Stringent nutritional labeling requirements and micronutrient dosage regulations across regions increase compliance costs and create barriers to rapid geographic expansion.

What are the key opportunities in the prenatal vitamins industry?

Premiumization and Functional Fortification

Premium blends containing probiotics, plant-based DHA, and methylated nutrients offer higher margin potential. Consumers are increasingly willing to pay 15–25% premiums for clean-label and clinically validated formulations.

Expansion into Emerging Asia-Pacific Markets

Rapid urbanization and maternal health awareness campaigns in India, Indonesia, and Vietnam present strong growth opportunities. Localization strategies and digital pharmacy expansion can unlock new demand pools.

Product Type Insights

Tablets dominate the global prenatal vitamins market, accounting for approximately 42% of the 2025 market share. Their leadership is primarily driven by cost efficiency, manufacturing scalability, dosage accuracy, extended shelf life, and long-standing physician familiarity. Healthcare providers frequently recommend tablet formulations due to their standardized dosing and proven clinical acceptance, reinforcing their position as the leading segment. Additionally, tablets allow for the incorporation of multiple micronutrients in stable concentrations, making them suitable for comprehensive prenatal supplementation.

Gummies represent the fastest-growing product format, supported by improved taste profiles, enhanced palatability, and greater ease of consumption, particularly among women experiencing nausea during early pregnancy. The growing preference for chewable formats among younger consumers and first-time mothers is accelerating adoption. Softgels maintain strong demand, especially in DHA-inclusive formulations, as lipid-based encapsulation improves omega-3 absorption and minimizes gastrointestinal discomfort. Meanwhile, liquid and powder formats occupy specialized niches, targeting consumers with swallowing difficulties, iron sensitivity, or those seeking customizable dosing options. Despite rapid innovation across formats, tablets remain the leading segment due to affordability, accessibility, and physician trust.

Nutrient Composition Insights

DHA-inclusive prenatal vitamins lead the market with nearly 48% share in 2025, supported by growing global awareness of fetal brain and retinal development. The increasing emphasis on early cognitive health, reinforced by obstetric recommendations, continues to drive demand for omega-3 fortified formulations. As clinical research underscores the importance of maternal DHA intake, manufacturers are expanding algae-based and purified fish oil sources to meet quality and sustainability expectations, solidifying DHA-inclusive products as the leading segment.

Iron-enhanced formulations maintain strong and consistent demand, particularly in regions with elevated anemia prevalence among women of reproductive age. Iron supplementation is critical for preventing pregnancy-related complications, supporting hemoglobin production, and reducing maternal fatigue. In emerging economies, public health initiatives targeting iron deficiency further strengthen this segment. Multi-micronutrient premium blends are expanding steadily as consumers increasingly seek comprehensive, all-in-one solutions that include folate, choline, iodine, calcium, vitamin D, and B-complex vitamins. While premiumization is accelerating innovation, DHA-inclusive formulations remain the primary revenue driver due to their strong clinical positioning and consumer awareness.

Distribution Channel Insights

Pharmacies and drugstores hold approximately 38% of global sales, maintaining their leadership due to physician recommendations, established consumer trust, and accessibility within organized retail healthcare systems. Pharmacist guidance and prescription-linked purchases significantly influence buying decisions, particularly during early pregnancy stages. The credibility associated with pharmacy channels continues to drive repeat purchases and brand loyalty, reinforcing their position as the leading distribution segment.

Online channels are expanding at the fastest rate, fueled by digital marketing strategies, subscription-based purchasing models, direct-to-consumer brands, and expanding e-commerce penetration. The convenience of home delivery and access to product reviews is particularly appealing to urban consumers. Supermarkets and hypermarkets contribute substantially in developed markets where prenatal supplements are integrated into mainstream health aisles. Practitioner-dispensed supplements are also gaining traction through fertility clinics and OB-GYN networks, where personalized supplementation protocols are recommended. Despite the rapid expansion of digital commerce, pharmacies remain the dominant channel due to medical endorsement and consumer confidence.

Consumer Stage Insights

Pre-conception supplements account for nearly 29% of the 2025 market, reflecting increasing awareness of early nutritional intervention before pregnancy confirmation. Growing educational campaigns emphasizing folic acid intake prior to conception are strengthening this segment. Women planning pregnancies are proactively adopting supplementation regimens to reduce neural tube defect risks and optimize maternal nutrient reserves, positioning pre-conception products as a significant revenue contributor.

First trimester products represent a substantial portion of the market due to heightened medical supervision, increased OB-GYN consultations, and critical organ development during early pregnancy. However, postpartum and lactation support products are the fastest-growing segment, expanding at over 9% CAGR. Extended supplementation practices, rising breastfeeding awareness, and the recognition of maternal nutrient depletion after childbirth are accelerating growth in this category. Increasing focus on maternal recovery, immune support, and infant nutrient transfer through breast milk continues to expand demand across postpartum formulations.

| By Product Form | By Nutrient Composition | By Distribution Channel | By Consumer Stage | By Pricing Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 39% of the global market in 2025, making it the leading regional contributor. The United States alone represents nearly 31% of global revenue, supported by high dietary supplement penetration, strong physician endorsement, advanced retail infrastructure, and widespread health insurance coverage that encourages early prenatal care. Increasing maternal age, rising awareness of DHA and choline supplementation, and premium product adoption further strengthen regional growth. Canada contributes around 5% share, driven by universal healthcare access, high maternal supplement awareness, and regulatory oversight that reinforces consumer confidence. The region’s mature nutraceutical industry, strong branding strategies, and high disposable income collectively drive sustained demand.

Europe

Europe holds nearly 26% of global market share, with Germany, the United Kingdom, and France leading regional demand. Growth is supported by established nutraceutical manufacturing capabilities, rising maternal age, and proactive prenatal screening programs. Regulatory compliance under European Food Safety Authority standards ensures stringent quality control, strengthening consumer trust and product credibility. Increasing awareness regarding micronutrient deficiencies, combined with public healthcare guidance on prenatal nutrition, continues to stimulate adoption. Additionally, clean-label trends and demand for plant-based DHA sources are shaping product innovation across the region.

Asia-Pacific

Asia-Pacific accounts for roughly 22% of the global market and represents the fastest-growing region with a CAGR exceeding 10%. China and India serve as primary growth engines due to expanding middle-class populations, rising disposable incomes, growing digital pharmacy penetration, and government-led maternal health initiatives. Increased urbanization, improved healthcare access, and rising awareness of prenatal nutrition significantly contribute to market expansion. Australia and Japan provide stable premium demand, supported by advanced healthcare systems and consumer preference for high-quality imported supplements. The region’s large population base and improving maternal health indicators position Asia-Pacific as a key long-term growth driver.

Latin America

Latin America holds around 8% market share, led by Brazil and Mexico. Urbanization, expanding private healthcare services, and improving retail pharmacy networks are supporting steady adoption of prenatal supplements. Growing middle-income populations and rising health awareness campaigns focused on maternal anemia prevention further drive demand. Although price sensitivity remains a constraint, increasing availability of affordable generic formulations is enhancing market penetration across metropolitan areas.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of global demand. The United Arab Emirates and Saudi Arabia are emerging premium markets due to higher healthcare expenditure, expanding hospital infrastructure, and increasing expatriate populations with strong supplement awareness. In Africa, South Africa leads regional consumption, supported by organized retail growth and improving maternal healthcare access. Rising government initiatives targeting maternal nutrition deficiencies and anemia prevention are expected to gradually strengthen regional demand over the forecast period.The prenatal vitamins market is moderately concentrated, with the top five players accounting for nearly 62% of global revenue. Established brands benefit from strong retail distribution, regulatory compliance, and consumer trust built through physician endorsements and quality certifications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Prenatal Vitamins Market

- Pharmavite LLC

- Bayer AG

- Nestlé S.A.

- Church & Dwight Co., Inc.

- Garden of Life LLC

- SmartyPants Vitamins

- MegaFood

- Thorne HealthTech

- New Chapter Inc.

- Rainbow Light Nutritional Systems

- Jamieson Wellness Inc.

- Blackmores Limited

- Herbalife Ltd.

- Nature's Way Products LLC

- GNC Holdings LLC