Premix Vitaminico Mineral Market Size

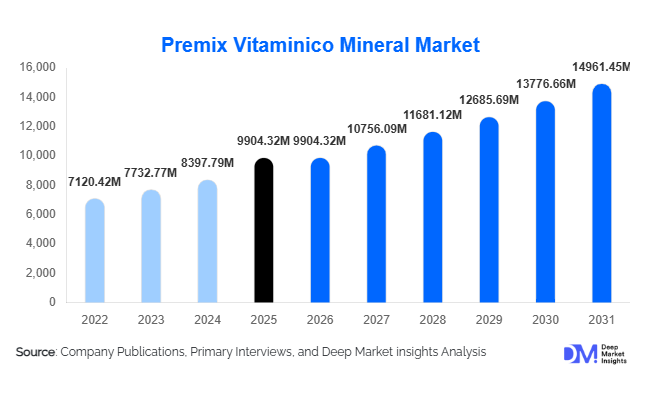

According to Deep Market Insights,the global premix vitaminico mineral market size was valued at USD 9,120 million in 2025 and is projected to grow from USD 9,904.32 million in 2026 to reach USD 14,961.45 million by 2031, expanding at a CAGR of 8.6% during the forecast period (2026–2031). The market growth is primarily driven by increasing demand for fortified food products, expanding global livestock production, rising health awareness, and regulatory mandates supporting micronutrient fortification programs. The integration of customized nutrient blends across animal nutrition, nutraceuticals, pharmaceuticals, and functional food applications is strengthening the role of premix vitaminico mineral formulations in global nutritional value chains.

Key Market Insights

- Animal nutrition accounts for the largest demand share, driven by rising poultry, dairy, and aquaculture production worldwide.

- Vitamin-mineral blended premixes dominate product type, offering cost-effective and customized nutrient delivery solutions.

- Asia-Pacific leads global consumption, supported by large-scale livestock industries and expanding food fortification programs.

- Nutraceutical applications represent the fastest-growing segment, fueled by preventive healthcare trends and immunity-focused supplements.

- Powdered premixes remain the preferred form, accounting for over 60% share due to ease of mixing and cost efficiency.

- Encapsulation and stability-enhancing technologies are improving bioavailability and shelf life, driving premium product adoption.

What are the latest trends in the premix vitaminico mineral market?

Customized and Precision Nutrition Formulations

Premix manufacturers are increasingly shifting toward customized formulations tailored to specific livestock species, lifecycle stages, and human health applications. In animal nutrition, precision feeding models are being adopted to improve feed conversion ratios and reduce nutrient waste. In human nutrition, personalized supplement blends targeting immunity, bone health, and metabolic support are gaining popularity. This customization trend is supported by advanced blending technologies and improved micronutrient stability systems, allowing manufacturers to offer high-value, differentiated solutions.

Microencapsulation and Bioavailability Enhancement

Technological innovation is reshaping product quality standards. Microencapsulation techniques are being widely adopted to protect heat-sensitive vitamins and prevent oxidation. Coated mineral premixes are improving absorption efficiency while minimizing nutrient interaction during processing. These advancements are particularly important for fortified beverages, extruded feed, and pharmaceutical applications where nutrient stability directly impacts product efficacy. Premium premixes with enhanced bioavailability are commanding higher margins and strengthening long-term supplier contracts.

What are the key drivers in the premix vitaminico mineral market?

Rising Global Livestock Production

The steady rise in meat, dairy, and aquaculture production is a major growth driver. Emerging economies such as China, India, Brazil, and Vietnam are expanding commercial livestock farming to meet domestic consumption and export demand. Vitamin-mineral premixes play a critical role in improving immunity, fertility, and weight gain, directly impacting farm profitability and export competitiveness.

Government-Led Food Fortification Programs

Many countries have introduced mandatory fortification of staple foods such as flour, edible oil, salt, and rice to address micronutrient deficiencies. These regulatory measures are generating large-scale institutional demand for standardized premix blends. National nutrition missions in Asia and Africa are expected to sustain long-term growth in bulk procurement.

What are the restraints for the global market?

Raw Material Price Volatility

Prices of key vitamins such as A, D, and E fluctuate due to supply concentration and energy costs. Mineral extraction and purification costs also vary significantly. This volatility impacts production planning and compresses margins, particularly in large-volume feed contracts.

Stringent Regulatory Compliance

Premix producers must comply with global quality standards such as GMP, HACCP, FDA guidelines, and EU feed additive regulations. Meeting homogeneity, stability, and traceability requirements increases production costs and creates entry barriers for small manufacturers.

What are the key opportunities in the premix vitaminico mineral industry?

Expansion in Functional and Preventive Healthcare

The global nutraceutical and dietary supplement market is expanding at over 7% annually, creating strong opportunities for premix suppliers. Immunity-boosting and metabolic health products are witnessing high consumer adoption. Companies investing in clean-label and plant-based mineral premixes can capture premium segments.

Precision Livestock Nutrition and Export-Led Demand

Export-oriented livestock economies such as Brazil and the United States are prioritizing high-performance feed solutions. Customized premixes that improve feed efficiency and reduce environmental footprint offer competitive advantages. Integration with digital farm management platforms further enhances growth prospects.

Type Insights

Vitamin-mineral blended premixes dominate the global market, accounting for approximately 46% of the 2025 market share. The leading position of this segment is primarily driven by the increasing demand for comprehensive and precisely balanced nutrient solutions that simplify large-scale formulation processes for feed, food, and nutraceutical manufacturers. Blended premixes offer significant operational advantages, including reduced formulation errors, uniform nutrient dispersion, lower inventory complexity, and improved cost efficiency in bulk production environments. Their growing adoption in commercial livestock operations and fortified staple food production further reinforces their leadership. As regulatory scrutiny around nutrient consistency and labeling accuracy intensifies, manufacturers increasingly prefer blended premixes to ensure compliance and performance optimization. While standalone vitamin and mineral premixes continue to serve niche and customized applications, they are progressively being integrated into blended formulations to enhance bioavailability, streamline supply chains, and achieve better cost optimization across high-volume production systems.

Form Insights

Powder premixes account for nearly 62% of the global market share in 2025, making them the dominant form segment. The primary driver behind this leadership is their superior stability, ease of storage, and compatibility with dry mixing systems used in animal feed mills and flour fortification plants. Powder formulations provide extended shelf life, reduced transportation costs, and high homogeneity during blending, making them particularly suitable for large-scale industrial applications. Additionally, powders are adaptable to automated batching systems, which enhances manufacturing efficiency and minimizes nutrient loss. Liquid premixes are gaining traction in beverage fortification, clinical nutrition, and certain pharmaceutical formulations where rapid absorption and ease of incorporation are critical. Encapsulated premixes are emerging in premium human nutrition and specialty feed applications, driven by demand for improved nutrient protection, controlled release, and enhanced bioavailability. However, powder premixes remain the backbone of the industry due to their cost-effectiveness and operational flexibility.

Application Insights

Animal nutrition leads the application landscape with a dominant 52% market share in 2025, supported by rising global protein consumption and expanding commercial livestock production. The primary growth driver within this segment is poultry feed, which represents the largest sub-segment due to shorter production cycles, high feed conversion efficiency, and strong global demand for poultry meat and eggs. Increasing emphasis on disease prevention, feed efficiency optimization, and livestock productivity enhancement further accelerates premix utilization in this sector. Swine, cattle, and aquaculture segments also contribute substantially, particularly in export-driven economies. Meanwhile, human nutrition is the fastest-growing application segment, fueled by rising consumer awareness of micronutrient deficiencies, increasing demand for dietary supplements, and the expansion of fortified foods and functional beverages. Government-led fortification initiatives in developing economies and the growing preference for preventive healthcare solutions are strengthening long-term demand across both animal and human nutrition categories.

End-Use Industry Insights

Feed manufacturers account for approximately 48% of overall demand, reflecting the large-scale and consistent integration of premixes in commercial feed production. The dominant driver in this segment is the need for standardized, performance-enhancing feed formulations that support growth rates, immunity, and feed efficiency in intensive livestock operations. Nutraceutical companies represent the fastest-growing end-use industry, expanding at nearly 9% CAGR, driven by the surge in dietary supplement consumption, aging populations, and increasing health-conscious consumer behavior. Pharmaceutical manufacturers utilize premixes in clinical nutrition products and therapeutic formulations, particularly in hospital and specialized medical settings. Food and beverage companies incorporate premixes into fortified staples such as flour, dairy products, and ready-to-drink beverages to address micronutrient deficiencies and meet regulatory mandates. Export-driven livestock industries in Brazil, the United States, and Southeast Asia significantly influence global procurement volumes, as large-scale producers seek consistent, high-quality premix solutions to maintain international quality standards and competitiveness.

| By Type | By Form | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds approximately 38% of the global market share in 2025 and represents the fastest-growing region at nearly 9.4% CAGR. Regional growth is primarily driven by rapid urbanization, rising disposable incomes, and increasing per capita consumption of animal protein. China alone contributes close to 18% of global demand due to its expansive livestock and aquaculture industries, supported by modernization of feed mills and productivity-focused farming practices. India is witnessing growth exceeding 10%, fueled by dairy sector expansion, poultry industry development, and government-led nutrition and food fortification initiatives aimed at addressing micronutrient deficiencies. Southeast Asian nations are increasing feed production capacity to meet growing domestic protein consumption and export demand. Additionally, expanding nutraceutical markets and improving regulatory frameworks for fortified foods further reinforce regional growth momentum.

North America

North America accounts for nearly 24% of the global market share, with the United States contributing approximately 20% individually. Growth in this region is supported by advanced feed technologies, precision nutrition practices, and strong demand for high-quality dietary supplements. The presence of large commercial livestock operations, coupled with export-oriented meat production, sustains consistent premix demand. In addition, well-established regulatory frameworks and consumer preference for fortified and functional food products contribute to steady expansion. Investments in research and development, along with technological advancements in nutrient encapsulation and bioavailability enhancement, further strengthen the regional market position.

Europe

Europe represents around 22% of global demand, driven by countries such as Germany, France, and the Netherlands. Regional growth is influenced by stringent regulatory standards related to feed safety, nutrient accuracy, and product traceability, which encourage the use of standardized premix solutions. The region’s well-developed livestock and premium pet food industries also contribute significantly to consumption. Increasing interest in sustainable animal nutrition, organic farming practices, and specialized functional foods supports stable long-term demand. Furthermore, Europe’s strong nutraceutical and pharmaceutical sectors provide additional growth opportunities for high-quality vitamin and mineral premixes.

Latin America

Latin America holds nearly 9% of the global market share, with Brazil emerging as a major growth hub due to its dominant poultry and beef export industries. Regional expansion is driven by large-scale livestock production, competitive feed manufacturing costs, and increasing integration into global meat supply chains. Mexico and Argentina also contribute to regional demand through expanding feed operations and improving food fortification initiatives. Growing domestic protein consumption and export competitiveness continue to stimulate consistent premix adoption across commercial farming operations.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% of global demand. Growth is supported by rising investments in feed self-sufficiency and food security initiatives, particularly in Saudi Arabia and South Africa. Increasing urban populations and improving dietary patterns are driving demand for both animal protein and fortified food products. Government-backed agricultural development programs, expansion of poultry and dairy sectors, and gradual modernization of feed infrastructure contribute to steady market expansion. Although the region remains comparatively smaller in volume, long-term structural improvements in food production and nutrition awareness are expected to support sustainable growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Premix Vitaminico Mineral Market

- DSM-Firmenich

- BASF SE

- Cargill Inc.

- Archer Daniels Midland (ADM)

- Nutreco N.V.

- Glanbia plc

- Corbion N.V.

- Land O’Lakes Inc.

- Alltech Inc.

- Kemin Industries

- SternVitamin GmbH

- Wright Enrichment Inc.

- Zagro Asia Limited

- Vitablend Nederland B.V.

- Jubilant Ingrevia Limited