Premium Shoes Market Size

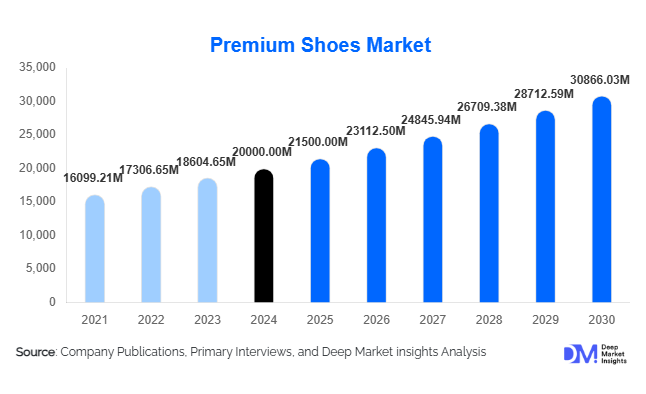

According to Deep Market Insights, the global premium shoes market size was valued at USD 20,000.00 million in 2024 and is projected to grow from USD 21,500.00 million in 2025 to reach USD 30,866.03 million by 2030, expanding at a CAGR of 7.50% during the forecast period (2025–2030). The market is driven by rising disposable incomes, growing fashion-conscious demographics, strong demand for premium casual footwear, and the rapid expansion of digital and omnichannel retail across global markets.

Key Market Insights

- Premium casual shoes, particularly sneakers and loafers, dominate global demand, accounting for over 40% of sales due to lifestyle-driven purchasing behavior.

- E-commerce is the fastest-growing distribution channel, capturing 30–35% of global sales in 2024 as brands accelerate direct-to-consumer strategies.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class incomes in China, India, and Southeast Asia.

- Women account for the largest end-user segment, representing over 50% of premium footwear purchases worldwide.

- Sustainable materials and ethical manufacturing practices are becoming decisive factors in consumer decision-making, especially among Millennials and Gen Z.

- Brand collaborations, limited-edition releases, and designer partnerships are reshaping competitive positioning and stimulating premiumization.

What are the latest trends in the premium shoes market?

Premium Casual Footwear & Sneaker Culture Leading Demand

Premium casual footwear, including designer sneakers, slip-ons, and hybrid lifestyle shoes, continues to define global demand. The convergence of streetwear with luxury fashion has elevated sneakers into high-value status symbols, driving multi-billion-dollar product lines for leading brands. Limited-edition drops, celebrity collaborations, and high-profile design partnerships are fueling demand volatility and premium pricing. Sneaker culture communities, online resale platforms, and social media influencers are amplifying trend cycles, increasing brand visibility, and accelerating adoption across generations. As formal shoes declines in everyday usage, premium casual shoes are becoming the default choice for work, travel, and social settings.

Rise of Sustainable & Ethical Footwear

Consumers are increasingly demanding environmentally responsible and ethically produced premium shoes. This trend is driven by heightened awareness of carbon footprint, leather tanning practices, synthetic waste, and supply-chain transparency. Brands are responding by launching vegan leather lines, recycled-material footwear, low-impact production methods, and ethically sourced hides. ESG-oriented premium brands are gaining traction among younger consumers who are willing to pay more for sustainable fashion. Certifications, eco-labels, and transparent supply-chain disclosures are becoming measurably differentiators, pushing large global brands to overhaul materials sourcing and manufacturing operations.

What are the key drivers in the premium shoes market?

Rising Disposable Income & Lifestyle Premiumization

Growing middle- and upper-income populations, particularly in emerging markets, are driving strong demand for premium shoes as consumers shift toward aspirational and lifestyle-oriented products. Footwear is increasingly viewed as both a necessity and an expression of personal style, with premium brands gaining momentum among young urban consumers. Rising office employment, social mobility, and fashion influence from Western cultures are further boosting multi-category demand, from casual sneakers to artisan leather footwear.

Fashion Influence, Digital Media & Globalization

Fashion influencers, celebrity endorsements, TikTok trends, and cross-border digital content are turbocharging global awareness of premium footwear. New styles, micro-trends, and designer collaborations spread rapidly across markets, accelerating product adoption. Global fashion weeks, streetwear movements, and luxury-athleisure crossover trends are reshaping product portfolios. Digital media has effectively democratized access to premium brands, exposing previously underpenetrated regions to global premium shoe trends.

Expansion of E-commerce & Omnichannel Retail

E-commerce has revolutionized premium footwear distribution. Digital channels now capture over one-third of premium shoe sales and remain the fastest-growing segment. Brands are leveraging advanced personalization tools, virtual try-ons, AI-powered recommendations, and interactive customization platforms to enhance engagement. Omnichannel models, online ordering with store pickup, hybrid retail, and direct-to-consumer websites are giving brands stronger margins, broader reach, and increased control over customer experience. This shift is especially significant in emerging markets, where physical retail penetration is low but online purchasing is rapidly rising.

What are the restraints for the global market?

High Price Sensitivity & Narrow Target Demographic

Premium shoes inherently target higher-income consumers due to elevated price points, typically ranging from USD 200 to over USD 800. This restricts adoption in price-sensitive markets and limits overall volume growth. Economic fluctuations, inflation, and currency depreciation in emerging markets also reduce consumer purchasing power, leading to delayed or downgraded purchases. For many mainstream consumers, premium footwear remains aspirational rather than attainable.

Supply Chain & Raw Material Cost Volatility

Premium footwear production relies heavily on high-quality leather, handcrafting, skilled labor, and advanced finishing techniques. Fluctuations in leather prices, rising wages in manufacturing hubs, and global supply-chain disruptions, especially in shipping and logistics, directly pressure margins. Counterfeit products and grey-market imports further threaten brand equity and price integrity. These challenges force brands to either increase prices, potentially reducing demand, or absorb margin compression.

What are the key opportunities in the premium shoes industry?

Growth of Emerging Markets & Aspirational Consumers

Asia-Pacific, Latin America, and the Middle East represent massive untapped potential for premium shoe brands. As incomes rise and fashion awareness expands, millions of new consumers shift toward premium and luxury footwear. The increasing youth population in India, China, Indonesia, and Vietnam offers a long-term demand pool. Brands entering early with localized pricing, regionally relevant styles, and digital-first distribution can capture significant market share.

Customization, Bespoke Products & Digital Personalization

The appetite for personalized footwear is accelerating rapidly. Consumers are willing to pay premium pricing for custom materials, monogramming, bespoke fits, and artisan-crafted shoes. Digital configurators, 3D foot-scanning, and AI-powered personalization are enabling brands to scale customization cost-effectively. Bespoke footwear lines not only command high margins but also create emotional value and long-term loyalty. This category is projected to expand significantly as brands integrate advanced manufacturing and design technologies.

Sustainable Premium Footwear & Eco-Innovation

Sustainability is no longer optional; it is a competitive advantage. Brands that adopt circular materials, reduce chemical-intensive tanning, and invest in eco-friendly manufacturing stand to win the loyalty of environmentally conscious consumers. Vegan leather, recycled textiles, bio-based materials, and water-reduced production models are gaining acceptance in the premium segment. Government regulations around environmental compliance are also pushing brands to innovate, creating opportunities for new entrants in the eco-premium footwear category.

Product Type Insights

Casual premium shoes, especially designer sneakers, dominate the market, representing more than 40% of global revenue. Their versatility, comfort, and cultural relevance make them the leading choice for everyday wear across demographics. Premium formal shoes, including dress shoes and loafers, retain strong demand among professionals and luxury buyers, while premium boots and seasonal footwear drive spikes in regional demand. Specialty designer shoes, including limited-edition releases, runway collections, and artisanal handcrafted shoes, cater to high-income consumers and collectors seeking exclusivity and status.

Application Insights

Casual and lifestyle wear is the fastest-growing application segment, driven by the global shift toward athleisure and comfort-focused fashion. Premium shoes used for office wear, formal events, and luxury travel also maintain steady demand. Fashion-driven applications, including streetwear, designer collaborations, and high-fashion editions, play a major role in expanding market reach. Niche applications such as premium outdoor leisure footwear, handcrafted artisan products, and event-specific designer shoes are emerging categories with growing profitability.

Distribution Channel Insights

E-commerce platforms and D2C brand websites dominate growth, providing transparent pricing, easy customization, and convenient access to premium collections. Specialist premium footwear stores and luxury boutiques continue to be important for high-end customers seeking personalized fitting and trial experiences. Department stores and premium retail chains help brands maintain visibility in major cities. Subscription-based fashion membership models and limited-edition drop platforms are emerging tools to target repeat buyers and collectors.

End-User Insights

Women represent the largest end-user segment, accounting for over 50% of premium footwear purchases, driven by strong fashion influence, wider style variety, and higher frequency of footwear replacement. Men’s premium shoes, particularly sneakers and leather dress shoes, constitute another major segment with growing demand. Unisex and gender-neutral footwear are emerging segments fueled by modern fashion trends, inclusivity, and designer collaborations promoting universal aesthetics.

| By Product Type | By Material Type | By Price Range | By Distribution Channel | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains one of the largest markets, accounting for approximately 25–30% of global premium shoe demand in 2024. The U.S. leads consumption due to high disposable income, strong sneaker culture, and deep-rooted brand loyalty. Premium casual footwear, luxury designer shoes, and limited-edition collaborations are especially popular. Canada contributes steadily, with rising demand for premium boots, lifestyle sneakers, and sustainable brands.

Europe

Europe accounts for 20–25% of global demand, supported by strong fashion heritage, established luxury brands, and high per-capita spending on footwear. Italy, France, Germany, and the U.K. lead consumption. European consumers favor premium craftsmanship, artisan-quality leather, and sustainable materials. Mature retail infrastructure, including flagship stores and luxury boutiques, supports market stability with modest but steady growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing 30–35% of global demand in 2024. China leads with a strong appetite for premium sneakers, luxury designers, and imported brands. India is experiencing rapid growth due to rising incomes, urbanization, and a booming youth population. Japan and South Korea remain mature markets with high brand loyalty and strong demand for premium casual footwear. Southeast Asia’s digitally active consumers are accelerating e-commerce-driven premium purchases.

Latin America

Latin America contributes 5–7% of global demand, with Brazil, Mexico, and Chile leading consumption. While price sensitivity is higher, premium footwear is gaining traction among affluent and aspirational consumers. Rising fashion influence and social media trends are driving interest in designer sneakers and luxury casual shoes.

Middle East & Africa

The MEA region, accounting for 3–5% of global demand, is driven by affluent consumers in the UAE, Saudi Arabia, and Qatar. High-income levels and strong luxury adoption support demand for designer and bespoke footwear. Africa’s urban centers, such as South Africa, Nigeria, and Kenya, are seeing increasing interest in premium imported shoes, driven by urbanization and growing aspirational consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|