Formal Shoes Market Summary

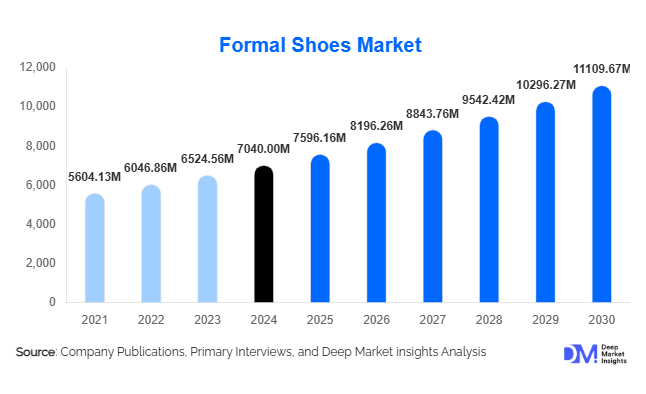

According to Deep Market Insights, the global formal shoes market size was valued at USD 7,040 million in 2024 and is projected to grow from USD 7,596.16 million in 2025 to reach USD 11,109.67 million by 2030, expanding at a CAGR of 7.9% during the forecast period (2025–2030). The formal shoes market growth is primarily driven by increasing professional dress code adoption, rising disposable income, growing fashion consciousness, and the expanding popularity of sustainable and technologically advanced footwear solutions worldwide.

Key Market Insights

- Leather and premium synthetic formal shoes dominate consumer preference, reflecting the demand for durability, style, and comfort across corporate and formal events.

- Asia-Pacific emerges as the fastest-growing market, led by India and China due to rising middle-class populations, urbanization, and professional workforce expansion.

- E-commerce is transforming distribution channels, enabling direct-to-consumer sales and increased accessibility for global buyers.

- Men’s formal shoes maintain the largest share, but women’s formal footwear is witnessing accelerated growth due to rising workforce participation.

- Technological integration, including ergonomic designs, advanced materials, and automated production techniques, is enhancing product quality and manufacturing efficiency.

- Brand differentiation through sustainability and ethical practices is gaining traction, catering to environmentally conscious consumers.

What are the latest trends in the formal shoes market?

Rise of Eco-Friendly and Sustainable Materials

Consumers are increasingly demanding formal shoes crafted from environmentally responsible materials such as vegetable-tanned leather, recycled synthetics, and biodegradable packaging. Leading brands are integrating sustainable practices into their production lines, highlighting transparency and ethical sourcing. This trend allows companies to cater to eco-conscious buyers while differentiating their products in a highly competitive market. Sustainable footwear not only meets regulatory and social expectations but also supports brand loyalty and premium pricing strategies.

Technology-Enhanced Comfort and Design

Advanced technologies are being employed to improve comfort, durability, and fit. From 3D foot scanning to automated stitching and lightweight cushioning materials, manufacturers are offering shoes that merge style with functionality. These innovations appeal to professionals who prioritize comfort during long working hours without compromising on aesthetics. Companies are also using digital customization platforms, enabling consumers to personalize designs, colors, and sizes, further enhancing engagement and repeat purchases.

What are the key drivers in the formal shoes market?

Corporate and Professional Dress Codes

The persistence of formal dress requirements in workplaces globally sustains steady demand for formal shoes. Sectors such as finance, law, and corporate services mandate professional footwear, providing a consistent revenue stream for manufacturers and retailers. As urbanization and white-collar employment expand in emerging markets, this driver is expected to further bolster growth.

Increasing Disposable Income and Fashion Awareness

Rising disposable income in both developed and emerging economies allows consumers to invest in premium and designer footwear. Exposure to global fashion trends via social media, celebrity endorsements, and international brands has intensified consumer focus on stylish formal shoes. This trend encourages diversification in product lines, including luxury and mid-tier segments.

Growth of Online Sales Channels

Online marketplaces and brand-owned e-commerce platforms have widened the reach of formal footwear brands. The convenience of digital shopping, combined with personalized marketing and detailed product information, has increased sales volumes while lowering entry barriers for new market participants. Mobile commerce, social media campaigns, and virtual try-on technologies are further enhancing adoption.

What are the restraints for the global market?

Competition from Casual and Athleisure Footwear

The rising popularity of casual shoes and athleisure trends challenges traditional formal footwear sales. Professionals increasingly prefer comfort-focused, versatile shoes suitable for both work and leisure, potentially limiting formal shoe market growth.

Economic Sensitivity

Economic downturns, inflationary pressures, and global recessions can reduce discretionary spending on non-essential items, including high-end formal shoes. Manufacturers must adapt pricing strategies and diversify product offerings to mitigate these effects.

What are the key opportunities in the formal shoes industry?

Expansion in Emerging Markets

Countries like India, China, and Southeast Asian nations offer significant growth opportunities due to a rising professional workforce and growing middle-class populations. Strategic retail expansions, localized marketing, and e-commerce penetration can help brands capture this demand.

Integration of Sustainability and Ethical Practices

Adopting eco-friendly materials and ethical manufacturing processes provides differentiation and appeals to environmentally conscious consumers. Sustainable production enhances brand image, allows premium pricing, and meets emerging regulatory requirements in multiple regions.

Technological Innovation in Design and Production

Advanced manufacturing techniques, including 3D printing, automation, and ergonomic design technologies, enable production efficiency, improved fit, and reduced material waste. Brands investing in these technologies can achieve higher margins and attract tech-savvy consumers seeking comfort and innovation.

Product Type Insights

Oxfords and Derbies lead the market, representing approximately 60% of the 2024 global formal shoes market. Their timeless design, versatility for multiple formal occasions, and compatibility with professional attire contribute to this dominance. Leather materials remain the preferred choice, valued for durability and premium appeal. Synthetic alternatives are growing in popularity, especially in price-sensitive segments or fashion-forward designs.

Application Insights

Corporate and professional end-users account for the largest share of demand. Formal shoes are also increasingly purchased for events such as weddings, business conferences, and social gatherings. Export-driven demand from developed regions like North America and Europe to emerging markets supports the global growth trend, alongside e-commerce platforms enabling cross-border sales.

Distribution Channel Insights

Offline retail stores continue to lead sales, but online platforms are rapidly expanding. Direct-to-consumer websites, mobile apps, and marketplaces such as Amazon and Zalando facilitate global reach and brand engagement. Omni-channel strategies, combining in-store experiences with online convenience, are increasingly adopted by market leaders.

End-User Insights

Men’s professional footwear accounts for the largest segment, with women’s formal shoes showing accelerated growth due to workforce participation. Growth is observed in sectors such as IT, finance, consulting, and hospitality. Export markets and international fashion adoption drive incremental demand, particularly for mid- to high-end product lines.

| By Product Type | By Material | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. leads the North American formal shoes market, representing 45% of the regional share in 2024. High corporate employment, fashion-conscious professionals, and e-commerce adoption drive sustained demand. Canada follows, with growth influenced by urbanization and rising fashion awareness.

Europe

Key countries include the U.K., Germany, and Italy, with mature markets for luxury and mid-tier formal shoes. In 2024, Europe accounted for 38% of the global market. Consumers prioritize style, quality, and brand heritage, supporting premium product sales. The region is also adopting sustainability-focused initiatives rapidly.

Asia-Pacific

China and India are the fastest-growing markets due to expanding white-collar populations and increasing urban professional lifestyles. India, in particular, shows strong double-digit growth driven by rising middle-class disposable income and the adoption of corporate dress codes. Southeast Asia is emerging as a strategic opportunity for new entrants.

Latin America

Brazil and Mexico show moderate growth, influenced by urban employment trends and increasing exposure to global fashion. Luxury and mid-tier products are gaining traction, particularly in metropolitan areas.

Middle East & Africa

UAE and South Africa are prominent markets, driven by expatriate populations, corporate hubs, and high-income consumers. Intra-regional trade and luxury demand from the Middle East further support growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Formal Shoes Market

- Clarks

- Allen Edmonds

- Church's

- John Lobb

- Hugo Boss

- Ecco

- Geox

- Florsheim

- Salvatore Ferragamo

- Magnanni

- Meermin

- Loake

- Johnston & Murphy

- Bruno Magli

- Barker

Recent Developments

- In March 2025, Clarks launched a sustainable formal shoe line using recycled leather and eco-friendly soles across Europe and North America.

- In January 2025, Allen Edmonds invested in automated manufacturing lines in the U.S. to enhance production efficiency and quality control.

- In December 2024, Hugo Boss expanded its e-commerce platform in Asia-Pacific, targeting emerging middle-class consumers with premium formal footwear offerings.