Potato Starch Gluten-Free Market Size

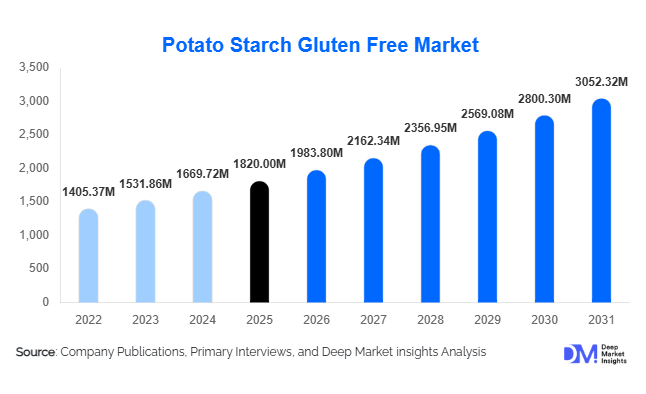

According to Deep Market Insights, the global potato starch gluten-free market size was valued at USD 1820 million in 2025 and is projected to grow from USD 1983.80 million in 2026 to reach USD 3052.32 million by 2031, expanding at a CAGR of 9.0% during the forecast period (2026–2031). The market growth is primarily driven by the rapid expansion of gluten-free food manufacturing, rising adoption of clean-label ingredients, and increasing use of potato starch as a functional, allergen-free alternative in food, pharmaceutical, and nutraceutical applications.

Key Market Insights

- Modified gluten-free potato starch dominates global demand due to its superior thickening, binding, and freeze–thaw stability across processed foods.

- Food & beverage manufacturing accounts for the largest share of consumption, supported by gluten-free bakery, ready meals, and plant-based foods.

- Europe leads global production and consumption, benefiting from strong potato cultivation, advanced starch-processing infrastructure, and stringent gluten-free standards.

- North America remains the largest consumer market, driven by high gluten-free food penetration and premium product demand.

- Asia-Pacific is the fastest-growing region, led by China and India, supported by food-processing investments and rising awareness of gluten intolerance.

- Sustainability-focused processing technologies, including water recycling and enzymatic modification, are reshaping competitive positioning.

What are the latest trends in the potato starch gluten-free market?

Shift Toward Clean-Label and Functional Gluten-Free Ingredients

Manufacturers are increasingly replacing wheat- and corn-derived starches with gluten-free potato starch to align with clean-label and allergen-free product positioning. Potato starch offers a neutral taste profile, superior viscosity, and excellent binding performance, making it highly suitable for gluten-free bakery, sauces, and plant-based formulations. Food brands are prioritizing short ingredient lists, pushing demand for minimally processed native starch alongside advanced modified variants that maintain label transparency.

Rising Adoption in Plant-Based and Alternative Protein Foods

The expansion of plant-based meat and dairy alternatives has accelerated demand for gluten-free potato starch as a texturizing and moisture-retention agent. Compared to tapioca and rice starch, potato starch provides improved mouthfeel and thermal stability, supporting its increased use in premium meat analogs and dairy-free desserts. This trend is particularly pronounced in Europe and North America, where plant-based consumption is growing at double-digit rates.

What are the key drivers in the potato starch gluten-free market?

Growing Global Gluten-Free Food Consumption

Rising diagnosis of celiac disease and increasing consumer preference for gluten-free diets have structurally expanded demand for gluten-free ingredients. Potato starch, being naturally gluten-free, has become a preferred input for manufacturers reformulating mainstream food products to meet regulatory and labeling requirements.

Functional Advantages Over Alternative Starches

Potato starch provides higher swelling power, superior clarity, and better freeze–thaw resistance than corn or wheat starch. These technical benefits are driving its adoption in processed foods, soups, sauces, and frozen products, where consistency and shelf stability are critical.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in potato crop yields caused by climate variability and seasonal conditions directly impact starch pricing. This volatility can compress margins for manufacturers and create procurement challenges for end users.

Capital-Intensive Processing Requirements

Potato starch extraction requires high water usage, advanced filtration, and energy-intensive drying processes. These factors increase entry barriers for new players and limit rapid capacity expansion in emerging markets.

What are the key opportunities in the potato starch gluten-free industry?

Pharmaceutical and Nutraceutical Applications

Demand for gluten-free excipients in pharmaceutical and dietary supplement manufacturing is rising due to stricter labeling regulations. Potato starch is increasingly used as a binder and disintegrant, creating a high-margin growth avenue for suppliers offering pharma-grade variants.

Emerging Market Food Processing Expansion

Asia-Pacific and Latin America present strong opportunities as governments invest in food-processing infrastructure. Localized production and partnerships can significantly reduce costs and expand market penetration.

Product Type Insights

Modified gluten-free potato starch leads the global market, accounting for approximately 58% of the total market share in 2025. Its dominance is primarily driven by the food processing industry’s need for enhanced viscosity, superior binding properties, thermal stability, and improved shelf-life performance. Modified variants are extensively used in gluten-free bakery products, ready-to-eat meals, sauces, soups, and meat analogs, where functional consistency is critical.

Native gluten-free potato starch holds a substantial share, particularly within clean-label, organic, and minimally processed food applications. Demand for native starch is accelerating in bakery, nutraceuticals, and infant nutrition products due to increasing consumer preference for natural ingredients and transparency in food labeling.

Nature Insights

Conventional gluten-free potato starch dominates the market, representing nearly 72% of global demand in 2025. This leadership is supported by its cost efficiency, high availability of raw potatoes, and widespread use across large-scale food, pharmaceutical, and industrial applications.

Organic gluten-free potato starch, although smaller in volume, is the fastest-growing segment. Growth is fueled by rising consumption of premium, organic, and non-GMO food products, particularly in Europe and North America. Increasing regulatory support for organic farming and strong demand from health-conscious consumers are key drivers of this segment.

Application Insights

Bakery and confectionery applications account for approximately 34% of global consumption, making it the leading application segment. Growth is driven by the rapid reformulation of gluten-free bread, cakes, biscuits, and snacks, where potato starch provides desirable texture, moisture retention, and volume enhancement.

Processed and convenience foods represent another major application area, supported by rising urbanization, busy lifestyles, and increased consumption of ready meals. Additionally, adoption is expanding in plant-based foods, soups, sauces, gravies, and pharmaceutical formulations, where gluten-free compliance and functional performance are essential.

End-Use Insights

Food and beverage manufacturing dominates end-use demand, accounting for nearly 68% of the market share in 2025. High-volume industrial consumption, continuous product innovation, and expanding gluten-free product portfolios among major food brands support this dominance.

Pharmaceutical and nutraceutical end uses are the fastest-growing segments, expanding at over 10% CAGR. Growth is driven by stringent regulatory requirements for gluten-free excipients, rising demand for dietary supplements, and increasing prevalence of celiac disease and gluten sensitivity.

Distribution Channel Insights

Direct B2B sales dominate the distribution landscape, as large food processors and pharmaceutical manufacturers prefer long-term contracts to ensure consistent quality, supply reliability, and price stability. This channel benefits from bulk procurement and customized starch formulations.

Ingredient distributors play a critical role in regional and mid-scale supply, particularly in emerging markets. Meanwhile, online B2B platforms are gaining traction as supplementary channels, especially for specialty, organic, and small-batch gluten-free potato starch variants.

| By Product Type | By Nature | By Form | By Application | By End Use | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Europe

Europe accounted for approximately 34% of the global gluten-free potato starch market in 2025, with Germany, the Netherlands, France, and Poland leading regional consumption. Growth is supported by strong agricultural output, advanced starch processing infrastructure, and stringent gluten-free labeling regulations under EU food safety frameworks.

Additional drivers include high consumer awareness of gluten intolerance, strong demand for organic and clean-label foods, and the presence of established starch manufacturers investing in product innovation and sustainability initiatives.

North America

North America held nearly 28% market share, led by the United States. High penetration of gluten-free diets, strong demand for premium and functional food products, and widespread adoption in pharmaceutical formulations drive regional growth.

Supportive FDA gluten-free labeling standards, rising health and wellness spending, and rapid growth in plant-based and specialty food segments further strengthen market expansion across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 11% CAGR, driven by China, India, and Japan. Increasing investments in food processing infrastructure, expanding middle-class population, and rising awareness of digestive health are key growth catalysts.

Additionally, growth in convenience food consumption, improving regulatory frameworks for food quality, and rising exports of processed foods are accelerating demand for gluten-free potato starch across the region.

Latin America

Latin America represents an emerging growth market, with Brazil and Mexico leading regional demand. Expansion is supported by the rapid growth of processed food industries, increasing urbanization, and rising availability of gluten-free product offerings.

Growing foreign investments in food manufacturing and gradual adoption of international food safety standards are expected to further support market growth.

Middle East & Africa

The Middle East & Africa market remains nascent but steadily expanding, led by South Africa and GCC countries. Growth is supported by increasing food imports, rising disposable incomes, and growing consumer awareness of gluten-free and health-oriented diets.

Expansion of modern retail channels, tourism-driven food service demand, and increasing adoption of premium and specialty food products are expected to drive long-term market development in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Potato Starch Gluten-Free Market

- Ingredion Incorporated

- Cargill, Incorporated

- Roquette Frères

- Tate & Lyle PLC

- Avebe U.A.

- Emsland Group

- AGRANA Beteiligungs-AG

- KMC amba

- Sudstärke GmbH

- Tereos Group

- Penford Corporation

- Lyckeby Starch AB

- Manildra Group

- Nihon Shokuhin Kako

- Global Bio-Chem Technology Group