Post Production Market Size

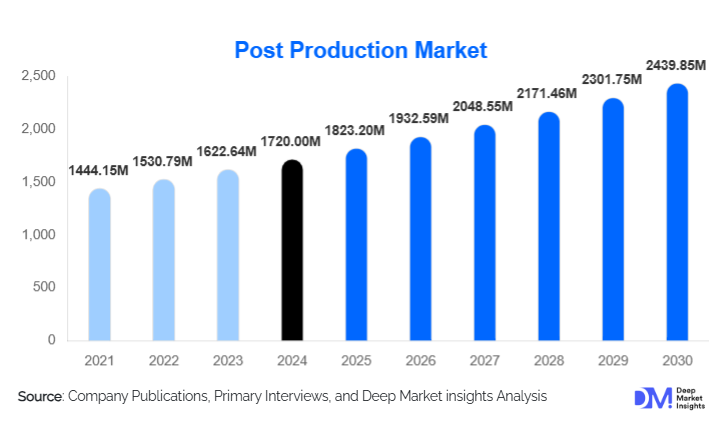

According to Deep Market Insights, the global post-production market size was valued at USD 1,720.00 million in 2024 and is projected to grow from USD 1,823.20 million in 2025 to reach USD 2,439.85 million by 2030, expanding at a CAGR of 6% during the forecast period (2025–2030). The post production market growth is primarily driven by the increasing demand for high-quality digital content across films, television, OTT streaming platforms, and gaming, coupled with rapid technological advancements in visual effects, animation, and sound design.

Key Market Insights

- Visual effects (VFX) and animation are leading service segments, driven by blockbuster films, streaming content, and gaming cutscenes that require high-end production quality.

- Television and streaming media applications dominate the market, fueled by the global rise of OTT platforms producing original series and long-form content requiring comprehensive post production services.

- Independent and outsourced post-production studios hold a significant market share, offering cost-effective and flexible services to multiple clients, outperforming in-house studios in scalability and specialization.

- North America is the largest regional market, supported by Hollywood productions, mature media infrastructure, and strong streaming service adoption.

- Asia-Pacific is the fastest-growing region, led by India and China, due to rising regional content production, outsourced post-production services, and increasing digital media consumption.

- Technological integration, including AI-assisted editing, cloud-based workflows, and virtual production tools, is reshaping efficiency and quality in post production processes.

What are the latest trends in the post-production market?

Adoption of AI and Cloud-Based Workflows

Post production studios are increasingly integrating AI-assisted editing, automated color correction, sound mixing, and cloud-based collaboration platforms. These technologies streamline workflows, reduce project turnaround time, and improve efficiency for complex projects involving multiple stakeholders. Cloud-based solutions also enable remote collaboration across geographies, allowing studios in emerging markets to serve global clients without compromising quality. This trend appeals particularly to content creators producing OTT series, animated films, and interactive media, as it allows faster scaling of operations while maintaining cost efficiency.

Growth in OTT and Streaming Content Production

The surge in original content production for streaming platforms has increased demand for end-to-end post-production services. Platforms such as Netflix, Amazon Prime Video, and Disney+ require high-quality editing, VFX, sound design, and animation to meet global audience expectations. Studios focusing on OTT content benefit from recurring contracts and premium pricing models. Additionally, the growth of regional OTT platforms in APAC and LATAM is creating new opportunities for localized content post production services, expanding the market beyond traditional cinema and television.

What are the key drivers in the post-production market?

Rising Global Content Production

The demand for films, web series, advertisements, and video games is driving post-production service growth. With the rise of streaming platforms and regional content hubs, studios need extensive post-production support to meet quality standards and delivery schedules. Content creators increasingly prefer outsourced post-production for efficiency and scalability, ensuring faster project completion without compromising technical quality.

Technological Advancements in VFX and Editing Tools

Innovation in real-time rendering, motion capture, AI-assisted editing, and high-definition color grading has enhanced the capabilities of post production studios. Studios leveraging advanced software can offer complex visual effects, animation, and sound enhancements at competitive rates, making these technologies key growth drivers.

Expansion of Gaming and Animation Industries

The global gaming and animation sectors are growing rapidly, particularly in North America, APAC, and Europe. Cinematics, interactive storylines, and animated sequences require sophisticated post-production, providing a new and lucrative revenue stream for service providers.

What are the restraints for the global market?

High Costs of Advanced Post Production Equipment

High-end VFX, color grading, and sound mixing equipment require significant capital investment. Smaller studios and independent operators may face entry barriers due to these costs, limiting their ability to compete with larger, fully-equipped studios. Maintenance and software licensing further add to operational expenses, restraining market growth in cost-sensitive regions.

Shortage of Skilled Professionals

The availability of experienced VFX artists, colorists, sound designers, and animators remains a challenge in many regions. A lack of trained talent can delay projects, reduce quality, and limit studio scalability, particularly in emerging markets with growing content demand.

What are the key opportunities in the post-production market?

Emerging Markets Expansion

Countries like India, China, and Brazil are investing heavily in content creation infrastructure, providing opportunities for international studios to establish partnerships or service centers. Government initiatives supporting digital media and technology adoption are further driving demand for localized post-production services. This expansion allows studios to cater to regional languages, cultural content, and niche markets at lower operational costs.

Integration of Advanced Technologies

AI-driven editing, real-time rendering, virtual production, and cloud-based collaboration tools offer opportunities for efficiency and differentiation. Studios adopting these technologies can handle complex projects, reduce production timelines, and offer premium-quality services, enhancing competitiveness and global reach.

Rising OTT and Streaming Content Demand

With the growing popularity of OTT platforms worldwide, demand for post-production services is expected to rise. Studios specializing in editing, VFX, sound design, and animation for streaming content can secure long-term contracts and capture high-value revenue streams. Regional OTT platforms are creating additional opportunities for localized post production, including multilingual content and culturally specific adaptations.

Service Type Insights

Visual Effects (VFX) dominates the post production market, capturing a 28% share of the 2024 global market. The demand for cinematic-quality effects in films, television, OTT series, and gaming drives growth in this segment. Advancements in CGI, motion capture, and real-time rendering tools further enhance the adoption of VFX services globally. Audio post production and editing services also maintain a strong demand, particularly for high-fidelity sound in films and advertisements.

Application Insights

Television and streaming media represent the largest application segment, accounting for 35% of the global market. With the proliferation of OTT platforms, content creators require comprehensive post-production services, including editing, sound design, VFX, and color grading to meet global standards. Advertising and marketing content, along with gaming and corporate media, are emerging as high-growth applications due to digital media proliferation and increasing marketing budgets worldwide.

End-User Insights

Outsourced/independent post-production studios dominate, holding approximately 40% of the global market share. These studios provide flexible, scalable services to multiple clients across films, OTT, and gaming, often outperforming in-house setups in efficiency and cost-effectiveness. In-house studios maintain relevance for high-budget projects, while freelancers and boutique studios cater to niche requirements, particularly in regional content markets.

| By Service Type | By Application | By End User |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the post production market with 32% of the global share, driven by Hollywood, Toronto, and Vancouver production hubs. High investments in technology, robust media infrastructure, and strong streaming platform demand maintain the region’s dominance. Premium VFX, sound design, and animation services are concentrated here, catering to both domestic and international projects.

Europe

Europe holds 22% of the market, with the U.K., Germany, and France leading content creation for TV and films. The U.K.’s VFX industry is particularly strong, serving global productions. Regional demand is supported by sustainable production practices, talent availability, and mature media infrastructure.

Asia-Pacific

APAC is the fastest-growing region (8.5% CAGR), led by India, China, and South Korea. Regional OTT platforms, digital media startups, and outsourcing demand drive growth. India and the Philippines are top outsourcing destinations for global post-production, benefiting from cost advantages and skilled labor.

Middle East & Africa

MEA, particularly the UAE and South Africa, is emerging as a regional content hub. Increasing local productions, international co-productions, and advertising content are driving demand for post-production services. Government incentives and media infrastructure development enhance growth prospects.

Latin America

Brazil and Argentina are emerging markets for post-production services, with growing digital content production. Outbound projects for global clients and increasing regional OTT adoption are contributing to market growth, although infrastructure and skilled workforce limitations remain challenges.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Post Production Market

- Deluxe Entertainment

- Technicolor

- Industrial Light & Magic

- Framestore

- MPC (Moving Picture Company)

- Pixelogic Media

- Company 3

- The Mill

- Prime Focus

- Method Studios

- Light Iron

- Wildbrain

- Bandai Namco Post

- Digital Domain

- Sony Pictures Post Production Services