Portable Air Humidifier & Dehumidifier Market Size

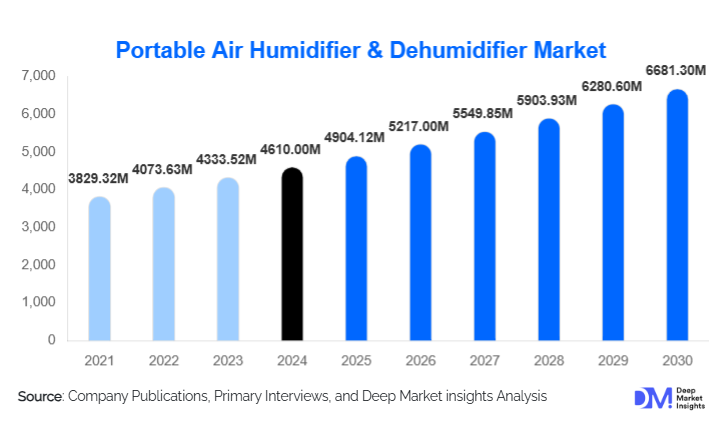

According to Deep Market Insights, the global portable air humidifier and dehumidifier market size was valued at USD 4,610.00 million in 2024 and is projected to grow from USD 4,904.12 million in 2025 to reach USD 6,681.30 million by 2030, expanding at a CAGR of 6.38% during the forecast period (2025–2030). Market growth is driven by rising indoor air quality concerns, increasing residential adoption of humidity-control appliances, rapid construction and remediation activity, and the growing penetration of smart, energy-efficient devices across global households and commercial facilities.

Key Market Insights

- Dehumidifiers dominate market revenue, supported by strong demand across residential, commercial, and industrial remediation applications.

- Smart and connected humidity-control devices are rapidly gaining traction, enabling predictive maintenance, app-based controls, and filter-replacement subscriptions.

- Asia-Pacific leads global market growth due to rising urbanization, large-scale housing development, and high humidity across tropical regions.

- North America remains one of the largest value markets, driven by high per-capita appliance spending and established renovation and remediation industries.

- E-commerce is the fastest-growing distribution channel, reshaping consumer purchase patterns for small and mid-size IAQ appliances.

- Energy efficiency, low-noise design, and low-GWP refrigerants are becoming critical differentiators as regulations tighten across major markets.

What are the latest trends in the portable air humidifier & dehumidifier market?

Smart & IoT-Enabled Humidity Control Systems

Manufacturers are increasingly integrating IoT technology, including Wi-Fi connectivity, app-based controls, environmental sensors, and automated humidity calibration, into portable humidifiers and dehumidifiers. These devices enable real-time humidity monitoring, predictive filter replacement alerts, and compatibility with digital ecosystems such as Amazon Alexa and Google Home. The trend is accelerating subscription-based revenue models through consumables such as filters and desiccant cartridges. Commercial facilities are adopting connected dehumidifiers for centralized monitoring, particularly in hotels, healthcare centers, and storage environments requiring precise humidity control. This shift toward intelligent, data-driven IAQ management is reshaping consumer expectations and accelerating premium segment growth.

Shift Toward Energy-Efficient & Low-Noise Technologies

As consumers become more environmentally conscious, energy-efficient compressor systems, inverter technology, and low-GWP refrigerants are becoming preferred features across portable dehumidifiers. Ultrasonic and evaporative humidifiers are gaining traction for their ultra-quiet operations, making them attractive for bedrooms, nurseries, and offices. Manufacturers are launching models with enhanced air filtration capabilities, enabling dual-function humidification and purification. Regulatory pressure on refrigerants and efficiency standards is pushing R&D investment toward sustainable designs, positioning energy-performance claims as major purchasing factors across global markets.

What are the key drivers in the portable air humidifier & dehumidifier market?

Increasing Focus on Indoor Air Quality & Health

Rising awareness of humidity-related respiratory health issues, mold growth, and indoor allergen proliferation is driving strong residential demand. Consumers are increasingly seeking devices that maintain optimal indoor humidity (30–50%), supporting comfort, skin health, sleep patterns, and general well-being. Post-pandemic behavioral shifts, with more time spent indoors and growing home-office adoption, have further boosted humidity-control appliance purchases.

Expanding Construction, Renovation & Remediation Activities

Global construction and home-renovation cycles are boosting demand for portable dehumidifiers, particularly in moisture-prone basements, new housing units, and areas requiring humidity stabilization during interior finishing. Water-damage restoration, flood remediation, and mold-control industries increasingly rely on high-capacity portable dehumidifiers, contributing significantly to commercial and industrial sales volumes.

Rising Adoption of Smart, Feature-Rich Appliances

As consumers shift toward premium, technology-integrated appliances, humidity control systems featuring smart sensors, automatic humidity balancing, air filtration, and IoT connectivity are gaining market share. These value-added features justify higher ASPs, expand margin opportunities for manufacturers, and encourage recurring service revenues, reinforcing long-term market growth.

What are the restraints for the global market?

Price Sensitivity & Market Commoditization

The entry of low-cost OEM manufacturers, especially across Asia, has intensified price competition, particularly in small humidifiers and basic dehumidifier models. This compresses margins and makes differentiation challenging for established brands. Consumers in developing markets often opt for low-priced alternatives, slowing premium product penetration.

Regulatory & Compliance Challenges

Fragmented safety and energy-efficiency regulations across the U.S., Europe, and Asia increase certification costs and extend product launch timelines. For dehumidifiers, evolving refrigerant and GWP restrictions require continual redesigns. Smaller manufacturers face financial and technical barriers in adapting to regulatory demands, limiting global market expansion.

What are the key opportunities in the portable air humidifier & dehumidifier industry?

IoT-Driven Aftermarket & Subscription Revenue Models

Smart humidity-control devices offer a significant opportunity to introduce subscription-based services, including filter replacements, consumable desiccant packs, predictive maintenance, and extended warranties. As households embrace connected ecosystems, manufacturers can leverage data insights to drive recurring revenue and strengthen customer loyalty. Commercial facilities, such as hotels, museums, and clinics, are particularly promising for remote monitoring and service contracts.

APAC Housing Boom & Climate-Driven Demand Surge

Asia-Pacific's rapid urbanization, dense residential construction, and high humidity levels make it a prime growth market. India, Southeast Asia, and China are witnessing large-scale adoption of room and console dehumidifiers, while dryer northern regions of China and Japan show rising demand for humidifiers. Localized manufacturing, affordable mid-market models, and region-specific form factors present high-value expansion opportunities.

Product Type Insights

Portable dehumidifiers dominate global revenue, accounting for nearly 58% of the market due to their higher ASPs and extensive use across residential basements, commercial buildings, and industrial remediation. Compressor-based units remain the top-selling technology, offering strong moisture removal capabilities and reliability in moderate-to-high humidity regions. Ultrasonic humidifiers continue to lead the humidifier segment due to quiet operation and low energy consumption. Hybrid and high-capacity units are gaining momentum as consumers seek multipurpose IAQ devices offering both humidity control and air purification.

Application Insights

Residential use represents over half of global demand, fueled by growing awareness of humidity-related health issues and the need for comfort optimization within homes. Commercial applications, including offices, hotels, educational institutions, and retail environments, are steadily increasing as organizations prioritize indoor air quality standards. Industrial and remediation applications remain the fastest-growing segment, driven by construction cycles, water-damage restoration, and strict environmental-control requirements in storage and manufacturing facilities. Museums, archives, and data centers also contribute to high-value niche demand due to the need for precise humidity regulation.

Distribution Channel Insights

Offline retail, including appliance stores and big-box retailers, currently accounts for the largest share of revenue due to consumers’ preference for viewing appliances physically before purchase. However, online sales are the fastest-growing channel, supported by competitive pricing, vast SKU visibility, and convenience-driven shopping behavior. Direct-to-consumer (D2C) brand sites are expanding, leveraging personalized recommendations and subscription-based filter sales. B2B procurement platforms are increasingly used by hotels, healthcare centers, and contractors sourcing high-capacity portable dehumidifiers.

End-User Insights

Residential consumers form the largest user base, driven by home comfort needs and rising health consciousness. Commercial end users, including hospitality, healthcare, and education, value durability, energy efficiency, and service contracts. Industrial users require high-capacity, rugged systems suited for remediation, manufacturing, and storage environments. Growth is strongest in industrial and construction end-use applications where humidity control directly impacts project timelines, material integrity, and safety compliance.

| By Product Type | By Technology | By Capacity / Form Factor | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 30% of global market value, with strong demand from the U.S. driven by mature residential adoption, high rates of basement humidity, and established water-damage remediation industries. Consumers exhibit high purchasing power and a preference for energy-star-rated and smart-enabled appliances. Replacement cycles and e-commerce penetration remain key growth factors.

Europe

Europe holds approximately 18% of the market and shows a preference for quiet, energy-efficient, and eco-friendly appliances. Germany, the U.K., and France lead demand, supported by strict building regulations and widespread adoption of IAQ standards. Cold climates increase seasonal humidifier use, while older building stock supports stable dehumidifier demand.

Asia-Pacific

APAC is the fastest-growing regional market with a 32% share. High humidity levels, rapid urban housing development, and expanding middle-class spending drive strong dehumidifier adoption. China and India are major volume markets, while Japan and South Korea maintain strong demand for compact, high-tech IAQ devices. Local manufacturing concentration further accelerates regional expansion.

Latin America

LATAM represents about 6% of the global market share, with growth led by Brazil and Mexico. High humidity zones, increasing construction, and improving retail infrastructure are boosting demand for mass-market dehumidifiers and personal humidifiers.

Middle East & Africa

MEA accounts for roughly 6% of global demand. Hot climates with varying humidity levels create selective opportunities, particularly in the Gulf region’s residential and hospitality sectors. Africa’s cultural heritage institutions and emerging commercial infrastructure also generate niche demand for controlled-humidity systems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Air Humidifier & Dehumidifier Market

- Midea Group

- LG Electronics

- Honeywell International

- Haier Smart Home

- Whirlpool Corporation

- De’Longhi Group

- Panasonic Corporation

- Electrolux AB

- Danby Products

- Munters Group

- Mitsubishi Electric Corporation

- Gree Electric Appliances

- Hisense

- Condair Group

- Deye Group

Recent Developments

- In March 2025, Midea Group expanded its smart dehumidifier series with AI-enabled humidity learning algorithms and energy-optimised compressor systems.

- In February 2025, LG Electronics introduced an IoT-based home climate ecosystem integrating dehumidifiers, purifiers, and HVAC systems through a unified app interface.

- In January 2025, Munters launched a new line of industrial portable dehumidifiers designed for construction drying, flood remediation, and precision storage environments.