Domestic Air Humidifier Market Size

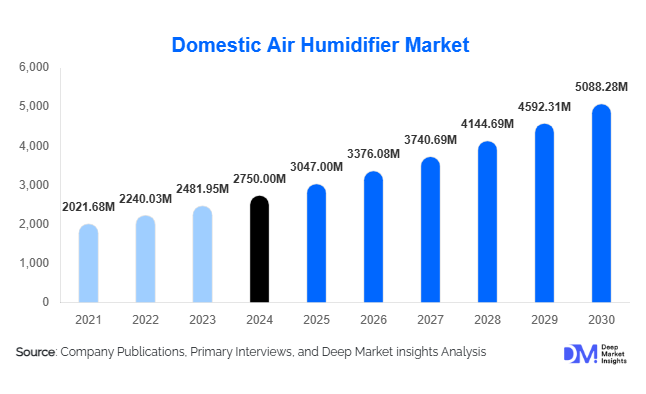

According to Deep Market Insights, the global domestic air humidifier market size was valued at USD 2,750 million in 2024 and is projected to grow from USD 3,047 million in 2025 to reach USD 5,088.28 million by 2030, expanding at a CAGR of 10.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness of indoor air quality, rising health and wellness concerns, and the expansion of smart and hybrid humidifier technologies.

Key Market Insights

- Ultrasonic humidifiers dominate the market globally, favored for their low noise, energy efficiency, and safe operation in homes.

- Residential applications account for the majority of demand, with bedrooms, nurseries, and living rooms being the primary use cases.

- North America holds the largest regional market share, with the U.S. leading adoption due to strong health consciousness and wintertime dryness.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, disposable incomes, and increasing awareness of indoor air quality.

- Technological integration, including IoT connectivity, auto humidity sensing, and hybrid air purification features, is reshaping consumer preference and product innovation.

- E-commerce channels are expanding rapidly, enabling consumers to compare models, read reviews, and access a wide range of products.

What are the latest trends in the domestic air humidifier market?

Smart and Connected Humidifiers

Manufacturers are increasingly integrating IoT-enabled features such as app-based control, automatic humidity monitoring, and scheduling. Smart humidifiers allow users to remotely adjust settings, monitor water levels, and receive filter replacement alerts. Some advanced models combine humidification with air purification, UV sterilization, and antimicrobial technology, offering enhanced indoor air quality. These innovations cater to tech-savvy consumers and premium market segments in North America, Europe, and Asia-Pacific.

Health and Wellness-Focused Devices

Growing awareness of respiratory health, allergies, and skin dryness is driving demand for medical-grade and wellness-focused humidifiers. Products designed for nurseries, hospitals, and clinics are gaining traction, particularly in developed markets. Integration of antimicrobial materials, UV sterilization, and HEPA filters helps prevent bacterial growth and ensures safer humidification, creating new product differentiation and boosting consumer confidence.

What are the key drivers in the domestic air humidifier market?

Rising Indoor Air Quality Awareness

Consumers are increasingly conscious of the health impacts of dry air, including respiratory issues, skin irritation, and allergies. This has led to growing adoption of humidifiers in homes, offices, and healthcare facilities. Awareness campaigns and guidance from health organizations about optimal indoor humidity (40–60%) are reinforcing this trend.

Technological Advancements and Product Innovation

Advances in ultrasonic, hybrid, and smart humidifier technologies are enhancing user experience. Energy-efficient, quiet, and easy-to-maintain devices appeal to consumers seeking convenience and safety. Integration with smart home systems and air quality monitoring further drives adoption.

Growth of Online Retail Channels

The expansion of e-commerce platforms allows consumers to easily research, compare, and purchase humidifiers. Online channels have increased visibility for premium and niche products, reduced purchase friction, and enabled faster access to replacement filters and accessories.

What are the restraints for the global market?

Maintenance Challenges and Water Quality Issues

Humidifiers require regular cleaning and filter replacement to prevent mold, bacterial growth, and mineral deposits. Poor maintenance can lead to health risks and reduced device lifespan, limiting consumer adoption in some markets.

Energy Consumption and Safety Concerns

High energy or water consumption in steam/warm-mist models and safety risks (e.g., burns from hot steam) can restrict adoption. Compliance with electrical and safety regulations adds cost and complexity for manufacturers, particularly in price-sensitive regions.

What are the key opportunities in the domestic air humidifier market?

Smart and IoT-Integrated Devices

IoT-enabled humidifiers provide automation, remote monitoring, and enhanced user experience. Integration with air purifiers and mobile applications creates a premium segment opportunity for manufacturers, particularly in developed markets with tech-savvy consumers.

Healthcare and Wellness Applications

Medical-grade humidifiers for hospitals, clinics, and home healthcare are increasingly in demand. Features such as UV sterilization, antimicrobial filters, and precise humidity control allow players to target niche high-value segments and differentiate their products.

Geographical Expansion in Emerging Markets

Asia-Pacific, the Middle East, and Latin America are high-growth regions due to rising urbanization, pollution, and disposable incomes. Manufacturers can expand distribution, develop locally adapted products, and capitalize on government initiatives promoting health and indoor air quality.

Product Type Insights

Ultrasonic humidifiers dominate the market due to low noise, energy efficiency, and safe operation, capturing around 45% of the 2024 market. Warm-mist/steam humidifiers are preferred in colder regions, while hybrid devices combining purification and humidification are gaining traction in premium segments.

Application Insights

Residential applications account for nearly 70% of global demand in 2024, driven by bedrooms, nurseries, and living rooms. Healthcare settings, including hospitals and clinics, are emerging as significant adopters. Commercial use in offices, hotels, and retail spaces is growing, particularly for premium devices with smart features and air purification.

Distribution Channel Insights

Online retail channels are rapidly gaining share, accounting for approximately 35% of global sales, particularly in Asia-Pacific and North America. Offline retail remains important, with specialty stores and home appliance chains dominating traditional sales. Direct-to-consumer models are also growing, enabling manufacturers to engage customers with warranties, replacements, and subscription-based filter programs.

End-User Insights

Households remain the largest end-user segment, with significant growth in urban middle-class markets. Healthcare facilities and hospitality establishments are expanding the adoption of wellness and comfort. Emerging applications include indoor gardening, semi-outdoor spaces, and integration with smart home systems. Export-driven demand is strong from Asia-Pacific manufacturers targeting North America and Europe.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share (33%), with the U.S. leading demand. High health awareness, dry winter climates, and disposable income drive adoption. Smart and premium models are particularly popular, with strong growth in residential and healthcare applications.

Europe

Europe accounts for 28% of the global market. Germany, the U.K., and France lead adoption, driven by environmental awareness and indoor air quality regulations. Mid-range and premium humidifiers dominate, with increasing interest in IoT-enabled and energy-efficient models.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea. Rapid urbanization, rising disposable incomes, and pollution concerns are boosting demand. Online retail penetration and growing awareness of health and wellness benefits are key growth drivers.

Middle East & Africa

The region holds around 10% market share, with the GCC countries driving premium product adoption. Arid climates and luxury hospitality demand support growth, while lower awareness and affordability limit penetration in other parts of Africa.

Latin America

Latin America accounts for 6–8% of the market, with Brazil and Mexico as key markets. Growing urbanization and rising middle-class income are gradually increasing adoption, particularly for residential and hospitality segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Domestic Air Humidifier Market

- Honeywell International Inc.

- Dyson Ltd.

- Boneco AG

- Philips Domestic Appliances

- Condair Group

- Levoit

- Vicks

- Crane USA

- Pure Enrichment

- Venta Airwasher

- TaoTronics

- Sharp Corporation

- DeLonghi

- Beurer

- Homasy

Recent Developments

- In March 2025, Honeywell launched a new smart ultrasonic humidifier series in North America featuring IoT control and antimicrobial filters.

- In February 2025, Dyson introduced a hybrid humidifier-purifier unit with air quality sensors for European markets.

- In January 2025, Boneco AG expanded its online distribution network across Asia-Pacific to tap into rapidly growing residential demand.