Porcine Gelatin Market Size

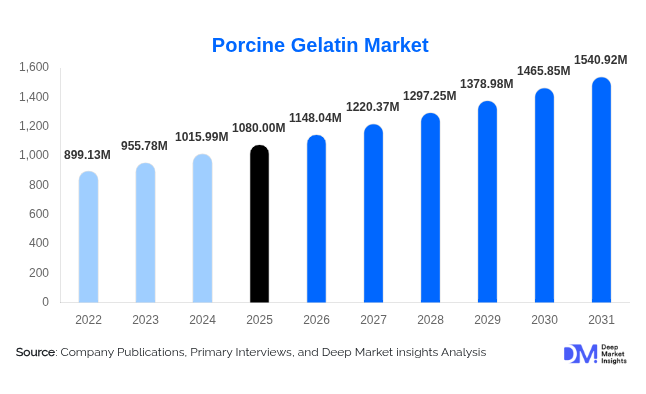

According to Deep Market Insights, the global porcine gelatin market size was valued at USD 1,080.00 million in 2025 and is projected to grow from USD 1,148.04 million in 2026 to reach USD 1,540.92 million by 2031, expanding at a CAGR of 6.3% during the forecast period (2026–2031). The porcine gelatin market growth is primarily driven by strong demand from the food processing and pharmaceutical industries, rising consumption of capsule-based drug delivery systems, and increasing use of gelatin as a functional protein ingredient in nutraceuticals and confectionery products.

Key Market Insights

- Food-grade porcine gelatin remains the dominant product category, supported by large-scale consumption in confectionery, dairy desserts, and processed meat applications.

- Pharmaceutical-grade porcine gelatin is the fastest-growing segment, driven by rising global production of hard and soft gelatin capsules.

- Europe leads the global market due to its advanced gelatin processing infrastructure and strong export capabilities.

- Asia-Pacific is the fastest-growing region, supported by the rapid expansion of pharmaceutical manufacturing in China and India.

- Powdered gelatin dominates by form, owing to ease of handling, longer shelf life, and compatibility with automated industrial processing.

- Direct B2B sales account for the majority of distribution, reflecting long-term supply contracts between manufacturers and end-use industries.

What are the latest trends in the porcine gelatin market?

Rising Demand for Pharmaceutical and Nutraceutical Applications

One of the most prominent trends in the porcine gelatin market is the accelerating demand from the pharmaceutical and nutraceutical industries. Porcine gelatin is widely preferred for hard and soft capsule manufacturing due to its superior film-forming properties, clarity, and cost efficiency compared to alternative sources. The growth of generic drugs, increasing OTC medication consumption, and expanding dietary supplement markets are significantly boosting demand. Gummy-based supplements, protein-enriched formulations, and functional nutrition products are further driving gelatin consumption, particularly in Asia-Pacific and North America.

Product Customization and Processing Innovation

Manufacturers are increasingly focusing on customized gelatin grades tailored for specific applications. Advances in enzymatic processing, bloom strength optimization, and odor-neutralization technologies are enabling suppliers to offer application-specific solutions. High-bloom and fast-dissolving gelatin variants are gaining popularity in premium confectionery, sports nutrition, and cosmetic formulations. These innovations allow companies to differentiate products, strengthen long-term customer relationships, and improve operating margins.

What are the key drivers in the porcine gelatin market?

Expansion of the Global Pharmaceutical Industry

The rapid expansion of pharmaceutical manufacturing worldwide is a major driver of porcine gelatin demand. Hard and soft gelatin capsules remain the preferred drug delivery format for many medications due to ease of swallowing, accurate dosing, and cost efficiency. Growing healthcare expenditure, aging populations, and increased prevalence of chronic diseases are fueling sustained demand for capsule-based formulations, particularly in emerging markets.

Growth in Processed and Functional Food Consumption

Rising urbanization, changing dietary habits, and increased consumption of processed foods are driving gelatin demand in the food industry. Porcine gelatin is widely used as a gelling, stabilizing, and texturizing agent in confectionery, dairy desserts, and meat products. Its functional benefits, including emulsification and moisture retention, make it an essential ingredient for food manufacturers aiming to improve product quality and shelf life.

What are the restraints for the global market?

Religious and Cultural Consumption Restrictions

Religious and cultural constraints related to porcine-derived products limit market penetration in Muslim-majority and Jewish regions. These restrictions reduce demand in parts of the Middle East, North Africa, and Southeast Asia, compelling manufacturers to rely on alternative gelatin sources or focus on export-oriented strategies.

Volatility in Raw Material Prices

Fluctuations in pork production, feed costs, and animal disease outbreaks can impact the availability and pricing of porcine raw materials. This volatility affects production costs and profit margins, posing challenges for manufacturers operating under long-term supply contracts.

What are the key opportunities in the porcine gelatin industry?

Emerging Market Pharmaceutical Manufacturing

Rapid growth of pharmaceutical manufacturing in emerging economies such as India, Vietnam, Brazil, and Indonesia presents significant opportunities for porcine gelatin suppliers. Government support for domestic drug production and export-oriented pharmaceutical hubs is creating sustained demand for pharmaceutical-grade gelatin.

Sustainability and Circular Economy Initiatives

The increasing emphasis on sustainability and waste valorization is creating new opportunities for the porcine gelatin market. Gelatin production utilizes animal by-products from the meat industry, aligning well with circular economy principles. Sustainability certifications, traceability systems, and energy-efficient processing are enhancing product acceptance among environmentally conscious buyers.

Product Type Insights

Food-grade porcine gelatin dominates the market, accounting for approximately 38% of global revenue in 2024. Its leadership is primarily driven by high-volume consumption in confectionery, dairy desserts, and processed meat applications, where gelatin is essential for texture, gelling, and stabilizing properties. The high stability and functional versatility of food-grade gelatin make it the preferred choice for large-scale food manufacturing, particularly in Europe and the Asia-Pacific. Pharmaceutical-grade porcine gelatin is the fastest-growing product type, supported by the rapid expansion of capsule-based drug delivery systems and increasing global pharmaceutical production. This segment benefits from rising demand for hard and soft gelatin capsules, especially in emerging markets such as India and China. Technical and industrial-grade gelatin serves niche applications, including photography, photographic films, and industrial adhesives. While smaller in market share, this segment remains stable due to specialized applications requiring high-purity or customized gelatin grades.

Form Insights

Powdered porcine gelatin holds the largest market share at around 62% globally. Its dominance is driven by ease of handling, longer shelf life, and compatibility with automated manufacturing processes, which are critical for both the food and pharmaceutical industries. Granulated gelatin is widely used in pharmaceutical and nutraceutical applications, particularly for capsule and supplement production, where precise dosing and uniformity are required. Sheet gelatin, though limited in volume, is still preferred for artisanal and specialty food applications, including high-end confectionery and culinary uses that require uniform melting and gelling characteristics.

Application Insights

The food and beverage sector accounts for approximately 41% of total porcine gelatin demand, with confectionery, marshmallows, and dairy desserts leading consumption. The pharmaceutical sector represents around 34% of revenue and is the fastest-growing application, fueled by rising production of hard and soft gelatin capsules and expanding OTC drug markets globally. Emerging applications such as nutraceuticals and functional foods are witnessing strong growth, particularly in the Asia-Pacific region, driven by increasing consumer awareness of health supplements, protein-enriched products, and gummy vitamins. The cosmetics and personal care sector, including facial masks, hair care formulations, and skincare products, is also gaining traction, especially in regions with rising disposable incomes and growing demand for high-quality personal care products.

End-Use Industry Insights

The food processing industry remains the largest end-use sector due to the high-volume adoption of gelatin in confectionery, desserts, and processed foods. The pharmaceutical industry, however, is the fastest-growing end-use sector, with surging demand for capsules and coated tablets driving growth. Nutraceutical manufacturers are increasingly integrating gelatin in gummy supplements, protein-enriched products, and functional nutrition items. Cosmetics and personal care products, particularly in Asia-Pacific, are emerging as high-growth verticals, fueled by increasing health-conscious consumers, premium skincare routines, and innovative formulations leveraging gelatin as a functional protein or gelling agent.

Distribution Channel Insights

Direct B2B sales dominate the porcine gelatin market, accounting for over 70% of total distribution. This is primarily driven by long-term supply contracts between manufacturers and large-scale industrial buyers, ensuring consistent quality, traceability, and reliable supply. Specialty ingredient distributors remain essential for small- and mid-sized customers, providing flexibility and regional reach. Online industrial procurement platforms are gradually emerging as supplementary channels, allowing smaller buyers to source standardized products efficiently. The trend toward digital sourcing is expected to increase, particularly in Asia-Pacific and North America, where e-commerce adoption is high.

| By Product Type | By Form | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global porcine gelatin market with approximately 34% market share in 2024. Germany, France, Spain, and the Netherlands are major producers and exporters, supported by advanced processing technologies, stringent quality standards, and well-established food and pharmaceutical industries. Regional growth is driven by high domestic consumption in food applications, strong pharmaceutical manufacturing infrastructure, and Europe’s role as a key exporter of high-purity gelatin grades. Technological innovations in hydrolysis and enzymatic treatment have further enhanced product quality and functional consistency, supporting both local and export markets.

Asia-Pacific

Asia-Pacific accounts for around 32% of global demand and is the fastest-growing region. China dominates regional consumption due to large-scale pharmaceutical and food manufacturing, rising demand for capsules, and growing processed food industries. India is emerging as a high-growth market, driven by pharmaceutical exports and nutraceutical production. Other countries such as Japan, South Korea, and Australia are also contributing to market expansion, particularly in high-value applications such as nutraceuticals, cosmetics, and functional foods. The rapid urbanization, increasing disposable income, and growing middle-class population are key drivers of regional growth, alongside government initiatives supporting pharmaceutical manufacturing and food safety standards.

North America

North America holds approximately 21% of the market, led by the United States. Growth is driven by strong demand from food processing, nutraceutical, and pharmaceutical industries, along with rising awareness of functional ingredients. The presence of major pharmaceutical manufacturers and large-scale confectionery companies ensures steady consumption of both food-grade and pharmaceutical-grade gelatin. Trends such as clean-label ingredients, high-protein formulations, and specialty confectionery products are also supporting the market in this region.

Latin America

Latin America represents a growing market, with Brazil and Mexico emerging as key consumers due to expanding food processing industries, increasing pharmaceutical production, and rising urbanization. Regional growth is also supported by rising awareness of dietary supplements and functional foods, alongside investments in processing infrastructure that allow local manufacturers to adopt advanced gelatin-based formulations.

Middle East & Africa

Demand in the Middle East & Africa remains limited due to cultural and religious restrictions on porcine products, but pharmaceutical imports and niche industrial applications support consistent consumption. South Africa and certain GCC countries represent pockets of demand, driven by pharmaceutical production and cosmetic formulations. The market in this region is gradually expanding due to increasing healthcare investments, growth in specialty food imports, and rising awareness of functional and nutraceutical ingredients.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Porcine Gelatin Market

- Gelita AG

- Rousselot

- PB Gelatins

- Nitta Gelatin

- Tessenderlo Group

- Weishardt Group

- Jellice Group

- Lapi Gelatine

- Sterling Gelatin

- India Gelatine & Chemicals

- Qinghai Gelatin

- Geltech Co. Ltd.

- Trobas Gelatine

- Roxlor Group

- Norland Products