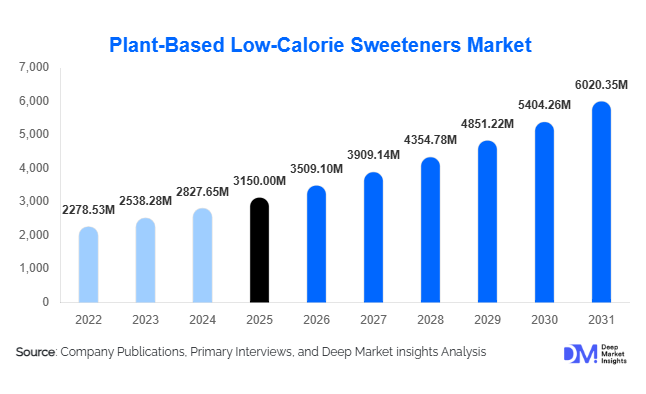

Plant-Based Low-Calorie Sweeteners Market Size

According to Deep Market Insights, the global plant-based low-calorie sweeteners market size was valued at USD 3,150 million in 2025 and is projected to grow from USD 3,509.10 million in 2026 to reach USD 6,020.35 million by 2031, expanding at a CAGR of 11.4% during the forecast period (2026–2031). Market growth is primarily driven by rising global diabetes prevalence, increasing sugar-reduction mandates, and strong reformulation demand from beverage and processed food manufacturers. The growing shift toward clean-label, plant-derived ingredients over artificial sweeteners is further accelerating industry expansion.

Key Market Insights

- Stevia dominates the global market, accounting for nearly 34% of total market share in 2025 due to broad regulatory approvals and beverage sector adoption.

- Beverages represent the largest application segment, contributing approximately 41% of global demand, led by reformulated carbonated drinks and functional beverages.

- North America leads the global market with 32% market share in 2025, supported by strong sugar taxation policies and consumer awareness.

- Asia-Pacific is the fastest-growing region, registering over 13% CAGR, driven by rising diabetes rates and expanding middle-class consumption.

- Direct B2B ingredient sales dominate distribution, contributing nearly 58% of total revenue due to large-volume industrial procurement.

- Fermentation-based innovation is reducing production costs of rare sugars like allulose and next-generation steviol glycosides.

What are the latest trends in the plant-based low-calorie sweeteners market?

Next-Generation Steviol Glycosides and Rare Sugars

Manufacturers are increasingly focusing on high-purity steviol glycosides such as Reb M and Reb D to address bitterness challenges historically associated with stevia. Precision fermentation technologies are improving scalability and lowering production costs, making advanced glycosides commercially viable. Additionally, rare sugars such as allulose are gaining traction due to their sugar-like taste profile and minimal glycemic impact. These innovations are enabling beverage and dairy companies to achieve higher sugar replacement ratios without compromising sensory appeal.

Clean-Label and Keto-Friendly Product Expansion

Consumer preference for natural, plant-derived ingredients is reshaping product development strategies across food and beverage categories. Keto, diabetic-friendly, and low-carb product launches have increased significantly, with manufacturers prominently highlighting plant-based sweetener usage on packaging. Retail shelves are expanding with tabletop sweetener blends, low-sugar protein bars, functional drinks, and dairy alternatives formulated with stevia, monk fruit, and erythritol combinations.

What are the key drivers in the plant-based low-calorie sweeteners market?

Rising Global Diabetes and Obesity Rates

The increasing prevalence of metabolic disorders is accelerating consumer demand for low-glycemic sweeteners. Governments and health organizations are advocating sugar reduction, encouraging manufacturers to reformulate products using plant-based alternatives. This structural health shift is driving consistent long-term demand growth.

Beverage Industry Reformulation

Major beverage producers are reducing sugar content across portfolios to comply with sugar taxes and improve brand positioning. Reformulated carbonated drinks, flavored waters, and functional beverages increasingly rely on plant-based sweeteners to maintain taste while lowering calorie content.

What are the restraints for the global market?

High Cost Compared to Sugar

Plant-based sweeteners remain significantly more expensive than refined sugar, limiting penetration in cost-sensitive developing markets. Although fermentation scaling is reducing costs, price parity remains a challenge.

Taste and Sensory Limitations

Despite technological advancements, certain plant-based sweeteners may still exhibit lingering aftertaste or reduced mouthfeel compared to sugar. Continued R&D investment is required to improve sensory performance.

What are the key opportunities in the plant-based low-calorie sweeteners industry?

Expansion in Emerging Markets

Countries such as India, Brazil, Indonesia, and Thailand present strong growth opportunities due to rising urbanization, increasing processed food consumption, and expanding diabetic populations. Localized production and regulatory approvals will accelerate penetration.

Biotechnology and Fermentation Investments

Precision fermentation and enzyme engineering platforms are creating opportunities for cost-effective production of high-intensity sweeteners and rare sugars. Companies investing in proprietary biotechnology can achieve competitive pricing advantages and margin expansion.

Product Type Insights

The stevia segment continues to lead the global plant-based sweeteners market, accounting for approximately 34% of total market share in 2025. Its dominance is primarily driven by widespread regulatory approvals across major economies, strong consumer acceptance of plant-derived sweetening agents, and extensive integration into beverages, dairy alternatives, and packaged foods. Stevia’s zero-calorie profile, natural origin, and compatibility with clean-label formulations position it as the preferred sweetener for large-scale reformulation initiatives. The leading segment driver for stevia remains the accelerating global push toward sugar reduction in mainstream food and beverage portfolios, particularly among multinational beverage manufacturers reformulating flagship products.

Monk fruit and allulose are emerging as high-growth sub-segments, benefiting from continuous improvements in taste masking technologies and enhanced formulation capabilities that minimize aftertaste. Their popularity is closely tied to the rapid adoption of ketogenic, low-carb, and diabetic-friendly diets. Meanwhile, erythritol and xylitol maintain stable demand due to their multifunctional benefits, including cooling effects, bulking properties, and dental compatibility, which support their continued use in confectionery, oral care products, and pharmaceutical formulations.

Application Insights

Beverages represent the largest application segment, contributing nearly 41% of total global demand in 2025. The segment’s leadership is driven by large-scale sugar reduction commitments from carbonated soft drink producers, sports drink manufacturers, and functional beverage brands. The primary segment driver is the aggressive reformulation of high-sugar beverages in response to regulatory pressures, sugar taxation frameworks, and changing consumer preferences toward low-calorie alternatives. Functional beverages, including energy drinks, flavored waters, and protein beverages, are increasingly incorporating plant-based sweeteners to meet demand for healthier positioning without compromising taste.

Bakery and confectionery applications are experiencing steady expansion, particularly in reduced-sugar and low-carb product lines where sweetener blends enable texture and sweetness optimization. Nutraceutical and dietary supplement applications are expanding at double-digit growth rates, fueled by rising health consciousness, growing demand for metabolic health solutions, and increasing product launches in protein powders, gummies, and wellness beverages that require sugar alternatives for formulation stability.

Distribution Channel Insights

Direct B2B sales dominate the distribution landscape, accounting for approximately 58% of total market share. This leadership reflects long-term supply agreements between ingredient manufacturers and multinational food and beverage producers seeking consistent quality, traceability, and pricing stability. The leading driver for this segment is the growing trend of strategic sourcing partnerships, which allow large manufacturers to secure high-purity sweetener extracts for reformulation initiatives at scale.

Ingredient distributors hold a significant secondary share, particularly in emerging markets where fragmented food processing industries rely on third-party sourcing networks. Online retail channels are rapidly expanding within the tabletop sweetener category, driven by the rise of health-focused e-commerce platforms and direct-to-consumer wellness brands targeting diabetic and keto-oriented consumers.

End-Use Industry Insights

Food and beverage manufacturers account for approximately 63% of total market consumption, making this the leading end-use industry. The primary driver for this segment is the intensifying global focus on sugar reduction targets, front-of-pack labeling regulations, and reformulation strategies designed to maintain product taste while lowering caloric density. Beverage giants, dairy processors, and snack producers are increasingly integrating plant-based sweeteners to align with consumer demand for healthier alternatives.

The nutraceutical sector represents the fastest-growing end-use segment, expanding at over 13% CAGR. Growth is supported by rising demand for diabetic-friendly, weight-management, and ketogenic formulations. Pharmaceutical manufacturers utilize plant-based polyols in syrups, chewable tablets, and medicated lozenges due to their non-cariogenic and low-glycemic properties. The HoReCa sector is gradually incorporating low-calorie sweeteners into specialty beverage offerings, premium cafés, and health-focused restaurant chains to accommodate evolving dietary preferences.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 32% of the global market share in 2025, with the United States serving as the primary revenue contributor. Regional growth is driven by rising obesity and diabetes prevalence, widespread implementation of sugar taxation policies in select jurisdictions, and aggressive reformulation strategies by beverage and snack manufacturers. The strong presence of health-conscious consumers, robust innovation pipelines, and well-established nutraceutical industries further reinforce market expansion. Canada contributes steady growth through increasing tabletop sweetener adoption and government-led sugar reduction initiatives, while Mexico’s taxation policies continue to influence product reformulation trends across the region.

Europe

Europe accounts for nearly 28% of the global market share, supported by stringent regulatory frameworks targeting sugar reduction and high consumer awareness regarding clean-label ingredients. Germany, the United Kingdom, and France lead adoption due to proactive public health policies, front-of-pack labeling systems, and established plant-based product markets. Regional growth is further driven by strong private-label expansion in supermarkets, rising vegan and flexitarian populations, and continued innovation in sugar-free confectionery and beverage segments. The European Union’s structured regulatory approvals also provide clarity for ingredient manufacturers, facilitating steady product development.

Asia-Pacific

Asia-Pacific represents the fastest-growing regional market, registering a CAGR exceeding 13%. China plays a critical role as both a leading producer and exporter of stevia extracts, strengthening regional supply chain integration and cost competitiveness. Rapid urbanization, rising disposable incomes, and increasing awareness of lifestyle-related diseases are driving domestic demand growth in China, India, and Japan. India’s expanding processed food sector and growing diabetic population contribute significantly to demand acceleration, while Japan’s long-standing acceptance of alternative sweeteners supports consistent innovation. The region’s expanding middle class and modernization of retail infrastructure further enhance market penetration.

Latin America

Brazil and Mexico are key contributors within Latin America, supported by well-established sugar taxation measures and expanding processed food industries. Regional growth is driven by increasing public health campaigns targeting sugar consumption, the presence of major beverage manufacturing hubs, and growing consumer awareness of metabolic health. Brazil’s domestic agricultural capabilities also provide opportunities for localized sweetener production, while Mexico’s beverage reformulation efforts continue to stimulate ingredient demand.

Middle East & Africa

The Middle East & Africa region represents an emerging growth frontier, with the United Arab Emirates and South Africa serving as key demand centers. Growth is driven by expanding premium retail networks, rising disposable incomes, and increasing awareness of lifestyle-related diseases. Government-led wellness initiatives and the expansion of modern foodservice chains further support sweetener adoption. Additionally, the rapid growth of organized retail and imported health-focused food products is enhancing product availability across urban markets, contributing to steady regional expansion.

Company Market Share

The plant-based low-calorie sweeteners market is moderately consolidated, with the top five companies accounting for approximately 48% of global revenue. Leading players maintain competitive advantages through fermentation technology, global distribution networks, and long-term supply contracts with beverage giants.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plant-Based Low-Calorie Sweeteners Market

- Cargill Inc.

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- Roquette Frères

- PureCircle Ltd.

- Sweegen Inc.

- GLG Life Tech Corporation

- Ajinomoto Co., Inc.

- DuPont Nutrition & Biosciences

- JK Sucralose Inc.

- Zhucheng Haotian Pharm Co., Ltd.

- Guilin Layn Natural Ingredients Corp.

- Pyure Brands LLC

- Matsutani Chemical Industry Co., Ltd.