Plant-Based Cheese Stabilizers Market Size

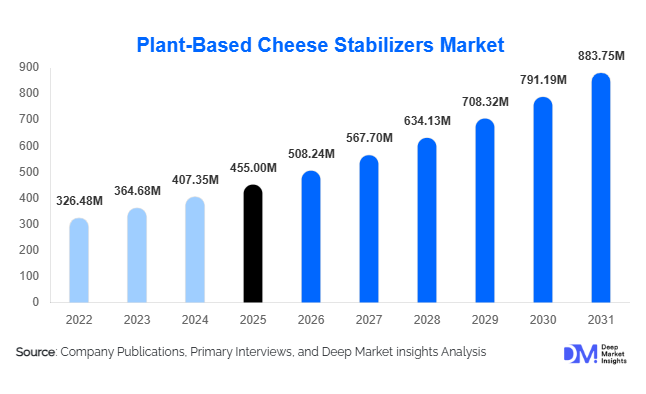

According to Deep Market Insights,the global plant-based cheese stabilizers market size was valued at USD 455 million in 2025 and is projected to grow from USD 508.24 million in 2026 to reach USD 883.75 million by 2031, expanding at a CAGR of 11.7% during the forecast period (2026–2031). The plant-based cheese stabilizers market growth is primarily driven by the rapid expansion of vegan cheese production, increasing demand for clean-label hydrocolloids, and the need for advanced texturizing and emulsification systems that replicate conventional dairy cheese functionality.

Key Market Insights

- Hydrocolloids dominate the market, accounting for nearly 48% of global demand in 2025 due to their superior water-binding and gel-forming capabilities.

- Powder-based stabilizers lead by form, contributing over 70% share owing to ease of transport, long shelf life, and compatibility with dry blending systems.

- Industrial vegan cheese manufacturers represent the largest end-use segment, contributing more than 60% of total stabilizer demand globally.

- North America holds the largest regional share (34%), led by strong plant-based food consumption in the United States.

- Asia-Pacific is the fastest-growing region, expanding at over 14% CAGR due to urbanization and rising lactose intolerance awareness.

- Blended and customized stabilizer systems are gaining traction as manufacturers seek application-specific meltability and stretch performance.

What are the latest trends in the plant-based cheese stabilizers market?

Shift Toward Clean-Label and Seaweed-Derived Hydrocolloids

Consumers increasingly prefer recognizable, natural ingredients in plant-based dairy alternatives. This has accelerated demand for seaweed-derived carrageenan, locust bean gum, and pectin systems that provide functional stability without synthetic additives. Manufacturers are reformulating products to remove controversial additives while maintaining melt, stretch, and moisture retention. Clean-label positioning has become a competitive differentiator, particularly in North America and Europe, where ingredient transparency significantly influences purchasing decisions.

Customized Multi-Functional Blended Stabilizer Systems

Cheese analog manufacturers are demanding application-specific stabilizer blends that combine hydrocolloids, plant proteins, and emulsifiers. These blends enhance emulsification, elasticity, and sliceability in mozzarella-style, cheddar-style, and processed vegan cheeses. Suppliers are investing heavily in R&D to offer proprietary systems tailored to industrial clients. The transition from single-ingredient stabilizers to integrated formulation systems is increasing average selling prices and improving supplier margins.

What are the key drivers in the plant-based cheese stabilizers market?

Rapid Expansion of Plant-Based Cheese Production

The global plant-based cheese market is growing at double-digit rates, directly driving stabilizer demand. Industrial production volumes have expanded significantly across North America and Europe, with major QSR chains introducing vegan pizza toppings and dairy-free slices. As production scales, stabilizers remain critical to ensuring consistent texture, meltability, and shelf stability, creating sustained ingredient demand.

Functional Performance Requirements in Cheese Analogs

Unlike plant-based milk or yogurt, cheese alternatives require complex structural properties such as stretch, elasticity, and controlled melt. Hydrocolloids and protein-based stabilizers play a crucial role in mimicking casein networks found in dairy cheese. The need to achieve authentic sensory profiles continues to drive high-value stabilizer innovation.

What are the restraints for the global market?

Raw Material Price Volatility

Prices of key inputs such as carrageenan and guar gum fluctuate due to climate variability, geopolitical trade restrictions, and seaweed supply constraints. Such volatility can compress manufacturer margins and impact contract pricing agreements.

Regulatory Scrutiny and Labeling Challenges

Certain hydrocolloids face regulatory evaluation in select markets. Usage limitations and labeling requirements may influence formulation strategies and slow adoption in highly regulated regions.

What are the key opportunities in the plant-based cheese stabilizers industry?

Asia-Pacific Manufacturing Expansion

Asia-Pacific presents strong opportunities for new entrants and existing players to establish localized hydrocolloid extraction and starch modification facilities. Countries such as China and India are experiencing rising vegan product launches, while government initiatives such as “Make in India” and “Made in China 2025” encourage domestic ingredient manufacturing.

Governance-Driven Sustainable Food Policies

European and North American sustainability policies are promoting plant-based food consumption to reduce carbon footprints. Public procurement programs in schools and institutions are incorporating plant-based dairy substitutes, indirectly boosting stabilizer demand at industrial scale.

Product Type Insights

Hydrocolloids continue to lead the global vegan cheese stabilizers market, accounting for approximately 48% of total revenue share in 2025. The dominance of this segment is primarily driven by their superior water-binding capacity, gel formation properties, and ability to replicate the stretch, firmness, and sliceability of conventional dairy cheese. Carrageenan and xanthan gum are extensively incorporated in mozzarella-style, block, and processed cheese analogs due to their strong gel strength, thermal stability, and moisture retention capabilities, which are essential for improving melt performance and structural integrity. The leading segment driver for hydrocolloids is their multifunctionality, as they simultaneously provide emulsification, viscosity control, and texture enhancement in cost-efficient formulations. Starches represent the second-largest product category, with modified tapioca and potato starches widely used for economical texturization and bulk formation in mass-market applications. Their ability to deliver elasticity and chewiness at a lower formulation cost supports adoption among large-scale manufacturers. Protein-based stabilizers, including pea and fava bean proteins, are witnessing accelerated adoption as brands aim to strengthen clean-label positioning and enhance nutritional value. These proteins contribute to improved structure while supporting high-protein claims, making them increasingly attractive in premium and health-focused vegan cheese formulations.

Form Insights

Powder stabilizers dominate the market with nearly 72% share in 2025, supported by their extended shelf life, ease of storage, and compatibility with automated dry blending systems used in industrial cheese production. The leading segment driver for powder formats is operational efficiency, as they enable precise dosing, consistent batch-to-batch quality, and reduced logistical costs during transportation and warehousing. Their stability under varying climatic conditions further strengthens their preference among global manufacturers. Liquid stabilizers remain limited to specialized and small-batch applications due to shorter shelf stability and higher storage requirements, although they provide advantages in rapid dispersion and simplified mixing in certain niche formulations.

Functionality Insights

Emulsification functionality leads the market with approximately 34% share, reflecting the critical importance of stable fat–water dispersion in achieving creamy mouthfeel and homogeneous texture in plant-based cheese. The leading driver for this segment is the need to replicate the smooth consistency and fat distribution of dairy cheese without phase separation during heating or storage. Texture enhancement and meltability control follow closely, particularly in shredded and pizza-style vegan cheese products where stretchability, browning behavior, and uniform melting performance are essential for consumer acceptance. Stabilizers that improve elasticity, firmness, and heat resistance continue to gain traction as manufacturers prioritize sensory parity with conventional cheese.

End-Use Insights

Industrial vegan cheese manufacturers account for approximately 61% of global stabilizer demand in 2025, supported by bulk procurement contracts, expanding production capacities, and rising private-label manufacturing. The leading driver for this segment is large-scale commercialization of plant-based cheese across retail chains, requiring consistent functional performance and cost optimization. Foodservice and quick-service restaurant chains represent the fastest-growing end-use segment, expanding at over 13% CAGR. Growth in this segment is fueled by global pizza consumption trends, menu diversification toward plant-based offerings, and partnerships between stabilizer suppliers and foodservice operators to develop customized meltable and stretchable cheese solutions.

| By Product Type | By Functionality | By Form | By Application (Cheese Type) | By End-Use | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global market share in 2025, with the United States contributing nearly 27% of total demand. Regional growth is driven by high vegan and flexitarian adoption rates, strong retail penetration of plant-based dairy alternatives, and advanced food processing infrastructure. The presence of established ingredient manufacturers and innovation-driven startups supports rapid product development and commercialization. Canada is experiencing steady growth due to expanding supermarket shelf space for plant-based cheese and increasing consumer awareness regarding lactose intolerance and sustainable diets. Rising investments in clean-label and non-GMO formulations further reinforce regional expansion.

Europe

Europe accounts for around 31% of global demand, led by Germany, the United Kingdom, and the Netherlands. Stringent sustainability regulations, carbon reduction initiatives, and strong consumer preference for clean-label ingredients are major growth drivers across the region. The expansion of private-label vegan cheese brands by leading supermarket chains has increased stabilizer consumption, particularly hydrocolloids and plant proteins. Growing demand for organic and allergen-free formulations, combined with supportive government policies promoting plant-based innovation, continues to accelerate market penetration across Western and Northern Europe.

Asia-Pacific

Asia-Pacific represents approximately 22% of the global market and is the fastest-growing region, expanding at over 14% CAGR. Growth is supported by rising urbanization, increasing disposable incomes, and expanding exposure to Western dietary patterns. China and Japan serve as key demand centers due to evolving foodservice industries and product innovation in plant-based dairy alternatives. India is emerging rapidly, driven by high lactose intolerance prevalence, a large vegetarian population, and growing startup activity in plant-based food manufacturing. Expanding e-commerce grocery platforms and improving cold chain infrastructure further facilitate regional adoption.

Latin America

Latin America holds roughly 7% market share, with Brazil and Mexico leading regional consumption. Market growth is supported by rising imports of plant-based food products, increasing domestic production capabilities, and growing health-conscious urban populations. Expanding modern retail channels and social media-driven awareness around vegan diets contribute to steady adoption. Although price sensitivity remains a constraint, localized production and cost-effective starch-based stabilizer formulations are helping improve market accessibility.

Middle East & Africa

The Middle East & Africa account for approximately 6% of global demand, with the United Arab Emirates and South Africa emerging as notable growth markets. Regional expansion is driven by premium retail development, rising expatriate populations, and increasing consumer awareness of plant-based nutrition. Growth in hospitality and foodservice sectors, particularly in metropolitan areas, supports demand for vegan cheese alternatives in quick-service and casual dining establishments. While the market remains in an early stage of adoption, investments in specialty food distribution networks and increasing availability of imported plant-based brands are expected to strengthen long-term growth prospects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plant-Based Cheese Stabilizers Market

- Cargill, Incorporated

- Ingredion Incorporated

- DuPont de Nemours, Inc.

- Kerry Group plc

- Tate & Lyle PLC

- CP Kelco

- DSM-Firmenich AG

- Ashland Inc.

- BASF SE

- Archer Daniels Midland Company

- Corbion N.V.

- Glanbia plc

- FMC Corporation

- Roquette Frères

- Palsgaard A/S