Pet Furniture Market Size

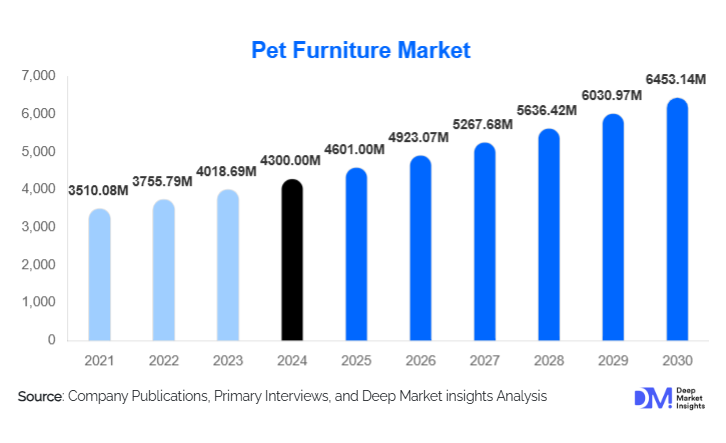

According to Deep Market Insights, the global pet furniture market size was valued at USD 4,300.00 million in 2024 and is projected to grow from USD 4,601.00 million in 2025 to reach USD 6,453.14 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The pet furniture market growth is driven by the rapid humanization of pets, rising disposable incomes, urban apartment living, and increasing consumer willingness to invest in comfort-oriented, aesthetically integrated furniture solutions for pets.

Key Market Insights

- Pet beds and sofas dominate the product landscape, accounting for the largest revenue share due to high replacement frequency and comfort-driven purchases.

- Dog furniture remains the largest pet-type segment, supported by higher dog ownership and larger furniture size requirements.

- Online retail channels are reshaping market access, driven by direct-to-consumer models, customization, and expanding e-commerce logistics.

- North America leads the global market, supported by high per-capita pet spending and premium product adoption.

- Asia-Pacific is the fastest-growing region, fueled by rising urban pet ownership in China and India.

- Sustainability and eco-friendly materials are emerging as critical differentiators for premium brands.

What are the latest trends in the pet furniture market?

Premiumization and Home Décor Integration

Pet furniture is increasingly designed to blend seamlessly with modern home interiors. Consumers are seeking furniture that complements interior décor styles such as minimalist, Scandinavian, and contemporary aesthetics. This trend has led to rising demand for designer pet sofas, wooden pet cabinets, and modular furniture that doubles as storage or seating. Premium products featuring orthopedic foam, solid wood, and luxury fabrics are gaining traction, particularly among urban households and high-income pet owners.

Sustainable and Eco-Friendly Materials

Sustainability is becoming a core purchasing criterion. Manufacturers are introducing pet furniture made from bamboo, recycled plastics, FSC-certified wood, and non-toxic finishes. Eco-labeling, carbon footprint disclosures, and sustainable sourcing are increasingly influencing buying decisions, especially in Europe and North America. This trend is also supported by regulatory pressure on manufacturers to reduce environmental impact and improve material traceability.

What are the key drivers in the pet furniture market?

Humanization of Pets

Pets are increasingly regarded as family members, driving demand for furniture that prioritizes comfort, health, and emotional well-being. Orthopedic beds, climate-adaptive cushions, and ergonomically designed furniture are witnessing strong adoption. This behavioral shift has significantly increased average spending per pet, especially in developed economies.

Urbanization and Smaller Living Spaces

Rising urbanization and compact housing are boosting demand for space-efficient and multifunctional pet furniture. Products that integrate feeding stations, storage, and sleeping areas are particularly popular among apartment dwellers. This driver is especially strong in Asia-Pacific and Europe, where urban living dominates residential patterns.

What are the restraints for the global market?

Price Sensitivity in Emerging Economies

While premium pet furniture is growing rapidly, high price points limit adoption in developing regions. Cost-conscious consumers often prefer basic pet accessories over furniture, constraining market penetration in lower-income markets.

Raw Material Price Volatility

Fluctuations in the prices of wood, foam, metals, and textiles impact manufacturing costs and profit margins. These variations often result in frequent price adjustments, affecting demand stability and long-term supplier contracts.

What are the key opportunities in the pet furniture industry?

Expansion in Emerging Markets

Asia-Pacific, Latin America, and the Middle East present significant growth opportunities due to rising pet adoption and growing middle-class income. Localized manufacturing and affordable mid-range products can help brands penetrate these markets more effectively.

Smart and Modular Pet Furniture

Technology-integrated furniture, such as temperature-controlled beds, modular units, and space-saving designs, offers new growth avenues. These innovations appeal to tech-savvy and urban consumers seeking convenience and functionality.

Product Type Insights

Pet beds and sofas dominate the global pet furniture market, accounting for approximately 34% of total revenue in 2024. This segment’s leadership is primarily driven by high replacement frequency, as pet beds experience faster wear due to daily usage, hygiene concerns, and pet growth cycles. Continuous innovation in orthopedic support, memory foam layering, temperature-regulating fabrics, and washable materials has further strengthened demand. In addition, rising awareness of pet joint health and comfort—particularly for aging dogs—has positioned premium and orthopedic beds as essential purchases rather than discretionary items.

Cat trees and condos represent a strong secondary segment, supported by the rapid increase in indoor cat ownership, especially in urban households. These products address cats’ natural climbing, scratching, and territorial behaviors, making them functionally indispensable. Growth in this segment is further fueled by vertical space utilization trends, as apartment dwellers seek furniture that maximizes usable space without increasing floor footprint.

Pet Type Insights

Dog furniture leads the global market with nearly 52% share in 2024, reflecting higher global dog ownership rates and the need for larger, more durable furniture. Dogs typically require beds, sofas, and houses that can withstand higher weight loads and frequent movement, increasing average selling prices and overall market value. The segment is further supported by growing demand for orthopedic and breed-specific furniture tailored to large and senior dogs.

Cat furniture follows as the second-largest segment, driven by the increasing popularity of indoor cats, particularly in urban and high-density residential environments. Demand for cat trees, condos, and wall-mounted structures is accelerating as owners seek to support feline behavioral enrichment while optimizing indoor space. The emphasis on vertical furniture solutions is a key differentiator driving sustained growth in this segment.

Material Insights

Fabric and foam-based furniture holds the largest share of the market at approximately 38%, owing to its affordability, comfort, and wide product availability across price ranges. Memory foam, microfiber, and plush fabrics dominate this category, particularly in pet beds and sofas, where comfort and thermal insulation are key purchasing factors. Easy-to-clean and machine-washable designs further support adoption among hygiene-conscious consumers.

Wood-based pet furniture is gaining traction in the premium and luxury segments, driven by demand for aesthetically refined products that blend seamlessly with home décor. Solid wood and engineered wood furniture are particularly popular in North America and Europe, where consumers prioritize durability, design, and long-term value.

Distribution Channel Insights

Online retail channels account for approximately 41% of global pet furniture sales, supported by the rapid expansion of e-commerce marketplaces and direct-to-consumer (DTC) brand platforms. Online channels enable wider product selection, customization options, transparent pricing, and doorstep delivery for bulky items, significantly improving purchase convenience. Digital marketing, influencer promotions, and social media-driven discovery further strengthen online sales growth.

Offline retail remains strategically important, particularly for premium and customized pet furniture. Specialty pet stores, furniture outlets, and experiential retail formats allow consumers to assess product size, material quality, and comfort firsthand. Offline channels continue to dominate in high-end purchases and commercial end-use segments such as pet hotels and veterinary facilities.

| By Product Type | By Pet Type | By Material Type | By Price Range | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global pet furniture market with nearly 38% share in 2024, driven by high pet ownership rates, strong humanization trends, and elevated per-capita pet spending. The United States alone contributes approximately 30% of global demand, supported by widespread adoption of premium and orthopedic pet furniture. Advanced e-commerce infrastructure, high penetration of DTC brands, and a strong culture of home décor spending further reinforce regional dominance. Rising demand for sustainable and designer pet furniture is also shaping product innovation in this region.

Europe

Europe accounts for around 28% of the global market, led by Germany, the U.K., and France. Growth is driven by stringent sustainability regulations, strong consumer preference for eco-friendly materials, and increasing demand for space-efficient furniture in urban housing. European consumers demonstrate a high willingness to pay for durable, design-oriented products, supporting premium segment expansion. The region also benefits from well-established specialty retail networks and strong cross-border e-commerce penetration.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR exceeding 11%. China and India are primary growth engines, supported by rapid urbanization, rising disposable incomes, and a sharp increase in first-time pet ownership. Smaller living spaces in major cities are driving demand for compact and multifunctional pet furniture. Additionally, the region’s role as a global manufacturing hub enables cost-efficient production and export-led growth, further strengthening market expansion.

Latin America

Latin America represents an emerging market, with Brazil and Mexico leading regional demand. Growth is driven by expanding middle-class populations, increasing pet adoption, and rising awareness of pet wellness. While price sensitivity remains a constraint, demand for mid-range and locally manufactured pet furniture is growing steadily. E-commerce adoption is improving market accessibility across urban centers.

Middle East & Africa

The Middle East and Africa show growing potential, led by the UAE and South Africa. Rising expatriate populations, premium pet ownership, and increasing disposable incomes are key growth drivers. Demand is skewed toward premium and imported pet furniture, particularly in the Gulf countries, while South Africa benefits from a well-established pet care ecosystem and growing urban pet populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Furniture Market

- Petmate

- MidWest Homes for Pets

- Ware Pet Products

- Go Pet Club

- North States Industries

- Furhaven Pet Products

- K&H Pet Products

- Trixie Pet Products

- Armarkat

- New Age Pet

- PetPals Group

- PawHut

- Veehoo

- Petsfit

- Molly and Friends