Luxury Fabric Market Size

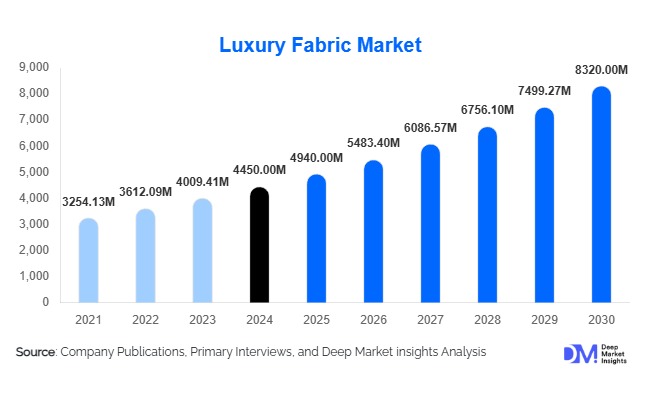

According to Deep Market Insights, the global luxury fabric market size was valued at USD 4,450.00 million in 2024 and is projected to grow from USD 4,940.00 million in 2025 to reach USD 8,320.00 million by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The luxury fabric market growth is primarily driven by rising demand for high-end interior furnishings, increasing premiumisation of residential and commercial spaces, and growing consumer preference for bespoke and sustainable luxury textiles across global markets.

Key Market Insights

- Europe remains the largest market, accounting for 30–35% of global luxury fabric sales in 2024, supported by heritage textile manufacturing in Italy, France, and the U.K.

- Asia-Pacific is the fastest-growing region, fueled by surging affluence, luxury real estate development, and hospitality expansion in China, India, and Southeast Asia.

- Interior luxury fabrics dominate the market, representing approximately 60% of global demand in 2024, driven by high-end upholstery and curtain applications.

- Silk continues to lead by raw material type, holding a 25–30% share of the total market value due to its premium aesthetic and historic luxury status.

- Offline channels account for nearly two-thirds of global revenue, although online bespoke and B2B luxury fabric platforms are rapidly emerging.

- Innovation and sustainability, including eco-certified fibres, traceable sourcing, and smart textile finishes, are reshaping competitive strategies among luxury mills.

Latest Market Trends

Sustainable and Traceable Luxury Fabrics

Manufacturers are increasingly prioritizing sustainable sourcing and production transparency. Organic silk, ethically sourced cashmere, and recycled luxury blends are gaining traction as eco-conscious consumers demand traceability and environmental responsibility. Heritage mills are introducing carbon-neutral production lines and investing in certification programs such as OEKO-TEX® and GOTS to enhance brand credibility. This transition toward “conscious luxury” is redefining the market narrative, merging craftsmanship with environmental stewardship and driving long-term brand differentiation.

Smart and Performance Luxury Textiles

Luxury fabrics are integrating advanced functionalities such as UV resistance, anti-stain coatings, temperature regulation, and antimicrobial properties. These innovations cater to the hospitality and automotive sectors where durability meets aesthetics. Smart textiles with embedded sensors or self-cleaning properties are emerging in premium interiors and luxury outdoor furnishings. The blend of technology with tactile luxury materials like silk and velvet is unlocking new premium categories and elevating perceived value.

Luxury Fabric Market Drivers

Premiumisation of Interiors and Lifestyle Spaces

The global emphasis on personalized, design-forward living spaces has significantly boosted luxury fabric consumption. High-net-worth homeowners are investing in bespoke upholstery, drapery, and bedding that reflect exclusivity and craftsmanship. Interior designers and boutique hotels increasingly specify luxury-grade fabrics, driving steady growth in both residential and commercial segments.

Expansion of Luxury Hospitality and Mobility Interiors

Luxury hotels, resorts, and premium automotive brands are incorporating high-end fabrics to elevate guest and customer experiences. Upholstery, curtains, and décor textiles crafted from silk, velvet, and jacquard are now standard in premium interiors. The rapid growth of luxury hospitality developments across the Middle East and Asia-Pacific has amplified fabric demand, while private aviation and yacht interiors represent emerging high-margin verticals.

Digital Access and Global Supply Chain Integration

Digitization has revolutionized how luxury fabrics are marketed and distributed. Virtual showrooms, 3D texture previews, and global B2B e-commerce portals are enabling international clients to explore collections remotely. This increased accessibility has expanded the total addressable market, allowing boutique mills to compete globally and designers to source exclusive fabrics seamlessly.

Market Restraints

High Production and Material Costs

Luxury fabrics depend on rare fibres like cashmere, vicuña, and mulberry silk, leading to high raw material costs. Low-volume, high-quality production adds to pricing pressures, limiting affordability for mid-tier customers and compressing manufacturer margins when costs spike. The niche scale of operations further constrains economies of scale.

Supply Chain and Regulatory Complexities

As sustainability regulations tighten, luxury fabric producers face challenges meeting environmental compliance, ethical labour standards, and traceability mandates. Balancing exclusivity with transparent sourcing and certified eco-production remains a costly and complex task that can hinder expansion, particularly for smaller mills.

Luxury Fabric Market Opportunities

Expansion into Emerging Luxury Hubs

Rapid urbanization and wealth creation in the Asia-Pacific and the Middle East are creating strong demand for premium interiors. Countries like India, China, and the UAE are witnessing a surge in luxury hospitality and real estate projects, offering untapped markets for fabric brands. Establishing regional design studios and partnerships with local designers presents substantial growth potential.

Smart and Sustainable Fabric Innovation

Investment in eco-friendly materials and smart finishes can differentiate brands. Incorporating traceable supply chains, biodegradable coatings, and performance features like stain resistance and temperature regulation appeals to both hospitality and residential buyers. Sustainable luxury is expected to command higher premiums, especially among millennial and Gen Z consumers.

Diversification into High-Value Verticals

Luxury automotive, private aviation, and yacht interiors represent lucrative growth avenues. These industries require superior textiles with aesthetic refinement and functional durability. Fabric manufacturers that develop specialized product lines for these applications can unlock steady demand and secure long-term OEM contracts.

Product Type Insights

Interior luxury fabrics dominate the global luxury fabric market, accounting for nearly 60% of total demand in 2024. This dominance is underpinned by the surge in home renovation, interior refurbishment, and premium décor spending across both developed and emerging markets. Consumers are increasingly investing in bespoke upholstery, high-end drapery, and artisan-made decorative textiles that reflect personalized aesthetics and sustainable craftsmanship. The segment benefits from the expansion of interior design studios and architectural firms focusing on experiential spaces that emphasize texture, tactility, and comfort.

By fiber type, silk fabrics lead the market with a 25–30% revenue share, owing to their unparalleled sheen, softness, and cultural association with luxury. Velvet continues to gain traction due to its contemporary reintroduction in furniture and fashion, while cashmere and fine cotton blends cater to both comfort and exclusivity in premium interiors. The integration of technological finishes such as stain resistance, anti-crease coatings, and smart textiles with thermal adaptability enhances the value proposition of luxury fabrics. Moreover, bespoke design and customization services are redefining trade value in the high-end textile segment, enabling global designers and consumers to co-create exclusive collections.

Application Insights

The residential interiors segment remains the largest application area, capturing approximately 50% of global market revenue in 2024. The steady rise in luxury real estate projects, smart home integration, and consumer preference for aesthetic personalization continues to drive growth. Designers and developers are increasingly specifying premium fabrics for curtains, wall panels, and upholstery to elevate living spaces, particularly in urban high-income households.

The hospitality and commercial interiors segment is the second-largest contributor, propelled by investments from luxury hotels, resorts, and boutique offices seeking distinct textile identities. From artisanal drapery to acoustically engineered wall coverings, luxury fabrics are enhancing brand experience in premium hospitality chains worldwide. Meanwhile, mobility interiors, including high-end automobiles, private yachts, and aviation cabins, represent a niche but rapidly expanding application. This segment is projected to witness the fastest CAGR through 2030, driven by a surge in automotive luxury branding, private aviation refurbishments, and yacht interior customization.

Distribution Channel Insights

Offline showrooms and design studios continue to dominate distribution, representing nearly 65% of global luxury fabric sales. The tactile nature of fabric selection, where texture, drape, and color must be physically assessed, keeps traditional channels vital. Leading fabric houses operate flagship showrooms in design capitals such as Milan, Paris, London, and New York, catering to designers, architects, and institutional buyers.

However, online channels are expanding at double-digit growth rates, transforming the sourcing landscape. The adoption of AI-driven visualization tools, 3D texture simulations, and digital swatch catalogs allows consumers and professionals to preview designs remotely. Direct-to-consumer luxury e-commerce and B2B sourcing platforms are bridging geographic barriers, enabling global mills to reach clients in new regions. Online trade integration is also facilitating real-time collaboration between suppliers and designers, reducing procurement cycles and expanding accessibility for boutique brands.

End-Use Industry Insights

The residential sector accounts for over 50% of the luxury fabric market, reflecting strong consumer spending on high-end home furnishing and interior customization. Rising disposable income and lifestyle upgrades in urban centers across North America, Europe, and Asia are fueling demand for unique textile aesthetics that complement architectural design trends.

The commercial sector, encompassing luxury hospitality, retail, and premium office spaces, is witnessing accelerating growth, particularly in Asia-Pacific and the Middle East. Luxury fabric suppliers are increasingly partnering with hotel chains and developers to deliver fire-retardant, sustainable, and acoustically optimized textiles that meet international standards. Additionally, export-driven opportunities from European and Indian mills supplying global fashion houses and interior studios are strengthening the supply chain. While automotive and aviation applications remain niche, their high margins and custom-engineered material requirements ensure steady expansion within the ultra-luxury mobility category.

| By Fabric Type | By Application | By Distribution Channel | By End Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents a mature yet resilient luxury fabric market, characterized by robust residential renovation activity and high per-capita spending on home décor. The U.S. and Canada lead regional demand, with prominent growth driven by the premium furniture and interior design sectors. Growing sustainability awareness is accelerating the adoption of eco-certified and recycled luxury fabrics. Urban centers such as New York, Los Angeles, and Toronto are witnessing demand from architects and luxury developers emphasizing locally crafted, environmentally responsible textiles. Additionally, the region’s flourishing hospitality refurbishments and boutique hotel expansions are providing consistent commercial demand for designer-grade fabrics.

Europe

Europe remains the world’s largest regional market, capturing approximately 30–35% of global luxury fabric revenues in 2024. The region’s leadership is supported by its deep-rooted textile heritage, luxury fashion ecosystem, and established manufacturing bases in Italy, France, and the United Kingdom. Italian mills dominate exports through high-end silk and wool fabrics, while France continues to lead in couture textiles and heritage weaving. Demand is driven by the integration of the luxury fashion and interior design industries, with designers increasingly emphasizing artisanal craftsmanship and sustainable material sourcing. Eastern Europe, particularly Poland and the Czech Republic, is emerging as a cost-effective manufacturing hub, supported by growing hospitality investments and industrial modernization initiatives.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for 20–25% of global market share in 2024. Countries such as China and India are driving growth through expanding urban luxury housing, high-rise developments, and a surging appetite for premium fabrics among affluent consumers. The region’s manufacturing competitiveness is enhanced by abundant raw materials and cost efficiencies, making it both a consumption and export powerhouse. Japan and South Korea continue to sustain strong demand from their high-end fashion and textile design industries, while Southeast Asia, particularly Vietnam, Thailand, and Indonesia, is emerging as a regional production and re-export hub. Government incentives promoting textile modernization, digital weaving, and sustainability certifications are further accelerating regional competitiveness.

Middle East & Africa

The Middle East is witnessing rapid expansion in the luxury fabric sector, led by large-scale hospitality, residential, and commercial development projects in the UAE, Saudi Arabia, and Qatar. Growing tourism, urban transformation projects such as NEOM and Expo City, and a culture of interior luxury are key growth enablers. Regional consumers exhibit a strong preference for opulent materials such as velvet, silk, and metallic jacquards, reflecting cultural affinities for grandeur and exclusivity. Africa’s luxury fabric segment remains smaller but is evolving, with South Africa emerging as a hub for design and export-led trade into neighboring economies. Expanding retail infrastructure and rising middle-class affluence are creating new consumption bases across key African cities.

Latin America

Latin America currently holds a modest share of the global market, led by Brazil and Mexico. However, steady growth is expected as regional economies stabilize and investments in luxury residential and hospitality projects accelerate. Rising participation in global design networks and the proliferation of high-end resorts and branded residences are stimulating textile imports from European and Asian suppliers. Local craftsmanship initiatives and designer collaborations in Brazil and Colombia are also fostering regional differentiation in luxury textile aesthetics, setting the stage for future market maturity.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Fabric Market

- Loro Piana

- Ermenegildo Zegna Group

- Holland & Sherry

- Scabal

- Dormeuil

- Vitale Barberis Canonico

- Reda 1865

- Huddersfield Fine Worsted

- Marzotto Group

- Kravet Inc.

- Sanderson Design Group

- The Romo Group

- Pierre Frey

- Sattler Group (SUN-TEX)

- De Le Cuona

Recent Developments

- In April 2025, Loro Piana announced an expansion of its sustainable fabric portfolio using traceable organic silk and carbon-neutral production processes.

- In March 2025, Ermenegildo Zegna Group invested in advanced digital weaving facilities in Italy to enhance custom luxury textile output.

- In February 2025, Holland & Sherry launched a new smart-fabric line for luxury interiors, integrating UV and stain-resistant coatings for hospitality applications.