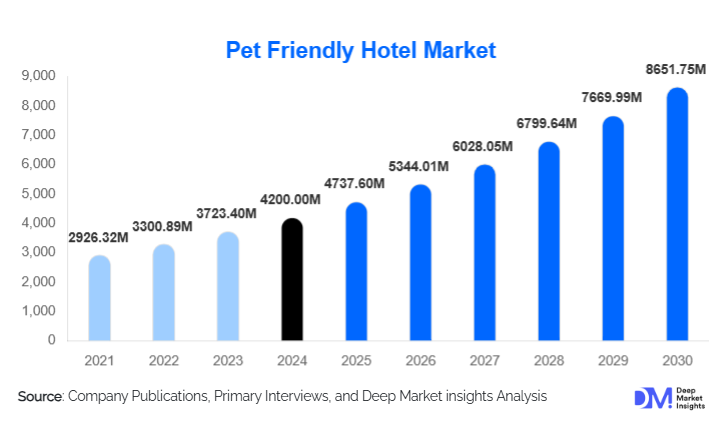

Pet-Friendly Hotel Market Size

According to Deep Market Insights, the global pet-friendly hotel market size was valued at USD 4,200.00 million in 2024 and is projected to grow from USD 4,737.60 million in 2025 to reach USD 8,651.75 million by 2030, expanding at a CAGR of 12.8% during the forecast period (2025–2030). The pet-friendly hotel market growth is primarily driven by rising pet ownership, the humanization of pets, increasing demand for experiential and lifestyle-focused travel, and the expansion of premium pet-inclusive services across global hotels.

Key Market Insights

- Luxury and midscale hotels are increasingly incorporating specialized pet services, including in-room pet facilities, grooming, daycare, and veterinary partnerships, to attract high-spending pet owners.

- Millennials and Gen Z are leading demand for pet-inclusive travel, prioritizing convenience, lifestyle experiences, and digital booking platforms that highlight pet-friendly options.

- North America dominates the pet-friendly hotel market, with the U.S. and Canada accounting for a significant share of demand due to high pet ownership and supportive regulations.

- Asia-Pacific is the fastest-growing region, driven by rising pet adoption, increasing disposable income, and a growing middle-class travel population in China, India, and Japan.

- Technological integration in booking platforms, mobile apps, and IoT-enabled pet services is enhancing customer experience and enabling personalized pet-friendly stays.

- Europe remains a strong market with high demand for sustainable, eco-friendly pet accommodations and wellness-focused pet services.

What are the latest trends in the pet-friendly hotel market?

Rise of Personalized In-Room Pet Amenities

Hotels are increasingly offering in-room pet facilities such as beds, toys, food, and water bowls, and smart monitoring devices. This trend caters to travelers who view pets as family members and prefer privacy and comfort for their pets. Luxury hotels are introducing curated services such as pet spa treatments, organic meals, and specialized grooming, creating differentiation in a competitive market. Midscale and budget hotels are also adopting cost-effective in-room solutions to capture a wider demographic.

Integration of Technology for Pet Services

Mobile apps and AI-powered platforms now allow travelers to pre-book pet-friendly rooms, schedule grooming, track pet activities during their stay, and order in-room pet meals. Hotels are using technology to enhance service delivery, such as automated check-ins for pets, smart feeding stations, and IoT-enabled climate control for pet comfort. Online travel agencies (OTAs) prominently feature pet-friendly filters, further simplifying booking and improving visibility for hotels targeting pet owners.

What are the key drivers in the pet-friendly hotel market?

Increasing Global Pet Ownership

Pet ownership continues to rise worldwide, particularly in North America, Europe, and APAC urban centers. Approximately 70% of U.S. households own pets, creating a steady demand for accommodations that cater to pets. Families and millennials are the key demographic driving demand for hotels that integrate pet amenities into their stay, resulting in increased occupancy rates and premium pricing opportunities.

Shift Towards Experiential and Lifestyle Travel

Modern travelers prioritize experiences and lifestyle alignment over traditional accommodation options. Pet-friendly hotels offer unique vacation experiences, combining comfort for both humans and pets. This includes pet-inclusive outdoor activities, on-site daycare, and wellness-focused pet services. Experiential travel trends have led to higher average daily rates (ADR) for hotels offering comprehensive pet services.

Growth of Online Booking and Travel Platforms

Online travel agencies and hotel booking websites are increasingly highlighting pet-friendly properties, increasing visibility and convenience. This trend has expanded the customer base, particularly among millennials and Gen Z, who prefer digital-first, hassle-free booking experiences. Digital marketing campaigns emphasizing pet-inclusive travel have further enhanced market penetration.

What are the restraints for the global market?

High Operational and Maintenance Costs

Providing pet-friendly services, such as in-room amenities, grooming, daycare, and veterinary care, increases operational costs for hotels. Smaller or budget hotels may find these costs prohibitive, limiting their ability to enter the market. Maintaining hygiene and preventing property damage from pets further adds to operational challenges.

Regulatory and Liability Concerns

Hotels must comply with local regulations related to animal welfare, health, and hygiene. Liability risks associated with pet behavior, injuries, or property damage can deter expansion. Compliance costs, coupled with insurance requirements, pose significant challenges, especially in regions with strict pet regulations.

What are the key opportunities in the pet-friendly hotel industry?

Emerging Markets in Asia-Pacific and LATAM

Countries like China, India, and Brazil present significant opportunities due to increasing pet adoption, urbanization, and disposable income growth. Hotels entering these regions can gain first-mover advantages by offering tailored pet services, culturally relevant amenities, and partnerships with local veterinary providers. Government initiatives promoting domestic tourism and pet welfare also support expansion.

Technology-Enhanced Pet Experiences

Hotels can leverage AI, IoT, and mobile apps to offer personalized pet services such as remote monitoring, meal customization, and activity scheduling. Technology not only improves customer experience but also generates new revenue streams through premium offerings and loyalty programs. Digital booking platforms are critical to reaching tech-savvy millennials and Gen Z pet owners.

Collaborations with Pet Care and Wellness Brands

Partnerships with pet food brands, grooming services, and veterinary clinics enhance credibility and add value for guests. Luxury hotels benefit from collaborations with premium pet wellness brands, while midscale hotels can offer cost-effective grooming and healthcare services. Sustainability-focused pet initiatives, such as organic food or eco-friendly waste management, further strengthen brand differentiation.

Product Type Insights

Luxury hotels dominate the global pet-friendly hotel market, capturing the largest share by offering comprehensive in-room amenities, personalized pet care services, and access to on-site grooming, daycare, and veterinary support. The luxury segment’s growth is primarily driven by rising disposable income among high-net-worth individuals and the increasing preference for experiential, lifestyle-oriented travel that includes pets as family members. Midscale hotels cater to travelers seeking convenience, comfort, and affordability, often providing essential pet facilities, partnerships with local pet service providers, and access to nearby veterinary and grooming services. The midscale segment is expanding due to growing demand from millennial and Gen Z travelers who prioritize functional pet-friendly accommodations without premium pricing. Budget hotels are also increasing their offerings to attract younger travelers and budget-conscious families, providing basic in-room pet amenities while maintaining low operational costs. Resorts and vacation rentals are integrating full-service pet facilities, including outdoor play areas, pet-sitting services, and extended-stay packages, appealing to families and travelers seeking longer stays. The adoption of technology-enabled services, such as smart feeding stations and in-app pet concierge services, is further driving differentiation across accommodation types.

Application Insights

Leisure travel represents the largest application segment, accounting for approximately 55% of market demand. This includes domestic vacations, family trips, weekend getaways, and multi-day stays where travelers seek integrated pet-friendly services. Business travel with pets is emerging as a niche yet growing application, driven by increasing acceptance of pet-inclusive corporate policies and lifestyle-oriented executives. New applications include extended-stay pet-friendly rentals, wellness retreats for pets and owners, and corporate tie-ups that accommodate traveling employees with pets. Ancillary demand is further bolstered by the growth of premium pet food, pet wellness products, and in-hotel pet services, creating cross-selling opportunities for hotels. Hotels that integrate lifestyle, wellness, and pet-inclusive experiences are positioned to capture a broader customer base and increase average daily rates (ADR).

Distribution Channel Insights

Online travel agencies (OTAs) dominate the booking landscape, offering convenience, filters for pet-friendly accommodations, real-time availability, and transparent pricing. Direct bookings through hotel websites are rising as properties enhance digital presence, invest in user-friendly booking platforms, and offer loyalty programs tailored to pet owners. Specialized travel agents focusing on pet-inclusive packages also capture high-value customers seeking curated experiences. Social media marketing and influencer promotions are playing an increasingly important role in shaping consumer choices, especially among millennials and Gen Z travelers who rely heavily on online reviews and social recommendations when selecting pet-friendly accommodations. Integration of AI and personalized recommendations in booking platforms further enhances conversion rates and guest satisfaction.

Traveler Type Insights

Family travelers constitute the largest segment, seeking child-friendly and pet-inclusive accommodations with recreational activities, daycare, and multi-generational facilities. Millennials and Gen Z travelers are fueling growth in midscale and budget segments, prioritizing convenience, online booking, and lifestyle experiences that include pets. Solo travelers typically prefer budget or midscale hotels with efficient pet services, while couples and high-income individuals gravitate toward luxury hotels offering personalized services and premium amenities. Each traveler type influences hotel service design, marketing strategies, and pricing models, emphasizing the need for segmentation and tailored offerings.

Age Group Insights

Travelers aged 31–50 represent the largest demographic in the pet-friendly hotel market, combining high disposable income with demand for experiential travel. The 18–30 age group is driving growth in budget and midscale segments, leveraging online platforms and mobile booking apps. Travelers aged 51–65 often prefer wellness-oriented, comfort-focused accommodations with reliable pet care services. High-net-worth travelers above 65 represent a niche but high-value segment seeking secure, accessible, and fully serviced pet-inclusive stays, particularly in luxury resorts and vacation rentals. The age-based demand distribution directly influences pricing, amenity offerings, and marketing communications.

| By Product Type | By Application | By Distribution Channel | By Traveler Type | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (45%) due to a high rate of pet ownership, supportive regulatory frameworks, and a deeply ingrained culture of pet humanization. The U.S. and Canada lead demand for luxury and midscale pet-friendly hotels, particularly in urban centers, tourist hotspots, and coastal vacation destinations. Drivers of regional growth include rising disposable income, lifestyle travel trends, advanced pet welfare legislation, and extensive digital infrastructure for online booking. North American travelers also demonstrate strong demand for premium services such as in-room pet amenities, pet daycare, and on-site grooming, encouraging hotels to continually upgrade facilities and technology-enabled services.

Europe

Europe accounts for 25% of the market, with the U.K., Germany, and France leading demand. Growth is fueled by stringent animal welfare regulations, high environmental and sustainability awareness, and strong consumer preference for wellness-oriented travel. Luxury pet-friendly hotels are particularly popular, offering eco-friendly amenities, organic pet meals, and spa or grooming services. Midscale hotels also thrive by offering practical, convenient services at competitive pricing for younger and urban demographics. Technological adoption, including online booking platforms with detailed pet-service filters, and social media-driven marketing, are key driver of regional expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region (CAGR 9%), led by China, India, Japan, and Australia. Regional growth is primarily driven by rising pet adoption, increasing disposable income, and growing exposure to Western travel trends and lifestyle preferences. Luxury and midscale hotels are expanding pet-inclusive offerings, including in-room services, grooming, and pet concierge solutions, to capture emerging affluent and urban middle-class consumers. Additional drivers include increasing domestic tourism, social media influence, and a growing culture of experiential and wellness travel that integrates pets. Urbanization and rising awareness of animal welfare are also contributing to market adoption.

Latin America

Latin America is gradually adopting pet-friendly accommodations, with Brazil, Mexico, and Argentina emerging as key markets. Growth is driven by affluent travelers seeking luxury pet-inclusive stays, midscale options for family travel, and outbound tourism to North America and Europe. Increasing urbanization, rising disposable income, and exposure to global travel trends are promoting demand. Hotels that integrate pet wellness services, daycare, and family-friendly amenities are expected to capture higher market share. Tourism policies supporting domestic travel also indirectly stimulate demand.

Middle East & Africa

Luxury pet-friendly hotels are expanding in the UAE, Saudi Arabia, and Qatar, supported by high-income populations, growing tourism infrastructure, and cultural acceptance of pets. In Africa, the emerging pet-travel market is concentrated in luxury resorts catering to international tourists and domestic high-net-worth travelers. Drivers include increasing urbanization, government tourism initiatives, investment in hospitality infrastructure, and rising inbound tourism from Europe and the Middle East. Luxury offerings, including in-room pet amenities, grooming, and specialized pet concierge services, are particularly attractive to high-spending travelers, fostering regional market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet-Friendly Hotel Market

- Marriott International

- Hilton Worldwide

- Hyatt Hotels Corporation

- InterContinental Hotels Group

- Accor

- Four Seasons Hotels & Resorts

- Shangri-La Hotels & Resorts

- Radisson Hotel Group

- Wyndham Hotels & Resorts

- Mandarin Oriental Hotel Group

- The Ritz-Carlton

- Fairmont Hotels & Resorts

- Kempinski Hotels

- Loews Hotels

- Best Western International