Pet Fitness Care Market Size

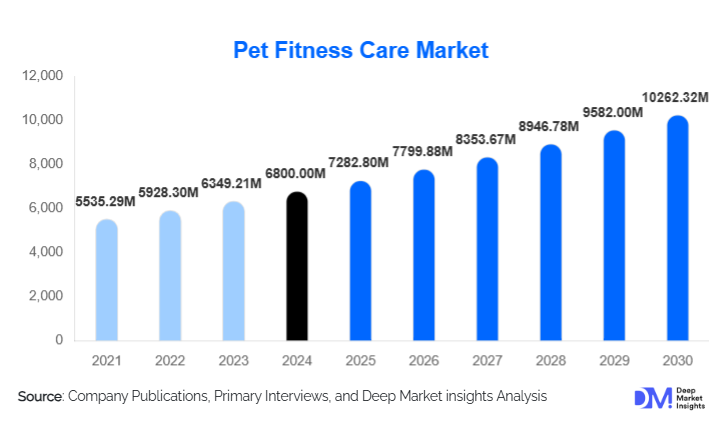

According to Deep Market Insights, the global pet fitness care market size was valued at USD 6,800.00 million in 2024 and is projected to grow from USD 7,282.80 million in 2025 to reach USD 10,262.32 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The pet fitness care market growth is primarily driven by rising pet humanization, increasing prevalence of pet obesity and lifestyle-related health issues, growing awareness of preventive animal healthcare, and rapid adoption of smart wearable technologies for pets.

Key Market Insights

- Pet fitness care is shifting from discretionary spending to preventive healthcare, with owners increasingly viewing exercise and activity monitoring as essential for pet longevity.

- Wearable fitness and health monitoring devices dominate product innovation, driven by advancements in IoT, AI, and mobile health analytics.

- North America leads the global market, supported by high pet ownership rates, premium spending behavior, and advanced veterinary infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable income, and increasing adoption of companion animals.

- Online and direct-to-consumer channels are reshaping distribution, enabling personalized engagement, subscription models, and recurring revenue streams.

- Veterinary-led fitness and rehabilitation programs are emerging as a high-margin growth segment within the market.

What are the latest trends in the pet fitness care market?

Smart Wearables and Connected Fitness Ecosystems

The pet fitness care market is witnessing rapid adoption of smart collars, activity trackers, and biometric monitoring devices. These products enable real-time tracking of steps, heart rate, sleep patterns, calorie expenditure, and behavioral changes. Integration with mobile applications and cloud-based analytics platforms allows pet owners and veterinarians to monitor long-term health trends and intervene early. Subscription-based analytics services and AI-driven insights are becoming a core revenue stream for manufacturers, transforming pet fitness from a one-time purchase into an ongoing service model.

Preventive Rehabilitation and Therapy Solutions

There is growing emphasis on physical therapy, mobility enhancement, and post-operative rehabilitation for aging pets and animals recovering from injuries. Hydrotherapy systems, muscle recovery tools, and balance training equipment are increasingly used in veterinary clinics and specialized rehabilitation centers. This trend is supported by rising awareness of joint disorders, arthritis, and obesity-related mobility issues in pets, particularly dogs. As veterinary medicine advances, fitness and rehabilitation equipment are becoming integral components of holistic pet healthcare.

What are the key drivers in the pet fitness care market?

Rising Pet Obesity and Lifestyle-Related Health Issues

Increasing urban lifestyles, reduced outdoor activity, and overfeeding have led to a significant rise in obesity among companion animals. This has heightened awareness among pet owners about the importance of structured exercise and activity monitoring. Pet fitness products are increasingly positioned as preventive healthcare solutions, helping reduce long-term veterinary costs while improving the quality of life for pets. Veterinary endorsements of fitness regimens further reinforce adoption.

Humanization of Pets and Premiumization of Pet Care

Pets are increasingly treated as family members, driving higher spending on premium health, wellness, and fitness solutions. Owners are willing to invest in advanced equipment, smart devices, and personalized fitness plans similar to human wellness routines. This emotional shift has significantly expanded the addressable market for pet fitness care products, particularly in developed economies.

Technological Advancements in Pet Health Monitoring

Advances in sensor technology, battery efficiency, and AI-driven analytics have enhanced the accuracy and usability of pet fitness devices. Seamless integration with smartphones and veterinary platforms has improved trust and usability, accelerating adoption across both household and professional end-use segments.

What are the restraints for the global market?

High Cost of Advanced Fitness and Wearable Devices

Premium fitness equipment and smart wearable devices remain relatively expensive, particularly in emerging economies. This limits adoption among price-sensitive consumers and restricts penetration beyond urban and high-income households. Maintenance costs and subscription fees further add to the total cost of ownership.

Lack of Standardization and Regulatory Clarity

The absence of standardized metrics for pet fitness and inconsistent regulatory oversight for wearable health devices pose challenges. Variability in data accuracy and limited clinical validation can reduce consumer trust, especially in veterinary-led applications. Regulatory fragmentation across regions also complicates product commercialization.

What are the key opportunities in the pet fitness care industry?

Veterinary-Integrated Fitness Programs

Integrating fitness monitoring and rehabilitation solutions into veterinary care presents a major opportunity. Clinics offering fitness assessments, weight management programs, and post-surgical rehabilitation services can drive recurring demand for professional-grade equipment and software platforms. Partnerships between device manufacturers and veterinary networks are expected to accelerate this trend.

Expansion in Emerging Urban Pet Markets

Rapid growth in pet ownership across Asia-Pacific, Latin America, and the Middle East offers untapped potential. Affordable, localized fitness products and mobile applications tailored to regional needs can significantly expand market reach. Governments promoting animal welfare and preventive healthcare further support long-term growth in these regions.

Product Type Insights

Wearable fitness and health monitoring devices dominate the global pet fitness care market, accounting for approximately 34% of total revenue in 2024. This segment leads primarily due to rising demand for continuous activity tracking, GPS-enabled location monitoring, biometric health indicators, and AI-driven behavioral analytics. Increasing integration of wearable devices with mobile applications and veterinary platforms has further strengthened adoption, enabling real-time health insights, preventive care, and early detection of lifestyle-related conditions such as obesity and cardiovascular issues.

Pet fitness equipment, including treadmills, interactive play systems, balance trainers, and agility tools, represents the second-largest product category. Growth in this segment is supported by the rising indoor pet population, particularly in urban households where outdoor activity is limited. Interactive and gamified fitness solutions are gaining traction as pet owners seek structured exercise alternatives that stimulate both physical activity and mental engagement.

Pet Type Insights

Dogs represent the largest pet type segment in the pet fitness care market, contributing nearly 62% of total revenue in 2024. This dominance is driven by dogs’ higher daily exercise requirements, greater susceptibility to obesity, and increasing incidence of joint, hip, and mobility-related conditions. Dog owners are more inclined to invest in structured fitness routines, wearable activity trackers, and rehabilitation programs, making this segment the primary revenue driver globally.

Cats account for a growing share of the market, supported by rising indoor living trends and increased awareness of feline obesity and inactivity-related health issues. Fitness solutions for cats, including interactive toys, motion-based play systems, and activity-tracking collars, are gaining popularity as owners seek to address sedentary lifestyles common among indoor cats. Other pets, including horses, rabbits, and select exotic animals, form a niche but high-value segment. These applications are largely concentrated in professional fitness, training, and rehabilitation settings. While lower in volume, this segment commands premium pricing due to specialized equipment requirements and professional end-use applications.

End-Use Insights

Households and individual pet owners constitute the largest end-use segment, accounting for approximately 48% of global demand in 2024. This segment’s leadership is driven by rising pet humanization, increased spending on preventive healthcare, and growing adoption of direct-to-consumer fitness and wearable products. Urban households, in particular, are investing in fitness solutions to compensate for reduced outdoor activity opportunities.

Veterinary clinics and animal hospitals represent the fastest-growing end-use segment. Growth is supported by increased focus on preventive care, weight management programs, post-operative rehabilitation, and senior pet wellness. Fitness and rehabilitation equipment is increasingly being incorporated into routine veterinary care, driving repeat purchases and long-term service contracts. Pet fitness centers, training facilities, and specialized therapy centers are emerging as niche but high-growth end-use categories. These facilities cater to premium customers seeking structured fitness programs, rehabilitation services, and professional supervision, particularly for aging or performance-oriented animals.

Distribution Channel Insights

Online distribution channels dominate the pet fitness care market, accounting for nearly 41% of total revenue in 2024. E-commerce platforms and direct-to-consumer (D2C) websites provide broad product accessibility, transparent pricing, and the ability to offer subscription-based services for data analytics, health monitoring, and personalized fitness plans. Digital marketing, influencer endorsements, and mobile-first purchasing behavior continue to accelerate online sales growth.

Offline channels, including pet specialty stores and veterinary clinics, remain critical for professional-grade equipment, rehabilitation tools, and high-trust product categories. Veterinary recommendations play a key role in influencing purchase decisions for higher-value fitness and therapy equipment, particularly among first-time buyers.

| By Product Type | By Pet Type | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 38% of the global pet fitness care market in 2024, with the United States alone contributing nearly 29%. Regional growth is driven by high pet ownership rates, high disposable income, advanced veterinary infrastructure, and widespread adoption of smart wearable technologies. Preventive pet healthcare is well established in the region, supported by insurance coverage, regular veterinary checkups, and high consumer awareness of obesity-related pet health risks. The presence of leading pet care brands and technology innovators further accelerates product penetration.

Europe

Europe represented around 26% of global market revenue, supported by strong animal welfare regulations and increasing emphasis on preventive healthcare. Countries such as Germany, the U.K., and France lead regional demand due to high veterinary standards, rising adoption of rehabilitation therapies, and strong consumer focus on pet wellness. Regulatory support for animal health, combined with growing demand for eco-friendly and ethically produced pet care products, continues to drive sustained market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of over 13%. Growth is fueled by rapid urbanization, rising middle-class incomes, increasing pet adoption, and expanding awareness of pet health and fitness. China and Japan lead demand for smart wearables and premium fitness solutions, while India and Southeast Asian countries are witnessing rising adoption of affordable fitness equipment and digital health applications. Improving veterinary infrastructure and the growing influence of Western pet care trends further support regional expansion.

Latin America

Latin America, led by Brazil and Mexico, is experiencing steady growth driven by expanding urban pet populations and rising awareness of pet wellness. Increasing availability of pet care products through e-commerce platforms and improving access to veterinary services are key growth drivers. While price sensitivity remains a challenge, demand for entry-level fitness equipment and wearable devices is gradually increasing among middle-income households.

Middle East & Africa

Growth in the Middle East & Africa is supported by rising luxury pet spending, particularly in the UAE and South Africa, alongside improving veterinary infrastructure. High-income households in the Middle East are increasingly adopting premium fitness equipment and smart wearables, while South Africa benefits from a well-established veterinary ecosystem. Expanding pet ownership and the gradual modernization of animal healthcare services are expected to support long-term market development across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Fitness Care Market

- Mars Incorporated

- Nestlé Purina PetCare

- Garmin Ltd.

- FitBark Inc.

- Whistle Labs

- PetPace

- Tractive

- IDEXX Laboratories

- Zoetis

- Hill’s Pet Nutrition

- Sure Petcare

- CleverPet

- PetSafe

- Pawbo

- GoPro (Pet Technology Segment)