Interactive Dog Toys Market Size

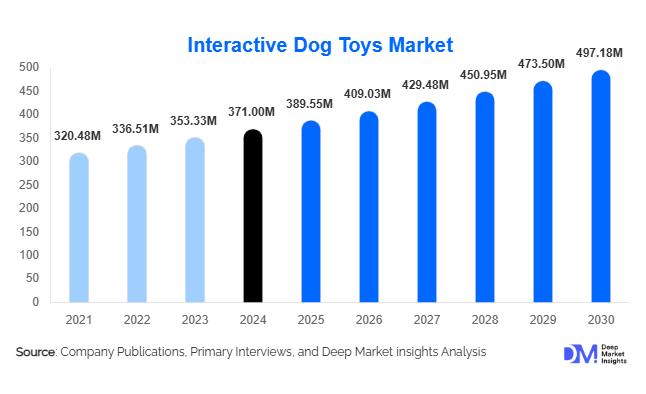

According to Deep Market Insights, the global interactive dog toys market size was valued at USD 371 million in 2024 and is projected to grow from USD 389.55 million in 2025 to reach USD 497.18 million by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). The market growth is being primarily driven by increasing pet humanization, rising demand for mentally stimulating and enrichment toys, and the growing penetration of e-commerce, combined with innovations in smart and electronic pet toys.

Key Market Insights

- Smart and high-engagement toys are becoming mainstream: Demand for electronic, sensor-based, and app-connected toys is rising, marking a shift from basic chew or plush toys toward technologically advanced interactive products.

- Online retail is the fastest-growing distribution channel: E-commerce platforms and brand websites are capturing nearly half of global sales, due to convenience, wide selection, and global shipping capabilities.

- Mid-tier interactive toys lead by volume, while premium toys lead by value: Mid-range treat-dispensing and puzzle toys account for the bulk of units sold, but premium smart toys contribute disproportionately to market revenues.

- Adult dogs are the primary target demographic: Toys designed for adult dogs, for mental stimulation and daily physical activity, account for the largest share of demand, as many owners look to improve pet well-being.

- Household pet owners dominate demand: The majority of interactive toy purchases are by individual pet owners; however, pet daycares, boarding centers, and training facilities are emerging as a promising B2B segment.

- Emerging markets present high-growth prospects: Rapid urbanization in Asia-Pacific, Latin America, and the Middle East & Africa, coupled with rising disposable incomes and increasing pet adoption, is creating new demand for interactive dog toys.

Latest Market Trends

Smart & IoT-Enabled Toys Gaining Popularity

Toy manufacturers are increasingly offering electronic and sensor-enabled interactive toys, such as app-controlled treat dispensers, motion-activated balls, and smart puzzle toys. These innovations appeal to tech-savvy pet owners who want to engage their pets even when away from home. As urban pet ownership and busy lifestyles grow, remote-accessible and automated toys are becoming a preferred choice over traditional chew or plush toys.

Rise of Eco-Friendly, Sustainable, and Non-Toxic Materials

With growing awareness around pet safety and environmental sustainability, there is a rising consumer preference for toys made from natural rubber, recycled materials, or non-toxic, pet-safe fabrics. Brands are responding by designing eco-conscious interactive toys, for example, treat-dispensing toys with recycled plastic housings, or puzzle toys using natural rubber components, creating differentiation and appealing to environmentally conscious consumers, especially younger pet owners.

Expansion of Subscription and Direct-to-Consumer Models

Subscription-based “toy-box” services for dogs are rising in popularity. These models deliver a curated set of interactive toys directly to pet owners regularly, ideal for busy owners who prefer convenience and variety. This trend supports consistent demand, enhances customer loyalty, and offers manufacturers predictable revenue flows, while giving consumers an easy way to periodically refresh their pet’s toy collection without repeated shopping trips.

Interactive Dog Toys Market Drivers

Pet Humanization and Rising Dog Ownership Worldwide

One of the strongest drivers is the growing trend of pet humanization, where dog owners increasingly treat pets as family members and are more willing to spend on high-quality toys that offer mental stimulation and entertainment. Global urbanization and changing social dynamics (single-person households, nuclear families) are resulting in increased dog adoption, especially in cities. As a result, demand for interactive, enrichment-focused toys has surged, moving beyond basic chew toys toward more engaging and feature-rich options.

Heightened Awareness of Pet Mental Health, Well-being & Enrichment Needs

With rising awareness about canine behavior, boredom, anxiety, and the need for physical and cognitive stimulation, many pet parents now recognize the importance of interactive toys in their dog’s overall well-being. Toys that challenge a dog’s intellect, offer treat rewards, or provide activity during owner absence, such as puzzle toys, treat dispensers, and automatic fetch toys, are increasingly in demand. This shift is particularly pronounced in regions where indoor living and apartment lifestyles limit outdoor play opportunities.

Technological Advancements and Product Innovation

Advances in electronics, sensors, and cost-effective manufacturing have enabled the production of more affordable smart toys. These technological innovations, such as motion sensors, sound modules, timers, and remote or app control, have broadened the appeal of interactive toys beyond premium-tier buyers. As manufacturers continue to innovate, they can offer interactive features at more accessible price points, thereby expanding the customer base.

Market Restraints

Price Sensitivity in Emerging and Developing Markets

Interactive toys, especially smart or electronic ones, are significantly more expensive than basic chew or plush toys. In developing or lower-income regions, a large segment of pet owners remains price-sensitive, preferring simple, low-cost toys over premium interactive ones. This limits the penetration of high-end interactive toys in many markets and restrains overall market growth in those geographies.

Safety, Quality, and Durability Concerns

Interactive dog toys, particularly those with electronics or mechanical parts, can raise safety, durability, or toxicity concerns. Issues such as choking hazards, toxic materials, breakage, or malfunctioning electronics can lead to recalls or consumer distrust, especially in markets with less stringent regulation. These concerns tend to make some pet owners revert to simpler, cheaper toys, thereby slowing the adoption of advanced interactive toys.

Market Opportunities

Smart & Tech-Enabled Toy Innovation

There is a substantial opportunity for both established players and new entrants to introduce smart, IoT-enabled toys, for example, smartphone-controlled fetch machines, treat dispensers with activity tracking, or interactive toys with adaptive behavior based on a dog’s usage. As urban pet ownership rises and owners spend long hours outside, demand for remote-controlled or automatic toys is expected to grow. Companies that invest in innovation and offer reliable, user-friendly smart toys could capture premium customers and enjoy higher margins.

Penetration into Untapped Emerging Markets (APAC, LATAM, MEA)

Massive potential exists in emerging regions such as Asia-Pacific, Latin America, and the Middle East & Africa, where pet adoption rates are rising, and e-commerce penetration is increasing. By offering mid-tier interactive toys at affordable price points, perhaps manufactured locally or via regional supply chains, companies can tap a large, underserved market of pet owners. Tailoring designs and price points to local needs and income levels can significantly expand the consumer base.

Eco-Friendly and Sustainable Toy Manufacturing

With growing consumer awareness about the environment, sustainability, and pet safety, particularly among younger generations, there is a growing niche for interactive toys made using eco-friendly, non-toxic materials or recycled components. Brands that emphasize sustainability and safety can differentiate themselves in crowded markets, build brand loyalty, and attract premium-conscious consumers, especially in developed regions with strict regulations and high ethical standards.

Product Type Insights

Within product types, smart and electronic toys, including sensor-based toys, app-controlled treat dispensers, automatic fetch machines, and interactive puzzle devices with AI integration, are currently the fastest-growing segment in terms of value contribution. This growth is primarily driven by increasing urban pet ownership, tech-savvy consumers, and rising disposable income in mature markets, which encourages spending on premium, feature-rich toys. These toys also provide remote monitoring and engagement opportunities for dogs, which is a key appeal for busy urban pet owners.

On the other hand, mid-tier treat-dispensing and puzzle toys continue to dominate in terms of volume, as they offer a balance between affordability and interactive functionality. These toys cater to the mass market of household pet owners who prioritize mental stimulation and physical activity for their dogs without incurring high costs. Basic plush interactive toys and economy-level treat dispensers remain relevant for price-conscious segments, though their market share is gradually declining as consumers increasingly upgrade to mid-tier and premium options. Overall, this dual-layer structure, with premium toys driving value and mid-tier toys driving volume, is shaping the global product-type dynamics, with innovation and technology being the key drivers for premium adoption.

Distribution Channel Insights

Online retail, including e-commerce platforms, brand websites, and online marketplaces, currently leads global distribution for interactive dog toys. This channel benefits from convenience, extensive selection, global reach, and the ability to support subscription-based “toy box” models. Online retail also allows manufacturers to directly engage with consumers, gather behavioral insights, and introduce new interactive products faster.

Specialty pet stores and mass-retail chains continue to be important distribution channels, particularly in developed regions and for mid-tier value-focused buyers. These physical stores allow customers to experience toy size, texture, and durability firsthand, which is crucial for first-time buyers or those concerned about product safety and longevity.

B2B channels, such as pet daycare centers, boarding facilities, veterinary clinics, and pet-training centers, are increasingly contributing to market growth. These institutions require durable, multi-dog toys and frequently replenish stock, providing a stable, recurring demand stream for manufacturers. This channel is becoming particularly attractive as professional pet care and training services expand globally.

End-User Insights

The largest demand segment remains household pet owners, particularly urban dog owners seeking mental stimulation, enrichment, and daily physical activity for their pets. Growth in this segment is fueled by rising urbanization, smaller family units, single-person households, and increased awareness of canine behavior and well-being. Consumers are investing in interactive toys to improve pet engagement, alleviate boredom, and prevent destructive behavior.

Emerging segments, such as pet daycare centers, boarding facilities, and dog-training/behavior-therapy institutions, are increasingly adopting interactive toys to manage multiple dogs, provide cognitive stimulation, and differentiate their services. These B2B channels contribute significantly to recurring sales, particularly for durable, high-quality toys designed for heavy use.

Export-driven demand is also rising, with manufacturers in mature markets exporting premium interactive toys to emerging regions where local production is limited. This trend is supported by the growing middle-class population, expanding e-commerce access, and increasing pet adoption across Asia-Pacific, Latin America, and the Middle East & Africa, creating opportunities for international players to penetrate high-growth markets.

| By Product Type | By End-User / Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest single market for interactive dog toys, accounting for approximately 35–38% of global demand in 2024. The market is driven by high pet ownership rates, strong pet-humanization trends, and widespread adoption of premium products such as smart treat dispensers and electronic toys. Consumers increasingly focus on cognitive enrichment and health benefits for dogs, which boosts demand for interactive toys. The United States leads regional growth due to high disposable income, strong awareness of pet well-being, and an extensive e-commerce infrastructure that facilitates access to both domestic and imported brands. Repeat purchases, subscription toy models, and seasonal product upgrades further support steady market expansion.

Europe

Europe contributes roughly 20–25% of global demand. Countries like the UK, Germany, France, and Nordic nations demonstrate high consumer awareness regarding pet welfare, safety, and enrichment. Regulatory frameworks mandating non-toxic materials and durability standards drive manufacturers to focus on high-quality and eco-friendly interactive toys. Key growth drivers include increasing urban pet adoption, rising disposable income, and cultural emphasis on preventive pet care. Additionally, subscription-based toy services and premium mid-tier toys are gaining traction among younger demographics, particularly in metropolitan areas where space and outdoor activity options are limited.

Asia-Pacific (APAC)

APAC accounts for approximately 15–18% of the global market and is the fastest-growing region. Growth is driven by rising urbanization, expanding middle-class income, and increasing pet adoption in countries such as China, India, Japan, South Korea, and Southeast Asia. E-commerce penetration and digital payment infrastructure enable consumers to access mid-tier and premium interactive toys conveniently. Additionally, the influence of social media, growing awareness of pet enrichment, and rising adoption of nuclear and single-person households are driving premium and smart toy adoption. Over the 2025–2030 forecast period, APAC is expected to register the highest regional CAGR, underpinned by favorable demographics and the rising pet humanization trend.

Latin America (LATAM)

Latin America accounts for around 5–8% of the global market in 2024. Growth is moderate but steady, led by urban centers in Brazil, Mexico, and Colombia, where pet adoption is rising. Price sensitivity remains a constraint, so mid-tier treat-dispensing and puzzle toys dominate demand. Key drivers include increasing disposable income, growing awareness of pet health and enrichment, and improving availability of imported products via online retail channels. Expansion of pet daycare and boarding facilities in urban areas also supports incremental demand.

Middle East & Africa (MEA)

MEA holds approximately 5–8% of the global market share as of 2024. Demand is concentrated in Gulf countries such as the UAE, Saudi Arabia, Qatar, and in urban centers of South Africa. Drivers include increasing pet adoption in middle- and upper-income households, rising awareness of pet cognitive enrichment, and greater access to global brands through e-commerce. Additionally, growth in luxury pet services, including boarding, grooming, and training facilities, supports B2B sales of durable interactive toys suitable for multiple-dog households. Infrastructure improvements and rising disposable incomes in the region further enhance market potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Interactive Dog Toys Market

- KONG

- Outward Hound

- Petmate

- PetSafe

- Jolly Pets

- Nylabone

- Benebone

- ZippyPaws

- Coastal Pet Products

- Multipet International

- Petsport USA

- Ethical Products

- Fluff and Tuff

- Honest Pet Products

- Cosmic Pet