Personal Services Market Size

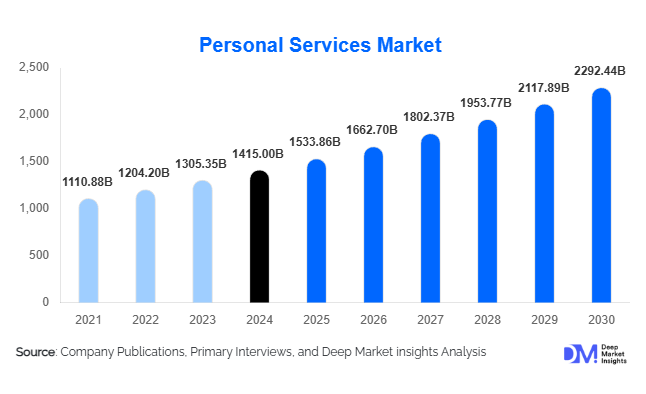

According to Deep Market Insights, the global personal services market size was valued at USD 1,415.0 billion in 2024 and is projected to grow from USD 1,533.86 billion in 2025 to reach USD 2,292.44 billion by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). The market growth is primarily driven by rising disposable incomes, increasing urbanization, demographic aging, and the expansion of digitally-enabled personal services platforms across multiple regions worldwide.

Key Market Insights

- Digital platforms and subscription-based service models are increasingly being adopted, enabling scalable, on-demand, and tech-enabled service delivery for consumers worldwide.

- Rising demand for household support and elderly care services due to dual-income families and aging populations is driving growth in the private household services segment.

- Asia-Pacific dominates the market in terms of volume, led by high population, rising middle-class income, and growing urban lifestyles in China and India.

- North America remains a key revenue contributor, driven by high per-capita spending on personal care, wellness, and household outsourcing services.

- Emerging markets present significant growth opportunities for personal services providers due to digital adoption, increasing affordability, and evolving lifestyles.

- Technology integration, including mobile apps, AI-driven workforce management, and online booking platforms, is reshaping service delivery and consumer convenience.

What are the latest trends in the personal services market?

Digital-First and On-Demand Services

Personal services are increasingly delivered through digital-first platforms. Consumers are leveraging mobile apps to book hair, beauty, housekeeping, pet-care, and wellness services on demand. Subscription models and recurring service packages provide predictable revenue for providers while offering consumers convenience and flexibility. Technology enables real-time service tracking, digital payments, and improved transparency, appealing especially to younger, tech-savvy urban populations. This digital transition is accelerating in emerging markets where mobile penetration is high but traditional service infrastructure is still developing.

Wellness and Lifestyle-Oriented Services

Consumers are increasingly prioritizing health, wellness, and lifestyle-oriented personal services. Spa, massage, grooming, fitness, and coaching services are integrating holistic health trends such as mindfulness, nutrition, and personalized wellness programs. The trend is driven by millennials and Gen Z consumers seeking experience-driven, self-care solutions. Service providers are bundling offerings and creating premium packages to cater to this growing segment. Pet-care and lifestyle support services are also gaining traction as consumers increasingly seek convenience and quality of life improvements.

What are the key drivers in the personal services market?

Rising Disposable Incomes and Urbanization

Urbanization and higher disposable incomes are fueling demand for personal services globally. Dual-income households and smaller family sizes reduce time for household chores, driving the outsourcing of home-cleaning, laundry, childcare, and elderly care. Urban populations are more willing to pay for convenience, grooming, and wellness services, which has expanded service frequency and overall market size.

Demographic Aging and Household Support Needs

The aging population in developed and emerging countries is increasing demand for in-home elderly care, companionship, and medical support services. Professional private household services are filling gaps left by evolving family structures, supporting independence and a higher quality of life for older adults.

Technology-Driven Service Delivery

Digital transformation enables service providers to offer scalable, on-demand solutions. Online booking platforms, AI-driven workforce management, and IoT-enabled home services improve customer convenience, reduce operational inefficiencies, and expand reach. These innovations are a critical growth enabler, especially in urban and high-density markets.

What are the restraints for the global market?

Workforce Availability and Cost Pressures

Personal services are labor-intensive, and maintaining a reliable, skilled workforce is a challenge. High labor costs, staff turnover, and quality control issues can restrict growth and compress margins, particularly in fast-expanding or labor-scarce regions.

Regulatory and Standardization Challenges

Fragmented regulation and lack of standardization in personal services, particularly in household support and informal services, limit market formalization. Licensing, safety standards, and professional certification inconsistencies pose barriers for large-scale, scalable service operations.

What are the key opportunities in the personal services industry?

Expansion of Digital Service Platforms

Platform-based delivery and subscription models provide opportunities to scale services quickly across geographies. Service providers can improve efficiency, customer engagement, and retention by integrating mobile apps, real-time tracking, and online payment systems.

Emerging Market Penetration

High population growth, urbanization, and rising incomes in Asia-Pacific, Latin America, and the Middle East present untapped markets for personal services. Localized offerings that cater to cultural preferences and lifestyle demands can capture high incremental growth.

Wellness and Lifestyle Integration

Integrating wellness, fitness, and lifestyle offerings into traditional personal services, such as beauty, spa, coaching, and pet-care services, opens premium revenue streams. Consumers are increasingly seeking holistic experiences, providing an opportunity for service diversification.

Product Type Insights

Personal care services, encompassing hair, skin, spa, and massage offerings, dominate the global personal services market, accounting for approximately 35% of the 2024 market (USD 441 billion). This segment is fueled by growing consumer awareness of wellness, grooming, and self-care, alongside rising demand for premium and personalized services such as mobile beauty, on-demand spa, and boutique wellness experiences. The increasing adoption of digital booking platforms and subscription models has also streamlined service accessibility, further driving adoption.

Private household services, including home cleaning, childcare, and elderly care, follow with a 25% market share (USD 315 billion). The main growth drivers here are rising female workforce participation, urban lifestyles, smaller household sizes, and an aging population requiring home and elderly care. Consumers increasingly outsource domestic chores and childcare to improve convenience, reflecting lifestyle-driven market expansion.

Other personal services, including pet-care, event planning, and personal coaching/counselling, account for 15% of the market. Growth in this segment is driven by rising disposable incomes, lifestyle-oriented spending, and the increasing popularity of experience-based services. Urbanization and digital service platforms also facilitate easy access to niche services.

Laundry and dry-cleaning services, along with death-care services, comprise the remaining 25% of the market. Laundry/dry-cleaning demand is propelled by dual-income households, urban time constraints, and commercial demand from hospitality and housing sectors. Death-care services are increasingly outsourced due to demographic aging, urbanization, and cultural shifts favoring professionally managed funeral and cremation services.

Application Insights

Urban households and dual-income families are the largest consumers, creating sustained demand for household and personal care services. Elderly populations increasingly require specialized in-home care, companionship, and support services. Wellness-focused individuals drive the adoption of spa, beauty, fitness, and personal coaching services, while pet-care and lifestyle support services are emerging as new applications, especially in urban centers. The proliferation of digital delivery models, including mobile apps and online booking platforms, has significantly expanded service reach, improved convenience, and enhanced customer engagement.

Distribution Channel Insights

Online platforms, mobile apps, and direct digital channels are now the dominant modes of service delivery, providing consumers with booking flexibility, subscription management, and secure payment options. Traditional offline channels, including local service providers, salons, and household service companies, remain relevant, particularly in semi-urban and rural areas. The most effective strategy combines offline trust with online convenience, providing broad market coverage while supporting repeat engagement and loyalty programs.

Customer Insights

Households and corporate groups represent a substantial share of the market, leveraging personal services for convenience and quality of life improvements. Individual consumers, particularly young professionals and wellness-conscious demographics, are adopting subscription-based and on-demand services. Families with elderly members increasingly demand in-home support and eldercare services. Pet owners and lifestyle-focused individuals are driving niche segment growth, fueling demand for premium and customized services.

Age Group Insights

The 31–50 age group forms the largest consumer base, combining disposable income with lifestyle-oriented demand. The 18–30 demographic drives adoption of digital and on-demand personal services, including wellness, beauty, and urban lifestyle offerings. Older consumers (51–65+) continue to focus on premium household, wellness, and elderly care services, while those above 65 remain a niche high-value segment, requiring specialized support and home care solutions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America represents approximately 30% of the 2024 market (USD 380 billion). Growth in the region is supported by high per-capita spending, mature service infrastructure, and a well-established on-demand/home services model. Key drivers include consumer preference for premium wellness and beauty services, digital adoption enabling convenience and subscription-based offerings, and the prevalence of dual-income households outsourcing household chores and childcare. The segment of private household services is particularly strong due to aging populations seeking home care and lifestyle management solutions.

Europe

Europe accounts for 20% of the market (USD 250 billion). Developed markets, including the U.K., Germany, and France, benefit from strong regulatory frameworks ensuring service quality and safety. Consumers display high awareness of personal wellness and self-care, driving demand for premium and standardized personal care services. Key growth drivers include digital integration, established distribution channels, and sustainability-conscious consumer preferences. Household support and wellness services are expanding steadily as urbanization continues and dual-income households increase.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, representing 35% (USD 440 billion) of the market. Growth is fueled by rapid urbanization, rising middle-class populations, increasing disposable incomes, and high digital platform adoption, enabling convenient service access. Regional drivers include a strong shift toward premium personal care, household outsourcing due to time constraints in urban centers, and rising demand for wellness, lifestyle, and eldercare services. Countries such as China, India, Japan, and Australia lead demand, with digital-first platforms supporting rapid expansion.

Latin America

Latin America accounts for 7% (USD 90 billion) of the global market. Growth is emerging, particularly in Brazil, Argentina, and Mexico, driven by rising urbanization, increasing disposable incomes, and growing awareness of lifestyle-oriented services. Digital adoption is accelerating access to personal care, household support, and niche lifestyle services. While overall penetration is lower than in mature markets, premium urban households and younger demographics present key opportunities for service expansion.

Middle East & Africa

MEA represents 8% (USD 100 billion) of the market, with strong growth in urban centers of the Gulf, South Africa, and select African cities. Regional drivers include high-income populations, increasing demand for premium personal services, and digital adoption enabling platform-based delivery. Household services, wellness, and death-care segments are seeing notable expansion due to urbanization, rising awareness, and lifestyle shifts favoring outsourced services. Africa, in particular, provides growth potential in elderly care and community-driven wellness services as urban middle classes expand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Personal Services Market

- Service Corporation International

- Dignity plc

- Regis Corporation

- Life Time, Inc.

- Equinox Holdings Inc.

- PetSmart Inc.

- Match Group Inc.

- Weight Watchers International Inc.

- Elis SA

- Spotless Group Holdings Ltd.

- Tivity Health

- Great Clips Inc.

- Supercuts Inc.

- Petco Health & Wellness Company Inc.

- Wag Group Co

Recent Developments

- In May 2025, Service Corporation International announced the expansion of its wellness-oriented funeral and memorial services in North America, integrating digital pre-arrangement platforms and remote service consultations.

- In April 2025, PetSmart launched a digital pet-care subscription platform in Asia-Pacific, offering grooming, boarding, and veterinary teleconsultations through a mobile app.

- In February 2025, Life Time, Inc. introduced home-based personal coaching and wellness subscriptions in Europe, combining digital coaching, fitness, and lifestyle services to cater to urban professionals.