Pepperoni Food Market Size

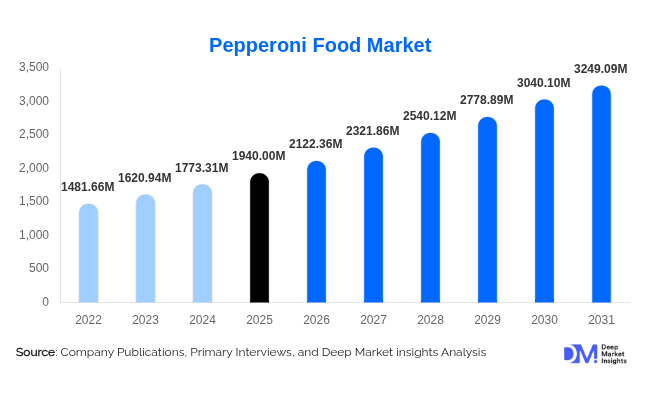

According to Deep Market Insights, the global pepperoni food market size was valued at USD 1,940.00 million in 2025 and is projected to grow from USD 2,122.36 million in 2026 to reach USD 3,249.09 million by 2031, expanding at a CAGR of 9.4% during the forecast period (2026–2031). The pepperoni food market growth is primarily driven by the sustained global demand for pizza and ready-to-eat foods, expanding quick-service restaurant (QSR) networks, and increasing penetration of frozen and processed meat products across emerging economies.

Key Market Insights

- Pepperoni remains the most consumed pizza topping globally, accounting for a dominant share of processed meat toppings used by QSRs and frozen food manufacturers.

- Foodservice channels dominate overall demand, supported by the expansion of international pizza chains and casual dining restaurants.

- North America leads global consumption, driven by high per-capita processed meat intake and a mature pizza culture.

- Asia-Pacific is the fastest-growing region, fueled by the westernization of diets, rapid urbanization, and rising frozen food adoption.

- Clean-label, uncured, and chicken-based pepperoni variants are gaining traction as consumers seek healthier alternatives.

- Technological advancements in curing, slicing, and cold-chain logistics are improving product consistency and shelf life.

What are the latest trends in the pepperoni food market?

Rising Demand for Clean-Label and Uncured Pepperoni

Consumers are increasingly scrutinizing processed meat labels, driving demand for uncured, nitrate-free, and clean-label pepperoni products. Manufacturers are reformulating products using natural preservatives, fermentation-based curing, and reduced sodium content to address health concerns while preserving traditional flavor profiles. This trend is particularly strong in North America and Europe, where regulatory scrutiny and consumer awareness are higher. Clean-label pepperoni is also gaining acceptance among premium pizza chains and private-label retail brands, enabling higher price realization and brand differentiation.

Growth of Chicken-Based and Alternative Protein Pepperoni

Chicken-based pepperoni is emerging as a high-growth segment due to its lower fat content, broader religious acceptance, and competitive pricing compared to pork and beef variants. Additionally, plant-based pepperoni alternatives are gaining visibility, particularly among flexitarian consumers. Although still a niche, alternative protein pepperoni is attracting investment and innovation, especially in developed markets, positioning it as a long-term growth driver.

What are the key drivers in the pepperoni food market?

Global Expansion of Pizza and QSR Chains

The continued expansion of global pizza chains and QSR brands is a primary driver of pepperoni demand. Pepperoni accounts for approximately 65% of all pizza topping applications globally, making it a staple ingredient for foodservice operators. Emerging markets are witnessing rapid store openings, directly translating into higher industrial-scale pepperoni consumption.

Growth of Frozen and Ready-to-Eat Foods

Rising demand for frozen pizzas, ready meals, and meal kits is accelerating pepperoni usage in food manufacturing. Pepperoni’s ability to retain texture and flavor after freezing makes it a preferred ingredient for frozen food producers. This driver is particularly strong in North America, Europe, and increasingly in Asia-Pacific.

What are the restraints for the global market?

Health Concerns and Regulatory Pressure

Processed meats face increasing regulatory scrutiny due to concerns over sodium, preservatives, and nitrates. Compliance with evolving food safety and labeling regulations increases production costs and limits formulation flexibility, particularly for smaller manufacturers.

Volatility in Raw Material Prices

Fluctuating pork, beef, and poultry prices directly impact pepperoni production costs and profit margins. Livestock disease outbreaks, feed cost inflation, and trade disruptions remain persistent challenges for the industry.

What are the key opportunities in the pepperoni food industry?

Emerging Market Penetration in Asia-Pacific and Latin America

Asia-Pacific and Latin America present significant growth opportunities as pizza consumption transitions from niche to mainstream. Establishing localized production facilities and region-specific flavor profiles can reduce import dependence and improve margins for manufacturers.

Customization for Foodservice and Industrial Clients

QSRs and frozen food manufacturers increasingly demand customized pepperoni solutions, including specific slice sizes, fat ratios, spice intensity, and halal or kosher compliance. Long-term supply contracts for customized products offer volume stability and predictable revenues.

Product Type Insights

Pork-based pepperoni continues to dominate the global market, accounting for approximately 48% of the 2025 market share. Its leadership is driven by traditional taste preferences, high consumer familiarity, and cost efficiency, particularly in North America and Europe. Beef-based pepperoni holds a significant share in regions with pork consumption restrictions, including the Middle East and parts of Asia. Meanwhile, chicken-based pepperoni is the fastest-growing segment, expanding at over 7% CAGR, fueled by increasing health-consciousness, lower fat content, and acceptance in halal markets. Mixed-meat and plant-based pepperoni variants remain niche segments but are gaining traction in premium, health-focused, and clean-label categories, reflecting growing consumer interest in alternative proteins and flexitarian diets.

Processing & Form Insights

Cured and fermented pepperoni represents nearly 62% of global demand, driven by its extended shelf life, consistent flavor, and compatibility with industrial-scale foodservice operations. This segment’s dominance is reinforced by strong adoption in pizza chains and frozen food manufacturers that require standardized products for global operations. In terms of form, sliced pepperoni holds over 70% share, as it offers operational efficiency, portion control, and ease of use in high-volume applications. Stick/whole pepperoni remains relevant for specialized culinary uses, while diced or crumbled forms are increasingly used in snacks, ready-to-eat meals, and frozen food processing, supporting diversification in applications.

End-Use Insights

Pizza applications account for approximately 65% of total pepperoni consumption, making it the largest end-use segment globally. This is driven by the consistent popularity of pizza across both developed and emerging markets, the expansion of international QSR chains, and the growth of frozen pizza consumption. Snacks, sandwiches, and ready-to-eat meals are emerging applications, particularly in Europe and North America, where urban lifestyles and on-the-go consumption trends are boosting demand. Food manufacturing for frozen meals represents a growing demand center, supported by private-label expansion, increasing household freezer penetration, and rising convenience food consumption, particularly in Asia-Pacific and Latin America.

Distribution Channel Insights

Foodservice channels dominate the global market with nearly 58% share, led by QSRs, pizzerias, and casual dining restaurants. The dominance of this channel is driven by high-volume, recurring orders and long-term supply contracts with industrial pepperoni producers. Retail channels, including supermarkets and hypermarkets, are growing steadily due to increasing consumer preference for at-home cooking and ready-to-cook pizza kits. Online and direct-to-consumer sales are gaining momentum, particularly for specialty, organic, and clean-label pepperoni products, enabling manufacturers to directly engage health-conscious and premium buyers while capturing higher margins.

| By Product Type | By Processing & Form | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global pepperoni food market in 2025, led by the United States. High per-capita pizza consumption, mature cold-chain infrastructure, and extensive QSR networks support this dominance. Drivers of growth include strong consumer familiarity with pork-based pepperoni, the rapid expansion of frozen pizza consumption, and widespread adoption of clean-label and chicken-based alternatives. Innovation in portion-controlled, pre-sliced formats for QSRs and frozen foods also bolsters regional demand.

Europe

Europe holds around 27% market share, with Germany, the U.K., Italy, and France driving the highest consumption. Growth in this region is fueled by the increasing popularity of clean-label and premium pepperoni products, urbanized lifestyles, and the expansion of frozen pizza and ready-to-eat meals. Regulatory focus on healthier processed meats has accelerated demand for uncured and nitrate-free pepperoni, while strong foodservice networks and increasing adoption of convenience foods support steady market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of nearly 7.8%. Major contributors include China, India, Japan, and Australia. Growth drivers include rapid urbanization, increasing disposable incomes, expanding QSR networks, and rising acceptance of Western-style diets. The growing frozen food sector, particularly frozen pizza kits, has further accelerated demand. Chicken-based and halal-compliant pepperoni variants are particularly favored, catering to local dietary requirements and health-conscious consumers. Rising e-commerce penetration and home delivery services are also enhancing distribution reach across urban and semi-urban markets.

Latin America

Latin America represents about 7% of global demand, with Brazil and Mexico leading consumption. Regional growth is primarily driven by expanding pizza chains and QSR networks, increasing adoption of frozen and ready-to-eat foods, and rising urban middle-class demand for convenient meal solutions. Chicken-based and mixed-meat pepperoni variants are gaining traction due to affordability and local dietary preferences, while retail expansion and cold-chain improvements are facilitating broader product availability.

Middle East & Africa

MEA remains an emerging market, with growth driven by halal-compliant pepperoni demand in GCC countries, growing tourism-led foodservice expansion, and increasing adoption of international QSR brands. Demand is also rising in North African countries and South Africa, supported by urbanization and increasing preference for convenience foods. Chicken-based and beef-based pepperoni dominate due to pork restrictions, while the introduction of frozen pizza and ready-to-eat meal options is creating additional growth opportunities. Government initiatives supporting cold-chain infrastructure and processed food manufacturing are further encouraging market development in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|