Pea Starch Market Size

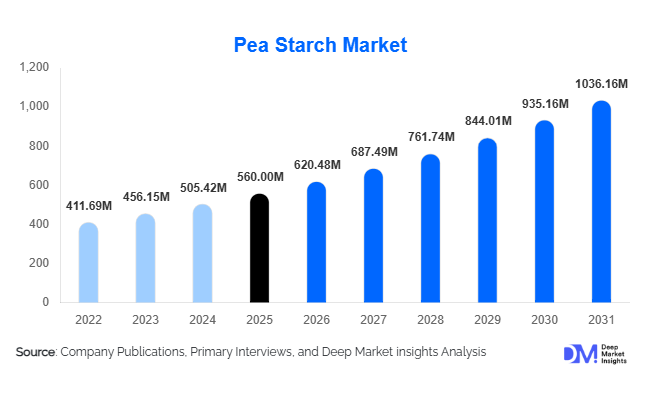

According to Deep Market Insights, the global pea starch market size was valued at USD 560 million in 2025 and is projected to grow from USD 620.48 million in 2026 to reach approximately USD 1,036.16 million by 2031, expanding at a CAGR of 10.8% during the forecast period (2026–2031). The pea starch market growth is primarily driven by the rising adoption of plant-based and clean-label ingredients, increasing demand from alternative protein and processed food industries, and expanding applications across pharmaceuticals and bio-based industrial materials.

Key Market Insights

- Pea starch is gaining rapid adoption as a clean-label and allergen-free starch alternative, replacing corn and wheat starch in food and beverage formulations.

- Modified pea starch dominates the market, driven by superior functional properties such as thermal stability, binding strength, and texture enhancement.

- Europe leads global demand, supported by strong regulatory backing for sustainable ingredients and widespread adoption of plant-based foods.

- North America remains a high-value market, fueled by innovation in alternative proteins, functional foods, and nutraceuticals.

- Asia-Pacific is the fastest-growing region, driven by expanding food processing capacity, rising disposable incomes, and government support for pulse crop cultivation.

- Industrial and pharmaceutical applications are emerging as high-margin growth areas, particularly in biodegradable packaging and tablet binding.

What are the latest trends in the pea starch market?

Expansion of Plant-Based and Alternative Protein Applications

The rapid growth of plant-based meat and dairy alternatives has emerged as a defining trend in the pea starch market. Pea starch is increasingly used alongside pea protein to improve texture, mouthfeel, and binding in meat analogs, plant-based cheeses, and non-dairy yogurts. Manufacturers prefer pea starch due to its neutral taste profile and compatibility with clean-label formulations. As global plant-based food sales continue to grow at double-digit rates, ingredient suppliers are investing in customized starch solutions specifically designed for alternative protein matrices, reinforcing pea starch’s strategic importance.

Rising Adoption in Bio-Based Industrial Materials

Another notable trend is the increasing use of pea starch in bio-based and biodegradable industrial applications. Modified pea starch is being incorporated into paper coatings, adhesives, biodegradable films, and specialty packaging materials as industries move away from petroleum-based inputs. Regulatory pressure on single-use plastics and synthetic polymers, particularly in Europe, is accelerating this transition. Manufacturers are also exploring pea starch-based composites for lightweight packaging and agricultural films, positioning the market for long-term industrial diversification.

What are the key drivers in the pea starch market?

Growing Demand for Clean-Label and Allergen-Free Ingredients

Consumer preference for transparent, minimally processed, and allergen-free food ingredients is a major growth driver for the pea starch market. Pea starch is naturally gluten-free, non-GMO, and free from major allergens, making it highly suitable for health-focused and specialty food products. Food manufacturers are increasingly reformulating products to meet clean-label standards, directly boosting demand for pea starch across bakery, snacks, sauces, and ready-to-eat meals.

Strong Growth of the Plant-Based Food Industry

The global shift toward plant-based diets is significantly supporting pea starch demand. As a co-product of pea protein processing, pea starch benefits from integrated supply chains and cost efficiencies. The continued expansion of plant-based meat, dairy alternatives, and functional nutrition products is reinforcing pea starch’s role as a critical functional ingredient, particularly in North America and Europe.

What are the restraints for the global market?

Raw Material Price Volatility

The pea starch market is exposed to fluctuations in raw material prices due to variability in pea crop yields and growing competition for peas from protein manufacturers. Climate variability and regional supply constraints can impact input availability, creating pricing uncertainty for starch producers and limiting long-term contract stability.

Higher Processing Costs Compared to Conventional Starches

Pea starch production requires specialized extraction and modification infrastructure, resulting in higher processing costs compared to corn or wheat starch. This cost differential can restrict adoption in price-sensitive applications and emerging markets, particularly where conventional starches remain widely available at lower prices.

What are the key opportunities in the pea starch industry?

Technological Innovation in Starch Modification

Advancements in enzymatic and physical modification technologies present significant opportunities for pea starch manufacturers. Enhanced performance characteristics enable penetration into pharmaceuticals, cosmetics, and specialty industrial applications. Companies investing in R&D and application-specific formulations can unlock premium pricing and higher-margin demand segments.

Government Support for Sustainable Agriculture and Bio-Based Materials

Government initiatives promoting pulse crop cultivation, sustainable agriculture, and bio-based materials are creating favorable conditions for pea starch expansion. Programs supporting domestic processing capacity and agricultural diversification, particularly in Europe and Asia-Pacific, provide incentives for new capacity investments and long-term supply chain stability.

Product Type Insights

Modified pea starch dominates the global pea starch market, accounting for over 60% of total demand. Its leadership is primarily driven by superior functional performance across food, pharmaceutical, and industrial applications. Modified variants offer enhanced thermal stability, improved viscosity control, better shear resistance, and higher tolerance to processing conditions such as freezing, thawing, and high temperatures. These properties make modified pea starch particularly suitable for processed foods, clean-label formulations, and advanced pharmaceutical applications.

Native pea starch continues to hold relevance in basic food formulations where minimal processing and cost efficiency are prioritized. However, its limited functional flexibility has resulted in gradual substitution by modified pea starch, especially in value-added and performance-driven applications. As food manufacturers increasingly seek consistency, longer shelf life, and improved texture profiles, modified pea starch is expected to maintain its dominant position throughout the forecast period.

Application Insights

The food and beverage segment represents the largest application area for pea starch, driven by its widespread use in bakery products, snacks, sauces, soups, and plant-based food formulations. The leading growth driver for this segment is the rising demand for clean-label, gluten-free, and plant-based ingredients, particularly in meat alternatives and dairy-free products, where pea starch provides desirable texture and binding functionality.

Pharmaceutical applications are steadily expanding, supported by increasing use of pea starch as a tablet binder, disintegrant, and excipient in controlled-release formulations. The segment benefits from the starch’s plant-based origin, non-allergenic profile, and regulatory acceptance in major markets.

Industrial applications, including paper coatings, adhesives, and biodegradable packaging materials, are emerging as fast-growing areas. Sustainability-driven innovation and the shift toward bio-based raw materials are key factors accelerating adoption within industrial end uses.

End-Use Industry Insights

The food processing industry accounts for nearly 70% of total pea starch consumption, making it the dominant end-use segment. Growth is supported by large-scale adoption across global manufacturing hubs and continuous product innovation in processed and convenience foods. The leading driver for this segment is the rapid expansion of plant-based food production, which relies heavily on pea-derived ingredients for texture, stability, and nutritional enhancement.

Pharmaceutical and industrial end-use segments, while smaller in volume, offer comparatively higher profit margins. These segments are expected to grow at above-average rates during the forecast period, driven by increasing demand for sustainable excipients, biodegradable materials, and specialty starch solutions.

| By Product Type | By Application | By End Use | By Form |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe holds the largest share of the global pea starch market, led by Germany, France, and the United Kingdom. Regional growth is driven by strong regulatory support for sustainable, plant-based, and non-GMO ingredients, combined with a well-established food processing industry. High consumer awareness regarding clean-label products and the presence of major starch manufacturers further support market expansion.

North America

North America represents a high-value market, with the United States accounting for the majority of regional demand. Growth is fueled by rapid innovation in alternative proteins, functional foods, and nutraceuticals. Strong research and development investments, coupled with increasing consumer preference for allergen-free and plant-based ingredients, continue to drive pea starch adoption across multiple applications.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, led by China, India, and Australia. Key growth drivers include expanding food processing industries, rising disposable incomes, and increasing consumption of processed and convenience foods. Additionally, government initiatives supporting pulse cultivation and domestic starch production are accelerating regional market development.

Latin America

Latin America is an emerging market for pea starch, with Brazil and Argentina showing notable growth potential. Expansion of food processing industries, rising exports of processed foods, and increasing interest in plant-based ingredients are key factors contributing to regional demand growth.

Middle East & Africa

The Middle East & Africa region represents a smaller but steadily growing market for pea starch. Growth is supported by rising imports to meet food processing needs, gradual expansion of local manufacturing capabilities, and increasing awareness of plant-based and clean-label ingredients across urban consumer populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pea Starch Market

- Roquette

- Ingredion

- Emsland Group

- Cosucra

- Puris

- AGRANA

- Tate & Lyle

- Avebe

- Meelunie

- Vestkorn

- Axiom Foods

- Nutri-Pea

- Shandong Jianyuan

- Yantai Oriental Protein

- Fenchem