Pawn Shop Market Size

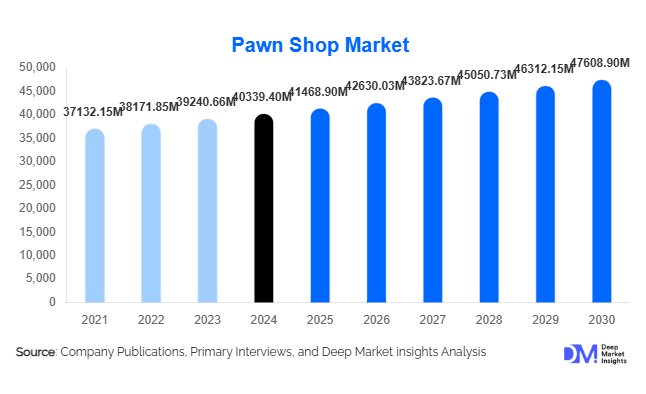

According to Deep Market Insights, the global pawn shop market size was valued at USD 40,339.40 million in 2024 and is projected to grow from USD 41,468.90 million in 2025 to reach USD 47,608.90 million by 2030, expanding at a CAGR of 2.8% during the forecast period (2025–2030). The growth of the pawn shop market is primarily driven by the increasing demand for short-term credit, rising adoption of luxury pawns, and rapid digitalization of pawn services, enabling online lending, app-based valuations, and broader consumer reach.

Key Market Insights

- Jewelry and precious metals dominate pawned items globally, accounting for a significant share of total market value due to their intrinsic liquidity and cultural demand in regions like Asia and the Middle East.

- Digital pawn shops and online platforms are transforming the industry, providing convenience, fast loan disbursals, and broader market access to younger, tech-savvy consumers.

- Retail consumers remain the primary end-users, representing 70% of global demand for pawn loans, highlighting the widespread need for short-term financial solutions.

- North America leads the global market, with the U.S. and Canada collectively accounting for 32% of the 2024 market share due to mature financial markets and urbanized populations.

- Asia-Pacific is the fastest-growing region, driven by rising disposable income, urbanization, and limited access to formal banking credit channels in countries such as China and India.

- Luxury and high-value asset pawning is expanding, attracting high-net-worth individuals and creating new revenue streams for specialized pawn shops.

What are the latest trends in the pawn shop market?

Digital Pawn Platforms and Online Lending

Pawn shops are increasingly integrating digital technologies to reach a wider audience. Online platforms now allow customers to submit items for appraisal remotely, receive instant loan offers, and manage repayments via mobile apps. AI-driven valuation tools and digital authentication of jewelry, electronics, and luxury items are improving trust and transparency in transactions. This trend caters to younger demographics who prefer digital-first experiences, allowing pawn shops to compete with traditional financial services while reducing operational costs and expanding geographic reach.

Luxury and Collectible Pawns on the Rise

The demand for luxury and collectible pawns, such as designer handbags, fine watches, and artwork, is growing rapidly. High-net-worth individuals are leveraging these assets for short-term liquidity without liquidating their holdings. Pawn shops are increasingly partnering with appraisal specialists and auction houses to ensure accurate valuations, high security, and credibility, which is helping them capture premium segments. This trend also supports higher profit margins and brand differentiation among market players.

Shift Toward Financial Inclusion

Pawn shops are becoming a critical alternative financial channel, particularly in regions with limited banking access. They provide quick, collateral-backed loans with minimal documentation, helping underserved populations meet immediate financial needs. Governments and regulatory bodies are recognizing this role, supporting policies that encourage safe, transparent pawn operations, which further expand the market potential in emerging economies.

What are the key drivers in the pawn shop market?

Growing Demand for Short-Term Credit

Increasing consumer reliance on short-term financing solutions is a primary driver. Pawn shops offer faster access to cash compared to banks or credit cards, often with flexible repayment options. This is especially important for individuals facing emergency expenses or temporary cash flow gaps, making pawn shops a preferred financial option.

Rising Popularity of Luxury and High-Value Pawns

High-net-worth consumers are increasingly leveraging luxury items such as jewelry, designer handbags, and art as collateral. This segment generates higher loan values and profit margins for pawn shops, encouraging specialized services and premium pawn offerings. The trend is particularly strong in Asia-Pacific and the Middle East, where cultural appreciation for gold and luxury goods is high.

Technological Adoption and Digital Transformation

Advances in digital tools, including online pawning platforms, mobile apps, and AI-driven appraisal solutions, have improved customer experience, expanded market reach, and reduced operational costs. Digitalization also enhances transparency, security, and efficiency, attracting younger consumers and enabling pawn shops to tap into previously inaccessible markets.

What are the restraints for the global market?

Regulatory Challenges

Pawn shops are subject to strict licensing, interest rate limits, and reporting regulations, which vary by country. Compliance costs and legal complexities can restrict market expansion and deter potential entrants, particularly in emerging regions with evolving financial regulations.

Negative Public Perception

In certain markets, pawn shops are still associated with financial distress or socioeconomic hardship, limiting consumer adoption. Addressing these perceptions through marketing, transparency, and community engagement is critical to expanding the customer base and ensuring sustainable growth.

What are the key opportunities in the pawn shop industry?

Expansion into Emerging Economies

Rising urbanization, limited banking access, and increasing disposable income in countries like India, China, and parts of Africa present untapped markets for pawn services. Players can expand their physical and online presence to capture new consumer segments while benefiting from supportive financial inclusion initiatives.

Specialized Luxury Pawn Services

Providing high-value pawns, including designer items, artwork, and collectibles, creates premium revenue streams. Tailored appraisal services, partnerships with auction houses, and secure storage solutions help pawn shops attract affluent clientele while commanding higher interest rates and fees.

Technological Integration and Online Growth

Digital tools, AI-based valuations, and online lending platforms allow pawn shops to enhance customer convenience and operational efficiency. Online pawning also broadens geographic reach, enabling national and cross-border expansion, particularly in regions with high smartphone adoption and e-commerce penetration.

Product Type Insights

Jewelry and precious metals dominate pawned items, accounting for approximately 58% of the 2024 market, due to their intrinsic value and cultural acceptance. Electronics and gadgets are rapidly growing, driven by urban, tech-savvy consumers seeking liquidity against high-value devices. Luxury items and collectibles, while niche, are increasingly profitable segments, generating higher margins and attracting high-net-worth individuals. Musical instruments and vehicles remain smaller segments but offer opportunities in specific markets with established demand.

Application Insights

Retail consumers remain the largest segment, representing 70% of global pawn shop demand, followed by small businesses using collateralized loans for cash flow. High-net-worth individuals drive luxury pawns, while emerging applications include digital pawn platforms, e-commerce partnerships, and pawn-backed financial products, expanding the market’s reach and versatility.

Distribution Channel Insights

Independent pawn shops account for 55% of the market, valued for trust, personalized services, and historical presence. Chain pawn shops and franchise models enable standardized services across regions. Online pawning is rapidly growing at a CAGR of 7%, offering convenience, remote appraisal, and broader geographic reach, particularly in urbanized and tech-enabled markets.

Customer Type Insights

Retail consumers dominate, followed by small businesses and high-net-worth individuals. The latter are increasingly leveraging luxury pawns for high-value collateral. The growth of digital platforms also attracts younger demographics, while traditional customers continue to rely on independent stores for trust and local service.

Age Group Insights

Adults aged 31–50 constitute the largest market segment due to disposable income and financial flexibility. Younger consumers (18–30) are driving online and electronics pawns, while high-net-worth older adults (51–65) fuel luxury pawns. Niche high-value segments among 65+ customers are emerging, emphasizing security and convenience.

| By Loan Type | By Pawned Item Category | By Customer Type | By Pawn Shop Format |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads with 32% of the global market, driven by high urbanization, disposable income, and established pawn chains. The U.S. is the largest contributor, with strong consumer trust and advanced regulatory frameworks supporting market growth. Canada also contributes, though smaller, with urban adoption and luxury pawns growing steadily.

Europe

Europe accounts for 25% of the market, with the U.K. and Germany as major contributors. Strong cultural acceptance of pawn services and urban demand drive steady growth. Regulatory oversight and consumer preference for secure pawning maintain market stability, with a CAGR of 5.2% projected.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a CAGR of 7.5%, led by China and India. Limited access to banking credit, rising disposable income, and a strong gold pawning culture are key drivers. Online pawning and luxury collateral are gaining traction, expanding market potential across urban and semi-urban regions.

Latin America

Brazil and Mexico show steady growth with increasing urban adoption and retail consumer demand. While overall market share is smaller (~8%), the growth potential exists through digital adoption and financial inclusion initiatives targeting urban centers.

Middle East & Africa

UAE and South Africa are emerging markets, driven by luxury pawns, jewelry demand, and rising disposable income. Regional intra-African trade is expanding, contributing to market growth, though regulatory and cultural factors vary across countries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pawn Shop Market

- Cash America International

- EZCORP

- First Cash

- Maxit

- Pawnbroking Ltd.

- I-Pawn

- Liberty Pawn

- The Money Shop

- H&T Group

- GoldSmith Pawnbrokers

- Empress Pawn

- Luxury Pawn

- Cash Converters

- PawnAmerica

- EZPawn

Recent Developments

- In May 2025, Cash America International expanded its digital pawn platform to 50 additional U.S. locations, integrating AI-based appraisal tools for faster evaluations.

- In April 2025, EZCORP launched a specialized luxury pawning service in Asia-Pacific, targeting high-net-worth consumers with high-value jewelry and collectible loans.

- In February 2025, First Cash introduced an online-only pawn model in Canada, allowing consumers to submit electronics and luxury items for instant loans without visiting stores.