Pastry Cream Fillings Market Size

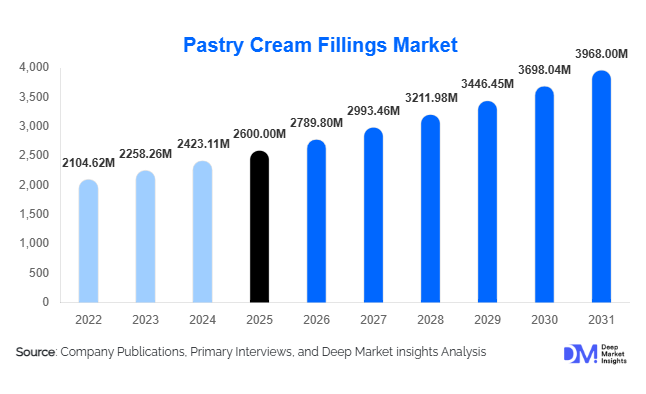

According to Deep Market Insights, the global pastry cream fillings market size was valued at USD 2,600 million in 2025 and is projected to grow from USD 2,789.80 million in 2026 to reach USD 3,968.00 million by 2031, expanding at a CAGR of 7.3% during the forecast period (2026–2031). The pastry cream fillings market growth is primarily driven by the rising global consumption of bakery and dessert products, expansion of industrial bakeries, increasing QSR penetration, and growing demand for clean-label and plant-based formulations. Innovation in ready-to-use (RTU) formats, improved shelf stability, and premium flavor customization are further strengthening demand across both developed and emerging markets.

Key Market Insights

- Industrial bakeries account for nearly 48% of total global demand, driven by automation, export-oriented frozen bakery production, and large-scale cake and pastry manufacturing.

- Vanilla pastry cream fillings dominate with approximately 31% market share, supported by universal flavor acceptance and multi-application versatility.

- Ready-to-use (RTU) formats lead the market with over 44% share, owing to operational efficiency and reduced preparation time in commercial bakeries.

- Asia-Pacific is the fastest-growing regional market, expanding at nearly 8.5% CAGR due to rapid urbanization and organized bakery retail growth.

- Dairy-based fillings represent around 58% of total consumption, particularly strong in Europe and North America.

- The top five companies collectively hold about 40% of global market share, indicating moderate fragmentation with strong regional competition.

What are the latest trends in the pastry cream fillings market?

Clean-Label and Plant-Based Reformulation

Manufacturers are increasingly developing pastry cream fillings free from artificial preservatives, colors, and hydrogenated fats. Clean-label starches, natural emulsifiers, and plant-based dairy alternatives such as almond and oat are gaining traction. With growing vegan and lactose-intolerant populations, non-dairy fillings are expanding beyond niche categories into mainstream bakery production. Functional variants enriched with protein or reduced sugar are also gaining prominence, allowing manufacturers to cater to health-conscious consumers without compromising indulgence.

Shelf-Stable and Automation-Compatible Formats

Industrial bakeries demand fillings that withstand freeze-thaw cycles, high-speed injection systems, and extended distribution timelines. UHT-treated and aseptic packaged pastry creams are witnessing increased adoption, especially in export-driven markets. Improved viscosity control, thermal stability, and extended ambient shelf life are becoming key competitive differentiators. Manufacturers investing in texture optimization technologies and automated filling line compatibility are gaining long-term B2B contracts.

What are the key drivers in the pastry cream fillings market?

Expansion of Global Industrial Bakery Sector

The rapid growth of large-scale bakery chains and frozen bakery exports is a primary growth driver. Countries such as China, India, Germany, and Poland are expanding production capacities, boosting bulk demand for pastry cream fillings. Increased mechanization and centralized bakery production further stimulate RTU filling adoption.

Growth of QSR and Café Chains

Global expansion of quick service restaurants and specialty cafés has increased consumption of filled donuts, éclairs, croissants, and layered cakes. Dessert menu innovation within QSRs contributes significantly to recurring bulk procurement of cream fillings.

Premiumization of Bakery Products

Consumers increasingly prefer gourmet and artisanal desserts featuring unique flavors such as pistachio, matcha, and salted caramel. Premiumization allows manufacturers to command higher margins while expanding flavor portfolios and custom solutions for bakery clients.

What are the restraints for the global market?

Volatility in Dairy and Sugar Prices

Milk solids, butterfat, and sugar price fluctuations directly impact production costs. Raw material inflation compresses margins, particularly for dairy-based formulations.

Cold Chain and Shelf-Life Limitations

Traditional custard-based fillings require refrigeration, limiting distribution in developing markets. While shelf-stable technologies are emerging, they require higher capital investments and advanced processing infrastructure.

What are the key opportunities in the pastry cream fillings industry?

Emerging Asia and Middle East Market Penetration

Rapid urbanization and westernization of diets in India, Southeast Asia, UAE, and Saudi Arabia are driving demand for modern bakery products. Establishing localized manufacturing facilities in these high-growth regions reduces import dependency and improves cost competitiveness.

Functional and Sugar-Reduced Innovations

Growing consumer focus on reduced sugar and high-protein desserts presents opportunities for differentiated offerings. Manufacturers developing low-glycemic, high-fiber, or fortified cream fillings can capture health-driven demand segments

Product Type Insights

Vanilla pastry cream fillings dominate the global market, accounting for approximately 31% of total market share in 2025. The segment’s leadership is primarily driven by its universal flavor appeal, compatibility across diverse bakery formats, and strong consumer preference for classic dessert profiles. Vanilla fillings are extensively used in cakes, éclairs, tarts, donuts, and layered pastries due to their balanced sweetness, smooth texture, and formulation stability under varying baking and storage conditions. Their versatility across both premium and mass-market bakery products further strengthens segment dominance.

Chocolate and fruit-flavored variants follow closely, supported by premiumization trends, seasonal product launches, and rising consumer demand for indulgent and visually appealing desserts. Fruit flavors such as strawberry, blueberry, and mango benefit from clean-label positioning and perceived naturalness. Meanwhile, nut-based fillings including pistachio and hazelnut are gaining traction in gourmet and artisan bakery segments, driven by luxury dessert trends and European-style pâtisserie expansion. Caramel, coffee, and specialty variants are increasingly adopted in café chains and quick-service restaurant (QSR) applications, supporting menu innovation and limited-edition offerings.

Form Insights

Ready-to-use (RTU) pastry cream fillings lead the market with nearly 44% share, driven by the growing need for operational efficiency, reduced preparation time, and consistent product quality in industrial bakeries and large QSR chains. The leading segment driver is automation and large-scale bakery production, which favors standardized, labor-saving solutions. RTU formats eliminate mixing errors, minimize waste, and ensure stable texture across high-volume production lines.

Powdered mixes maintain relevance, particularly in cost-sensitive and developing markets, where flexibility in batch production and lower transportation costs are advantageous. Ultra-high temperature (UHT) shelf-stable formats are expanding in export-driven markets, benefiting from extended shelf life and reduced cold-chain dependency. Frozen concentrates serve niche industrial applications requiring long-term storage, seasonal production planning, and centralized manufacturing models.

Application Insights

Cakes represent the largest application segment, contributing approximately 29% of global demand. The leading driver for this segment is the consistent global consumption of celebration and occasion-based cakes, supported by birthdays, weddings, festivals, and corporate events. Cream-filled layered cakes, sponge cakes, and premium decorated cakes sustain high-volume usage across retail and foodservice channels.

Pastries such as croissants, éclairs, and Danish products follow closely, supported by café culture expansion and premium breakfast trends. Donuts are among the fastest-growing applications, driven by aggressive QSR expansion, franchise growth, and product customization strategies. Tarts and pies maintain steady demand in Europe and North America, where traditional dessert consumption remains strong and seasonal bakery launches support incremental growth.

End-Use Insights

Industrial bakeries dominate the market with nearly 48% share, primarily driven by large-scale automated production, private-label manufacturing, and growing supermarket in-store bakery operations. The leading driver for this segment is the consolidation of bakery production and increasing reliance on centralized manufacturing facilities supplying national and international retail chains.

Artisan bakeries are expanding their adoption of premium and specialty pastry cream fillings, leveraging differentiated flavors and clean-label positioning to attract quality-conscious consumers. Quick-service restaurants (QSRs) represent the fastest-growing end-use segment, expanding at approximately 8.5% CAGR, fueled by rapid outlet expansion, menu diversification, and the introduction of filled dessert products. Household DIY baking remains a smaller but steadily growing channel, supported by social media-driven baking trends and increased retail availability of packaged fillings.

Distribution Channel Insights

Industrial direct supply accounts for around 52% of market share, reflecting long-term B2B contracts, volume-based pricing agreements, and strategic supplier partnerships. The leading driver is the preference for integrated supply chains among large bakery manufacturers seeking cost stability and consistent raw material sourcing.

Bakery ingredient distributors and HoReCa suppliers maintain strong regional penetration, particularly in fragmented artisan markets. Retail packaged pastry cream fillings are gradually expanding shelf space in supermarkets and specialty stores. E-commerce sales are growing steadily, particularly in North America and Europe, where online grocery penetration and home baking trends are more mature.

| By Product Type | By Form | By Ingredient Profile | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 27% of the global market in 2025, with the United States contributing nearly 21% of total global demand. Regional growth is driven by a highly developed industrial bakery infrastructure, high per capita bakery consumption, and strong QSR penetration. The expansion of premium dessert chains, private-label retail bakery products, and demand for clean-label and non-GMO ingredients further support market growth. Innovation in seasonal flavors and functional bakery products also enhances regional competitiveness.

Europe

Europe holds the largest regional share at approximately 30% in 2025. France, Germany, Italy, and Spain are key markets, supported by deeply rooted pastry traditions and high consumption of filled bakery products. Regional growth is driven by premium dessert culture, strong artisan bakery networks, and high demand for authentic pâtisserie-style fillings. Clean-label adoption, regulatory emphasis on food quality, and innovation in organic and natural ingredients are particularly strong across EU countries, reinforcing market maturity and steady expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at around 8.5% CAGR. China and India are witnessing rapid bakery chain expansion, urbanization-driven consumption growth, and rising disposable incomes. Western-style bakery adoption, café culture expansion, and increasing youth population influence are key growth drivers. Japan maintains strong demand for premium, high-quality dessert fillings, while Southeast Asia benefits from growing modern retail penetration and international bakery franchise entry.

Latin America

Brazil and Mexico dominate the regional market, supported by expanding supermarket bakery sections and growing urban populations. Rising middle-class income levels, increasing demand for packaged bakery goods, and the expansion of local bakery chains drive regional growth. Additionally, improved cold-chain logistics and retail modernization contribute to stronger product availability and distribution efficiency.

Middle East & Africa

The UAE and Saudi Arabia lead Middle Eastern demand, driven by rapid hospitality sector expansion, tourism growth, and increasing café and dessert chain presence. Large-scale events and luxury hotel development support premium dessert consumption. In Africa, South Africa anchors regional industrial production, supported by expanding retail infrastructure and growing urban consumer demand. Rising westernized eating habits and investment in food processing capacity further support long-term market potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pastry Cream Fillings Market

- Puratos Group

- Barry Callebaut

- Cargill Incorporated

- Dawn Foods

- IFF

- ADM

- Tate & Lyle

- Kerry Group

- Lesaffre

- Bakels Worldwide

- Zeelandia

- AGRANA

- Dr. Oetker

- Palsgaard

- Corbion