Papaya Digestive Enzymes Market Size

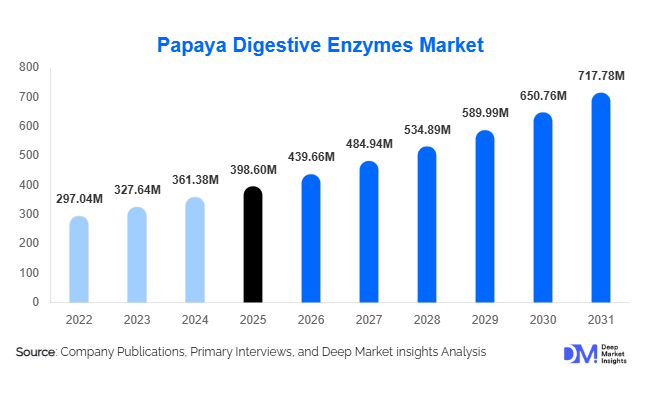

According to Deep Market Insights, the global papaya digestive enzymes market size was valued at USD 398.6 million in 2025 and is projected to grow from USD 439.66 million in 2026 to reach USD 717.78 million by 2031, expanding at a CAGR of 10.3% during the forecast period (2026–2031). The papaya digestive enzymes market growth is primarily driven by rising awareness of digestive health, increasing demand for plant-based and clean-label enzymes, and expanding applications across nutraceuticals, pharmaceuticals, and food processing industries.

Key Market Insights

- Papaya-derived enzymes, particularly papain, are gaining preference over animal-based enzymes due to vegan, allergen-free, and clean-label trends.

- Digestive supplements remain the largest application segment, supported by growing prevalence of gut health disorders and aging populations.

- Asia Pacific dominates global supply, leveraging favorable agro-climatic conditions and cost-efficient enzyme processing infrastructure.

- North America leads global consumption, driven by a mature nutraceutical industry and high per-capita supplement intake.

- Refined and high-activity papain grades are witnessing faster growth, particularly in pharmaceutical and premium nutraceutical formulations.

- Technological advancements in enzyme purification and stabilization are expanding use in wound care, cosmetics, and specialty therapeutics.

What are the latest trends in the papaya digestive enzymes market?

Shift Toward Plant-Based and Clean-Label Enzymes

The global shift toward plant-based nutrition is significantly influencing the papaya digestive enzymes market. Consumers are increasingly avoiding animal-derived digestive aids such as pancreatin, favoring botanical alternatives with fewer allergen concerns and better label acceptance. Papaya enzymes align well with vegan, halal, and kosher certifications, making them suitable for a broad consumer base. Nutraceutical brands are actively marketing papaya enzymes as natural, gentle-on-the-gut solutions, reinforcing their adoption across dietary supplements and functional foods.

Rising Adoption of High-Purity and Specialty Enzyme Grades

Manufacturers are increasingly investing in advanced filtration, drying, and standardization technologies to produce high-activity and pharmaceutical-grade papain. These refined enzymes are gaining traction in wound debridement, anti-inflammatory drugs, and specialty digestive formulations. High-purity grades command premium pricing and offer better margin stability, encouraging suppliers to move up the value chain. This trend is also supporting long-term supply agreements with pharmaceutical and medical device manufacturers.

What are the key drivers in the papaya digestive enzymes market?

Growing Prevalence of Digestive Disorders

Digestive health concerns such as protein intolerance, bloating, and enzyme deficiencies are rising globally due to aging populations, sedentary lifestyles, and high-protein diets. Papaya digestive enzymes, known for their proteolytic efficiency, are increasingly recommended as natural digestive aids. This has directly boosted demand from nutraceutical and over-the-counter supplement manufacturers, particularly in North America, Europe, and Japan.

Expansion of the Global Nutraceutical Industry

The rapid growth of the nutraceutical and dietary supplements industry is a major driver for papaya digestive enzymes. Preventive healthcare trends, rising disposable incomes, and growing self-care awareness are fueling supplement consumption worldwide. Papaya enzymes are widely incorporated into multi-enzyme blends, digestive tablets, powders, and gummies, strengthening their demand base. Emerging markets such as India, China, and Southeast Asia are further accelerating growth through expanding domestic supplement consumption.

What are the restraints for the global market?

Raw Material Price Volatility

Papaya enzyme production is highly dependent on agricultural output, which is subject to seasonal variations, climate conditions, and crop diseases. Fluctuations in papaya fruit availability directly impact enzyme extraction costs, leading to pricing volatility. This poses margin risks for manufacturers, particularly those operating in food-grade and bulk enzyme segments.

Regulatory Complexity in Pharmaceutical Applications

While demand for pharmaceutical-grade papaya enzymes is growing, stringent regulatory requirements related to purity, activity consistency, and documentation increase compliance costs. Approval timelines and quality audits can delay commercialization, especially for smaller players seeking entry into regulated markets such as the U.S. and Europe.

What are the key opportunities in the papaya digestive enzymes industry?

Expansion of Export-Oriented Enzyme Manufacturing in Asia

Asia Pacific offers strong opportunities for capacity expansion and export growth due to abundant papaya cultivation and favorable labor economics. Countries such as India, Thailand, Indonesia, and the Philippines are increasingly positioning themselves as global enzyme manufacturing hubs. Government initiatives supporting agro-processing exports and food ingredient manufacturing are further enhancing this opportunity.

Emerging Applications in Pharmaceuticals and Wound Care

Beyond digestion, papaya enzymes are gaining attention for their anti-inflammatory, debriding, and tissue-healing properties. Pharmaceutical formulations for wound care, post-surgical recovery, and inflammation management represent high-value growth opportunities. Continued clinical validation and product innovation are expected to unlock new revenue streams in this segment.

Product Type Insights

Refined papain dominates the global papaya digestive enzymes market, accounting for approximately 46% of total market value in 2025. Its leadership is primarily driven by higher enzymatic purity, consistent activity levels, improved shelf stability, and wider acceptance across regulated nutraceutical and pharmaceutical applications. Refined papain is extensively used in digestive supplements and therapeutic formulations where dosage accuracy and product safety are critical.

Crude papain continues to play a vital role in cost-sensitive applications, particularly in food processing industries such as meat tenderization, brewing, and protein modification. Its lower processing cost makes it attractive for high-volume industrial use, especially in developing markets.Meanwhile, blended papaya enzyme formulations are gaining traction, especially in nutraceutical products. These blends combine papain with complementary enzymes to deliver synergistic digestive benefits, supporting improved protein breakdown and gut health. Rising consumer preference for multi-enzyme solutions and holistic digestive wellness is accelerating demand for blended formulations.

Application Insights

Digestive supplements represent the largest application segment, contributing nearly 41% of the global market share in 2025. The segment’s dominance is driven by growing consumer awareness of digestive health, rising incidence of lifestyle-related gastrointestinal disorders, and increasing preference for plant-based and natural digestive aids. Preventive healthcare trends and expanding e-commerce distribution channels further strengthen this segment.

Food and beverage processing remains a stable and high-volume application segment, supported by consistent demand from meat processing, bakery, dairy alternatives, and protein hydrolysis applications. Papain’s effectiveness in improving texture, tenderness, and digestibility sustains its adoption across industrial food processing.Pharmaceutical applications, although smaller in volume, are witnessing faster growth due to higher value addition. Increasing clinical interest in enzyme-based therapies, anti-inflammatory formulations, and digestive disorder treatments is expanding papain usage in prescription and OTC pharmaceutical products.

End-Use Insights

Nutraceutical and dietary supplement manufacturers constitute the largest end-use segment for papaya digestive enzymes, driven by surging global supplement consumption and increasing demand for clean-label, plant-derived ingredients. This segment is also the fastest growing, expanding at an estimated CAGR exceeding 11%, supported by aging populations, rising preventive healthcare spending, and innovation in functional nutrition products.

Pharmaceutical companies represent the second-largest end-use group, leveraging refined papain in digestive and therapeutic formulations that require high purity and regulatory compliance. Food processors continue to provide steady demand, particularly in meat, beverage, and specialty food segments.Emerging end-use applications in cosmetics and animal feed additives are creating incremental growth opportunities. In cosmetics, papain is used for exfoliation and skin renewal, while in animal nutrition it supports improved protein digestibility. Although these segments currently contribute a smaller revenue share, they offer long-term diversification potential.

| By Enzyme Type | By Form | By Purity / Activity Level | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 27% of the global papaya digestive enzymes market in 2025, led predominantly by the United States. Regional growth is driven by high per-capita dietary supplement consumption, strong consumer awareness of digestive and gut health, and the presence of well-established nutraceutical and pharmaceutical brands.

Favorable regulatory frameworks for plant-based supplements, along with the widespread adoption of preventive healthcare products, continue to support demand. Additionally, the U.S. remains the world’s largest importer of papaya digestive enzymes, reinforcing its role as a key consumption hub.

Europe

Europe held around 22% of the global market share in 2025, with Germany, the U.K., and France emerging as major consuming countries. Growth in the region is primarily driven by stringent clean-label regulations, rising adoption of vegan and plant-based products, and strong pharmaceutical utilization of plant-derived enzymes.

Increasing consumer focus on natural ingredients, digestive wellness, and sustainable sourcing is further accelerating demand. The region also benefits from advanced pharmaceutical manufacturing capabilities and strong research activity supporting enzyme-based formulations.

Asia-Pacific

Asia Pacific dominated the global market with nearly 38% share in 2025, supported by its dual role as a major production and consumption center. India alone contributed approximately 14% of global market value, driven by export-oriented enzyme manufacturing, abundant raw material availability, and expanding domestic nutraceutical demand.

The region is also the fastest growing, expanding at over 12% CAGR. Growth drivers include rising disposable incomes, increasing health awareness, rapid urbanization, and growing adoption of dietary supplements across China, Japan, South Korea, and Southeast Asia. Cost-effective manufacturing and expanding export networks further strengthen Asia Pacific’s market leadership.

Latin America

Latin America represents an emerging market for papaya digestive enzymes, with Brazil and Mexico leading regional demand. Growth is supported by expanding food processing industries, increasing use of enzymes in meat and beverage applications, and rising nutraceutical adoption among middle-income consumers.Improving healthcare awareness, dietary shifts toward functional foods, and gradual regulatory alignment with global standards are expected to support sustained market expansion across the region.

Middle East & Africa

The Middle East & Africa region is experiencing steady growth, driven by increasing imports of papaya digestive enzymes for pharmaceutical, nutraceutical, and food applications. South Africa and the UAE serve as key markets, supported by regional manufacturing capabilities, trade infrastructure, and re-export activities.Rising healthcare investments, growing awareness of digestive health, and expanding functional food markets are gradually enhancing regional demand, particularly in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Papaya Digestive Enzymes Market

- Advanced Enzyme Technologies

- Amano Enzyme Inc.

- Enzyme Development Corporation

- Specialty Enzymes & Probiotics

- Biocatalysts Ltd.

- Creative Enzymes

- Enzyme Bioscience Pvt. Ltd.

- Maps Enzymes Ltd.

- Jiangsu Boli Bioproducts

- Shenzhen Sunson Industry

- Soufflet Group

- Enzyme Solutions Inc.

- Novozymes

- DSM-Firmenich

- Aum Enzymes