Packaged Burgers Market Size

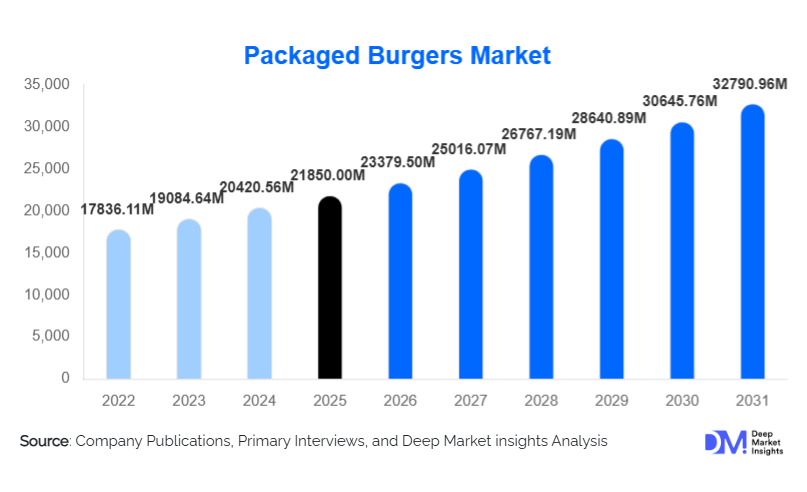

According to Deep Market Insights, the global packaged burgers market size was valued at USD 21,850.00 million in 2025 and is projected to grow from USD 23,379.50 million in 2026 to reach USD 32,790.96 million by 2031, expanding at a CAGR of 7.0% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for convenient, ready-to-cook, and ready-to-eat food products, increasing consumer preference for plant-based protein options, and the expansion of organized retail and e-commerce channels globally.

Key Market Insights

- Frozen packaged burgers dominate due to their long shelf life and wide availability, catering to time-constrained urban consumers.

- Plant-based and vegetarian burgers are witnessing rapid adoption, driven by health-conscious and environmentally aware consumers across North America and Europe.

- Supermarkets and hypermarkets remain the leading distribution channels, offering extensive visibility, promotions, and convenient packaging formats for consumers.

- Online retail is emerging as a high-growth channel, especially in urban regions, offering home delivery of fresh and frozen burgers.

- Europe leads the global packaged burgers market, accounting for more than 42% of revenue in 2024, supported by high disposable income and strong demand for convenient foods.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising middle-class incomes, and increasing exposure to Western food trends.

What are the latest trends in the packaged burgers market?

Rise of Plant-Based and Alternative Proteins

Plant-based and vegetarian burgers are gaining significant traction as consumers prioritize health, sustainability, and ethical sourcing. Innovations in pea, soy, and vegetable-based patties are enhancing taste and texture, allowing brands to appeal to flexitarian and vegan consumers. Clean-label formulations with no artificial preservatives are becoming mainstream, and manufacturers are increasingly leveraging sustainable packaging and production processes to strengthen brand perception. This trend is contributing to higher margins and premium pricing opportunities while broadening the consumer base globally.

Convenience and Ready-to-Cook Innovations

The market is witnessing increasing demand for frozen, chilled, and ready-to-cook burger formats. Modified atmosphere packaging (MAP) and vacuum-sealed packs are extending shelf life and preserving taste, making burgers more accessible for at-home preparation. Subscription meal kits and heat-and-serve options are also gaining popularity, particularly in urban regions and among dual-income households, aligning with growing consumer preference for time-efficient meals without compromising quality.

Online Retailing and Direct-to-Consumer Channels

E-commerce platforms are increasingly reshaping the packaged burgers market. Retailers and brands are leveraging online grocery portals, mobile apps, and subscription-based models to deliver burgers directly to consumers. Digital platforms allow for real-time promotions, targeted marketing, and flexible delivery schedules, enhancing convenience for urban buyers. Online channels are especially important for fresh and premium products, offering geographic expansion beyond traditional retail footprints.

What are the key drivers in the packaged burgers market?

Urbanization and Changing Lifestyles

Rapid urbanization and rising disposable incomes are driving demand for ready-to-eat and ready-to-cook meals. Consumers increasingly seek convenient, nutritious, and flavorful food options that align with busy schedules. Urban households prefer packaged burgers for their quick preparation, consistent quality, and accessibility across retail and online channels.

Growing Health and Sustainability Awareness

Consumers are increasingly gravitating toward plant-based and functional food options. Burgers made from plant proteins or fortified with additional nutrients appeal to health-conscious and environmentally aware segments. Sustainable sourcing, reduced carbon footprint products, and eco-friendly packaging are becoming key differentiators, driving both repeat purchases and brand loyalty.

Expansion of Retail and E-Commerce Channels

Wider distribution through supermarkets, hypermarkets, and online retail networks is expanding consumer access to packaged burgers globally. Multi-channel strategies, including subscription meal kits, direct-to-consumer platforms, and partnerships with quick commerce providers, are fueling incremental demand, particularly in urban and semi-urban areas.

What are the restraints for the global market?

Cold Chain and Supply Chain Limitations

Maintaining the quality of frozen and chilled burgers requires robust cold chain logistics. In regions with underdeveloped infrastructure, limited refrigeration capacity can lead to spoilage, higher costs, and restricted market reach, posing challenges for both local and global players.

Raw Material Price Volatility

Fluctuations in prices for beef, chicken, and other proteins affect profitability. Sudden increases in input costs can limit market growth or force price adjustments, which may deter price-sensitive consumers and slow adoption, particularly in developing regions.

What are the key opportunities in the packaged burgers industry?

Expansion of Plant-Based Alternatives

Innovating with plant-based, vegetarian, and hybrid burgers presents substantial growth opportunities. With health, ethical, and environmental concerns driving demand, companies can differentiate through taste, texture, and nutrient-rich formulations, capturing premium price points and expanding into new consumer segments.

Online and Direct-to-Consumer Growth

Brands can leverage e-commerce, subscription meal kits, and D2C channels to reach consumers in previously underserved geographies. Omnichannel integration improves customer engagement, drives repeat purchases, and allows for innovative product bundles and promotions, supporting incremental revenue streams.

Regional Taste Customization and Innovation

Adapting flavors to local culinary preferences offers strong differentiation. Spiced burgers in Asia Pacific, gourmet variants in Europe, and fusion products in North America appeal to adventurous consumers while allowing brands to tap into premium segments and establish a stronger regional presence.

Product Type Insights

Frozen burgers dominate the global packaged burgers market, representing over 83% of total revenue in 2024. Their long shelf life, consistent quality, and convenience make them the preferred choice for retail consumers and e-commerce buyers alike. Supermarkets and online platforms extensively promote frozen variants, supporting both mainstream and premium segments. Fresh (chilled) burgers are increasingly gaining traction, particularly in urban centers with higher disposable incomes and health-conscious consumers who prefer minimally processed products. The growth of fresh burgers is driven by rising demand for natural, preservative-free options, particularly among millennials and Gen Z consumers who prioritize taste, nutrition, and clean-label products. Additionally, innovations in plant-based frozen burgers are further boosting the frozen segment, creating new revenue streams and expanding appeal across flexitarian and vegan consumer segments globally.

Distribution Channel Insights

Supermarkets and hypermarkets are the leading distribution channels, capturing approximately 40% of global packaged burger sales in 2024. Their wide reach, in-store promotions, and strong brand visibility make them the most influential channel for both frozen and fresh burgers. Online retail is the fastest-growing channel, fueled by urban convenience, subscription-based meal kits, and direct-to-consumer engagement. E-commerce adoption is particularly strong in North America, Europe, and Asia-Pacific, where consumers increasingly seek home delivery for frozen and plant-based burger options. Convenience stores, specialty food stores, and foodservice supply chains also contribute significantly, especially in emerging markets such as Latin America, the Middle East, and Africa, where rapid urbanization and rising disposable income are boosting on-the-go consumption. Digital marketing, app-based ordering, and flash delivery services are further accelerating the online retail segment, helping brands reach younger, tech-savvy consumers efficiently.

| By Product Type | By Patty Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is a leading market for packaged burgers due to strong consumer preference for convenient, ready-to-cook meals, coupled with high per capita income and urbanized lifestyles. The U.S. and Canada account for a major portion of frozen and plant-based burger consumption, with the frozen segment remaining dominant. Drivers of growth include extensive supermarket networks, advanced cold chain infrastructure, and a high penetration of e-commerce platforms enabling fast delivery. Increasing consumer health awareness is fueling demand for premium plant-based burgers, while foodservice chains continue to drive volume through QSR partnerships. Rising interest in sustainable packaging and protein diversification also supports the premium and alternative-protein segments.

Europe

Europe contributes roughly 42% of global packaged burger revenue in 2024. High urbanization, disposable incomes, and health consciousness drive demand for both meat-based and plant-based burgers. Germany, France, and the U.K. are key markets, with strong growth in plant-based frozen burgers due to sustainability and wellness trends. Drivers include regulatory support for clean-label products, innovation in plant-based proteins, and widespread adoption of online grocery platforms. Younger European consumers, particularly millennials and Gen Z, are influencing product diversification and packaging innovations. The trend of premiumization, including gourmet frozen and ready-to-cook burgers, is further supporting market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the packaged burgers market. Urbanization, rising disposable incomes, exposure to Western-style diets, and increasing foodservice penetration are driving rapid adoption. China and India are the largest contributors, where convenience-oriented lifestyles and growing awareness of plant-based nutrition are shaping consumption patterns. Online retail expansion, especially through grocery apps and D2C delivery services, accelerates the adoption of both frozen and fresh burgers in major urban centers. Western fast-food culture and increasing penetration of QSRs in metropolitan areas also act as growth catalysts. The rising middle-class population, coupled with social media influence, is boosting demand for premium and ready-to-cook options, particularly plant-based variants.

Latin America

Latin America’s packaged burger market is expanding, driven by urban middle-class populations in Brazil, Argentina, and Mexico seeking convenient and affordable meal solutions. Frozen burgers dominate retail shelves, supported by growing supermarket chains, while fresh burgers are gaining popularity in urbanized cities. Key drivers include the expansion of modern retail infrastructure, rising per capita income, and exposure to global food trends. The penetration of QSRs and delivery services further fuels demand, particularly in metropolitan areas, while younger populations increasingly adopt plant-based and healthier alternatives, supporting premium product growth.

Middle East & Africa

Africa serves as both a production and consumption base for packaged burgers, while the Middle East, particularly the UAE, Saudi Arabia, and Qatar, is witnessing strong market expansion. Drivers include increasing disposable income, urban lifestyle adoption, and a growing preference for premium frozen and plant-based burgers. Modern retail formats, including hypermarkets and online grocery platforms, support wider product availability. Additionally, rising health awareness and demand for convenient meal options in urban centers drive growth in fresh and chilled burgers. Investments in cold chain logistics and QSR partnerships are further enabling faster distribution and adoption in these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Packaged Burgers Market

- Tyson Foods

- JBS S.A.

- Hormel Foods

- Maple Leaf Foods

- Marfrig Global Foods

- Kraft Heinz Company

- Beyond Meat

- Impossible Foods

- OSI Group

- Conagra Brands

- Meatless Farm

- MorningStar Farms

- Sanderson Farms

- Perdue Farms

- BRF S.A.