Organic Milk Powder Market Size

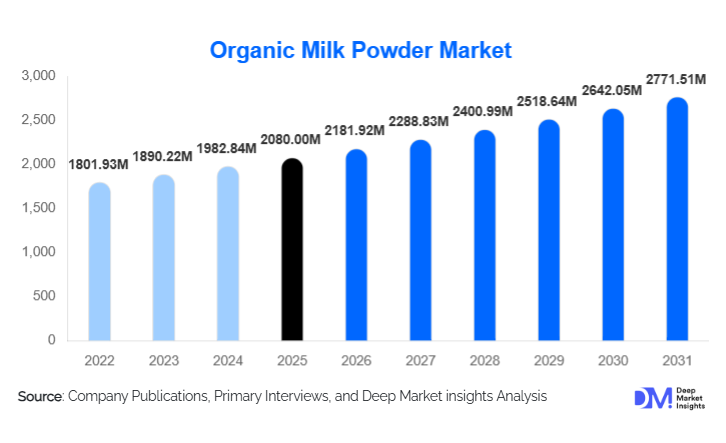

According to Deep Market Insights, the global organic milk powder market size was valued at USD 2,080 million in 2025 and is projected to grow from USD 2,181.92 million in 2026 to reach USD 2,771.51 million by 2031, expanding at a CAGR of 4.9% during the forecast period (2026–2031). The organic milk powder market growth is primarily driven by rising consumer preference for clean-label dairy products, increasing demand for organic infant and clinical nutrition, and expanding global trade of certified organic dairy ingredients.

Key Market Insights

- Organic infant formula remains the largest demand driver, accounting for a significant share of global organic milk powder consumption due to stringent safety and quality regulations.

- Europe dominates global consumption, supported by strong regulatory frameworks, high organic food penetration, and mature dairy processing infrastructure.

- Asia-Pacific is the fastest-growing region, led by China and India, driven by rising birth rates, premiumization of baby food, and increasing health awareness.

- B2B distribution channels dominate, as food, beverage, and nutrition manufacturers rely heavily on bulk organic milk powder supplies.

- Spray-dried organic milk powder leads processing technologies, offering scalability, cost efficiency, and nutrient retention.

- Traceability and certification compliance are becoming key competitive differentiators among manufacturers.

What are the latest trends in the organic milk powder market?

Premiumization of Infant and Clinical Nutrition

The organic milk powder market is increasingly shaped by premium infant formula and medical nutrition applications. Parents and healthcare providers are prioritizing organic, antibiotic-free, and hormone-free ingredients, leading manufacturers to adopt stricter sourcing standards and enhanced quality assurance systems. Organic milk powder with whole-fat profiles and high bioavailability is gaining traction, particularly in Europe and East Asia. Clinical nutrition brands are also incorporating organic dairy ingredients into specialized formulations for immune support, digestive health, and elderly nutrition, further expanding the market’s value proposition.

Technology-Driven Processing and Traceability

Manufacturers are investing in advanced spray-drying, low-temperature processing, and digital traceability platforms to preserve nutritional integrity and ensure regulatory compliance. Blockchain-enabled traceability systems are increasingly used to track milk origin, certification status, and processing conditions. These technologies enhance consumer trust, support premium pricing, and facilitate exports to markets with strict organic standards. Automation and energy-efficient drying technologies are also being adopted to reduce production costs and carbon footprints.

What are the key drivers in the organic milk powder market?

Rising Demand for Organic Infant Formula

Infant nutrition is the single largest driver of organic milk powder demand, accounting for approximately 39% of the global market in 2024. Growing awareness of early-life nutrition, increasing disposable incomes, and regulatory tightening around infant food safety are accelerating adoption. Organic milk powder offers superior positioning for premium infant formulas, particularly in China, Germany, France, and the U.S., where parents actively seek certified organic products.

Growing Consumer Shift Toward Clean-Label Dairy

Consumers globally are increasingly avoiding synthetic additives, genetically modified feed, and chemical residues in food products. Organic milk powder aligns well with clean-label trends, offering transparency, natural sourcing, and sustainability credentials. This shift is particularly strong in Europe and North America, where organic food penetration is well established and supported by government-backed certification systems.

What are the restraints for the global market?

High Production and Certification Costs

Organic dairy farming requires strict compliance with certification standards, longer conversion periods, and higher feed and land costs. These factors significantly increase raw milk procurement expenses, which are passed on to end users. As a result, organic milk powder remains premium-priced, limiting penetration in cost-sensitive markets.

Supply Constraints of Certified Organic Milk

The availability of certified organic raw milk remains limited compared to conventional milk. Climate variability, land availability, and animal health challenges can disrupt supply, leading to price volatility and production bottlenecks. This remains a key challenge for large-scale expansion.

What are the key opportunities in the organic milk powder industry?

Export-Led Growth from Emerging Dairy Economies

Emerging dairy-producing countries such as India, Argentina, Uruguay, and Eastern European nations are expanding organic milk production. Favorable government policies, lower production costs, and growing certified farmland present strong export opportunities to high-demand regions such as Europe, China, and the Middle East.

Expansion into Sports and Functional Nutrition

Organic milk powder is gaining adoption in clean-label sports nutrition and functional food formulations. As consumers seek natural protein sources with minimal processing, organic whole and skim milk powders are being integrated into performance nutrition blends, recovery drinks, and wellness-focused food products.

Product Type Insights

Organic whole milk powder dominates the global product landscape, accounting for approximately 58% of total market value in 2024. This leadership is primarily driven by its extensive use in infant formula, baby food, and premium dairy applications, where higher fat content is critical for energy density, taste, and nutritional completeness. Whole milk powder closely resembles the natural composition of fresh milk, making it the preferred base ingredient for infant and medical nutrition formulations that require balanced macronutrient profiles.

The segment further benefits from growing consumer preference for minimally processed, full-fat organic dairy products, particularly in Europe and North America, where whole-fat consumption is increasingly associated with better satiety and natural nutrition. In addition, whole milk powder commands higher average selling prices, contributing disproportionately to overall market value growth. Organic skim milk powder accounts for the remaining market share and is supported by steady demand from bakery, confectionery, sports nutrition, and low-fat dairy applications. Its longer shelf life, functional properties such as emulsification and water binding, and suitability for protein fortification make it attractive for food manufacturers targeting health-conscious consumers. Growth in organic sports and performance nutrition products is gradually improving demand prospects for skim milk powder, particularly in the Asia-Pacific and North America.

Application Insights

Infant formula and baby nutrition represent the largest application segment in the organic milk powder market, contributing nearly 39% of total global demand in 2024. The dominance of this segment is driven by increasing parental awareness regarding early-life nutrition, rising birth rates in select emerging economies, and strict regulatory scrutiny over infant food quality. Organic milk powder is widely preferred in premium infant formula due to its clean-label positioning, traceability, and absence of antibiotics and synthetic inputs.

Dairy beverages and reconstituted milk products form the second-largest application segment, particularly in regions with limited access to fresh organic milk. Clinical and medical nutrition is another high-value application, benefiting from aging populations, rising prevalence of lifestyle-related disorders, and increasing adoption of organic ingredients in therapeutic diets. Bakery and confectionery applications are witnessing steady growth, especially in Europe, where organic baked goods and desserts have strong consumer acceptance. Meanwhile, sports and performance nutrition is emerging as a high-growth niche, supported by demand for clean, natural protein sources in recovery drinks, functional beverages, and nutritional powders. This diversification of applications is enhancing demand resilience across economic cycles.

Distribution Channel Insights

B2B distribution channels dominate the organic milk powder market, accounting for nearly 67% of global demand. Large-scale food, beverage, infant nutrition, and clinical nutrition manufacturers rely heavily on bulk organic milk powder supplies for formulation and processing. Long-term supply contracts, stringent quality requirements, and consistent volume demand make B2B channels the primary revenue driver for producers.

B2C retail distribution, while smaller in volume, is expanding steadily in value terms. Retail sales through tins, sachets, and pouches are gaining traction in Asia-Pacific and the Middle East, driven by rising household consumption of organic dairy products and growing trust in branded organic labels. The rapid expansion of e-commerce and direct-to-consumer platforms is further improving accessibility and visibility of organic milk powder products, particularly among urban consumers seeking premium and specialty nutrition.

End-Use Industry Insights

The infant nutrition industry remains the fastest-growing end-use segment, expanding at an estimated CAGR of over 11% during the forecast period. Growth is supported by increasing premiumization of infant formula, higher regulatory standards, and strong import demand from Asia-Pacific and the Middle East.

Clinical and medical nutrition represents the second-fastest-growing end-use segment, driven by aging populations, rising healthcare spending, and increasing adoption of organic diets for immune support and chronic disease management. Emerging end uses in sports nutrition, functional foods, and ready-to-mix beverages are expected to positively influence long-term demand, particularly as consumers prioritize natural and minimally processed nutrition solutions.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the global organic milk powder market with approximately 34% market share in 2024. Germany, France, the Netherlands, and Denmark are major demand centers, supported by high organic food penetration, strong consumer trust in certification systems, and advanced dairy processing infrastructure. Growth in the region is driven by stringent food safety regulations, government incentives for organic farming, and strong demand from the infant nutrition and bakery industries. Europe’s export-oriented dairy sector also plays a critical role in supplying organic milk powder to Asia and the Middle East.

North America

North America accounts for around 28% of the global market share, led by the United States and Canada. Regional growth is driven by high consumer awareness of clean-label products, strong demand for organic infant formula, and well-established organic certification frameworks. Increasing adoption of organic dairy in clinical nutrition, sports nutrition, and functional beverages is further supporting market expansion. The presence of major multinational dairy companies and advanced supply chain infrastructure strengthens North America’s competitive position.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR exceeding 11%. China dominates regional demand due to high infant formula consumption, strong preference for imported organic products, and limited domestic organic milk supply. India is emerging as both a demand and supply hub, supported by rising middle-class incomes, expanding organic farming initiatives, and increasing investments in dairy processing capacity. Rapid urbanization, e-commerce growth, and heightened health awareness are key demand drivers across the region.

Latin America

Latin America is evolving as a key organic milk powder supply region, with Argentina, Brazil, and Uruguay increasing certified organic milk production and export volumes. Growth is supported by favorable agro-climatic conditions, expanding organic farmland, and lower production costs. The region is increasingly positioned as a strategic export base supplying Europe, North America, and the Asia-Pacific.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing rising import demand for organic milk powder due to premium infant nutrition consumption, high per-capita income, and limited domestic dairy production. Growth is further supported by expanding retail distribution of organic foods and increasing awareness of infant and clinical nutrition quality. In Africa, South Africa and Kenya are emerging as regional consumption and processing hubs, supported by growing urban populations and improving dairy infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Organic Milk Powder Market

- Nestlé

- Danone

- FrieslandCampina

- Fonterra Co-operative Group

- Lactalis Group

- Arla Foods

- DMK Group

- Saputo Inc.

- Kerry Group

- Valio Ltd

- Organic Valley

- HiPP GmbH

- Abbott Nutrition

- Yili Group

- Mengniu Dairy