Organic Berries Market Size

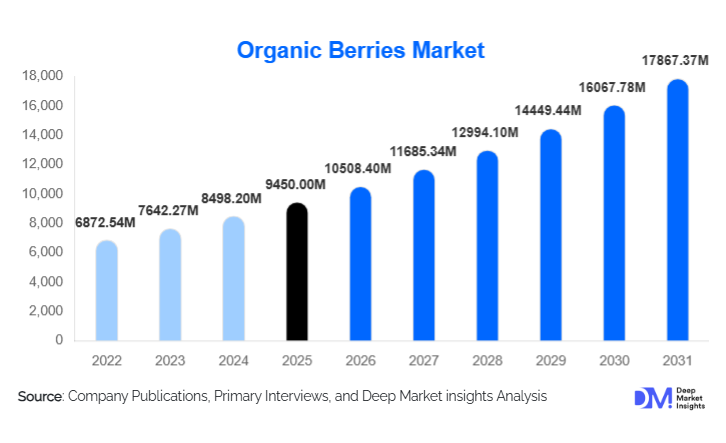

According to Deep Market Insights, the global organic berries market size was valued at USD 9,450 million in 2025 and is projected to grow from USD 10,508.40 million in 2026 to reach USD 17,867.37 million by 2031, expanding at a CAGR of 11.2% during the forecast period (2026–2031). The organic berries market growth is primarily driven by rising consumer preference for pesticide-free produce, increasing awareness of the health benefits of antioxidant-rich berries, and strong demand from food & beverage, nutraceutical, and functional food industries.

Key Market Insights

- Fresh organic berries dominate global demand, supported by premium retail pricing and strong household consumption patterns.

- Organic strawberries and blueberries collectively account for over half of total revenue, due to high availability and widespread application across fresh and processed formats.

- North America leads global consumption, driven by strong organic certification frameworks and high consumer trust.

- Europe remains a mature but steadily growing market, supported by government subsidies and sustainability mandates.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class incomes, urbanization, and increasing imports.

- Technological advancements in cold-chain logistics and protected cultivation are improving yield stability and year-round availability.

What are the latest trends in the organic berries market?

Rising Demand for Functional and Nutrient-Dense Foods

Organic berries are increasingly positioned as functional foods due to their high antioxidant, vitamin, and polyphenol content. Demand is rising from consumers seeking immunity-boosting, anti-inflammatory, and heart-health benefits through natural food sources. This trend is accelerating the use of organic berries in smoothies, fortified yogurts, cereals, and snack bars. Food manufacturers are actively reformulating products to include organic berry ingredients, aligning with clean-label and health-forward positioning. The growing popularity of plant-based diets is further reinforcing this trend, as berries serve as versatile, nutrient-rich ingredients across vegan and vegetarian product portfolios.

Growth of Frozen, Powdered, and Processed Organic Berry Formats

While fresh berries remain dominant, frozen, dried, and powdered organic berries are gaining traction due to extended shelf life and suitability for global trade. These formats support a consistent supply for food processors and nutraceutical manufacturers while reducing post-harvest losses. Organic berry powders and concentrates are increasingly used in dietary supplements, cosmetics, and functional beverages. Advances in freeze-drying and IQF (individually quick frozen) technologies are preserving nutritional value, making processed organic berries a fast-growing subsegment of the market.

What are the key drivers in the organic berries market?

Growing Consumer Awareness of Organic and Clean-Label Foods

Rising awareness of the adverse effects of synthetic pesticides and chemical residues has significantly boosted demand for organic berries. Consumers increasingly associate organic certification with food safety, nutritional quality, and environmental sustainability. This shift is particularly strong in developed economies, where organic food penetration is high, and premium pricing is widely accepted. Retailers are expanding private-label organic berry offerings, further normalizing consumption across income groups.

Expansion of Organic Food Retail and E-Commerce Channels

The rapid expansion of supermarkets, specialty organic stores, and online grocery platforms has improved access to organic berries globally. E-commerce and direct-to-consumer models are enabling producers to reach urban consumers more efficiently, while cold-chain improvements are reducing spoilage. Subscription-based organic produce boxes and farm-to-table delivery models are also contributing to higher consumption frequency and brand loyalty.

What are the restraints for the global market?

High Production and Certification Costs

Organic berry cultivation involves higher labor intensity, lower yields, and stringent certification requirements compared to conventional farming. These factors elevate production costs and result in premium pricing, limiting affordability in price-sensitive markets. Smaller farmers often face financial barriers during organic transition periods, constraining supply expansion.

Climate Sensitivity and Supply Volatility

Organic berries are highly sensitive to weather conditions, pests, and diseases, with limited chemical intervention options. Climate variability, including unseasonal frosts and heatwaves, can disrupt supply and lead to price volatility. These challenges create uncertainty for large buyers seeking consistent year-round sourcing.

What are the key opportunities in the organic berries industry?

Expansion into Nutraceuticals and Dietary Supplements

The nutraceutical industry presents a high-margin opportunity for organic berry producers. Extracts, powders, and concentrates derived from organic berries are increasingly used in capsules, functional drinks, and immunity supplements. This segment allows producers to monetize lower-grade berries and diversify revenue streams beyond fresh retail markets.

Emerging Demand from Asia-Pacific and the Middle East

Rapidly growing organic food demand in China, India, South Korea, and the UAE is creating strong export opportunities. Rising disposable incomes, westernized dietary habits, and government-led organic initiatives are driving imports of organic berries. Export-oriented producers with strong certification and traceability systems are well-positioned to capture this demand.

Product Type Insights

Fresh organic berries account for approximately 52% of global market revenue, making them the dominant product type in the organic berries market. This leadership is primarily driven by strong household consumption, premium positioning in modern retail, and consumer preference for minimally processed, nutrient-dense produce. Fresh berries benefit from higher price realization, particularly in North America and Europe, where organic certification and traceability significantly influence purchasing decisions. In addition, the expansion of refrigerated logistics, rapid-turn inventory models, and private-label organic programs by supermarkets has improved availability while maintaining freshness.

Frozen organic berries represent a rapidly growing segment, supported by rising demand from foodservice operators, bakeries, smoothie chains, and export markets. Their extended shelf life, consistent quality, and suitability for year-round supply make frozen berries particularly attractive to commercial buyers. Meanwhile, dried berries, purees, concentrates, and organic berry powders, though smaller in market share, are expanding at a faster pace. Growth in these segments is driven by their increasing use in nutraceuticals, functional foods, cosmetics, and dietary supplements, where shelf stability, standardized nutritional content, and ease of formulation are critical advantages.

Berry Type Insights

Organic strawberries lead the global organic berries market with an estimated 34% share of total revenue in 2025. Their dominance is supported by high consumer familiarity, widespread global cultivation, and versatile usage across fresh consumption, processed foods, and beverages. Strawberries also benefit from strong retail visibility and frequent promotional activity, making them the most accessible entry point for organic berry consumers.

Organic blueberries follow closely, driven by strong scientific and consumer awareness of their antioxidant and cognitive health benefits. Blueberries are particularly popular in functional food, nutraceutical, and breakfast categories, contributing to steady demand growth. Raspberries and blackberries occupy premium and niche segments, benefiting from higher price points and demand in gourmet, bakery, and dessert applications. Cranberries and specialty berries such as goji, elderberry, currant, and acai are gaining momentum due to their immunity-boosting, anti-inflammatory, and functional positioning, especially in supplements, superfoods, and clean-label wellness products.

Distribution Channel Insights

Supermarkets and hypermarkets dominate the organic berries distribution landscape, accounting for approximately 41% of total global sales. Their leadership is driven by expanding private-label organic ranges, strong cold-chain infrastructure, and high consumer trust in certified retail environments. Large retailers also benefit from economies of scale, allowing them to offer competitive pricing while maintaining quality standards.

Specialty organic stores continue to play a crucial role in urban and premium markets, particularly among health-conscious and sustainability-focused consumers. Online retail and direct-to-consumer (DTC) channels are the fastest-growing distribution segments, supported by convenience, subscription-based produce boxes, farm-to-home delivery models, and improved last-mile cold-chain logistics. Additionally, food processors and foodservice operators represent a significant B2B demand base, sourcing organic berries in bulk for use in dairy, beverages, baked goods, and prepared foods.

End-Use Insights

Household consumption remains the largest end-use segment, contributing approximately 46% of global market revenue in 2025. Growth in this segment is driven by rising health awareness, increased home cooking, and higher penetration of organic products in everyday diets. Consumers increasingly associate organic berries with food safety, superior nutrition, and environmental responsibility.

The food and beverage industry represents the second-largest end-use segment, with strong demand from dairy manufacturers, beverage producers, bakeries, and confectionery companies seeking clean-label and natural ingredients. The nutraceutical sector is the fastest-growing end-use segment, expanding at over 15% CAGR, driven by demand for antioxidant-rich supplements, functional beverages, and immunity-focused formulations. Cosmetics and personal care applications are emerging as high-margin niche uses, particularly in anti-aging, skincare, and natural beauty products that leverage organic berry extracts for their bioactive properties.

| By Product Type | By Berry Type | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global organic berries market, led by the United States. Regional dominance is driven by high organic food penetration, strong consumer trust in certification standards, and well-established retail and cold-chain infrastructure. Favorable government support for organic farming, rising disposable incomes, and widespread adoption of healthy eating habits further strengthen demand. Blueberries and strawberries are the most consumed organic berries in the region, supported by strong domestic production and year-round import availability.

Europe

Europe holds nearly 29% market share, with Germany, France, and the United Kingdom serving as major consumption hubs. Growth in the region is driven by strong sustainability awareness, government subsidies for organic agriculture, and stringent food safety regulations that favor certified organic produce. European consumers show a high willingness to pay for ethically sourced and environmentally friendly foods. Intra-regional trade and imports from Latin America and Africa support year-round availability, while private-label organic offerings continue to expand across major retail chains.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at an estimated 14.8% CAGR. China, Japan, South Korea, and Australia are key demand centers, driven by rising middle-class incomes, rapid urbanization, and growing awareness of health and wellness. Increasing adoption of Western dietary habits, expansion of premium grocery retail, and rising imports of organic produce are accelerating market growth. E-commerce grocery platforms and cross-border trade channels are playing a critical role in improving access to organic berries across the region.

Latin America

Latin America plays a dual role as both a major production hub and a growing consumption market. Countries such as Chile, Mexico, and Peru lead organic berry exports, benefiting from favorable climatic conditions, counter-seasonal production, and strong trade relationships with North America and Europe. Regional growth is supported by increasing investments in organic farming, certification infrastructure, and export-oriented processing facilities. Domestic consumption is also rising gradually among urban populations, driven by expanding modern retail and growing health awareness.

Middle East & Africa

The Middle East relies heavily on imports of organic berries, with the UAE and Saudi Arabia emerging as key demand centers due to high disposable incomes, premium food consumption patterns, and strong retail infrastructure. Demand is largely driven by expatriate populations and growing health-conscious consumer segments. Africa, on the other hand, is an increasingly important producer region, particularly for export-oriented organic berry cultivation. Countries such as Morocco, South Africa, and Egypt are expanding organic acreage to serve European and Middle Eastern markets, supported by favorable climates and improving agricultural investment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Organic Berries Market

- Driscoll’s

- Naturipe Farms

- BerryWorld Group

- Cal Organic Farms

- Wish Farms

- SunOpta

- North Bay Produce

- Camposol

- Vital Berry

- Angus Soft Fruits

- Hortifrut

- Agrovision

- Rainier Fruit

- SanLucar Group

- Naturipe Organic